Exploring Benefits and Compensation for Expats in Singapore

Singapore, a vibrant and multicultural city-state, is a top destination for expats seeking exciting opportunities and a high standard of living. With its thriving economy, excellent healthcare, and quality education, it’s no wonder that many professionals choose Singapore as their new home.

While the cost of living in Singapore can be high, the benefits and compensation offered to expats make it an attractive choice. From competitive salaries to comprehensive healthcare coverage, Singapore ensures that expats are well taken care of. So, let’s dive into the exciting world of benefits and compensation for expats in Singapore.

Key Takeaways:

- Singapore offers attractive benefits and compensation packages for expats.

- Expats can enjoy competitive salaries, comprehensive healthcare coverage, and quality education opportunities.

- The high cost of living in Singapore is offset by the excellent quality of life and job prospects.

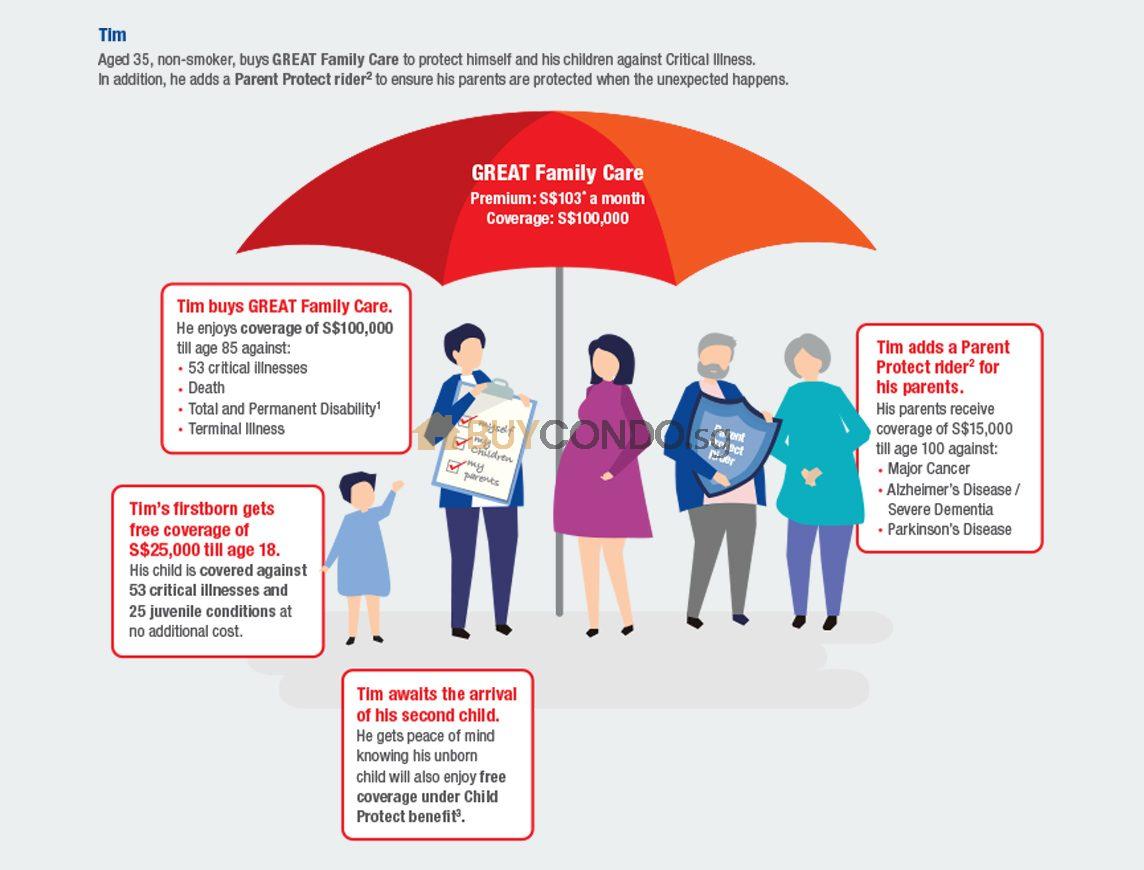

- Choosing the right insurance coverage is crucial when moving to Singapore.

- Expats should carefully budget and research to make the most of their experience in Singapore.

Life in Singapore

Welcome to Singapore, a vibrant island nation located in Southeast Asia! With its tropical climate, multicultural population, and high standard of living, Singapore offers a unique experience for expats.

In terms of weather, Singapore enjoys a year-round tropical climate, with temperatures ranging from a balmy 22 to 35 degrees Celsius. This means you can expect warm and humid days throughout the year, perfect for enjoying the city’s outdoor attractions and lush green spaces.

What makes Singapore truly fascinating is its multicultural population. The country is home to a diverse community comprising ethnic Chinese, Malays, and ethnic Indians, creating a rich tapestry of cultures, traditions, and cuisines. English is widely spoken as the primary language of government and business, making it easier for expats to adapt and communicate effectively.

When it comes to lifestyle, Singapore offers a high standard of living. The city-state boasts a well-developed infrastructure, efficient public transportation system, and a reputation for cleanliness and safety. Whether you’re exploring the bustling city streets, enjoying the vibrant nightlife, or indulging in the city’s world-class dining scene, Singapore has something for everyone.

| Key Highlights of Life in Singapore |

|---|

| • Multicultural Population |

| • Tropical Climate |

| • High Standard of Living |

| • Efficient Public Transportation System |

| • Reputation for Cleanliness and Safety |

So, whether you’re strolling through the historic streets of Chinatown, exploring the vibrant neighborhoods of Little India, or enjoying the breathtaking views from the iconic Marina Bay Sands, life in Singapore promises an exciting and enriching experience for expats.

Working in Singapore

Singapore, a global financial hub, offers a plethora of job opportunities for expats looking to work in the city-state. To secure employment in Singapore, expats must obtain either an Employment Pass or a Work Permit, depending on their professional qualifications and skills. The Ministry of Manpower diligently formulates and implements labor policies to ensure a fair and efficient working environment.

Foreign workers, excluding domestic workers, play a crucial role in Singapore’s employment sector, contributing to the country’s thriving economy and diverse workforce. Expats looking to work in Singapore can expect a dynamic and multicultural work environment that fosters growth, innovation, and collaboration.

“Working in Singapore is like embarking on a professional adventure. The city-state offers countless opportunities to explore your potential and make meaningful contributions to a range of industries. You’ll witness firsthand how Singapore’s strategic location, political stability, and government support attract top talent from around the world.”

Whether you’re an entrepreneur, a skilled professional, or a business executive, Singapore’s robust job market caters to various industries, including finance, technology, healthcare, logistics, and more. Expats can take advantage of the city’s well-established network of local and international businesses, which often provide competitive compensation packages and ample career advancement opportunities.

Employment Pass vs. Work Permit

| Employment Pass | Work Permit |

|---|---|

| Reserved for professionals, executives, and skilled workers. | Available for foreigners seeking low-skilled or semi-skilled employment. |

| Requires a job offer from a Singapore-based employer. | Employer must apply on behalf of the foreign worker. |

| Higher salary threshold and qualifications required. | Dependent on the specific industry and job requirements. |

| Typically valid for two years, with the possibility of renewal. | Validity period varies based on the sector and duration of employment. |

Securing an Employment Pass or Work Permit allows expats to legally work in Singapore and enjoy the perks of living in this vibrant city-state. From unique career prospects to a high standard of living, working in Singapore opens doors to a world of opportunities.

Cost of Living in Singapore

Singapore undeniably holds the reputation of being one of the most expensive cities in the world. The cost of living in this vibrant metropolis can certainly make a dent in one’s wallet. Expats considering a move to Singapore should be prepared to tackle the high cost of housing expenses, particularly in downtown areas.

Housing expenses in Singapore can be a significant part of the overall cost of living. The demand for housing in prime locations drives rental prices up, making it quite challenging for expats to find affordable accommodations. However, with careful planning and research, it’s still possible to find suitable housing options within a specific budget.

Aside from housing, there are other factors that contribute to the overall high cost of living in Singapore. Transportation expenses can be quite steep, but the city compensates with an efficient public transportation system that offers convenience and accessibility. Healthcare, education, and childcare are also known to be expensive in Singapore, further adding to the overall cost of living.

Despite the expensive nature of the city, expats who secure a decent salary can still enjoy a high-quality lifestyle in Singapore. The city offers a plethora of opportunities to explore and indulge in its vibrant culture, diverse culinary scene, and extensive shopping options.

| Expenses | Average Cost |

|---|---|

| Housing | High |

| Transportation | Expensive |

| Healthcare | Costly |

| Education | Expensive |

| Childcare | Pricey |

It’s important for expats to carefully assess their financial situation and plan their budget accordingly before making the move to Singapore. With the right preparation and a comprehensive understanding of the cost of living, expats can navigate the challenges and enjoy the many benefits that this bustling city-state has to offer.

Healthcare in Singapore

In the bustling city of Singapore, access to quality healthcare is of utmost importance. Singapore boasts a well-developed healthcare system that caters to both locals and expats alike. With a range of public and private hospitals to choose from, individuals have the flexibility to select the healthcare option that best suits their needs.

Public healthcare in Singapore is known for its affordability and accessibility. The public hospitals, such as Singapore General Hospital and Changi General Hospital, provide comprehensive medical services and have highly skilled doctors and medical professionals. The government heavily subsidizes public healthcare in Singapore, making it an attractive option for those seeking cost-effective healthcare solutions.

On the other hand, private healthcare in Singapore offers a more exclusive and personalized experience. Private hospitals, such as Mount Elizabeth Hospital and Raffles Hospital, are renowned for their state-of-the-art facilities and specialized treatments. Patients who choose private healthcare can enjoy shorter waiting times and a higher level of personalized care.

“In Singapore, both public and private healthcare options are readily available, catering to the diverse needs and preferences of individuals. Expats can choose between affordability and accessibility provided by public healthcare or the exclusivity and personalized care offered by private healthcare.”

The Advantages of International Health Insurance

When living as an expat in Singapore, having comprehensive health insurance is highly recommended. International health insurance plans provide expats with a wider range of coverage options and additional benefits beyond what public and private healthcare may offer.

International health insurance plans ensure that expats have access to global care options, emergency evacuation services, and specialized treatments. These plans offer peace of mind, knowing that individuals are covered for any unexpected medical expenses that may arise during their time in Singapore.

The Importance of Coverage

When considering international health insurance plans, it is essential for expats to thoroughly review the coverage provided. The policy should include coverage for both inpatient and outpatient treatments, specialist consultations, prescription medications, and emergency services.

Expats should also ensure that the insurance policy covers their specific healthcare needs while living in Singapore. This includes coverage for pre-existing conditions, maternity care, and dental or vision services, among others. Having a comprehensive insurance policy will help expats navigate the healthcare system with ease and confidence.

Comparing Options: Public, Private, and International

The table below highlights the key differences between public healthcare, private healthcare, and international health insurance in Singapore:

| Factors | Public Healthcare | Private Healthcare | International Health Insurance |

|---|---|---|---|

| Cost | Affordable with heavy government subsidies | More expensive | Varies based on coverage and provider |

| Access | Widely accessible to Singapore residents | Exclusive and personalized | Global access to medical facilities and services |

| Wait Times | Can be longer | Shorter wait times | N/A |

| Coverage | Comprehensive medical services | Specialized treatments and premium facilities | Global coverage and emergency services |

By considering these factors, individuals can make an informed decision about their healthcare options in Singapore.

Getting Around in Singapore

When it comes to getting around in Singapore, expats have plenty of efficient and convenient options at their disposal. This vibrant city-state takes pride in its well-connected public transportation system, making it a breeze to navigate from one corner to another.

The Mass Rapid Transit (MRT) system is the backbone of Singapore’s public transportation network. It consists of various lines that span across the island, providing quick and reliable transportation for commuters. Whether you’re heading to the office, meeting friends for dinner, or exploring the city’s attractions, the MRT is a convenient and efficient choice.

In addition to the MRT, Singapore also boasts a comprehensive network of Light Rapid Transit (LRT) and monorail systems that connect residential estates and other areas not covered by the MRT. These systems ensure that no matter where you live or work, you can easily hop on a train and reach your destination hassle-free.

If you prefer a different mode of transportation, Singapore offers an extensive bus network that covers nearly every corner of the city. Public buses are a convenient and economical option, allowing you to explore different neighborhoods and discover hidden gems along the way.

Pro Tip: Download a reliable navigation app like Google Maps or CityMapper to easily plan your public transportation routes and find the nearest bus stops or MRT stations.

For those who crave a scenic commute or want to explore the nearby islands, ferries are available for travel to destinations like Sentosa Island and Batam. Soak in the stunning coastal views as you make your way to these idyllic locations.

However, if you prefer the convenience and privacy of your own vehicle, it’s important to note that driving in Singapore can be a luxury rather than a necessity. The city-state has limited road space, and strict regulations are in place to manage traffic congestion and ensure road safety.

Expats who wish to drive in Singapore must convert their foreign driver’s license to a Singapore driver’s license. This process involves passing a theory test and practical driving test administered by the Traffic Police. It’s also worth considering the high costs associated with owning a car in Singapore, such as road tax, parking fees, and the Certificate of Entitlement (COE) system.

Pro Tip: Consider whether owning a car is essential for your lifestyle in Singapore. With the efficient public transportation system and ride-hailing services like Grab, getting around without a car is entirely feasible.

Public Transportation Options in Singapore:

| Transportation Mode | Pros | Cons |

|---|---|---|

| Mass Rapid Transit (MRT) | Frequent and reliable service Extensive coverage Affordable fares |

Peak hour congestion Crowded during rush hour |

| Light Rapid Transit (LRT) | Connectivity to residential areas Convenient interchange with MRT |

Can be crowded during peak hours Limited coverage |

| Public Buses | Extensive network Affordable fares |

Bus lanes may be congested during peak hours |

| Taxis | Convenience and door-to-door service Available 24/7 |

Can be more expensive than other options Traffic jams during peak hours |

| Ferries | Scenic travel Access to nearby islands |

Can be crowded on weekends and public holidays |

Singapore’s efficient public transportation system ensures that expats can effortlessly explore every corner of this bustling metropolis. With a multitude of choices at your disposal, you can navigate the city with ease, whether you’re commuting to work, exploring cultural landmarks, or indulging in the vibrant food scene.

Singapore Government Insurance Requirements

While strolling through the bustling streets of Singapore, it’s essential to protect yourself against unexpected bumps along the way. Though insurance is not mandatory for tourists, it’s highly recommended, especially considering the exorbitant cost of healthcare in the city-state. For expats, it’s common to have insurance provided by employers, but the key lies in ensuring that the coverage is comprehensive.

Expats in Singapore can consider supplemental private insurance to enhance their coverage. This additional layer of protection can offer peace of mind and safeguard against unforeseen medical expenses. With a wide range of insurance plans available, tailored for both short-term and long-term needs, expats can find the right option to fit their lifestyle.

Still curious about the insurance requirements set by the Singapore government? Let’s dive into the details and explore the options available.

Insurance Options*

To help you navigate the labyrinth of insurance choices, here’s an overview of the different types of insurance coverage available in Singapore:

| Type of Insurance | Features |

|---|---|

| Health Insurance | Comprehensive medical coverage for hospitalization, surgeries, and outpatient treatments |

| Life Insurance | Financial protection for loved ones in the event of death, offering lump-sum payouts or regular income |

| Travel Insurance | Protection against unexpected events during travels, including trip cancellations, medical emergencies, and lost luggage |

| Motor Insurance | Compulsory coverage for vehicles against third-party liability and optional coverage for own damages |

| Your Insurance | Customize this space with the insurance type that suits your needs |

*Disclaimer: The information provided above is for illustrative purposes only. Please consult an insurance professional to get the most accurate and up-to-date advice for your specific situation and needs.

With the right insurance coverage in place, you can confidently explore every corner of Singapore, knowing that you’re protected against any unexpected incidents. Secure your peace of mind and safeguard your financial well-being while embracing the vibrant lifestyle this extraordinary city offers.

Public vs Private Hospitals

When it comes to healthcare in Singapore, expats have the option to choose between public and private hospitals. Both options offer their own unique advantages, catering to the diverse needs of individuals and families.

Private Hospitals: Premium Facilities and Convenience

Private hospitals in Singapore are renowned for their premium facilities and world-class services. Expats who opt for private hospitals often enjoy reduced wait times, personalized care, and a comprehensive selection of specialists. These hospitals prioritize patient comfort and convenience, providing a luxurious experience that is tailored to individual needs.

Private hospitals in Singapore are known for their:

- State-of-the-art medical equipment and technology

- Exclusive amenities and comfortable rooms

- Access to renowned international specialists

- Shorter waiting times for consultations and procedures

With their focus on delivering exceptional care and a wide range of specialized services, private hospitals are a favored choice for expats seeking high-quality healthcare in Singapore.

Public Hospitals: Excellent Healthcare at Affordable Costs

While private hospitals offer premium services, public hospitals in Singapore are equally recognized for their excellent healthcare standards. These hospitals provide affordable healthcare options to both residents and expats, ensuring equal access to quality medical services.

Public hospitals in Singapore are known for their:

- Comprehensive range of medical services and specialties

- Highly skilled healthcare professionals

- Robust infrastructure and technology

- Government support and subsidies for Singaporeans, Permanent Residents, and eligible expats

Public hospitals are often the go-to choice for individuals who prioritize affordability and value for money without compromising on the quality of care.

Ultimately, the choice between public and private hospitals in Singapore depends on individual preferences, healthcare needs, and financial considerations. Expats should weigh the benefits of both options to make an informed decision that aligns with their priorities and circumstances.

Local Singapore Insurance

When it comes to insurance in Singapore, expats have two options: local Singapore insurance and international health insurance plans. While local insurance plans may be more economical, they often provide limited coverage compared to international plans. On the other hand, international health insurance plans offer a wide range of benefits that cater to the needs of expats.

International health insurance plans provide expats with the assurance of worldwide coverage, ensuring that they are protected no matter where their travels take them. These plans also grant access to elite private hospitals, renowned for their state-of-the-art facilities and top-notch medical services. In addition, international plans offer emergency evacuation services, guaranteeing prompt and efficient care in times of crisis.

For expats living in Singapore, international health insurance plans also provide the advantage of English-speaking support. Dealing with medical matters can be overwhelming, especially in a foreign country, but having a support team that speaks your language can alleviate any concerns you may have and ensure clear communication.

Before making a decision, it is crucial for expats to thoroughly investigate local Singapore insurance plans and compare them to international options. Adequate coverage is vital when it comes to healthcare, and it is essential to find a plan that best aligns with your specific needs and gives you peace of mind.

International Insurance in Singapore

When it comes to healthcare coverage in Singapore, international insurance plans offer expats a wide range of benefits and peace of mind. These plans provide global coverage, ensuring that expats have access to quality healthcare services both in Singapore and abroad. With international insurance, expats can receive treatment at elite private hospitals, known for their advanced medical facilities and experienced healthcare professionals.

One of the key advantages of international insurance is the flexibility it provides with unlimited claims. Expats can rest assured that their medical expenses will be fully covered, allowing them to focus on their health without worrying about financial burden.

Emergency evacuation services are another crucial feature offered by international insurance plans. In the event of a medical emergency, expats can be safely transported to the nearest appropriate medical facility, whether it is within Singapore or in another country. This ensures that expats receive prompt and specialized care, even if it requires travel or repatriation.

| Benefits of International Insurance in Singapore |

|---|

| Global coverage |

| Access to elite private hospitals |

| Unlimited claims |

| Emergency evacuation services |

Renowned insurance providers offer comprehensive health plans specifically tailored to meet the healthcare needs of expats residing in Singapore. These plans ensure that expats have access to a wide range of medical services, including specialist consultations, hospital stays, diagnostic tests, and prescription medications.

When choosing an international insurance plan, expats should consider factors such as pre-existing conditions coverage, maternity benefits, dental and vision care, as well as the overall cost of the plan. It is important to select a plan that aligns with their specific healthcare needs and budget.

By investing in international insurance in Singapore, expats can obtain comprehensive coverage that allows them to prioritize their health and well-being. With global coverage, access to top-notch healthcare facilities, unlimited claims, and emergency evacuation services, expats can rest assured that they are well-protected in case of any medical emergencies or situations requiring specialized care.

Average Rent in Singapore

Renting in Singapore can be quite the challenge, especially if you have your heart set on those trendy central neighborhoods. You see, the cost of rent in Singapore is famously high. We’re not talking about the sort of prices that make you raise an eyebrow; we’re referring to a level of expense that can truly knock you off your feet.

Living in this vibrant city-state comes with its fair share of expenses, and housing is by far one of the biggest. The average rent in Singapore is significantly higher than in many other countries, making it a substantial contributor to the overall high cost of living.

But don’t fret just yet—there are ways to navigate through this real estate madness. Expats in Singapore have the option to rent apartments or even consider the concept of flat sharing to help reduce those housing expenses without sacrificing the quality of life.

However, before you sign on the dotted line, it’s wise to do your research. Take your time, scour the web, and carefully examine rental prices in the areas you prefer. Don’t forget to consider your budget constraints, because let’s face it, saving a few extra dollars on rent could mean more shopping sprees and flavorful food adventures.

Rental Prices in Popular Singapore Neighborhoods

| Neighborhood | Average Monthly Rent |

|---|---|

| Orchard Road | $4,500 – $10,000 |

| Marina Bay | $4,500 – $12,000 |

| Tanjong Pagar | $3,500 – $7,000 |

| Bugis | $3,500 – $7,000 |

As you can see from the table above, average rental prices vary depending on the neighborhood. The more popular and central the location, the higher the price tag tends to be. If you’re willing to venture slightly further from the city center, you might find more affordable options that could help you save a pretty penny.

Remember, finding a place to call home in Singapore can be an adventure in itself. So strap on your seatbelt, keep an open mind, and get ready to explore the possibilities. After all, this is the Lion City, and she’s full of surprises.

Conclusion

Expats considering a move to Singapore can look forward to a wealth of benefits and attractive compensation packages. With its high standard of living, excellent healthcare, world-class education, and thriving job market, Singapore is a top choice for international workers. However, it is crucial for expats to carefully evaluate their unique circumstances and financial situation before making the move.

While the cost of living in Singapore may be higher compared to other countries, the advantages and opportunities available more than compensate for it. Expats can enjoy a vibrant lifestyle, efficient infrastructure, and a multicultural environment that promotes diversity and inclusivity.

By conducting thorough research and budgeting wisely, expats can make the most of their experience in Singapore. This includes considering housing options, exploring healthcare coverage options, and understanding the tax system. With proper planning, expats can embrace the benefits and compensation offered by Singapore, paving the way for a successful and rewarding journey in this dynamic and cosmopolitan city-state.

FAQ

What are the benefits and compensation for expats in Singapore?

Expats in Singapore can enjoy a high standard of living, excellent healthcare, quality education, and attractive job opportunities. The city-state offers competitive salaries and a favorable tax rate.

What is life like in Singapore?

Singapore has a multicultural population and a tropical climate. It offers a high standard of living, efficient public transportation, and is known for its cleanliness and safety.

How can I work in Singapore?

To work in Singapore, expats need to obtain an Employment Pass or Work Permit, depending on their qualifications and skills. The Ministry of Manpower governs Singapore’s labor policies.

Is Singapore an expensive city to live in?

Yes, Singapore is consistently ranked as one of the most expensive cities in the world. Housing expenses, in particular, can be a significant part of the cost of living.

What is the healthcare system like in Singapore?

Singapore has a well-developed healthcare system with both public and private hospitals. Expats can choose between the two options, and many opt for international health insurance plans for comprehensive coverage.

How can I get around in Singapore?

Singapore has an efficient public transportation system, including the Mass Rapid Transit (MRT), buses, and taxis. Driving in Singapore is limited due to strict regulations and limited road space.

What insurance requirements are there in Singapore?

While insurance is not mandated for tourists, it is highly recommended due to the high cost of healthcare. Expats often have employer-provided insurance, but it’s important to ensure comprehensive coverage.

Are there differences between public and private hospitals in Singapore?

Yes, private hospitals offer reduced wait times, premium facilities, and a wide range of specialists. However, public hospitals in Singapore are also known for providing excellent healthcare services at a more affordable cost.

What types of insurance are available in Singapore?

Expats can choose between local Singapore insurance plans, which may offer more economical coverage but with limitations, or international health insurance plans that provide global coverage and emergency evacuation services.

What is the average rent in Singapore?

Rent in Singapore can be expensive, especially in popular central neighborhoods. Researching rental prices and considering budget constraints when looking for accommodation is advisable.

Q: What are the benefits of working in Singapore as an expat?

A: As an expat in Singapore, you can enjoy a high standard of living, excellent healthcare facilities, a diverse and vibrant culture, and a strong expat community. Additionally, Singapore offers attractive tax rates and a conducive environment for business and career growth.

Q: How does the salary for expats in Singapore compare to their home country?

A: The salary for expats in Singapore is often higher than in their home country, making it an attractive destination for professionals seeking career advancement and a higher income potential.

Q: What is the cost of living like for expats in Singapore?

A: The cost of living in Singapore for expats can be relatively high, especially in terms of accommodation and education. However, the quality of life and available amenities generally offset the higher costs.

Q: What are the key components of compensation for expats in Singapore?

A: Compensation for expats in Singapore typically includes a competitive salary package, housing allowances, medical insurance, and contributions to the Central Provident Fund (CPF), the country’s social security savings plan.

Q: How does the education system in Singapore cater to expat families?

A: Singapore offers a world-class education system with numerous international schools catering to expat families. This ensures that children receive high-quality education while living in Singapore.

Q: Can expats in Singapore access medical insurance?

A: Yes, expats in Singapore can access comprehensive medical insurance coverage, ensuring access to quality healthcare services in the country.

Q: What are the tax implications for expats working in Singapore?

A: Expats working in Singapore are subject to income tax, but the country offers various tax reliefs and incentives to attract and retain foreign talent.

Q: Are there any additional benefits for expats moving to Singapore for work?

A: Expats in Singapore may also enjoy benefits such as a favorable climate, efficient public transportation, a safe and clean environment, and proximity to diverse travel destinations in the region.

Q: What makes Singapore an attractive destination for expats?

A: Singapore’s dynamic business environment, political stability, advanced infrastructure, and the opportunity for personal and professional growth make it an attractive destination for expats seeking new experiences and opportunities.

A: Expats relocating to Singapore can seek assistance from relocation services and online resources to streamline the process, find suitable accommodation, and familiarize themselves with the local culture and lifestyle.