Resale Condos vs New Launch for Condos 2026: The Cheat Sheet

TLDR: There is no single “best” option. It is a trade-off between the certainty, space, and immediate income of a resale unit versus the capital appreciation potential, modern facilities, and financial flexibility of a new launch.

Part 1: The Case for Resale Condos

Best for: Families needing immediate housing, investors seeking instant cash flow, and buyers who value space.

1. What You See Is What You Get (The Certainty Factor)

-

Physical Inspection: Unlike new launches, you can physically visit the unit. You can touch the surfaces, check the quality of the walls and floors, and inspect “hidden” corners.

-

Environmental Vetting: You can investigate potential annoyances that floor plans won’t show you, such as odours from nearby rubbish chutes, road noise levels, or the direction of the wind and sun.

-

Neighbourhood Recon: You can gauge the demographic of the residents and, crucially, see who your immediate neighbours are. This is vital for a 3 to 5-year stay; bad neighbours can turn a great deal into a nightmare.

2. Immediate Financial Benefits

-

Rental Income from Day One: There is no construction wait time. You can rent the unit out immediately (usually within 8-12 weeks after possession) to offset mortgage payments. In some cases, the rent may cover the interest portion of the loan completely.

-

Negotiation Power: Prices and terms are often negotiable with individual sellers, whereas developers of new launches have fixed price lists.

-

Renovation Savings: You might find a “gem” that is already beautifully renovated. Sellers may also include furniture, curtains, or blinds, saving you significant upfront cash.

3. Size and Layout

-

Larger Spaces: Generally, older resale condos offer larger room sizes and more spacious individual layouts compared to the more compact units found in modern new launches.

-

En-bloc Potential: Older developments may carry en-bloc (collective sale) potential, which can be a lottery ticket for owners down the line.

Singapore Biggest Condo by Land Area

The Sen – New Launch Condo November 2025

Part 2: The Case for New Launch Condos

Best for: Investors looking for capital growth, buyers who want a “hands-off” renovation experience, and those needing progressive payment flexibility.

1. Investment & Capital Appreciation

-

The “First Mover” Advantage: Buyers who enter during the launch phase often enjoy lower prices. As the project nears TOP (completion), prices often re-price upwards, creating a “windfall” or paper gain.

-

The “Safety Net”: Buying a new launch gives you multiple exit strategies. You can sell to future resale buyers or “subsale” buyers—people who want a brand-new home immediately and are willing to pay a premium to skip the construction wait.

-

Defect Warranty: Developers provide a warranty period (liability period) to rectify defects, protecting you from initial repair costs.

2. Modern Living & Convenience

-

Contemporary Facilities: New condos feature the latest amenities (smart home features, modern pools, gyms) that are highly sought after by tenants and future buyers.

-

Zero Renovation Headache: Units come with brand-new fittings, appliances, lighting, and flooring. The renovation cost is negligible as the developer provides a “move-in ready” base.

-

Tenant Appeal: New facilities and a fresh look make it easier to attract tenants compared to older, tired developments.

3. Financial & Valuation Security

-

No Valuation Surprise: When you buy a new launch, the Sale Price is the Valuation. You don’t have to worry about “Cash Over Valuation” (COV).

-

Flexible Payments: New launches often follow a Progressive Payment Scheme, meaning you don’t pay the full mortgage immediately, which helps with cash flow management during the construction phase.

Part 3: The Hidden Risks & “Gotchas”

1. The Resale “Cash Trap” (COV)

-

Risk: When buying resale, bank valuation is key. If the seller wants $2M but the bank values it at $1.7M, you must top up that $300k difference in cash. This can deplete your savings unexpectedly.

-

Contrast: New launches do not have this problem; the bank matches the developer’s price.

2. The “Top Effect” in Resale Pricing

-

Risk: Existing owners often have “holding power.” They bought years ago and will only sell if offered a “spicy price” (substantially high). This can artificially inflate resale asking prices, making it harder to find a bargain unless you hunt aggressively.

3. The Emotional Trap

-

Insight: Buyers often think they use their brains, but the decision is frequently made subconsciously by the “heart” within the first 8 seconds of entering a resale unit. Be aware of this bias; a beautifully staged home might hide structural or environmental flaws.

Summary Comparison – Resale Condos vs New Launch Condos

| Feature | Resale Condo | New Launch Condo |

| Wait Time | Immediate (Move-in/Rent out) | 3-4 Years (Construction) |

| Price | Negotiable | Fixed |

| Valuation | Risk of COV (Cash top-up) | Sale Price = Valuation |

| Renovation | Can be high (or zero if pre-reno) | Low (Fittings provided) |

| Unit Size | Generally Larger | Generally Compact/Efficient |

| Defects | Sold “As-Is” (Caveat Emptor) | Developer Warranty provided |

| Capital Gain | Slow (needs market shift) | High Potential (Progressive growth) |

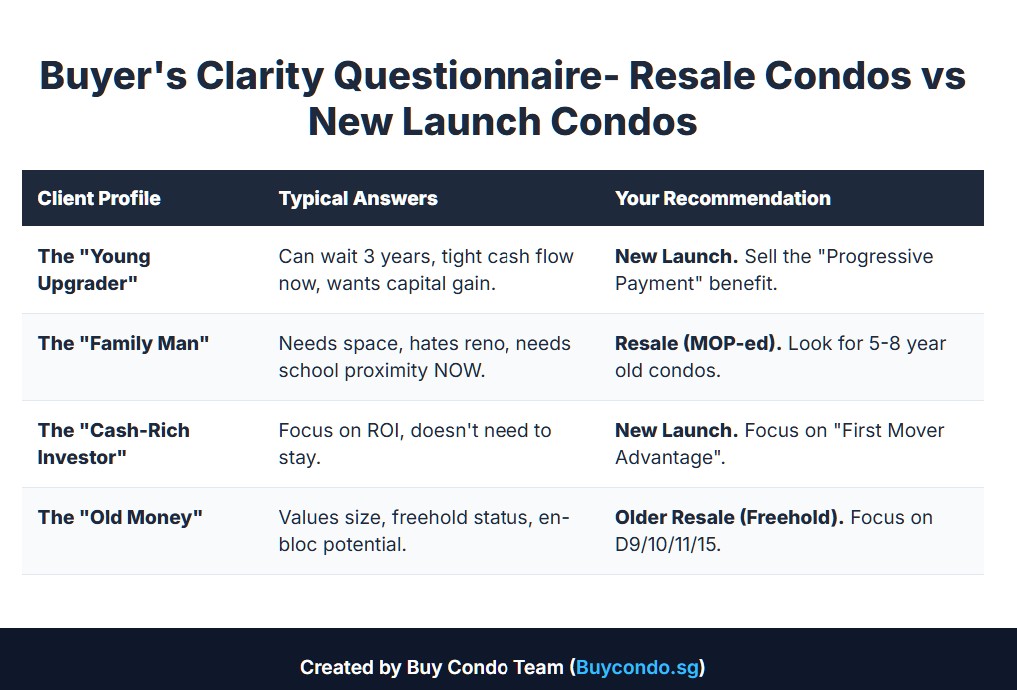

This Client Clarity Questionnaire helps you to decide what would be more suitable for you as a buyer.

I have structured this framework:

-

Questions to uncover their real motivation (pain points).

-

Questions to guide their expectations and prevent future shock.

-

Questions that force a decision based on logic and data.

Buyers Clarity Questionnaire Provided – Resale Condos vs New Launch for Condos 2026

Client Name: ___________________

Date: ___________________

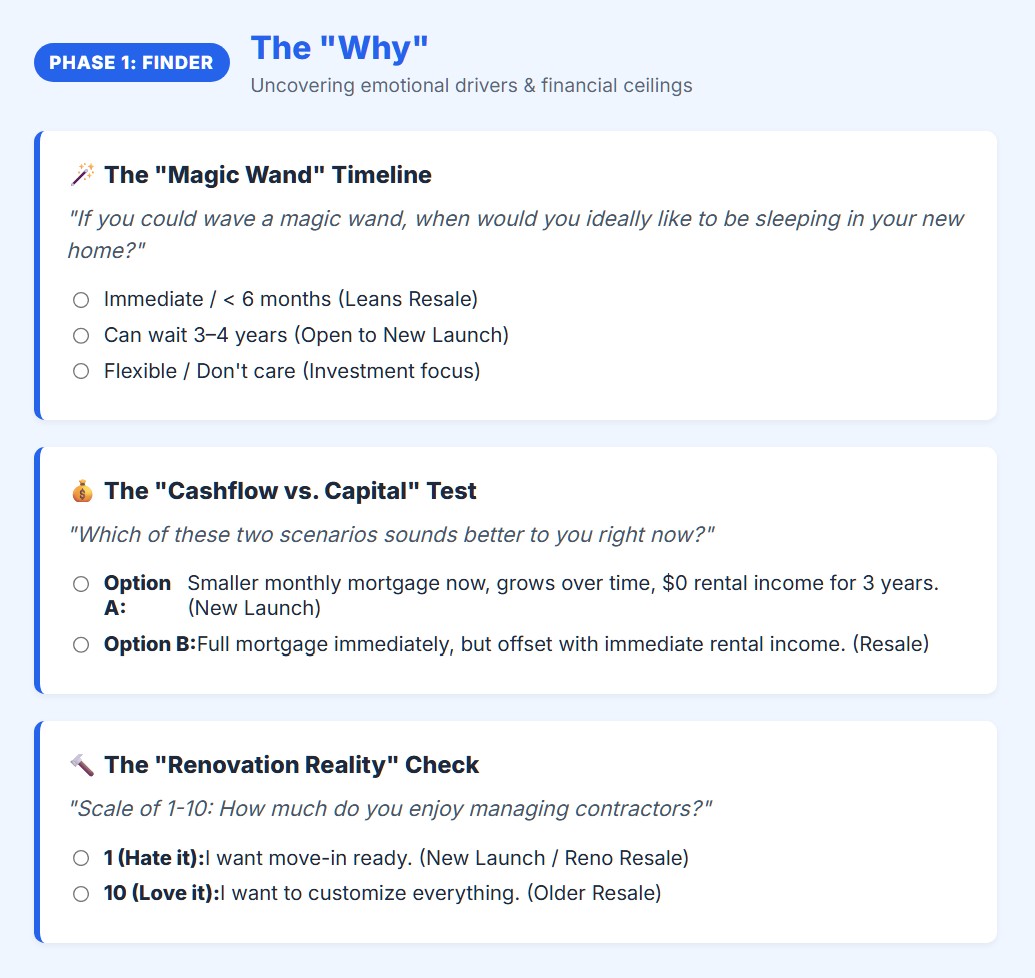

Phase 1: Uncovering the “Why” – Resale Condos vs New Launch for Condos 2026

Goal: Find the emotional driver and the financial ceiling immediately.

-

The “Magic Wand” Timeline

-

“If you could wave a magic wand, when would you ideally like to be sleeping in your new home?”

-

[ ] Immediate / < 6 months (Leans heavily Resale)

-

[ ] Can wait 3–4 years (Open to New Launch)

-

[ ] Flexible / Don’t care (Investment focus)

-

-

The “Cashflow vs. Capital” Test

-

“Which of these two scenarios sounds better to you right now?”

-

Option A: Paying a smaller monthly mortgage now that grows over time, but receiving $0 rental income for 3 years. (New Launch – Progressive Payment)

-

Option B: Paying the full monthly mortgage immediately, but potentially offsetting it with rental income right away. (Resale)

-

-

-

The “Renovation Reality” Check

-

“On a scale of 1 to 10, how much do you enjoy managing contractors and renovations?”

-

1 (Hate it): I want move-in ready. (New Launch or Fully Reno Resale)

-

10 (Love it): I want to hack walls and customize everything. (Resale – specifically older units)

-

-

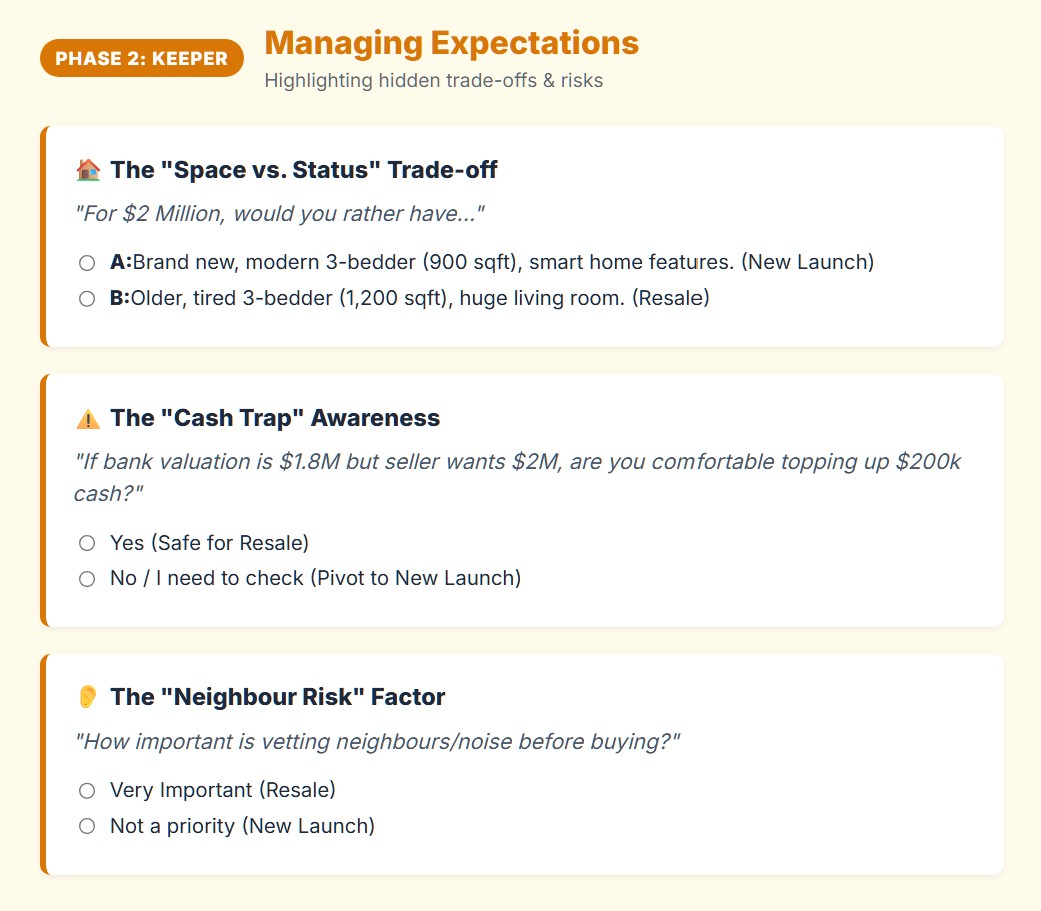

Phase 2: Managing Expectations & Risk – Resale Condos vs New Launch for Condos 2026

Goal: Keep them grounded by highlighting the hidden trade-offs they haven’t thought of.

-

The “Space vs. Status” Trade-off

-

“For $2 Million, would you rather have…”

-

A: A brand new, modern 3-bedder (900 sqft) with smart home features and a grand entrance? (New Launch)

-

B: An older, slightly tired 3-bedder (1,200 sqft) with a huge living room and enclosed kitchen? (Resale)

-

-

-

The “Cash Trap” Awareness (Crucial for Resale)

-

“If the bank values the house at $1.8M but the seller wants $2M, are you comfortable topping up that $200k difference in cash immediately?”

-

[ ] Yes (Safe for Resale)

-

[ ] No / I need to check (Pivot to New Launch where Price = Valuation)

-

-

-

The “Neighbour Risk” Factor

-

“How important is it for you to know exactly who your neighbours are and what the noise level is like before you buy?”

-

[ ] Very Important (Resale – advise them to visit at night)

-

[ ] Not a priority (New Launch)

-

-

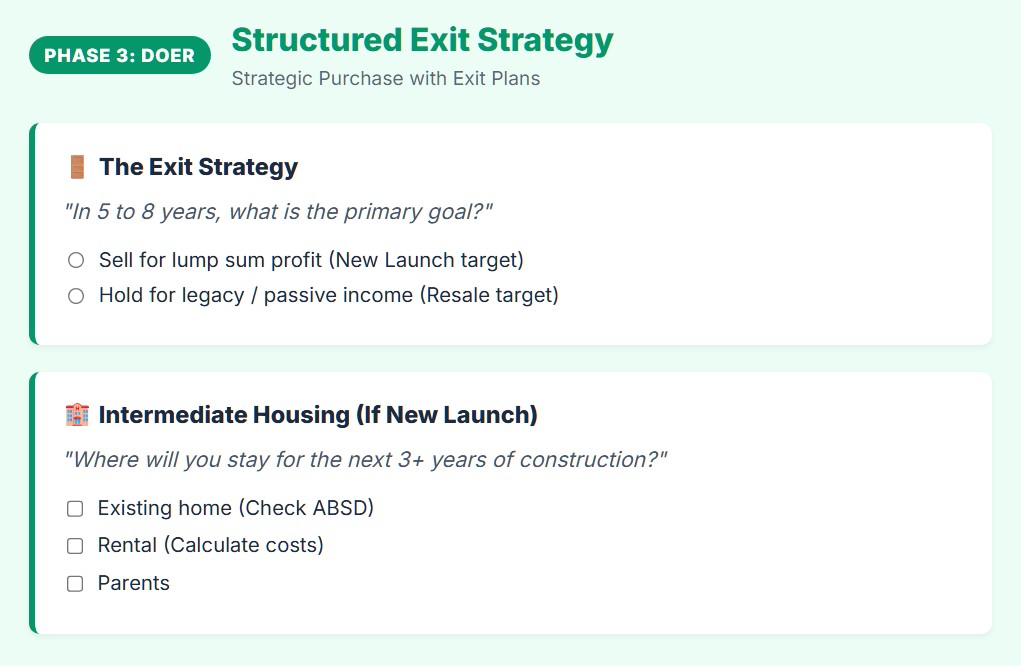

Phase 3: Structured Exit Stategy – Resale Condos vs New Launch for Condos 2026

Goal: Define the exit strategy so you can execute the transaction.

-

The Exit Strategy

-

“In 5 to 8 years, what is the primary goal for this asset?”

-

[ ] Sell for a lump sum profit (New Launch – targeting the TOP appreciation spike)

-

[ ] Hold for passing down to children / passive rental income (Resale – Freehold or well-located Leasehold)

-

-

-

The “Intermediate Housing” Plan (If New Launch is chosen)

-

“If we go for a New Launch, where will you stay for the next 3+ years of construction?”

-

[ ] Existing home (Need to check ABSD remission timeline)

-

[ ] Rental (Need to calculate if rental costs eat up the potential New Launch profits)

-

[ ] Parents

-

-

BUYCONDO Team – Buyer’s Cheat Sheet

Use this quick reference to guide your advice based on their answers:

| Client Profile | Typical Answers | Your Recommendation |

| The “Young Upgrader” | Can wait 3 years, tight cash flow now, wants capital gain. | New Launch. Sell the “Progressive Payment” benefit. It’s easier on their monthly cash flow initially. |

| The “Family Man” | Needs space for kids, hates renovation, needs school proximity now. | Resale (Recently MOP-ed). Look for 5-8 year old condos. Modern enough facilities, but you can move in now. |

| The “Cash-Rich Investor” | Focus on ROI, doesn’t need to stay. | New Launch. Focus on “First Mover Advantage” and getting in at launch price vs. future prices. |

| The “Old Money” | Values size, freehold status, and en-bloc potential. | Older Resale (Freehold). Focus on D9/10/11 or D15 resale with good en-bloc potential. |

Next Step for You

WhatsApp message to Buy Condo Team to book a “New Launch vs. Resale Strategy Call” using this framework.