For a 35-year-old Permanent Resident (PR) looking to purchase a S$2 million property in Singapore. (Case Study)

This guide focuses on making the financial aspects easy to understand, highlighting the key amounts you’ll need to prepare for.

The payments can be broadly categorised into initial upfront costs and ongoing expenses.

I. Initial Upfront Payments (What you pay at the start) – For Resale Condo

When you decide to buy a S$2 million property, you’ll have several significant payments to make right away:

- Booking Fee (Option to Purchase – OTP):

- This is the very first payment to secure the property.

- It’s typically 1% of the purchase price, paid in cash.

- For a S$2,000,000 property, this means S$20,000 in cash.

- Downpayment:

- After the booking fee, you’ll need to pay the rest of your downpayment when you sign the Sale & Purchase Agreement (S&P).

- In total, you need to put down 25% of the property’s price.

- Out of this 25%, at least 5% of the purchase price must be in cash (this includes your initial 1% booking fee, so another 4% in cash is due).

- Minimum Cash Downpayment: S$2,000,000 x 5% = S$100,000 (cash).

- The remaining 20% of the downpayment (S$2,000,000 x 20% = S$400,000) can be paid using your CPF Ordinary Account (OA) savings or more cash.

3. Stamp Duties (Taxes on Property Purchase):

-

-

- These are taxes calculated on the higher of the property’s purchase price or its market value.

- For a S$2,000,000 property, the Buyer’s Stamp Duty (BSD), which everyone pays, is S$69,600.

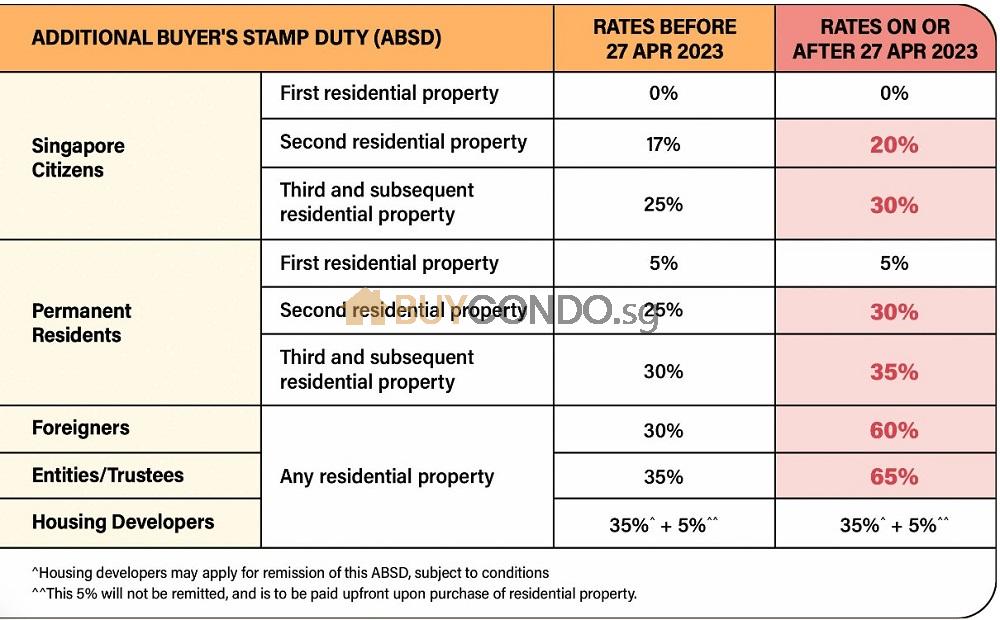

- The most significant variable is the Additional Buyer’s Stamp Duty (ABSD), which depends on how many properties you own in Singapore:

- Scenario 1: PR buying their FIRST residential property

- ABSD is 5%.

- ABSD amount = S$2,000,000 x 5% = S$100,000.

- Total Stamp Duties (BSD + ABSD) = S$69,600 + S$100,000 = S$169,600.

- Scenario 2: PR buying their SECOND residential property

- ABSD is 30%.

- ABSD amount = S$2,000,000 x 30% = S$600,000.

- Total Stamp Duties (BSD + ABSD) = S$69,600 + S$600,000 = S$669,600.

- Scenario 1: PR buying their FIRST residential property

- How you pay stamp duties: You can use your CPF Ordinary Account (OA) savings to cover stamp duties.

- However, for resale private properties, you’ll typically need to pay the stamp duties in cash first, then apply for a reimbursement from your CPF OA later.

- For new launch properties (Building Under Construction – BUC), you can usually pay for stamp duties directly from your CPF OA, so immediate cash payment might not be needed for this part.

-

II. Loan Financing (How you pay the rest)

After your downpayment, a bank loan typically covers the remaining portion of the property price:

- Maximum Loan Amount: For your first property, banks can usually lend up to 75% of the property’s price.

- For a S$2,000,000 property, this means a loan of up to S$1,500,000.

- Note: If this is your second property and you already have an outstanding home loan, the maximum loan amount you can get will be much lower, at 45%.

- Loan Approval Factors: Banks will check your ability to repay. This involves looking at your Total Debt Servicing Ratio (TDSR), which ensures your total monthly loan repayments (including car loans, personal loans, etc.) don’t exceed 55% of your gross monthly income. Banks use a “floor” interest rate (currently 4% per annum) for this calculation, even if the actual loan rate is lower.

- Progressive Payments (for new launch condos):

- If you buy a new launch property (still under construction), you don’t pay the full loan amount at once. Instead, your loan is disbursed in stages as the construction progresses.

- This means your monthly loan instalments start lower and gradually increase over time as more of the loan is released to the developer.

III. Other Costs & Ongoing Payments (Recurring expenses)

Beyond the initial purchase, there are other costs to factor in:

- Legal Fees: To cover the lawyer’s services for the property transaction, expect fees starting from S$2,200. For more complex situations like decoupling, it could be around S$6,000.

- Valuation Fees: A fee of S$200-S$400 is usually charged for the property valuation report.

- Annual Property Tax: This is a yearly tax based on the property’s Annual Value. Rates are lower if you live in the property (owner-occupied: 0-32%) and higher if it’s an investment property (non-owner occupied: 12-36%).

- Condominium Maintenance Fees: For condos, these are recurring fees (often paid quarterly) for facilities and upkeep, ranging from S$300 to S$1,500 per month.

IV. Key Things to Remember About CPF Usage

- Your CPF Ordinary Account (OA) is a key resource for housing payments (downpayment and monthly instalments). It offers a decent 2.5% interest rate.

- There’s a CPF Withdrawal Limit for housing, set at 120% of the property’s value at the time of purchase. Once you reach this limit, you’ll need to pay any further loan repayments in cash.

- Upon selling your property, you must refund the CPF amount you used (plus the interest it would have earned) back into your CPF account. This is to replenish your retirement savings.

In a Nutshell:

The biggest financial factor for a 35-year-old PR buying a S$2 million property is whether it’s their first or second residential property in Singapore, due to the substantial difference in ABSD:

- If it’s your first property (as a PR):

- Your Total Stamp Duties will be around S$169,600.

- Your minimum cash outlay for the initial downpayment (5%) and potentially stamp duties (if resale) would be around S$269,600 (S$100,000 cash for downpayment + S$169,600 for stamp duty, though stamp duty can be reimbursed from CPF for resale) [6, 10, 397, my calculation].

- The rest (S$400,000 downpayment, S$1,500,000 loan, and stamp duty reimbursement) can be covered by CPF or a bank loan.

- If it’s your second property (as a PR):

- Your Total Stamp Duties will jump significantly to around S$669,600.

- Your minimum cash outlay for the initial downpayment (5%) and potentially stamp duties (if resale) would be around S$769,600 (S$100,000 cash for downpayment + S$669,600 for stamp duty, though stamp duty can be reimbursed from CPF for resale) [6, 10, 397, my calculation].

- The remaining downpayment (S$400,000) can be from CPF, but your maximum bank loan will be capped much lower (45%) if you still have an outstanding loan on your first property. This means you’d need significantly more cash/CPF beyond the initial 25% downpayment to cover the difference.

Given the large sums involved and the various rules, it’s highly recommended to consult with a property agent, mortgage broker, or financial advisor for a personalised assessment.

Listings for Sale Condo in Singapore