Recently our Team have transacted more than before Commercial/industrial Properties.

Although was a bit surprised given the Higher Interest Rates, however, what has taken place makes some sense overall. With Interior Design can bring the potential out of the property.

For business owners who could be looking to hedge against the possibility of stagflation, buying their business premises is a smart move. Not only will this provide them with a physical asset that will hold its value during periods of inflation, but it will also give them the flexibility to use the space as they see fit. In addition, owning their property will enable businesses to avoid the spiralling costs of renting commercial space.

Top 5 Benefits Can be: Save on Rent, Stability, Flexibilty, Investment Potential and Tax Breaks.

1. You’ll save money on rent. Over time, the cost of rent will almost certainly go up. By owning your property, you have more control, allowing you to better budget for other expenses and avoid the financial stress of ever-increasing rent payments.

2. When you own your office space, you don’t have to worry about being priced out of the market or having your lease renewed on unfavourable terms. You’re in control of your destiny, which can provide great peace of mind. And, if you ever need to downsize or expand, you can do so without having to go through the hassle and expense of finding new office space.

3. You’ll have more control over your space. When you own your property, you can make whatever changes you want without getting approval from a landlord, including adding an extra office or making cosmetic changes like painting or installing new carpeting.

4. While there are no guarantees when it comes to investing, owning your own office space gives you the potential to earn a return on your investment if the property’s value appreciates over time. Even if the value doesn’t increase, you’ll still benefit from not having to pay rent. And, if you ever decide to sell, you’ll be able to keep any profits from the sale.

5. You’ll be able to take advantage of tax breaks. When you own your commercial property, you’ll be able to deduct the interest on your mortgage and any repairs or improvements you make to the property. It can help fray an amount of money in your tax planning cost.

Why Stagflation is a Threat to Businesses

Stagflation is a term used to describe a period of economic slowdown or stagnation combined with high inflation. It can be a challenging time for businesses, as they may struggle to maintain profitability in the face of rising costs and stagnant demand.

During periods of stagflation, businesses are forced to choose between passing on higher costs to consumers through price increases or absorbing these costs and eating into their profits. Neither option is ideal, and businesses not prepared for stagflation can quickly find themselves in difficulty.

How Owning Commercial Property Can Help Hedge Against Stagflation

Given the above risks associated with stagflation, cash-rich businesses should consider using some of their capital to buy their commercial premises. Not only will this provide them with a physical asset that will hold its value during periods of inflation, but it will also give them the flexibility to use the space as they see fit. In addition, owning their property will enable businesses to avoid the spiralling costs of renting commercial space.

Conclusion:

Buying their business premises is a smart move for business owners looking to hedge against the possibility of stagflation. Not only will this provide them with a physical asset that will hold its value during periods of inflation, but it will also give them the flexibility to use the space as they see fit. In addition, owning their property will enable businesses to avoid the spiralling costs of renting commercial space.

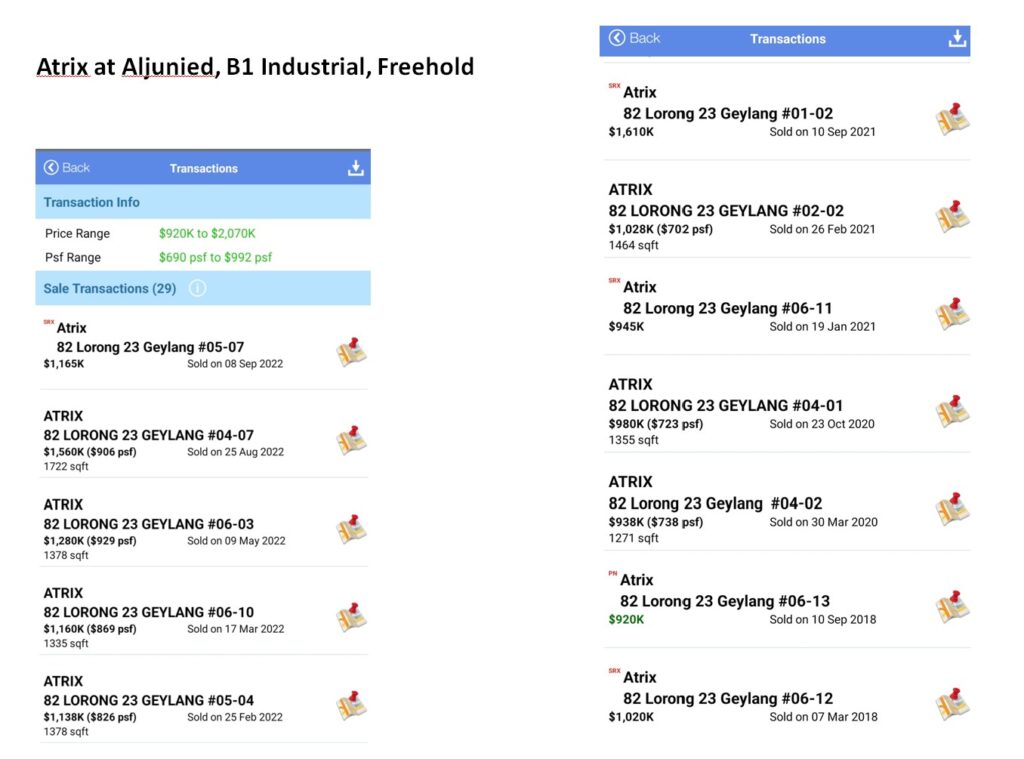

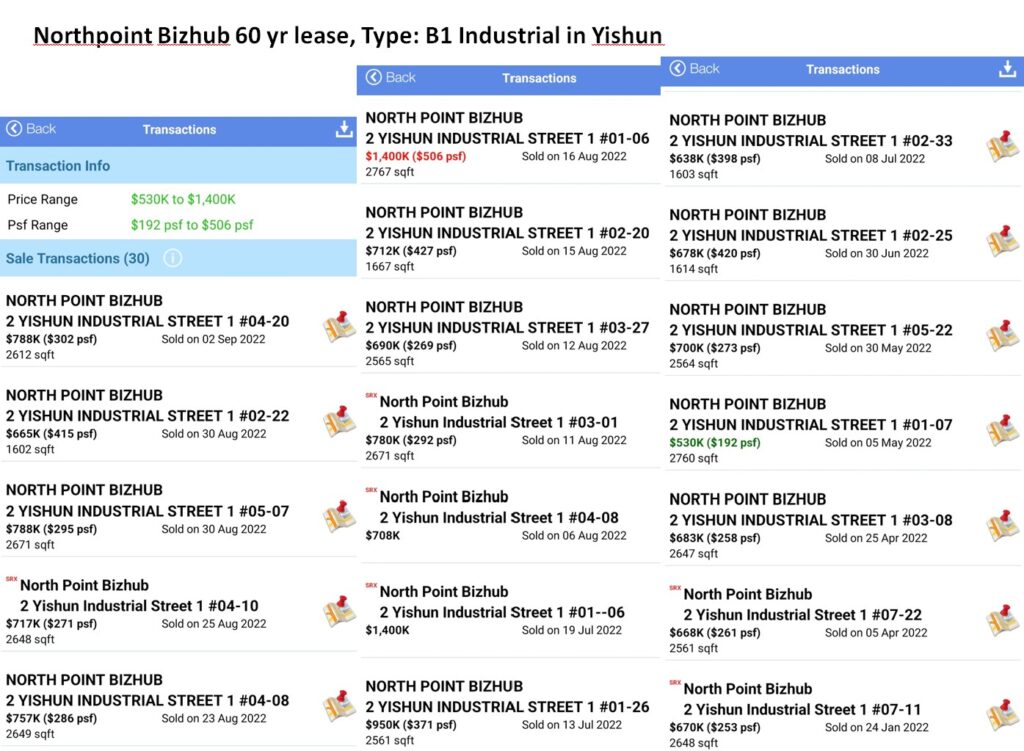

Examples of Some Properties were the Sales Transactions sold by us that were higher in Volume and Price than before.

Property that We have assisted the Owner to Sell more than $100K Above Valuation.:

To Get Better Sound Advice. Contact us today.

We Help Property Owners to get the best out of their Investment properties as well as giving advises for Business Owners looking to buy a property for their own-use.