Pinery Residences Review: The Missing Piece in the Tampines Puzzle?

For years, the narrative around Tampines has been about its status as a Regional Centre—a bustling, self-sufficient giant in the East. But for discerning buyers, there has been a noticeable gap. If you wanted a brand-new, private condominium that was truly integrated with an MRT station in a mature part of Tampines, your options were non-existent.

Untill Pinery Residences.

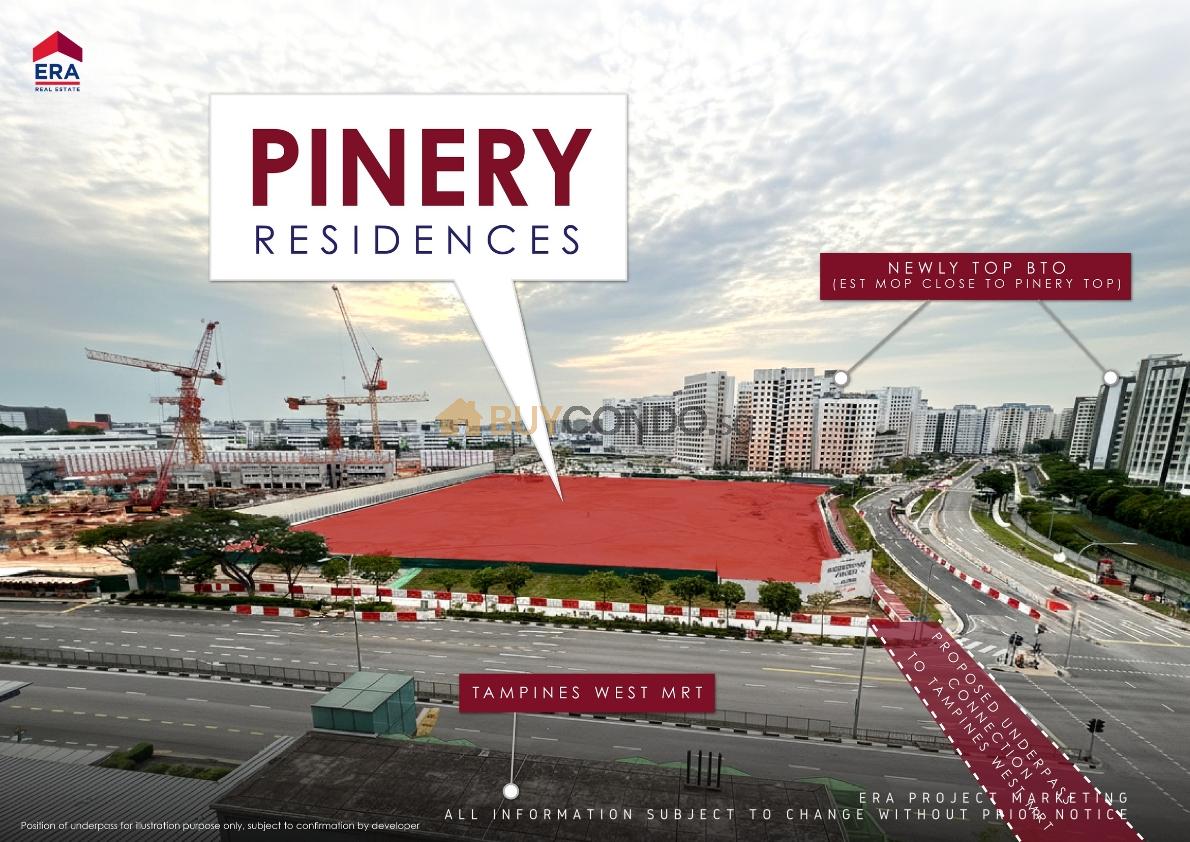

Located at Tampines Street 94, this development is not just another condo launch; it represents a significant shift in the district’s housing landscape. It is a mixed-use development directly connected to the Tampines West MRT (Downtown Line), built by the reputable joint venture of Hoi Hup Realty and Sunway Developments.

In this complete review, we strip away the marketing fluff to look at the hard facts: the pricing logic, the lifestyle realities, the layout efficiencies, and the long-term exit strategies. If you are an HDB upgrader in the East or an investor eyeing the Changi business cluster, this is the analysis you need.

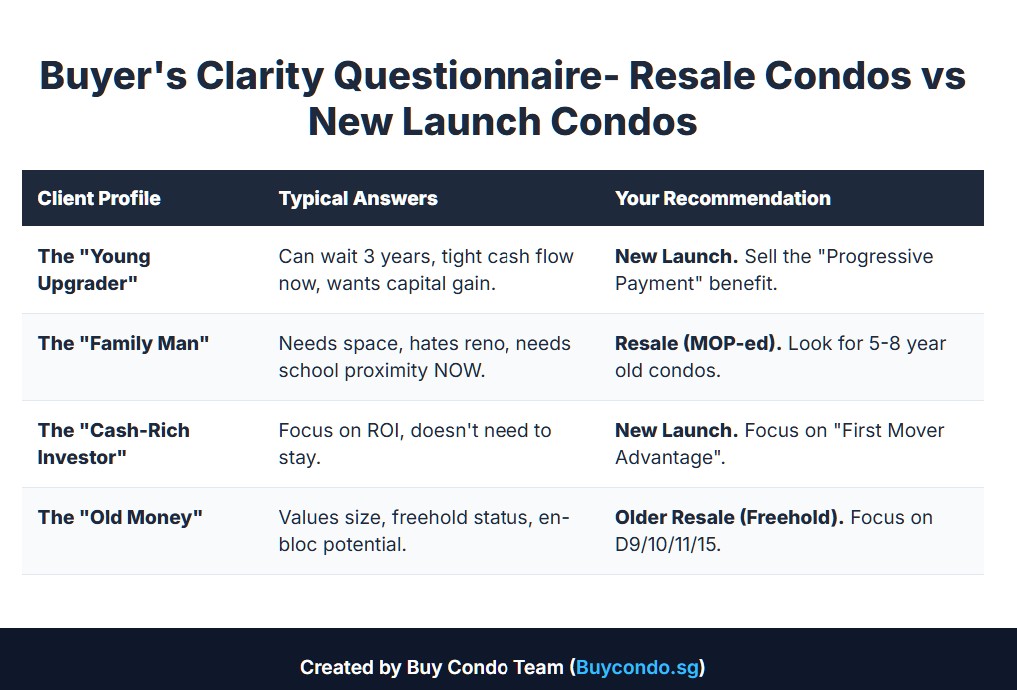

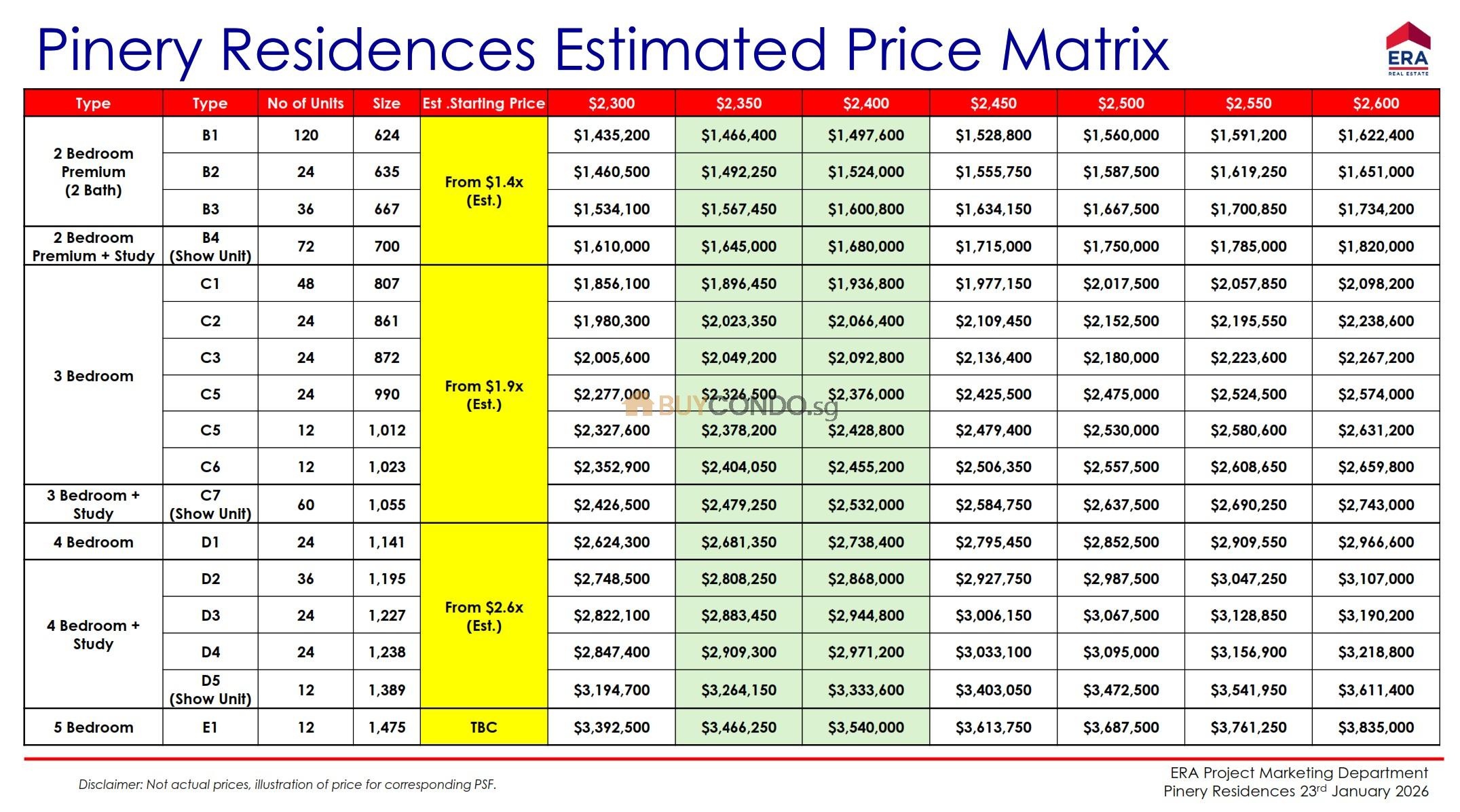

Pinery Residences Price Matrix (Guided)

1. The Core Value Proposition: Why Pinery?

Before we look at floor plans or prices, we must understand the strategic positioning of this project. Pinery Residences sits on a site of approximately 252,989 square feet and will yield an estimated 588 residential units.

The “shiny object” here is undeniably the integration.

The “Underground” Advantage : Pinery Residences Review

Most “near MRT” condos require a walk through the rain or heat. Pinery Residences features a direct underground link to Tampines West MRT station. This is a game-changer for daily liveability. The Downtown Line (DTL) is arguably the most efficient line for professionals today, cutting through MacPherson (Circle Line interchange), Expo (Changi Business Park), Bugis, and straight into the CBD (Downtown/Telok Ayer) without the congestion often found on the East-West Line.

The Commercial Podium

This is a mixed-use development, not a standalone condo. It features a commercial podium of roughly 120,000 square feet. To put that in perspective, this isn’t just a few shop houses; it is a managed commercial space that will include:

- A Supermarket

- A Food Court

- An Early Childhood Development Centre (Childcare)

- Various Retail and F&B options

For a family, this means the “milk run” or the “quick dinner” solution is an elevator ride away. It creates a self-sufficient ecosystem that is highly valued in the rental and resale market.

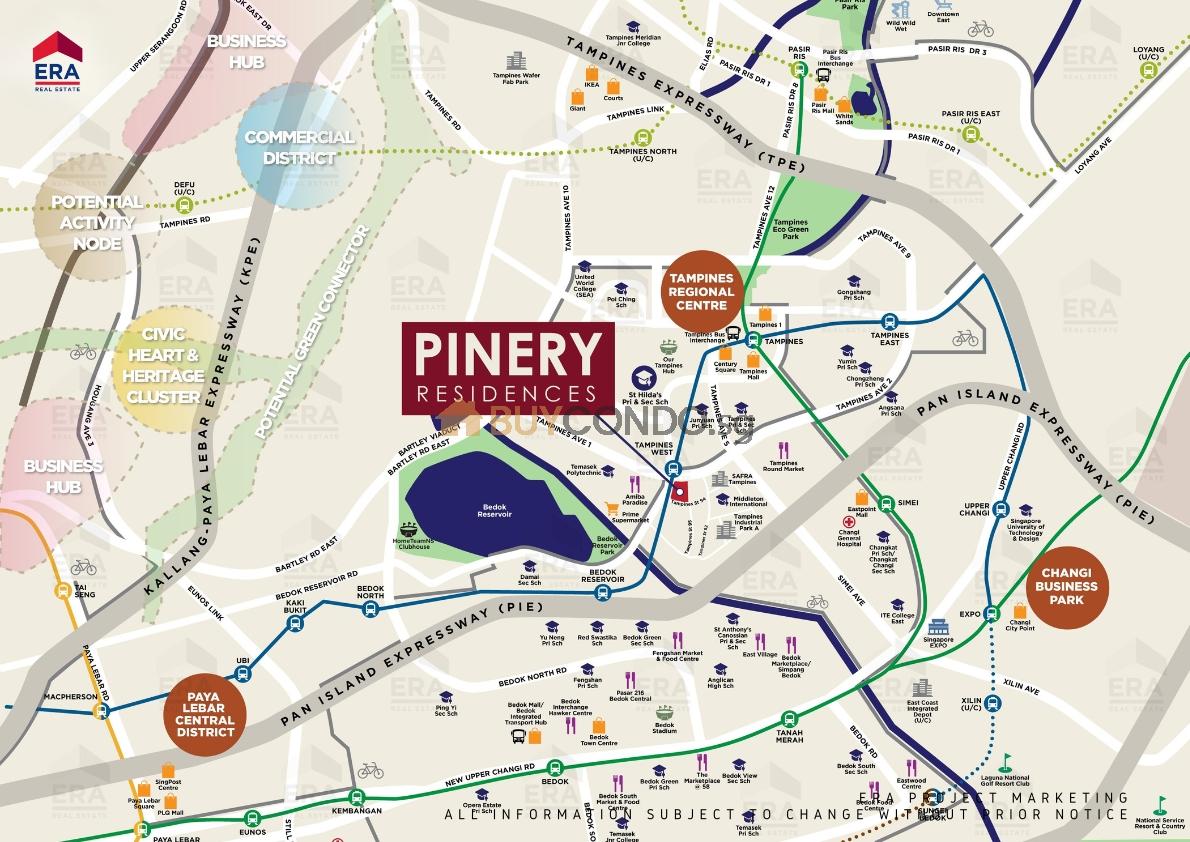

2. Location Analysis: The “Mature” Tampines West

There is a distinct difference between Tampines North (where future supply is heavy) and Tampines West (where Pinery resides). Pinery is situated in a mature enclave.

The Immediate Vicinity

The site is bordered by Bedok Reservoir Road and Tampines Avenue 1. This location offers a dual-lifestyle benefit:

- Urban Connectivity: You are one MRT stop away from the Tampines Regional Centre (Tampines Mall, Century Square, Tampines 1). You are minutes away from the PIE and TPE expressways.

- Nature & Recreation: You are within walking distance of Bedok Reservoir Park, a major lifestyle asset for joggers and families. You are also close to Safra Tampines and the massive Our Tampines Hub (OTH), which houses a library, swimming complex, and 24-hour hawker centre.

The School Advantage (The St. Hilda’s Factor)

For parents, property value is often dictated by the “1km radius.” Pinery Residences sits within 1km of St. Hilda’s Primary School, one of the most sought-after primary schools in the East. It is also near Junyuan Primary and Tampines Primary.

Beyond primary education, the site is surrounded by tertiary institutions like Temasek Polytechnic and SUTD (Singapore University of Technology and Design), and is accessible to UWC South East Asia (East Campus). This creates a natural tenant pool of academics and international families.

3. Developer Track Record: Hoi Hup & Sunway

When buying a new launch, the “who” is as important as the “where.” Pinery Residences is developed by a consortium that has a proven track record in Singapore: Hoi Hup Realty and Sunway Developments.

This partnership is responsible for successful projects like Ki Residences at Brookvale, Terra Hill, and The Continuum. They are known for practical layouts (avoiding excessive wasted space) and high construction standards (BCA Quality Excellence Awards).

Why does this matter?

- Construction Quality: They have a history of delivering well-finished products.

- Layout Efficiency: Hoi Hup tends to prioritize livable spaces over gimmicky features. Expect functional dumbbells layouts for 2-bedders and proper yard/utility spaces for larger units.

4. The Pricing Logic: Doing the Math

This is the most critical part of the review. Is Pinery Residences worth the entry price?

The Land Cost

The developers won the site with a bid of $668.28 million, which translates to a land rate of $1,004 per square foot per plot ratio (psf ppr).

Estimated Breakeven & Launch Price

Based on construction costs, marketing, and profit margins, the estimated breakeven is likely around $1,700 – $1,800 psf. This suggests an average launch price in the range of $2,100 to $2,350 psf.

Comparative Market Analysis (CMA)

To understand if this is “fair value,” we must look at the competition in District 18.

- VS. Parktown Residences (Tampines Ave 11): Parktown is a massive integrated mixed-use project in Tampines North. Its land bid was lower ($885 psf ppr), but it launched at an average of $2,363 psf. Pinery Residences has a higher land cost ($1,004 psf ppr) but sits in a more mature location with an existing MRT line (Parktown relies on the future Cross Island Line). If Pinery launches competitively around the $2,200-$2,300 mark, it presents a compelling value proposition given its “ready-to-use” infrastructure.

- VS. Rivelle Tampines EC: Rivelle is an Executive Condo launching nearby at Tampines St 95. ECs are subsidized and will launch significantly lower (likely ~$1,500 psf). However, Rivelle comes with MOP restrictions, income ceilings, and no direct MRT link. Pinery appeals to those who are ineligible for ECs or want immediate rental flexibility and MRT integration.

- VS. Resale Market: Newer resale condos in Tampines (like The Tapestry or The Alps Residences) trade lower than new launches. However, none of them offer the direct MRT integration or the mixed-use convenience of Pinery. You are paying a premium for the “integrated” status, which historically holds value better during downturns.

5. Layout & Facilities: What to Expect

While finalized floor plans are usually released closer to the preview, based on the site plan and developer history, here is what we can anticipate.

The Site Layout

The development consists of 6 residential blocks of 14 storeys each. The residential units are elevated above the commercial podium and car park (starting from level 3), providing privacy from the public commercial areas.

Facilities

The project will feature over 70 facilities, including:

- A 50m Lap Pool (standard for a project of this size).

- A Community Plaza to facilitate social interaction.

- Family-centric zones like BBQ pavilions, a clubhouse with co-working spaces, and children’s play areas.

- Lush landscaping that integrates with the nearby green corridors.

Unit Mix Expectation

- 2-Bedroom: Likely to feature dumbbell layouts (efficient, no wasted corridor space). Ideal for investors targeting Changi Business Park tenants.

- 3-Bedroom: The core product for HDB upgraders. Look for enclosed kitchens and yard spaces in the “Premium” variations.

- 4 & 5-Bedroom: Limited supply. These will cater to multi-generational families who want to stay in Tampines but need a modern, facility-rich environment.

6. The Investment Case: Who Should Buy?

Pinery Residences is not a “one-size-fits-all” product. Here is how it stacks up for different buyer profiles:

For the HDB Upgrader (The “Sweet Spot”)

This project is tailor-made for families upgrading from HDBs in Tampines, Bedok, or Pasir Ris.

- Why: You stay in your familiar estate but upgrade to a condo with a mall and MRT downstairs. The proximity to St. Hilda’s protects your resale value.

- The Move: Selling a high-value Tampines HDB allows for a comfortable transition into a 3-bedroom unit here.

For the Investor

- Rental Yield: The rental pool is deep. You have tenants from Changi Business Park, Changi Airport, SUTD, and the Airbase. The direct MRT link to the CBD also opens up the tenant pool to city workers looking for lower rent than D1/D9 but with direct train access.

- Capital Appreciation: Integrated developments (like Watertown or Bedok Residences) have historically shown resilience. The entry price is high compared to resale, but the “scarcity” of integrated projects in Tampines West provides a defensive moat.

For the Wealth Preservation Buyer

- Long-Term Hold: With the Paya Lebar Airbase relocation (projected from 2030 onwards), the entire East region is set for a massive transformation. Pinery Residences sits on the fringe of this future growth story.

7. Risk Factors: The “Elephant in the Room”

No review is complete without addressing the downsides.

- Price Point: At $2,200+ psf, this is a record price for a condo in Tampines West. Buyers must be comfortable with the fact that they are paying for future value and convenience, not bargain-hunting.

- 99-Year Leasehold: Like most government land sales, this is a leasehold project. While standard for mass-market condos, it is a factor for those looking for multi-generational legacy assets compared to freehold options in District 15.

- Competition: The upcoming supply in Tampines North (Parktown, Tenet EC, etc.) means there will be competition for tenants and buyers in the future. However, Pinery differentiates itself through its location in the mature estate vs. the developing North.

8. Pinery Residences vs Rivelle Tampines

9. The Verdict

Pinery Residences offers a synthesis of convenience that is currently missing in the Tampines West precinct.

It is not the cheapest option in the East. It is not a quiet, secluded retreat (it’s a bustling mixed-use hub).

However, it creates immense value for:

- Families prioritizing St. Hilda’s and seamless school runs.

- Professionals who value the time-savings of a direct MRT connection to the CBD.

- Upgraders who want the “condo lifestyle” without losing the convenience of HDB town amenities.

Disclaimer: All pricing estimates and floor plan details are based on available information at the time of writing and are subject to change by the developer. Buyers are advised to conduct their own due diligence.