Example:Total Costs for an $800K Property (For Rental)

| Cost Type | Estimated Amount |

|---|---|

| Upfront Costs | |

| Property Price | $800,000 |

| Buyer Stamp Duty (BSD) | $18,600 |

| Additional Buyer Stamp Duty (ABSD) | $160,000 |

| Legal Fees | $3,000 |

| Renovation Costs | $20,000 |

| Total Upfront Costs | $1,001,600 |

| Recurring Costs (Annual) | |

| Property Tax (AV: $24,000) | $2,640 |

| Maintenance Fees | $4,800 |

| Repairs and Maintenance (5% of Rental Income: $36,000) | $1,800 |

| Agent Fees (2-Year Lease) | ~$1,500 (half month) |

| Total Recurring Costs | ~$10,740/year |

_________________________________________________________________________________________________________________________________________________________

When CPF funds are withdrawn for property purchase, any amount used (including for the property price, ABSD, BSD, and legal fees) must be repaid into your CPF account when the Rental property is sold. This repayment includes the principal amount withdrawn and the accrued interest that would have been earned if the funds had remained in your CPF account. The accrued interest is currently at 2.5% per annum, compounded annually.

Below are the calculations for both scenarios, assuming a holding period of 10 years.

Summary of CPF Repayment After 10 Years

| Scenario | Principal CPF Used | Accrued Interest (10 Years) | Total CPF Repayment |

|---|---|---|---|

| $500K Cash Contribution | $481,600 | $132,600 | $614,200 |

| $700K Cash Contribution | $321,600 | $88,700 | $410,300 |

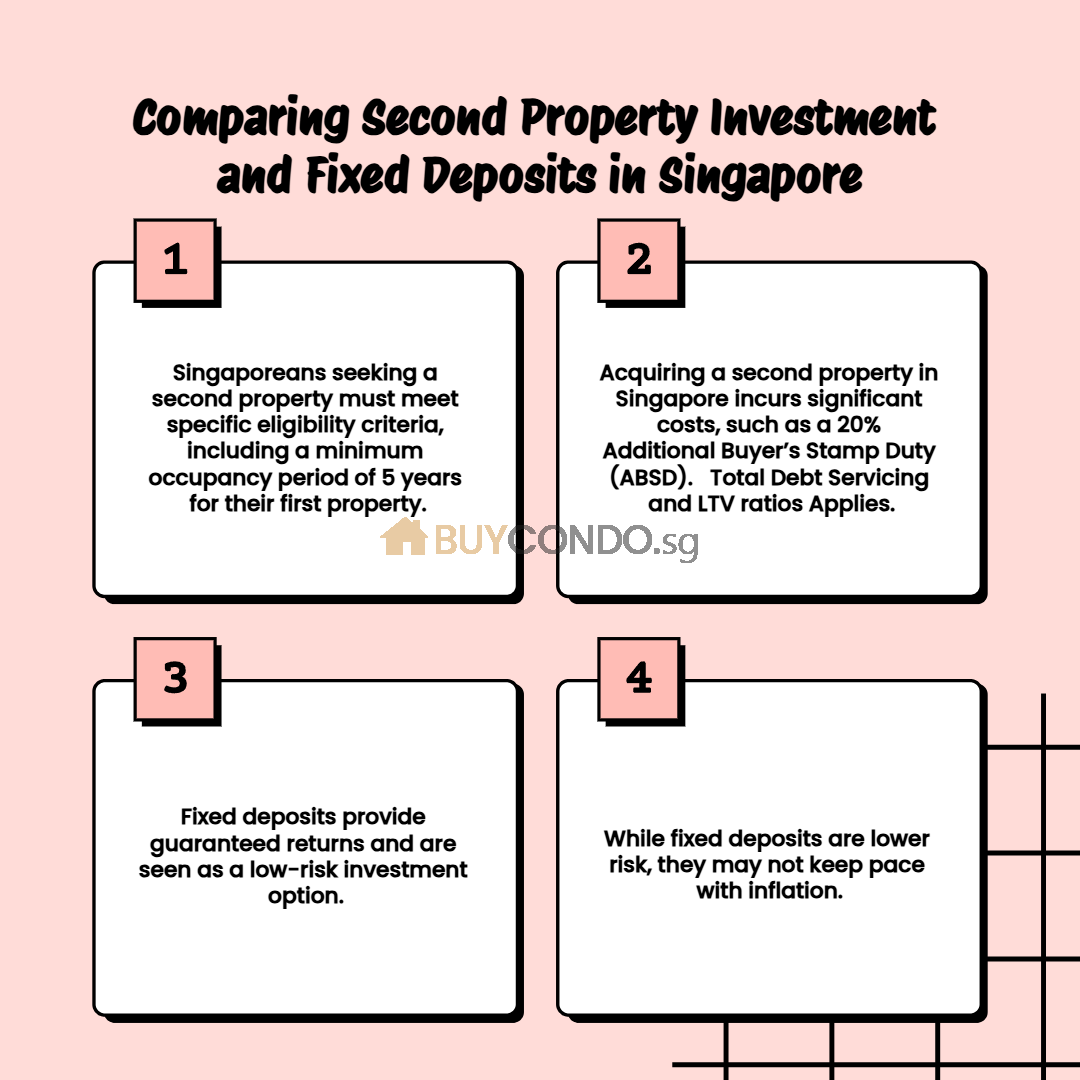

Important Notes : Buying 2nd Property Vs Fix Deposit

- Accrued Interest: This is the interest your CPF funds would have earned if they had not been withdrawn. It is calculated at 2.5% per annum, compounded annually.

- Repayment Obligation: Upon selling the property, the total CPF amount used (including accrued interest) must be refunded to your CPF Ordinary Account.

- Holding Period Assumption: This calculation assumes the property is held for 10 years without any partial repayments during the holding period.

https://www.cpf.gov.sg/member/infohub/educational-resources/sales-proceeds-after-selling-your-home

Advantage of Buying Property Using CPF: Generating Monthly Cash Flow

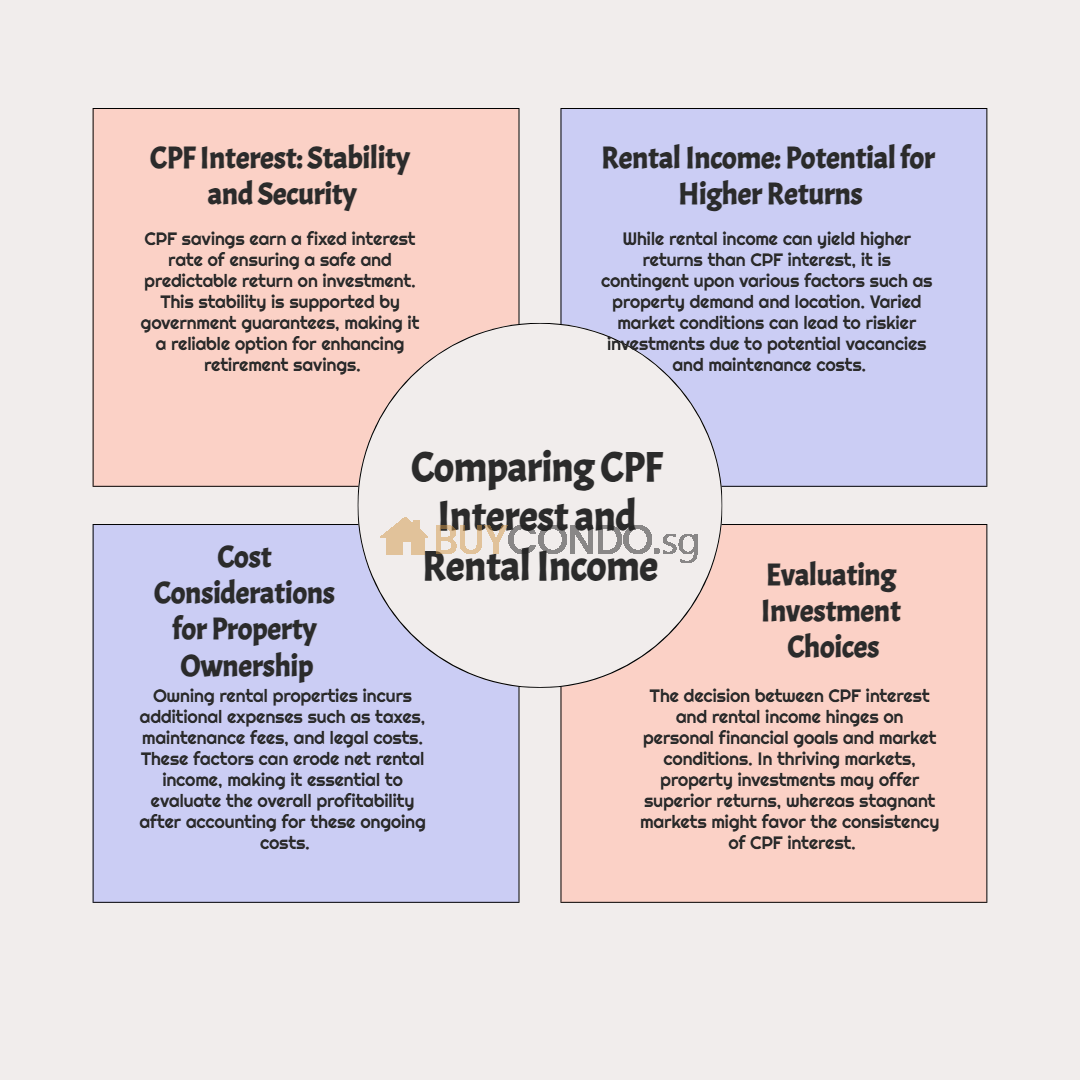

- Rental Income vs CPF Interest:

- CPF funds left in your Ordinary Account earn a fixed 2.5% annual interest, compounded annually.

- When used to purchase property, the same funds can help you generate monthly rental income, which typically yields a higher return compared to the CPF interest rate.

- Example Comparison:

- Scenario 1: Leave CPF in Account

- $321,600 in CPF earns 2.5% annually, which is ~$8,040 per year. Over 10 years, this totals ~$88,700 in accrued interest.

- Scenario 2: Use CPF for Property Purchase

- The same $321,600 helps fund a property that generates $3,500/month in rental income (based on a $1M property).

- Annual Rental Income: ~$42,000. Over 10 years, this totals ~$420,000 (excluding potential rental increases).

- Scenario 1: Leave CPF in Account

- Immediate Cash Flow:

- Rental income provides immediate monthly cash flow, which can be used for personal expenses, reinvestments, or even offsetting other costs, such as property maintenance or taxes.

- CPF interest, on the other hand, is locked in and only accessible upon retirement or specific withdrawal conditions.

- Capital Appreciation:

- In addition to rental income, the property itself has the potential to appreciate in value over time, resulting in long-term capital gains.

- CPF funds in the Ordinary Account do not benefit from such appreciation.

- Leveraging a Tangible Asset:

- A property is a tangible asset that can hedge against inflation, whereas CPF interest rates are fixed and may not keep up with inflation in the long run.

Key Takeaway : Buying 2nd Property Vs Fix Deposit

Using CPF to purchase a property allows you to own a tangible asset and exchange it for monthly rental income, which can significantly outpace the returns from leaving CPF funds in your account. This makes property investment a more dynamic and potentially lucrative wealth-building option.

__________________________________________________________________________________________________________________________________________________________________________

Costs to Take Note of When Buying a Property to Rent Out

Here’s the revised breakdown of costs, removing home insurance and adjusting repairs and maintenance to 5% of annual rental income instead of 10%.

1. Upfront Costs

These are one-time costs incurred during the purchase of the property.

a) Property Price

- The purchase price of the property is the largest upfront cost.

b) Stamp Duties

- Buyer Stamp Duty (BSD):

- Calculated based on the property price or market valuation (whichever is higher).

- Example for a $1,000,000 property: ~$24,600.

- Additional Buyer Stamp Duty (ABSD):

- Applicable if it’s your second or subsequent property.

- For Singapore Citizens, ABSD is 20% for the second property.

c) Legal Fees

- Covers the conveyancing process, title search, and other paperwork.

- Estimated at $2,500 to $3,500.

d) Property Valuation Fee

- The bank will require a property valuation if you’re taking a loan.

- Estimated cost: $300 to $500.

e) Loan-Related Costs (if applicable)

- Mortgage Stamp Duty: ~$500.

2. Recurring Costs

These are ongoing costs you need to manage while holding the property.

a) Mortgage Repayments (if applicable)

- Monthly repayments for any housing loan taken to finance the property.

b) Property Taxes

- Residential Non-Owner-Occupied Tax Rate:

- Progressive rates starting at 11% of the Annual Value (AV) for the first $30,000, and up to 27% for higher AV.

- Example: If the AV is $30,000, property tax = $3,300/year.

c) Maintenance Fees (for Condominiums)

- Monthly fees for upkeep of common facilities like pools, gyms, and security.

- Estimated at $300 to $500/month, depending on the condo.

d) Repairs and Maintenance

- Set aside 5% of annual rental income to cover minor repairs and maintenance.

- Example: For a property generating $42,000/year in rental income, allocate $2,100/year.

e) Agent Fees (for Renting Out)

- If you engage a property agent to find tenants, the standard fee is:

- 1 month’s rent for a 2-year lease.

- 0.5 month’s rent for a 1-year lease.

3. Miscellaneous Costs

a) Vacancy Periods

- Account for periods when the property is not rented out.

- Budget for 1-2 months of vacancy per year as a buffer.

b) Furniture and Appliances

- If renting out a fully furnished unit, factor in the cost of furniture and appliances.

- Estimated around One Month of Rental for Fully furnished.

c) CPF Accrued Interest (if CPF is used)

- As mentioned earlier, any CPF funds must be repaid with accrued interest (2.5% per annum).

4. Selling Costs (Future Consideration) : Buying 2nd Property Vs Fix Deposit

a) Seller Stamp Duty (SSD)

- Applicable if you sell the property within 3 years of purchase.

- 1st year: 12%, 2nd year: 8%, 3rd year: 4%, 4th year onwards: No SSD.

b) Agent Fees (for Selling)

- Typically 2% of the selling price, plus GST.