Guide to Gifts and Trusts for Singapore Condos 2025

Navigating the Singapore private property market is an exciting journey. But sometimes, you might encounter properties transferred through less conventional means, such as a gift or a trust. While these are popular methods for passing assets to the next generation, they come with a unique set of legal complexities and potential risks for an unprepared buyer.

At buycondo.sg, we believe a well-informed buyer is an empowered buyer. This guide will unpack the critical aspects of property gifts and trusts, ensuring you have the knowledge to navigate these situations with confidence in 2025.

Understanding Property Gifts: More Than Just a Handover

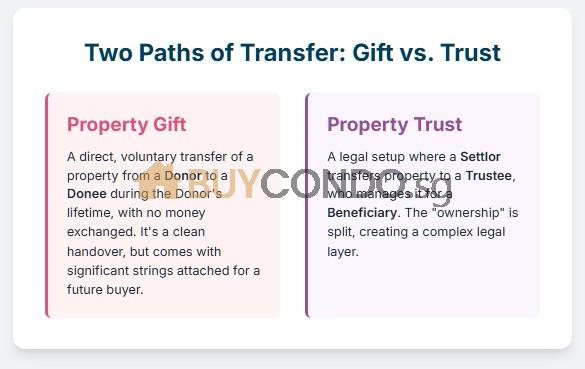

A property gift is when a “Donor” voluntarily transfers property to a “Donee” without receiving any payment or consideration in return. It’s a lifetime transfer, distinct from a Will, which only comes into effect after death.

For a gift of property to be legally binding, it must be documented in writing through a formal Deed and the transfer registered with the Singapore Land Authority. While a properly executed gift is generally irrevocable, several situations can arise where the gift may be challenged or even voided.

Key Risks and Considerations for Buyers in 2025:

- The Insolvency Shadow: A gift can be made voidable if the Donor is declared bankrupt within a specific period. This principle, previously under the Bankruptcy Act and now governed by the Insolvency, Restructuring and Dissolution Act 2018 (IRDA), is designed to prevent debtors from hiding assets from creditors. The risk period is still five years. To protect buyers, the Law Society’s Conditions of Sale 2012 includes a warranty from the seller that the property has not been subject to such a transaction within that timeframe.

- Financing Hurdles: Due to the risk of the gift being voided by insolvency, most financial institutions are very cautious about approving loans for a property that has recently been the subject of a gift. Buyers should exercise extreme caution.

- Stamp Duties Apply (Updated 2025 Rates): A gifted property is not exempt from taxes.

- Stamp Duty and Additional Buyer’s Stamp Duty (ABSD) are payable based on the property’s market value, even with no sale price.

- The property counts towards the Donee’s property count for future ABSD calculations.

- Crucially, ABSD rates are now significantly higher. As of 2025, foreigners buying any residential property face a 60% ABSD rate. Singapore Citizens now pay 20% ABSD on their second residential property and 30% on their third and subsequent properties.

- Restrictions on Foreign Ownership: The Residential Property Act strictly prohibits the transfer of any restricted residential property to a foreign person by way of a gift without formal approval from the Land Dealings (Approval) Unit (LDAU). Any such transfer without approval is considered null and void.

- Estate Duty Abolished: The document mentions that a gift could be subject to estate duty if made within five years of the donor’s death. It’s important to clarify that Estate Duty was abolished in Singapore for any death occurring on or after 15 February 2008. This rule is therefore not a concern for current transactions.

Demystifying Property Trusts: Who Really Owns the Condo?

A trust is a legal arrangement where a property owner, the “Settlor,” transfers the legal title of their property to a “Trustee”. The Trustee holds and manages this property for the benefit of another person or group, the “Beneficiary”.

Think of it as a split in ownership:

- The Trustee: Holds the legal title and is named on the property’s title deed. They manage the asset and have a fiduciary duty to act honestly and in the best interest of the beneficiary.

- The Beneficiary: Holds the “equitable” or beneficial title. They are the true owner and have the right to enjoy the benefits of the property.

Trusts are used for various purposes, including asset protection, privacy, and deferred distribution of assets.

Key Considerations for Buyers in 2025:

- Authority to Transact: When purchasing a property held in a trust, the Trustee is the party who must sign the legal documents. It is vital to confirm they are acting within the powers granted by the trust deed and the Trustees Act. Beneficiary consent may also be required.

- ABSD for Trusts: This is a major update. Any residential property transferred into a trust is now subject to a 65% ABSD rate, payable upfront.

- Foreign Beneficiaries: Similar to gifts, the Residential Property Act prohibits trusts where a restricted residential property is held by a Singaporean trustee for a foreign beneficiary without prior written approval from the LDAU.

- Financing Difficulties: Securing a bank loan for a property held under a trust can be challenging.

Transactions involving gifts and trusts demand extra diligence. Before you commit, ensure you or your real estate professional clarifies the following:

- Was this property ever transferred as a gift? If so, when?

- If the property is in a trust, who is the Trustee and do they have the full legal authority to sell?

- Given the high ABSD rates, has legal and tax advice been sought to confirm all duties on the trust have been paid?

- Are there any foreign persons involved as donees or beneficiaries, which could trigger RPA issues?

- Have you consulted with your bank about their willingness to finance a property with this type of ownership history?

Understanding the nuances of property gifts and trusts is not just about ticking legal boxes; it’s about protecting your investment. These transactions, while common, carry inherent risks that require professional guidance to mitigate.

Ready to make your move in the Singapore condo market? Contact the experts at buycondo.sg today for the specialist advice you need to navigate any transaction, no matter how complex.

// Note this is more for information sharing and do check with your legal counsel if you need professional expert advice.