Foreign Buyers Guide for Singapore Properties on Downpayment and Remission Table

Discover essential insights on foreigners buying properties in Singapore, including downpayment requirements and the significance of the remission table.

Loan Documents for Bank Loan

| When foreigners apply for a bank loan to purchase property in Singapore, they typically need to provide various documents to demonstrate their financial stability and creditworthiness.

Here is a list of standard requirements and documents that banks may request: |

||||

| Identification Documents: | ||||

| Passport copies. | ||||

| Employment Pass or other relevant visa documents (if applicable). | ||||

| Income Documents: | ||||

| Latest computerized payslips (usually the last 3 months). | ||||

| Latest Income Tax Notice of Assessment (often the last 2 years). | ||||

| Employment letter or contract that states the terms of employment and salary. | ||||

| Bank Statements: | ||||

| Bank statements for the last 3-6 months to show savings history and financial stability. | ||||

| Credit Report: | ||||

| Some banks may require a credit report from the applicant’s home country to assess creditworthiness. | ||||

| Property Details: | ||||

| Option to Purchase (OTP) agreement for the property being purchased. | ||||

| Sales and Purchase Agreement (once available). | ||||

| Other Financial Documents: | ||||

| Details of existing debts or loans. | ||||

| Proof of other income sources, such as rental income or investments, if applicable. | ||||

| Guarantor Details (if required): | ||||

| Some banks might require a local guarantor, and similar documents will be needed from the guarantor. | ||||

| Additional Documents: | ||||

| Any other documents that the bank might specifically request to further assess the loan application. | ||||

| It’s important to note that requirements can vary between different banks and financial institutions. Therefore, it’s advisable for foreign buyers to consult directly with the bank they are considering or work with a mortgage broker who can guide them through the process and ensure they have all necessary documents prepared. If you need more specific advice or assistance, feel free to ask! | ||||

Overview of Foreign Property Buying in Singapore

The Singapore property market has emerged as a prime destination for foreign investors, primarily due to its robust economy, strategic location, and stable political environment. The city-state’s appeal lies in its high standard of living, excellent infrastructure, and favorable business climate, making it attractive for both residential and commercial investments. Additionally, the government’s efforts to maintain a transparent real estate market bolster foreign interest, as investors seek secure and lucrative opportunities.

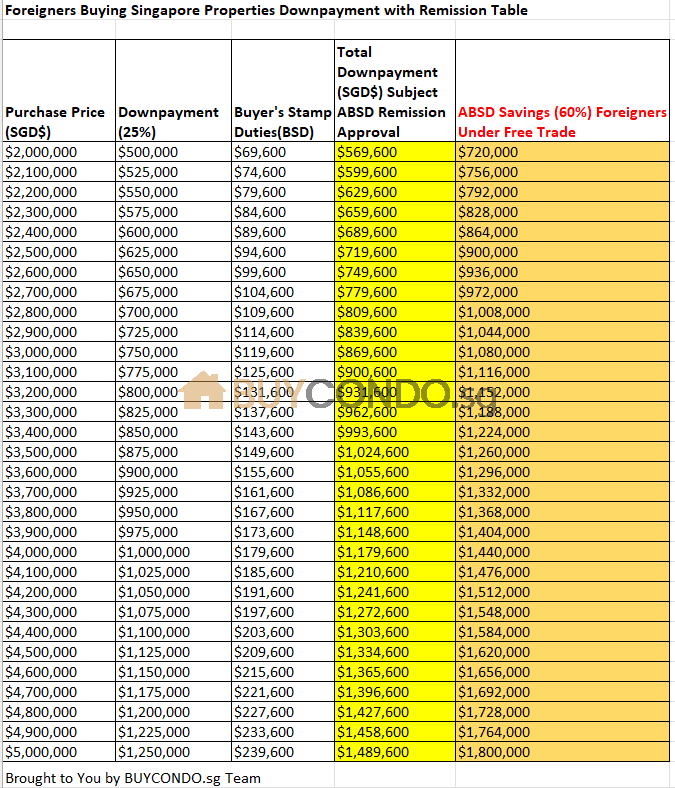

Central to the investment process for foreign buyers is the remission table, which outlines conditions under which they can receive refunds on Additional Buyer’s Stamp Duty (ABSD). This framework is particularly significant as it provides financial relief under specific circumstances, thus incentivizing foreign investments while ensuring the local property market remains accessible to Singaporean citizens. However, the focus on foreign ownership in the property market has led to regulations that balance the interests of residents and investors, ensuring that affordability remains a priority for locals.

Understanding the Remission Table

Understanding the Remission Table

The remission table is an essential component of property transactions for foreigners in Singapore. It specifies the conditions under which foreign property buyers can apply for a refund on the ABSD, particularly when at least one spouse is a Singapore Citizen. This potential refund can significantly ease the financial burden associated with property purchases. However, it is crucial to note that the remission does not apply to Housing and Development Board (HDB) flats or new Executive Condominiums (ECs), limiting its benefits to specific types of real estate.

To access these remission benefits, foreign buyers must meet all eligibility criteria and ensure that their application is submitted within a stipulated timeframe after the property purchase. This process can be complex, requiring a thorough understanding of the regulations and documents needed to successfully navigate the system. Engaging a property professional can assist buyers in fulfilling these requirements and maximizing their potential benefits.

Downpayment Requirements for Foreign Buyers

Downpayment Requirements for Foreign Buyers

Foreign buyers in Singapore face specific downpayment requirements when purchasing property. Generally, they must provide a minimum downpayment of 25% for residential properties. This requirement is higher compared to local buyers, reflecting the government’s strategy to regulate foreign investment in the property market. For foreign buyers that are not eligible for housing loans, the downpayment requirement increases to 50%.

Moreover, financial planning is critical for foreign investors, as the ABSD must be paid upfront and cannot be financed through bank loans. This adds another layer of complexity to the purchasing process, making it essential for buyers to understand the total cost of acquisition, which includes stamp duties and legal fees. It is advisable for potential investors to assess their financial situation thoroughly and engage financial advisors to ensure they can meet the necessary requirements while making informed investment decisions.

Legal Considerations for Foreigners – Foreign Buyers Guide for Singapore Properties on Downpayment and Remission Table

Legal Considerations for Foreigners – Foreign Buyers Guide for Singapore Properties on Downpayment and Remission Table

Foreigners looking to purchase property in Singapore must navigate a set of legal considerations that can impact their buying experience. As of April 2023, foreign buyers are subject to a steep 60% ABSD rate on any property purchase. This tax significantly influences the overall cost of acquiring property and requires careful financial planning. Furthermore, in cases of joint purchases with individuals of different residency statuses, the higher ABSD rate applicable to foreigners will apply, which can further complicate financial arrangements.

Engaging a legal professional is advisable for foreign buyers to help them understand and comply with the Residential Property Act, which dictates the regulations surrounding foreign ownership of residential properties in Singapore. Certain restrictions apply, especially concerning landed properties, where prior government approval may be necessary. This legal framework aims to regulate foreign investment while protecting the interests of local residents, ensuring that the property market remains sustainable and accessible.

Types of Properties Available for Foreign Ownership

Foreign buyers have several options regarding property ownership in Singapore, although certain restrictions apply. They can purchase private residential properties, including condominiums and landed properties, but must comply with specific regulations. Commercial properties are another attractive option, as they are exempt from ABSD, making them a viable investment avenue for foreign investors looking for higher rental yields and capital appreciation.

However, purchasing HDB flats is typically restricted to Singaporean citizens, while Executive Condominiums (ECs) are available to foreigners only after a minimum occupation period. Foreign buyers must conduct thorough research and align their investment choices with their residency status and financial capabilities. Understanding the nuances of property types and the associated regulations is crucial for making informed investment decisions in the competitive Singaporean real estate market.

Recent Trends in the Singapore Property Market

Recent trends indicate significant shifts in the Singapore property market, particularly for foreign buyers. In the second quarter of 2023, foreign condominium transactions plummeted by 59.2%, primarily due to the increased ABSD rates. This decline highlights how regulatory changes can impact foreign interest and investment strategies, necessitating a cautious approach from potential buyers. Despite these challenges, the Core Central Region remains attractive for foreign investors seeking premium properties, demonstrating resilience even in a challenging market.

Moreover, the demand for luxury properties remains strong, with affluent foreign buyers actively seeking high-end real estate despite regulatory hurdles. Economic recovery following the pandemic has also contributed to changing buyer sentiments, influencing investment strategies in the property market. As the landscape evolves, foreign buyers must remain vigilant and responsive to market trends and regulatory changes to navigate potential opportunities and challenges effectively.

Importance of Informed Decision-Making in Foreign Property Investment

Understanding the remission table and downpayment requirements is crucial for foreign property buyers aiming to invest in Singapore’s dynamic property market. The complexities surrounding property ownership, tax liabilities, and legal considerations necessitate informed decision-making and expert guidance. Buyers must weigh the potential benefits and risks associated with their investments, ensuring they are well-equipped to navigate the intricacies of the market.

Engaging experienced real estate agents familiar with Singapore’s property regulations can significantly enhance the buying experience. Additionally, staying updated on regulatory changes and market trends is vital for making strategic investment decisions. By being proactive and informed, foreign buyers can successfully navigate the complexities of property investment in Singapore, maximizing their opportunities while minimizing risks.

Contact us at BUYCONDO.sg Team, we can assist with your property purchase and your relocation transit to Singapore.