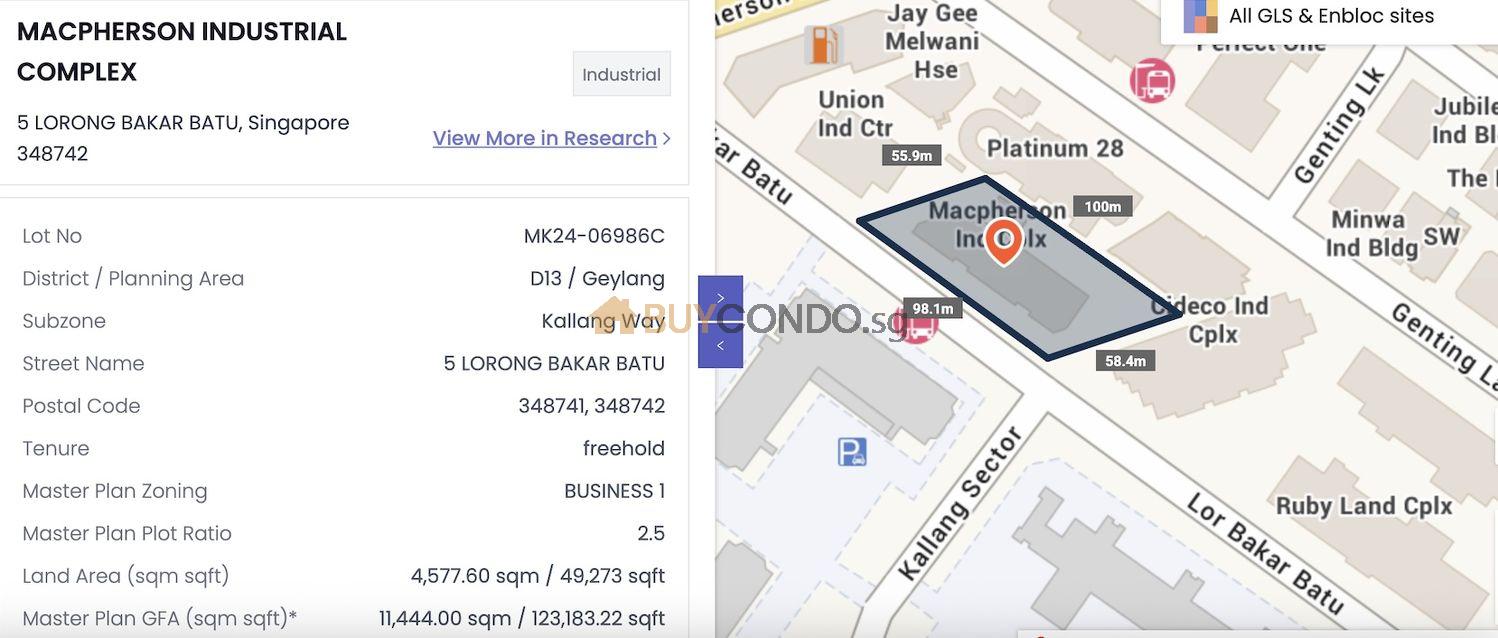

MacPherson Industrial Complex New Launch | 5 Lorong Bakar Batu

Is this the most strategic industrial investment of 2026? A deep dive into the redevelopment of 5 Lorong Bakar Batu.

In the tightly regulated and land-scarce landscape of Singapore’s industrial property market, one word instantly commands attention: Freehold.

For investors and business owners alike, the opportunity to own a freehold industrial asset in the city fringe is a rarity that surfaces perhaps once in a decade. The upcoming redevelopment of the site formerly known as the MacPherson Industrial Complex at 5 Lorong Bakar Batu represents exactly such an opportunity.

Sold via collective sale for S$103.9 million in May 2025, this site is being transformed by the Chiu Teng Group into a modern, high-specification industrial hub. As Singapore’s industrial sector navigates the economic headwinds and opportunities of 2026, this new launch stands out not just for its tenure, but for its strategic positioning in the heart of District 13.

In this comprehensive guide, we will explore every facet of this new launch—from its architectural specifications and connectivity to the rich historical tapestry of MacPherson and the future growth catalysts promised by the URA Master Plan.

1. The Project: A Modern Industrial Fortress

The new development at 5 Lorong Bakar Batu is poised to replace the aging infrastructure of the original MacPherson Industrial Complex with a cutting-edge 8-storey ramp-up multi-user light industry (Business 1) development.

Designed to meet the evolving needs of modern SMEs and logistics firms, the project balances functional ruggedness with corporate elegance.

Key Project Specifications

Based on preliminary planning parameters, the development is set to offer a density and layout that maximizes operational efficiency:

- Developer: CT Macpherson Pte Ltd (A subsidiary of Chiu Teng Group).

- Site Area: Approximately 4,590.30 sqm (49,409.98 sqft).

- Total Units: 63 Production Units + 3 Industrial Canteens.

- Parking: Estimated 39 car lots, with provisions for future EV charging (4 lots), plus lorry lots for rigid frame vehicles.

The “Ramp-Up” Advantage

One of the defining features of this new launch is its partial ramp-up design. Unlike older flatted factories where goods must be laboriously moved via cargo lifts from a central loading bay, a ramp-up facility allows vehicles to drive directly to upper levels. This drastically reduces loading/unloading times—a critical factor for logistics, food distribution, and light manufacturing businesses where time is money.

High-Spec Interiors for Versatile Operations

The developer has calibrated the floor specifications to cater to a wide range of B1 industrial activities, from clean manufacturing to warehouse storage.

- Ceiling Heights: The vertical clearance is generous, offering immense flexibility for racking and mezzanine installations.

- 1st Storey: A towering 7.35 meters, allowing for robust high-stacking or grand frontage.

- 2nd Storey: 6.3 meters.

- 3rd & 4th Storey (Mezzanine Units): 7.35 meters, designed with mezzanines for ancillary office usage.

- 8th Storey: 7.0 meters at the top floor.

- Heavy Duty Floor Loading:

- Production areas on levels 1, 3, 4, and 8 are designed to support 10 kN/m². This is significantly higher than standard commercial buildings, allowing for the installation of heavier machinery.

- Other levels support a respectable 7.5 kN/m².

- Power Supply:

- Standard production units are provisioned with 63 Amp to 100 Amp (3 Phase) power.

- The industrial canteens are equipped with significantly higher power (150–200 Amp) to support heavy kitchen equipment.

Connectivity Within the Building

Efficiency extends to vertical transport. The development includes two passenger lifts (min 18 pax) and one service lift with a 2.8-ton capacity. Furthermore, roller shutters are provided for units on levels 1 through 4, with widths up to 3000mm, ensuring smooth logistics flow for tenants.

2. The Golden Location: District 13

“Location, Location, Location” is a cliché for a reason. For industrial property, location translates to logistics speed and labor accessibility. The MacPherson precinct scores exceptionally high on both counts.

The “City Fringe” Advantage

Located in the Central Region, MacPherson is what planners call a “city-fringe” industrial node. It sits at the geographic crossroads of Singapore, bordering Joo Seng, Kampong Ubi, Aljunied, and Kallang Way.

This centrality means that a delivery van leaving 5 Lorong Bakar Batu can reach the Central Business District (CBD) or Orchard Road in under 20 minutes. For businesses that service corporate clients in the city or distribute goods island-wide, this reduces fuel costs and delivery times significantly.

Unrivaled Transport Connectivity

The site boasts incredible accessibility for both heavy vehicles and public transport commuters—a rare duality for industrial zones.

1. The Expressway Network: The development is flanked by two of Singapore’s most vital arterial highways:

- Pan-Island Expressway (PIE): Provides direct east-west access, linking to Changi Airport in ~20 minutes and Tuas in the west.

- Kallang-Paya Lebar Expressway (KPE): Offers a rapid underground link directly to the Marina Bay financial district and the northeast corridor (Sengkang/Punggol).

- Woodsville Tunnel: The nearby tunnel at the junction of MacPherson and Bendemeer Roads has significantly alleviated traffic bottlenecks, ensuring smooth flow even during peak hours.

2. Public Transport (The Talent Magnet): Attracting talent to industrial jobs can be difficult if the workplace is inaccessible. However, this new launch is highly walkable:

- Potong Pasir MRT (NE10): Located approximately 800m away, or a brisk 10-minute walk. This line connects directly to Dhoby Ghaut and Serangoon.

- Mattar MRT (DT25) & Geylang Bahru MRT (DT24): These Downtown Line stations are also in close proximity, providing connectivity to the Bukit Timah corridor and Bedok.

- Bus Services: Multiple bus stops are located just outside the development (e.g., at Kallang Sector and Genting Lane), served by routes like 125, 151, and 154.

3. The Investment Case: Why Freehold B1 Matters

In the Singaporean industrial property market, land tenure is the single most critical differentiator.

The Scarcity of Freehold

The vast majority of industrial land in Singapore is owned by JTC Corporation and leased out on tenures of 20, 30, or 60 years. Once these leases expire, the land reverts to the state, often leaving the asset with zero residual value.

Freehold industrial land is rare. The government ceased releasing freehold industrial land decades ago. Consequently, the existing stock of freehold industrial properties is a finite resource that shrinks every time a site is acquired by the government for infrastructure or rezoned.

Legacy and Wealth Preservation

Investing in a freehold unit at 5 Lorong Bakar Batu is not just a business decision; it is a legacy play.

- No Lease Decay: Unlike a 30-year leasehold property that depreciates rapidly as the clock ticks down, freehold land retains its value and often appreciates significantly over the long term.

- En-Bloc Potential: As land becomes scarcer, freehold plots in central locations become prime targets for collective sales, offering owners potential windfall exits in the future.

- No Land Rent: Owners of freehold strata units do not pay the escalating land rents associated with JTC properties.

It is rare to find a freehold industrial property in Singapore, making assets like the Aljunied Industrial Complex (and its successor) highly sought after by wealth-preservation investors.

4. MacPherson: A Neighborhood with Deep Roots

To understand the value of this location, one must understand the history and character of MacPherson. This is not a sterile, soulless industrial park; it is a vibrant district with a story.

Historical Origins

The area was historically known as Jalan Klapa, named after the coconut plantations that once dominated the landscape. The modern name honors Lieutenant Colonel Ronald MacPherson, the first Colonial Secretary of the Straits Settlements and the architect behind the magnificent St. Andrew’s Cathedral.

In the mid-20th century, the area’s destiny was shaped by the Paya Lebar Airport (operational 1955–1981). MacPherson Road became a vital logistical artery serving the airport, naturally evolving into a hub for warehouses and light industry. Today, that logistical DNA remains, but it has been upgraded for the 21st century.

The “Hawker Industrial” Ecosystem

One of the hidden benefits of the MacPherson location is the incredible food culture. For business owners, having good, affordable food nearby is essential for employee satisfaction. MacPherson is legendary in this regard.

Top Food Spots for Your Staff:

- Circuit Road Hawker Centre: Just a stone’s throw away, this is a foodie paradise. Famous stalls include Victor Veggie (known for plant-based satay) and Hup Hup (for robust Mee Siam).

- MacPherson Market & Food Centre: A breakfast hotspot featuring Guan’s Cafe and traditional Cantonese porridge.

- Casual Dining: The stretch along MacPherson Road is lined with eateries like Crab At Bay (for after-work seafood dinners) and One Prawn & Co, a prawn noodle spot run by a former fine-dining chef.

- Cafes: For client meetings, Knots Cafe & Living offers a lush, garden-like setting nearby.

5. Market Context: Industrial Trends in 2025/2026

Why invest in industrial property now? The data from 2025 paints a picture of a resilient sector that is outperforming other asset classes.

A Resilient Asset Class

According to ERA Singapore’s 2Q 2025 market report, the industrial property market has shown steady recovery.

- Price Growth: The Industrial Property Price Index grew by 1.4% quarter-on-quarter in 2Q 2025.

- Rental Growth: Rentals have risen for 19 consecutive quarters as of mid-2025, driven by demand for high-specification spaces.

- Occupancy: Despite new supply, occupancy rates remain healthy at over 90%.

The Shift to “High-Spec”

There is a distinct “flight to quality” occurring. Modern tenants—tech firms, high-end manufacturing, and e-commerce logistics—are moving away from old flatted factories into high-spec buildings with better corporate image, higher ceilings, and smarter infrastructure. The new development at Lorong Bakar Batu fits squarely into this demand category.

Strategic Front-Loading

Interestingly, 2025 saw manufacturing output rise due to “front-loading activities” by companies anticipating global trade tariffs. This suggests that manufacturers are aggressively securing space and inventory, keeping demand for warehousing high.

6. Future-Proofing: The URA Master Plan & Transformation

Real estate investment is about peering into the future. The URA Master Plan 2025 and beyond holds massive promise for District 13.

The Paya Lebar Airbase Transformation

The “elephant in the room” for the eastern/central region is the impending relocation of the Paya Lebar Airbase in the 2030s.

- The Big Picture: The relocation will free up 800 hectares of land—larger than Ang Mo Kio—for a new commercial and residential town.

- Impact on MacPherson: Currently, building heights in MacPherson are restricted due to the flight path. Once the airbase moves, plot ratios could potentially be revised upwards, unlocking massive redevelopment value for freehold land owners in the area.

- Connectivity: The redevelopment will likely stitch MacPherson closer to the eastern hubs, creating a seamless belt of economic activity.

Adaptive Reuse and Sustainability

The government is actively rejuvenating nearby industrial estates. Just down the road at Kallang Way, JTC has launched a pilot “Adaptive Reuse” site. This project retains existing industrial blocks to reduce carbon emissions while injecting retail and F&B vibrancy. This signifies a shift in the entire precinct towards becoming a “lifestyle industrial” hub—cleaner, greener, and more vibrant.

Integration of Life, Work, and Play

The URA’s Draft Master Plan 2025 emphasizes “Vibrant City Living” even in business nodes. We are seeing this with developments like Grantral Mall/Complex nearby, which mixes B1 industrial space with retail, gym, and childcare facilities. The new MacPherson launch, with its integrated industrial canteens and proximity to the Pelton Park Connector, aligns perfectly with this vision.

7. Comparative Analysis: Is it Worth the Price?

When evaluating this launch, investors should compare it against the alternatives.

Option A: 30-Year Leasehold B1 (JTC Land)

- Pros: Lower entry price, higher immediate rental yield.

- Cons: Value depreciates to zero. Strict JTC subletting regulations (e.g., anchor tenant rule). Land rent payable.

Option B: Freehold B1 (MacPherson Launch)

- Pros: Perpetual ownership. No land rent. No anchor tenant restrictions (generally easier to sublet). Capital appreciation potential. En-bloc potential.

- Cons: Higher price per square foot (PSF). Lower initial rental yield compared to leasehold.

The Verdict: For businesses looking for a permanent operational base, or investors seeking a safe harbor for capital preservation with steady growth, the freehold option at MacPherson is superior. The freedom from lease decay allows the asset to be passed down generations or held as a long-term collateral for business financing.

Contact us Consultant Gary Lim.

8. Conclusion: A Rare Window of Opportunity

The redevelopment of 5 Lorong Bakar Batu is more than just a new building; it is a renewal of a historic industrial node.

It combines the hard specs required by modern industry (high ceilings, heavy floor load, ramp-up access) with the soft attributes that drive value (freehold tenure, city-fringe location, vibrant food culture).

As Singapore pushes towards advanced manufacturing and urban rejuvenation, well-located freehold industrial assets will only become scarcer. For the astute investor, securing a unit here is not just about buying square footage; it’s about buying a permanent stake in Singapore’s industrial future.

Project Summary:

- Name: New Industrial Launch (fka MacPherson Industrial Complex)

- Location: 5 Lorong Bakar Batu, D13

- Tenure: Freehold

- TOP: Est. 2030

- Developer: Chiu Teng Group

Disclaimer: All information regarding specifications and plans is based on draft documents and market reports available as of February 2026. Potential buyers should verify all details with the developer and appointed sales agents.