Comprehensive Home Insurance: Protecting Landlords and Tenants Alike

Comprehensive Home Insurance: Protecting Landlords and Tenants Alike. Safeguard the tenants for their personal belongings, Fittings such as the kitchen, carpentry and appliances so and so forth for Landlords.

We also cover some of the benefits of insurance plans offered by Singlife, AIG, and Great Eastern.

Overview of Home Insurance for Landlords and Tenants

Home insurance is an essential aspect of protecting both landlords and tenants, ensuring the safety and security of the property and personal belongings. Many individuals may overlook the importance of home contents insurance, leaving their valuable possessions at risk. Basic fire insurance, which is typically owned by most homes, does not cover personal belongings, leaving homeowners and tenants exposed to potential loss. Fires, floods, and incidents in neighboring units can lead to significant damages to personal belongings, emphasizing the need for comprehensive home insurance coverage.

Based on my 14 years of experience in the Property Management Service, I have encountered 4 times of the water hazards in the apartment and industrial properties.

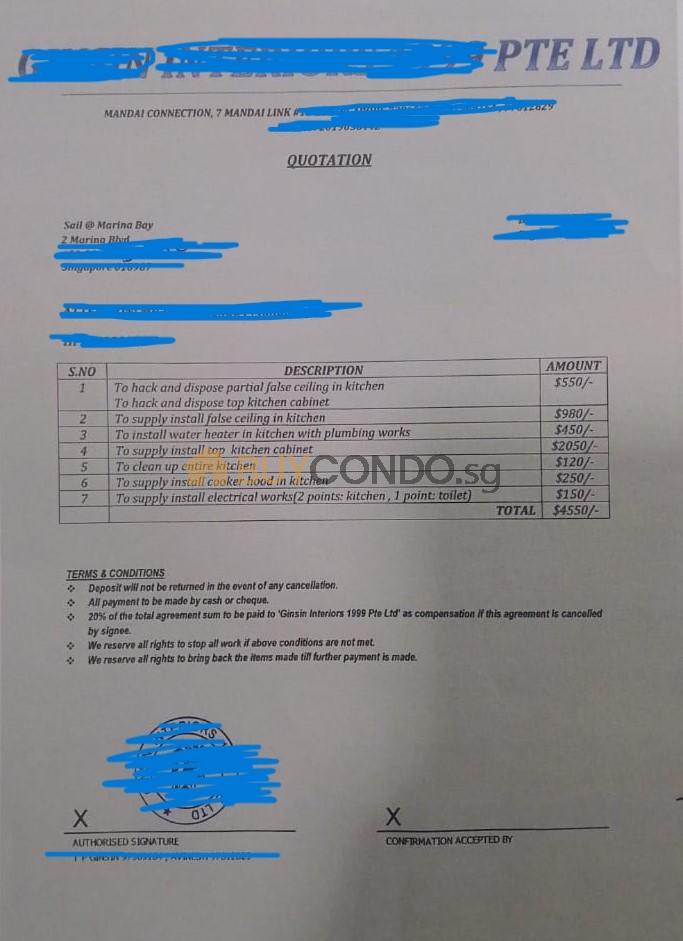

First time was in the Sail Condo, the tenant was overseas did not turn of the water supplies. The Water Heater above the Kitchen burst, by the time the landlord is being contacted by the MCST damaged is already made.

For this instance in 2019, landlord incurred additional renovation cost of $4,550 as well as a lost of rental for close to a month.

Scenario 1: Fire Hazards

For instance, consider a scenario where a fire breaks out in a neighboring unit of a rented apartment, causing damage to the tenant’s personal belongings such as furniture, electronics, and clothing. In such a distressing situation, having comprehensive home insurance could provide the necessary financial support to replace or repair these items without incurring significant out-of-pocket expenses, offering peace of mind to tenants and ensuring that they can quickly recover from the unfortunate incident.

Scenario 2: Water or Electrical Hazards

In addition to fire, other unforeseen events such as floods, burst water pipes, or short-circuiting electrical appliances can also pose risks to personal belongings and property. With the right home insurance coverage, both landlords and tenants can mitigate these potential risks and protect their valuable assets from various perils, ensuring a sense of security and financial stability.

In 2022, a case of a flood where the Smoke Detectors as the result of the water sprinklers being activated in a industrial property. The Water excessly back flow into the individual Strata units.

The Importance of Home Insurance

Home insurance plays a crucial role in safeguarding the financial interests and personal belongings of both landlords and tenants. Basic fire insurance, which is commonly held by most homeowners, does not provide coverage for personal belongings, leaving individuals vulnerable to potential loss. It is important to emphasize the significance of comprehensive home insurance, which extends protection to personal belongings and provides a safety net against unforeseen events such as theft, fire, or natural disasters. This comprehensive coverage ensures that both landlords and tenants have the necessary financial security and peace of mind, knowing that their valuable assets are adequately protected.

Furthermore, the importance of home insurance can be highlighted through real-life examples where individuals faced unexpected losses due to the lack of adequate coverage. For instance, a tenant who experienced a burglary and suffered significant losses in terms of stolen valuables and personal belongings could have benefitted from renters’ insurance to mitigate the financial impact of the incident. Similarly, a landlord who faced property damage due to a burst water pipe could have relied on comprehensive home insurance to cover the repair costs and avoid substantial financial burden. These examples underscore the critical role of home insurance in protecting the interests of both landlords and tenants, emphasizing the need for comprehensive coverage to ensure financial security and peace of mind.

Understanding Landlord and Tenant Insurance Policies

Landlord insurance policies are specifically designed to protect the property owner’s investment, covering various aspects such as the building, liability, and potential loss of rental income. These policies offer a comprehensive approach to safeguarding the financial interests of landlords, ensuring that their property and rental income are adequately protected. On the other hand, tenant insurance policies, also known as renters’ insurance, are essential for protecting personal belongings, liabilities to third parties, and may include personal accident and medical benefits. It is crucial to understand the distinctions between these policies and the specific coverage options they offer to landlords and tenants [2].

For example, consider a landlord who rents out a residential property and faces a situation where the rented unit suffers damage due to a fire. In such a scenario, the landlord insurance policy can provide coverage for the repair or reconstruction costs of the building, ensuring that the financial impact of the incident is mitigated. Conversely, a tenant who experiences a similar fire incident can rely on renters’ insurance to cover the replacement or repair costs of their personal belongings, offering financial protection and support in the face of unexpected events. These examples illustrate the tailored nature of landlord and tenant insurance policies, emphasizing the importance of understanding the specific coverage options available to both parties.

Landlord’s home insurance policy does not extend coverage to the personal belongings of tenants, necessitating the need for renters’ insurance. This distinction underscores the importance of tenants securing their own insurance to protect their assets and personal belongings. By understanding the unique coverage options offered by landlord and tenant insurance policies, both landlords and tenants can make informed decisions to ensure comprehensive protection for their respective interests and assets.

The Role of Renters’ Insurance

The Role of Renters’ Insurance

Renters’ insurance, also known as tenant insurance, plays a critical role in protecting personal belongings, liabilities to third parties, and potential medical benefits for tenants. This type of insurance provides essential coverage for individuals who are renting residential properties, offering financial security and peace of mind in the face of unforeseen events. It is imperative for tenants to ensure that the policy provides necessary coverage for specific events and fits their individual needs. Creating a detailed list of their belongings and calculating the replacement cost can help determine the required coverage, ensuring tenants have adequate protection for their personal assets.

Consider a scenario where a tenant experiences a break-in and theft of valuable possessions from their rented apartment. Renters’ insurance can offer the necessary financial support to cover the replacement or repair costs of the stolen items, mitigating the impact of the theft and providing peace of mind to the tenant. Additionally, in the event of accidental damage to a neighbor’s property caused by the tenant, renters’ insurance can offer liability coverage, ensuring that the tenant is financially protected from potential legal claims and associated costs. These examples illustrate the vital role of renters’ insurance in providing comprehensive protection for tenants, offering financial security and support in various unforeseen circumstances.

Choosing the Right Insurance Coverage

Selecting the right mix of coverage for home insurance is crucial for both landlords and tenants, considering their specific needs and the nature of their property or rented space. Policies offering higher coverage for expensive items and including alternative accommodation benefits should be prioritized to ensure comprehensive protection. It is essential for individuals to assess their unique requirements and the value of their assets to make informed decisions about the most suitable insurance coverage for their properties or rented spaces.

In the context of choosing the right insurance coverage, it is important to consider the specific needs and preferences of both landlords and tenants. For landlords, the focus is on safeguarding the property and rental income, necessitating comprehensive coverage for the building, liability, and potential loss of rental income. On the other hand, tenants require protection for their personal belongings and liabilities to third parties, and may include personal accident and medical benefits. This distinction underscores the need for tailored insurance coverage that addresses the distinct requirements of both landlords and tenants, ensuring that they have the necessary protection and financial security in place.

Furthermore, the process of choosing the right insurance coverage can involve assessing the potential risks and perils that may impact the property or personal belongings. For landlords, this may include evaluating the structural integrity of the building, the likelihood of rental income loss, and the potential liabilities associated with property ownership. For tenants, the focus may be on assessing the value of their personal assets, the likelihood of theft or damage, and the potential liabilities to third parties. By carefully considering these factors and evaluating the coverage options available from insurance providers, both landlords and tenants can make informed decisions to ensure comprehensive protection for their respective interests and assets.

Notable Insurance Companies for Home Insurance

When it comes to home insurance, several reputable insurance companies offer comprehensive coverage for both landlords and tenants. Singlife, for instance, provides a variety of insurance plans, including medical, life, critical illness, disability, maternity, accident, car, travel, and home insurance. The company’s Home Insurance plans offer comprehensive coverage for household contents, personal legal liability, and alternative accommodation, with additional add-ons for extra protection, such as bicycle coverage, replacement locks, and family cyber risk protector. This extensive coverage ensures that both landlords and tenants have access to a wide range of benefits and protection for their respective interests and assets.

AIG, another notable insurance provider, offers various types of insurance for personal and business needs, including home insurance for private property owners. The company’s home insurance plans provide coverage for the building, contents, personal belongings, and liability, along with additional coverage options and optional add-ons, catering to the diverse needs of property owners. AIG’s coverage options are designed to address the specific requirements of different property owners, offering a tailored approach to home insurance that ensures comprehensive protection for both landlords and tenants. Additionally, AIG’s optional add-ons, such as worldwide identity fraud cover and multi-appliance extended warranty, provide additional layers of protection for property owners, offering a more holistic approach to home insurance.

Great Eastern also stands out as a reliable insurance provider, offering the HomeGR8 Plus—an all-risks home insurance cover that protects the building, renovations, and household contents. This comprehensive policy ensures that all valuable possessions are adequately protected without the fear of penalties for under-insurance, providing a sense of security and financial stability for homeowners and tenants alike. By providing extensive coverage for various perils and risks, Great Eastern’s HomeGR8 Plus offers a comprehensive solution for individuals seeking robust home insurance that safeguards their interests and assets.

Benefits of Singlife’s Home Insurance Plans

Benefits of Singlife’s Home Insurance Plans

Singlife’s Home Insurance plans offer a wide range of benefits for both landlords and tenants, ensuring comprehensive coverage for various aspects of home protection. For landlords, the plans provide coverage for household contents, safeguarding valuable assets within the property. This includes protection against perils such as fire, theft, and vandalism, mitigating potential financial losses in case of unforeseen events. Additionally, the inclusion of personal legal liability coverage in Singlife’s plans is particularly advantageous for landlords, offering protection against legal claims and associated costs in the event of injuries or property damage sustained by third parties on the premises. This ensures that landlords have financial security and peace of mind, knowing that they are protected from potential legal liabilities that may arise from renting out their property.

For tenants, Singlife’s Home Insurance plans offer essential coverage for personal belongings, ensuring that their possessions are safeguarded against risks such as theft, fire, and damages. This is especially crucial given that landlord’s home insurance policies do not extend coverage to the personal belongings of tenants, emphasizing the importance of renters’ insurance to protect their assets. Furthermore, the provision of alternative accommodation benefits in Singlife’s plans is an invaluable feature for tenants, as it ensures that they have a safety net in the event that their rented property becomes uninhabitable due to covered perils. This means that tenants can have peace of mind, knowing that they have a temporary living arrangement and are not financially burdened in case of unforeseen circumstances that render their rented property unlivable. The seamless claims experience offered by Singlife further enhances the overall benefits of their Home Insurance plans, providing a convenient and efficient process for landlords and tenants to address any potential claims and receive the necessary support in a timely manner.

In conclusion, Singlife’s Home Insurance plans offer a comprehensive range of benefits for both landlords and tenants, ensuring that their respective needs and assets are adequately protected. From safeguarding household contents and providing legal liability coverage for landlords to protecting personal belongings and offering alternative accommodation benefits for tenants, Singlife’s plans are designed to provide financial security and peace of mind for all parties involved in the renting process.

Benefits of AIG’s Home Insurance Plans

Benefits of AIG’s Home Insurance Plans

AIG’s home insurance plans not only offer coverage for the building and its contents but also extend protection to personal belongings and liability. This means that in the event of unforeseen circumstances such as fire, theft, or natural disasters, both the structure of the property and the items inside, including personal belongings, are safeguarded. Additionally, AIG’s coverage options are designed to address the specific needs of different property owners, whether they own condominiums, landed homes, or HDB flats, providing a tailored approach to insurance.

For example, if a landlord owns a condominium unit and rents it out to tenants, AIG’s home insurance plan can cover the building, common areas, and the landlord’s liability as the property owner. Furthermore, the plan can also extend coverage to the landlord’s personal belongings that are kept within the rental property. This comprehensive protection ensures that the landlord’s investment is safeguarded from potential risks, such as damage to the unit due to a burst pipe or accidental fires, giving them the peace of mind that their property is adequately covered.

Moreover, AIG’s optional add-ons, such as worldwide identity fraud cover and multi-appliance extended warranty, provide additional layers of protection for property owners, offering a more holistic approach to home insurance. These add-ons can be particularly beneficial for landlords who furnish their rental properties with expensive appliances and electronics, as they can mitigate the financial impact of potential damages or theft. Overall, AIG’s home insurance plans are designed to provide a comprehensive cover for the home and its contents, offering property owners a sense of security and protection against unexpected events.

Benefits of Great Eastern’s HomeGR8 Plus

Great Eastern’s HomeGR8 Plus is an all-encompassing home insurance plan that goes beyond the basic coverage to protect homeowners and tenants from a wide range of risks and potential losses. This comprehensive policy not only safeguards the building and its renovations but also extends its coverage to the household contents, ensuring that all valuable possessions are adequately protected without the fear of penalties for under-insurance.

For instance, imagine a scenario where a fire breaks out in a neighboring unit and spreads to your rented apartment, causing damage to your personal belongings such as furniture, electronics, and clothing. In such a distressing situation, having Great Eastern’s HomeGR8 Plus could provide the necessary financial support to replace or repair these items without incurring significant out-of-pocket expenses, offering peace of mind to tenants and ensuring that they can quickly recover from the unfortunate incident.

Furthermore, this insurance plan is designed to protect the interests of landlords and property owners as well. In the event of a major renovation or construction project, the HomeGR8 Plus policy can safeguard the property from potential damages, providing a safety net against unexpected events such as structural damage, theft of building materials, or accidental loss during the renovation process. By offering such extensive coverage, Great Eastern’s HomeGR8 Plus stands out as a reliable and comprehensive solution for homeowners and tenants, ensuring that they are well-prepared for any unforeseen circumstances that may arise.

In conclusion, the availability of comprehensive home insurance plans from reputable providers such as Singlife, AIG, and Great Eastern ensures that both landlords and tenants have access to a wide range of benefits and protection for their respective interests and assets. By carefully evaluating the coverage options offered by these insurance companies, individuals can make informed decisions to ensure that their properties and personal belongings are adequately protected from potential risks and perils.

Conclusion : Comprehensive Home Insurance: Protecting Landlords and Tenants Alike

In conclusion, home insurance is a vital aspect of protecting the financial interests and personal belongings of both landlords and tenants. The availability of comprehensive coverage from reputable insurance providers such as Singlife, AIG, and Great Eastern ensures that both landlords and tenants have access to a wide range of benefits and protection for their respective interests and assets. By understanding the importance of home insurance, the distinctions between landlord and tenant insurance policies, and the specific benefits offered by leading insurance companies, individuals can make informed decisions to safeguard their properties and personal belongings from potential risks and perils. Whether it’s protecting household contents and personal belongings or ensuring alternative accommodation benefits, comprehensive home insurance offers financial security and peace of mind for both landlords and tenants, ensuring that their valuable assets are adequately protected.