Convert Residential Apartment to Co-Living

Case Study 1

A Business Owner(Singapore PR) reaching out to us, looking to venture a 2nd business, in particular doing Co-Living.

Being in Singapore for more than 20 years, see the potential in the demand for expats and students renting rooms in good locations that area near MRT and Malls.

Fortunately enough we managed the Secure 2 units in different areas within a one-month span.

Case Study 2

Landed Owner Landlord wanting to Rent out their Unit. Deciding between Renting to Family or Coliving.

Asked to meet up with us on the Feasibility. Based on the requirements we took us the task and proposed to try renting the house as a whole unit as well as room rental to see the demand.

Because the landed house is near International Schools, demand for family and potentially student with a parent coming over to stay is equally high.

For the Student with Parent, they would have an option to rent Studios or 2 Bedrooms and/or renting a Coliving Space to stay.

Case Study 3

Client Stationed Overseas, Wanting to get a property in Singapore, since no existing property on hand eligible to buy the 1st Property with no ABSD.

Wanting to find a place that can collect good rental to pay for the bank mortgage while meantime able to have a choice of moving into the unit after posting back to singapore.

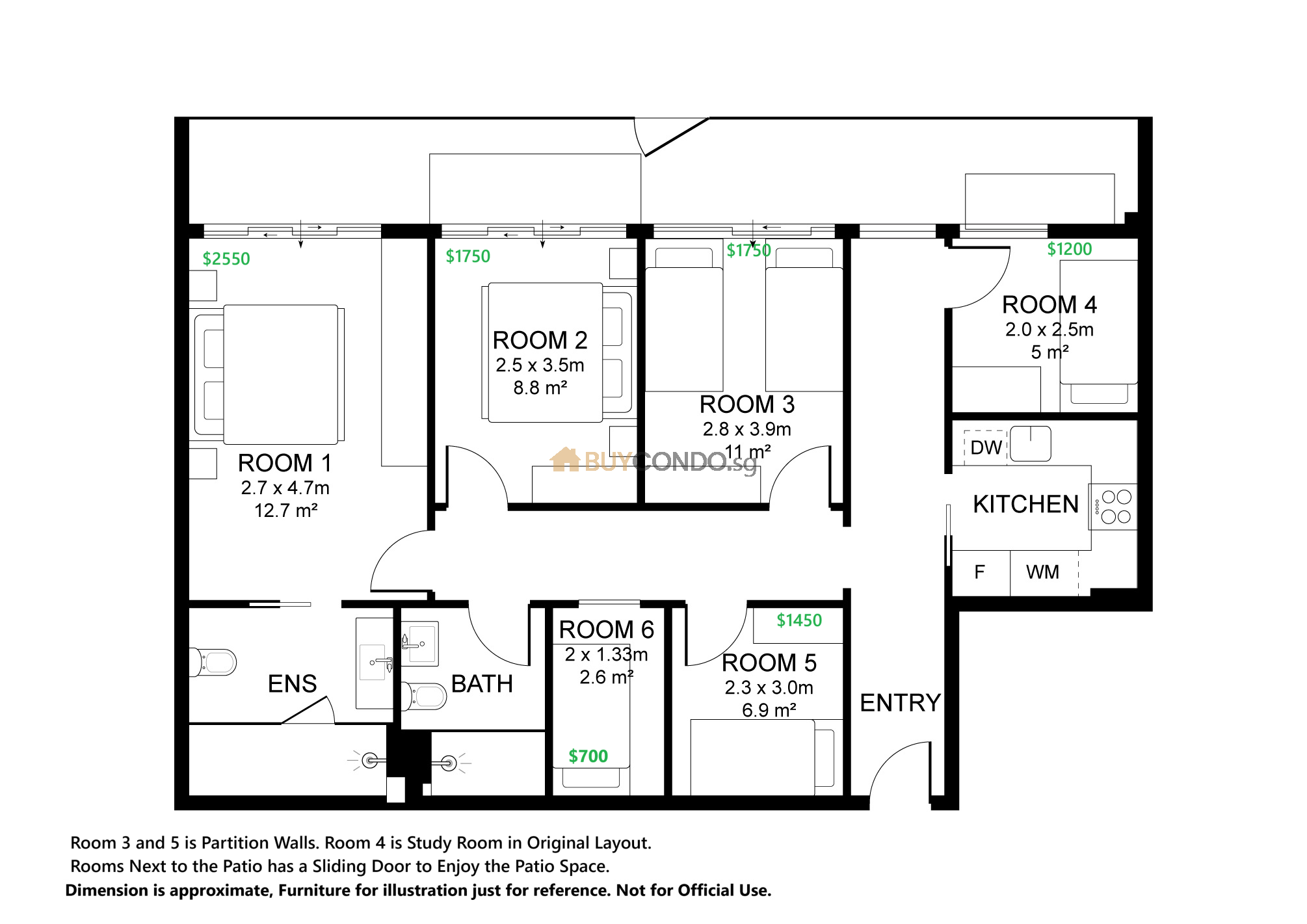

2 Bedroom + Study Original Layout.

2 Bedroom + Study Original Layout into a 6 Bedroom, including the Bomb Shelter.

IF you are Owner wanting to rent out, currently if you have a 90sqm apartment you can increase the named register occupier from 6 to 8 person by URA.

Here is the below link:

Hdb and Condo is now allowed to rent up to 8 person unrelated (Updated for 2024)

IF you are a buyer want to buy a investment property for Rental Income you can also contact us we have listings that you can buy that gives you immediate rental yields.

Converting residential properties to co-living spaces impacts Singapore’s property market in several ways, primarily affecting rental dynamics, market trends, and potentially future resale opportunities for landlords and investors.

- Enhanced Rental Yield Potential: Converting traditional properties into co-living spaces is presented as a viable approach to augment rental income. Co-living spaces can offer potentially higher rental yields compared to traditional rentals, and landlords may be able to command higher per-square-foot rental rates. Co-living companies might even pay a premium for properties that meet their specific requirements. This model can help landlords achieve stable rental income and higher occupancy rates, potentially offsetting challenges like rising costs affecting rental yield sustainability.

- Response to Shifting Demand and Market Growth: The increasing demand for co-living reflects a societal shift towards communal living experiences and flexibility, particularly among millennials, mobile professionals, expatriates, and students. This growing momentum, catalysed by evolving urban lifestyles and housing requirements, drives the co-living sector forward as a space-efficient solution amidst urbanisation pressures. Converting properties helps cater to this specific and growing demographic.

- Introduction of Operational Complexities: While financially attractive, managing co-living spaces involves complexities, particularly concerning the maintenance of communal areas. Wear and tear can be higher due to multiple occupants, and costs related to cleaning services and frequent upkeep need to be astutely handled to avoid eroding profit margins. Landlords also face limited control over the selection of individual tenants when renting to a co-living company, and potential disturbances might arise from communal living.

- Potential Challenges for Resale and Financing: A significant impact noted is the potential difficulty in selling the property in the future. This can be challenging due to difficulties coordinating viewings with multiple tenants. Furthermore, some banks may be less keen to lend or offer lower amounts to buyers purchasing a unit previously used for co-living. Not all banks provide loans for such properties, and those that do may offer slightly higher interest rates compared to normal condo loans. This suggests that converting a property to co-living, while beneficial for rental income, might affect its liquidity and financing options for future buyers.

In essence, converting residential properties to co-living is shaping the Singapore property market by offering landlords a route to potentially higher rental yields and catering to a specific, growing demand demographic. However, it also introduces operational challenges and can potentially impact the property’s attractiveness and financing options on the resale market. The regulatory landscape, including occupancy caps (currently relaxed to 8 for 90sqm apartments), also plays a crucial role in enabling or limiting such conversions.

All you Need to know About Co-living in Singapore

- What is co-living in Singapore?

- Co-living is a contemporary housing concept where individuals rent private bedrooms and sometimes have private bathrooms, while sharing common areas such as kitchens and living rooms. In Singapore, it often involves co-living companies leasing residential units from landlords and then subletting individual rooms to multiple tenants. This model caters to individuals seeking flexibility, affordability, community, and convenience in urban settings.

- Is co-living legal in Singapore, and what regulations apply?

- Yes, co-living is legal in Singapore. However, it must comply with specific regulations set by the Urban Redevelopment Authority (URA). Key requirements include the property being approved for residential use, meeting minimum size requirements (typically 35 sqm or 376.74 sqft), adhering to building and condominium bylaws, not being located in restricted zones, and observing a minimum stay duration (often at least 3 months). There is also a temporary relaxation allowing up to 8 unrelated occupants in a unit, although infractions can lead to penalties.

- What are the potential benefits for landlords renting to co-living companies?

- Renting to co-living companies can offer landlords several advantages. These include the potential for higher rental yields compared to traditional rentals due to the ability to charge per room, steady rental income through longer-term contracts with the company, and reduced vacancy risk as the co-living company is responsible for finding and managing individual tenants.

- What are the drawbacks for landlords renting to co-living companies?

- Despite the benefits, there are disadvantages for landlords. These can include limited control over the selection of individual tenants, increased wear and tear on the property due to higher occupancy and communal living, potential for noise and disturbances, and challenges in coordinating property viewings for potential sale due to multiple tenants. There is also the risk of the co-living company struggling financially or going bankrupt, potentially leaving the landlord with rental arrears and issues regarding property modifications.

- How can landlords maximize revenue from co-living spaces?

- Landlords can maximize revenue by implementing strategic rental pricing based on room size and amenities, benchmarking against local co-living rates, and potentially incorporating a buffer for maintenance costs. Exploring ancillary revenue streams like vending machines, laundry services, storage unit rentals, or hosting events can also enhance profitability.

- What cost management strategies are important for co-living properties?

- Effective cost management is crucial. This involves managing common area maintenance by securing competitive bids for cleaning services, regularly reviewing service contracts, and scheduling preventative maintenance to avoid costly repairs. Investing in durable materials and furnishings can also reduce long-term replacement and repair costs. Educating tenants on proper usage and care can also help mitigate wear and tear.

- What legal considerations are essential for co-living landlords?

- Landlords must be well-versed in Singapore’s real estate laws concerning co-living, including URA guidelines and zoning regulations. Thorough tenancy agreements are paramount, clearly outlining shared responsibilities, individual tenant liabilities, maintenance schedules, and procedures for addressing damages or breaches of contract. Complying with occupancy caps and minimum rental periods is also vital.

- How does co-living compare to traditional rentals in terms of cost and benefits for tenants in Singapore?

- For tenants, co-living is often more cost-effective than traditional rentals as it shares housing expenses, utilities, and amenities. It offers a community-oriented environment with opportunities for social interaction and networking through organized events. Co-living spaces typically provide convenience through furnished rooms and shared amenities like kitchens, laundry, and co-working spaces. They also offer flexibility with shorter rental terms and are often located in convenient, prime areas. Many co-living spaces benefit from professional management, handling maintenance and security, and offer enhanced safety measures like CCTV and secure entry systems.

Corner Terrace in Century Woods: Perfect for Families Near Singapore American School