What are CCR, RCR and OCR?

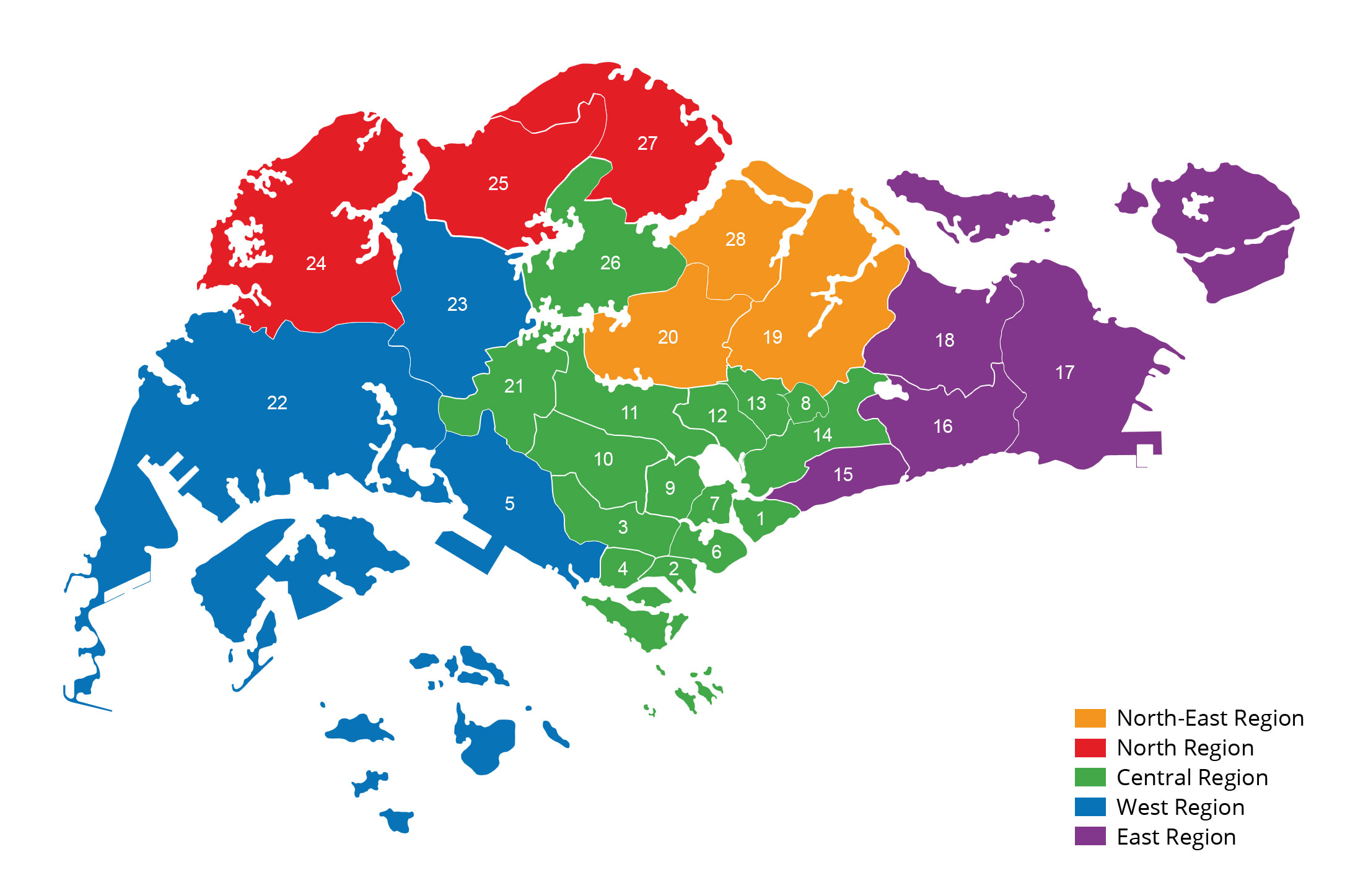

Broadly, the Urban Redevelopment Authority (URA) has divided Singapore into three main regions, which the URA calls “market segments”.

These regions are the Core Central Region (CCR), Rest of Central Region (RCR), and the Outside Central Region (OCR).

Singapore regions Postal districts it covers

Core Central Region (CCR) 9, 10, and 11, and parts of 1, 2, 4, 6 and 7

Rest of Central Region (RCR) 3, 8 and 12, and parts of 1, 2, 4, 5, 6, 7, 13, 14, 15 and 20

Outside Central Region (OCR) 16 to 19, 22, 23 and 25 to 28, and parts of 5, 14, 15 and 20

Core Central Region (CCR): City, Downtown Core and Sentosa

The Core Central Region, also known as the CCR, includes the traditional prime areas of Singapore (i.e. postal districts 9, 10 and 11), the Downtown Core (including parts of Bugis south of Ophir Road), as well as Sentosa.

This is where most high-end, luxury properties in Singapore can be found. Many of the private residential properties in the CCR are also freehold in tenure.

| Singapore Postal District | Area |

|---|---|

| 9 | Orchard, Somerset, River Valley |

| 10 | Tanglin, Bukit Timah, Holland |

| 11 | Newton, Novena, Dunearn, Watten |

| 1 (Part) | Boat Quay, Raffles Place, Marina Downtown, Suntec City |

| 2 (Part) | Shenton Way, Tanjong Pagar |

| 4 (Part) | Sentosa |

| 6 (Part) | City Hall |

| 7 (Part) | Bugis |

What’s not part of the CCR: Outram, Clarke Quay, Chinatown, Bencoolen and anything north of Ophir Road

Our take on the CCR: Even though the CCR might be made up mostly of high-end properties, there can still be a few value finds.

Rest of Central Region (RCR): Central areas that are not part of CCR

The Rest of Central Region, also known as the RCR, is sandwiched between the CCR and the Outside Central Region (OCR).

The RCR is regarded as the intermediate, or mid-tier, region in terms of pricing, between the mass market condos in the OCR region and the high-value properties in the CCR. However, as our Property Market Outlook 2020 shows, the gap is closing between RCR and CCR properties, particularly in districts where urban development, renewal and infrastructure growth has taken place.

| Singapore Postal District | Area |

|---|---|

| 1 (Part) | Marina South |

| 2 (Part) | Chinatown |

| 3 | Queenstown, Alexandra, Tiong Bahru |

| 4 (Part) | Harbourfront, Keppel, Telok Blangah |

| 5 (Part) | Buona Vista, Dover, Pasir Panjang |

| 6 (Part) | Fort Canning |

| 7 (Part) | Rochor |

| 8 | Little India, Farrer Park |

| 12 | Balestier, Whampoa, Toa Payoh Boon Keng, Bendemeer, Kampong Bugis |

| 13 (Part) | Potong Pasir, Bidadari, MacPherson, Upper Aljunied |

| 14 (Part) | Geylang, Dakota, Paya Lebar Central Eunos, Ubi, Aljunied |

| 15 (Part) | Tanjong Rhu, Amber, Meyer, Katong Dunman, Joo Chiat, Marine Parade |

| 20 (Part) | Bishan, Thomson |

What’s not part of the RCR: Upper Serangoon, How Sun, Ang Mo Kio, Clementi, Telok Kurau, Kembangan

Our take on the RCR: The RCR benefits from the confluence of demand from various buyer groups, from investors to owner-occupiers, and from young families to empty nesters.

Outside Central Region (OCR): Everywhere else in Singapore

The Outside Central Region (RCR) is about three-quarters the size of Singapore, and basically refers to areas where mass-market condos at the lower range of price points are located, including Executive Condominiums (ECs). You could say that these places are “suburbs”, but this would give a false impression of remoteness.

Here’s the thing: with excellent MRT connectivity around the island, the OCR is a very viable and affordable housing option even for those who work in the city, with resale condo prices as low as $800 per square foot (psf).

The government also has plans to bring high-value jobs to the OCR, in the form of Jurong Second CBD, Punggol Digital District and Woodlands Regional Centre.

Private residential projects in the OCR are also typically larger, with condos usually clocking in at 300 units or above, barring some boutique developments that are typically located among landed property enclaves.

OCR properties are also mostly 99-year leasehold.

| Singapore Postal District | Area |

|---|---|

| 5 (Part) | Clementi, West Coast |

| 14 (Part) | Kembangan, Kaki Bukit |

| 15 (Part) | Telok Kurau, Siglap, Frankel |

| 16 | Bedok, Upper East Coast, Bayshore Tanah Merah, Upper Changi |

| 17 | Flora Drive, Loyang, Changi |

| 18 | Tampines, Pasir Ris |

| 19 | Punggol, Sengkang, Hougang, Kovan Serangoon, Lor Ah Soo |

| 20 (Part) | Ang Mo Kio |

| 22 | Jurong East, Jurong West, Boon Lay |

| 23 | Hillview, Bukit Panjang, Bukit Batok, Choa Chu Kang |

| 25 | Woodlands, Admiralty |

| 26 | Lentor, Springleaf, Mandai |

| 27 | Yishun, Sembawang |

| 28 | Seletar, Seletar Hill, Sengkang West |

Our take on the OCR: Given the stiff competition between projects across various OCR locations, developers are pulling out all the stops to lure buyers.

Attractive pricing is only one thing; given the larger size and higher unit counts of OCR projects, developers can afford to include show-stopping facilities, making the projects particularly appealing to young couples and millennial families.

According to recent transaction data from URA, the most popular OCR districts are 5, 17 and 19, thanks to a succession of newly launched condominiums in these areas.

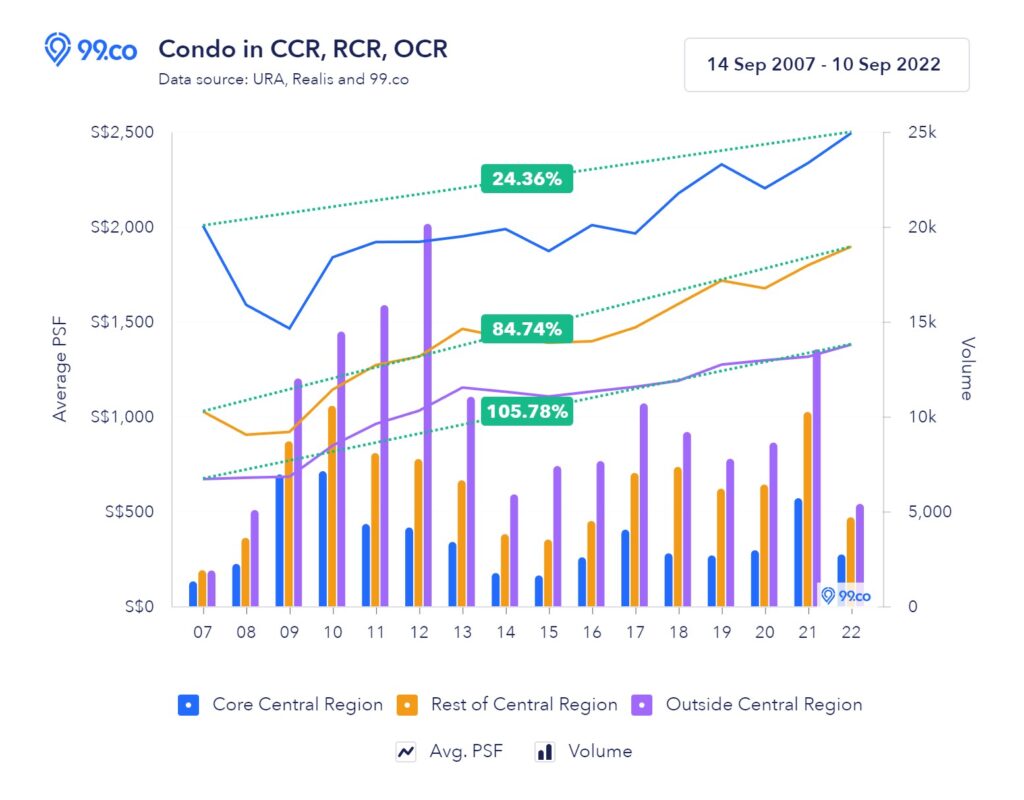

Condo in CCR,RCR,OCR Perfomance Growth Graph Chart

FAQs around the regions of Singapore

What is CCR property?

CCR property refers to properties in the Core Central Regions of 9, 10 and 11, the Downtown Core and Sentosa.

What is considered Central Singapore?

Singapore’s Central Region is made up of 22 URA planning areas that are Downtown Core, Orchard, Marina East, Marina South, Museum, Newton, Outram, River Valley, Rochor, Singapore River, Straits View, Bishan, Bukit Merah, Bukit Timah, Geylang, Kallang, Marine Parade, Novena, Queenstown, Southern Islands, Tanglin and Toa Payoh.

Does Singapore have districts?

Yes, Singapore is divided into 28 postal districts.

CCR, RCR, and OCR – Rental yields across Singapore’s different regions

More focused table with the latest data and sources:

| Region | Average PSF Price | Monthly Rent PSF | Gross Rental Yield | Net Rental Yield | Q3 2024 Rental Change | Source |

|---|---|---|---|---|---|---|

| CCR (Core Central) | $2,800 | $4.80 | 2.8% | 2.3% | -1.6% | URA Q3 2024, ERA Research |

| RCR (Rest Central) | $2,100 | $4.20 | 3.2% | 2.7% | +1.7% | URA Q3 2024, PropertyGuru |

| OCR (Outside Central) | $1,600 | $3.80 | 3.6% | 3.1% | +2.2% | URA Q3 2024, ERA Research |

Sources:

- URA Q3 2024 Real Estate Statistics (Released 25 Oct 2024)

- ERA Singapore Market Report Q3 2024

- PropertyGuru Singapore Property Market Index Q4 2024

Notes:

- Net yield calculations account for property tax, maintenance fees, and vacancy periods

- Rental changes are based on the latest URA data for Q3 2024

- Price per Square Foot (PSF) data is averaged from multiple sources, including URA and PropertyGuru

- The CCR shows continued rental decline, while RCR and OCR show growth in Q3 2024

The data shows interesting trends where OCR and RCR are showing positive rental growth. At the same time, CCR continues to experience some decline, which might affect investment decisions for property investors in different regions of Singapore.