HDB Housing Schemes And Grants 2024

Did you know that around 90% of Singapore residents are homeowners? Owning a home is even considered one of the metrics of success! However, it can come with a huge responsibility and a hefty price tag. Getting a public housing allocation itself can be pretty challenging, especially since there has been a surge in property demands.

Fortunately for us Singapore Citizens (SC) and Singapore Permanent Residents (SPR), the government has implemented a range of housing schemes and grants to make home ownership more accessible and affordable

While Build-to-Order (BTO) flats remain a popular choice for first-timers, some savvy individuals are opting for alternatives like Executive Condominiums (EC) and private condos. These well-informed buyers may have reasons beyond pure affordability for their choice. Perhaps they prioritise amenities unavailable in BTOs, or seek a more modern aesthetic. Or, perhaps they recognise and understand the potential benefits of owning private properties.

In this article, we’ll delve deeper into how you can take advantage of these schemes and grants to unlock your dream home, regardless of the type of housing you choose to buy.

Singapore‘s home ownership schemes began with the mission to solve the housing shortage crisis in the nation’s early years. Today, that mission has transformed into a comprehensive range of schemes to help citizens achieve home ownership. Here are the different schemes you can explore.

Priority Schemes

As you may already know, the Housing Development Board (HDB) uses a balloting system for the allocation of BTO and Sale of Balance Flats (SBF). While this system ensures fairness, it can also present challenges in securing a spot. Fortunately, there are various Priority Schemes that can enhance your chances, especially if you are a first-timer applicant.

That said, you should note that priority schemes operate through separate ballots. If you qualify for multiple priority schemes, your application will be balloted under one scheme first. If unsuccessful, then it will be balloted under the other scheme.

Priority for first-timers : HDB Housing Schemes And Grants 2024

Unlike second-timer applicants who only get a single ballot chance, first-timer applicants can get two or even three ballot chances if they qualify for FT(PMC), more on that below. Additionally, all first-timers will get an additional ballot chance for every subsequent unsuccessful BTO application in non-mature estates after failing twice.

For context, an application is considered unsuccessful if you did not receive a queue number or the flats are fully booked before your queue number is due. To illustrate, if you have had two unsuccessful BTO applications, you would get an additional ballot chance on top of the two you get as a first-timer, giving you a total of three ballot chances.

If you are invited to book a flat but decide not to even though there are units available, you will incur what’s called a non-selection count. This means that you’ll be considered a second-timer for a year. Any prior application you made will be cancelled, and any accumulated extra ballot chances will be reset to zero. So, make sure you apply wisely and book when invited!

First-Timer (Parents & Married Couples), or FT(PMC) category

First-timer families with young children and young married couples may qualify for FT(PMC), which offers some advantages in the application process. Applicants in this category are granted three ballot chances compared to the standard two that first-timer families get. This enhances the probability of securing your desired flat of any type in any estate. The best part is that you don’t even have to apply to be in this category. HDB will automatically evaluate your eligibility based on the information you provide in your flat application. Furthermore, couples consisting of both a first-timer and second-timer are still recognised as a first-timer family.

1. Family and Parenthood Priority Scheme (FPPS)

This scheme helps first-timer married couples with children and young married couples get a flat more easily.

Flat allocation: up to 40% of BTO flats and up to 60% of SBF flats

Eligibility conditions:

– You and your spouse are both first-timers

– You have an SC child aged 18 or below

– If you or your spouse is expecting and can provide a doctor’s certificate confirming the pregnancy, you can also apply for this scheme

– If you are in the FT(PMC) category, you will be eligible for this scheme

2. Multi-Generation Priority Scheme (MGPS)

Parents and their married child can submit a joint application for two flats in a BTO project.

Flat allocation and type:

– Parents can only apply for a 2-room Flexi or 3-room flat. They will get up to 15% allocation (minimum of 20 units)

– The married child can apply for a 2-room Flexi or bigger flat. The allocation will depend on the amount allocated to their parents.

– The flats will be chosen randomly beforehand

Eligibility conditions:

– Parents (including widowed or divorced) must apply jointly with their married child

– If the child is widowed or divorced with child(ren) under their care, they can also qualify for MGPS

Application process:

Successful MGPS applications will be issued up to three queue positions:

– One for both parents and married child to book their respective flats together under the MGPS

– One for the parents’ application under the public scheme

– One for the married child’s application under the public scheme

Should the parents and married child decide not to proceed with the joint booking under the MGPS, they may pursue their flat applications independently under the public scheme using their respective queue positions.

3. Married Child Priority Scheme (MCPS)

This scheme helps married children live with or close to their parents for mutual care and support. Engaged couples can also apply for MCPS. However, availability in prime locations may be limited.

Flat allocation for first-timer families:

– Up to 30% of BTO flats

– 30% of SBF

Flat allocation for second-timer families:

– Up to 5% of BTO flats

– 3% of SBF

Eligibility conditions:

– At least one of your parents/married child is an SC or SPR

– You must include your parents/married child’s name in your application

– You are applying for a flat within 4 km of your parents/married child’s current residence

Important notes:

– Your parents/married child who helps you qualify for the MCPS must continue to live with you or within 4 km of your new flat throughout the minimum occupation period

– The proximity is measured from your parents/married child’s primary residence, which is owned by them or owner-occupied by their immediate family members

Distribution of quota:

|

Household Status |

BTO Sales Launch |

SBF Sales Launch^ |

|||

|

Non-Mature Estates* |

Mature Estates |

||||

|

2-room Flexi |

3-room |

4-/ 5-room |

2-room Flexi and bigger^ |

||

|

First-timer family |

5% |

30% |

30% |

30% |

30% |

|

Second-timer family |

5% |

5% |

3% |

3% |

3% |

4. Third Child Priority Scheme (TCPS)

This scheme prioritises applications from families with three or more children during the balloting process

Flat allocation:

– Up to 5% of BTO flats

– 5% of SBF

Eligibility conditions:

– You and/or your spouse is an SC

– If you are divorced or widowed, you must be an SC

– You have at least 3 children (natural offspring or legally adopted)

– Your third child is an SC born on or after 1 January 1987

– Your other children are either Sc or SPR

– You have not bought a property under TCPS before

– All three children must live with you during the Minimum Occupation Period. They also must not buy or rent other properties

5. Assistance Scheme for Second-Times (Divorced or Widowed Parents) (ASSIST)

This scheme supports divorced and widowed people with children

Flat allocation: up to 5% of 2-room Flexi and 3-room BTO flats in non-mature estates. This quota is shared with the 15% quota set aside for second-timers.

Eligibility conditions:

– You have a child aged 18 or below

– Aside from your matrimonial property, you must not have acquired any interest in an HDB or private residential property after the date of divorce, separation or demise of your spouse

6. Tenant’s Priority Scheme (TPS)

This scheme assists HDB tenants and those applying under SERS as well as Relocation and Resettlement

Flat allocation: up to 10% of 2-room Flexi and 3-room BTO/SBF

Eligibility condition: you and your family must be living in an HDB public rental flat for at least two years

7. Senior Priority Scheme (SPS)

This scheme prioritises seniors buying 2-room Flexi flats near their current home or their parents/married child

Flat allocation: At least 40%

Eligibility condition near existing home: the new flat must be within 4 km of your current residence

Eligibility conditions near parents/married child:

– You are married, divorced or widowed

– At least one of your parents/married child is an SC or SPR

– You must include your parents/married child’s name in your application

– You are applying for a flat within 4 km of your parents/married child’s current residence

Important notes:

– Your parents/married child who helps you qualify for the SPS must continue to live with you or within 4 km of your new flat throughout the minimum occupation period

– The proximity is measured from your parents/married child’s primary residence, which is owned by them or owner-occupied by their immediate family members

Fresh Start Housing Scheme

This scheme helps families with young children currently in public rental flats buy a 2 to 3-room flat with a shorter lease. If interested, you need to apply for this scheme first before applying for a flat. Below are the details

|

Criteria |

Details |

|

Age |

35-54 years old

|

|

Citizenship |

At least one core applicant and one of your children (aged 18 or younger) must be Singapore Citizens (SC) |

|

Employment |

At least one core applicant must have been in stable employment in the preceding 12 months and employed at the time of application |

|

Monthly household income ceiling |

$7,000 |

|

Previous housing subsidies |

– You and your spouse (if applicable) have previously taken a housing subsidy and form a second-timer family with your children – Have not received any public rental tenancy discount/grant under the Relocation, Sale of Flat to Sitting Tenants, or Rent & Purchase Scheme |

|

Flat type and lease options |

2-room Flexi or 3-room flat on shorter leases in any estate, except for flats in projects under the Prime Location Public Housing (PLH) model. Lease options range from 45 to 65 years, but it must cover all owners and their spouses until they are 95 years old.

|

|

Priority allocation |

Up to 10% of 2-room Flexi and 3-room BTO/SBF under the TPS (see above) |

|

Cap on resale levy |

$30,000 (levy will be reduced based on the length of lease) |

|

Minimum occupation period |

20 years |

|

Grant amount |

For applications made from sales launch in May 2022, you can receive a grant of $50,000. This will be divided as follows: – An upfront disbursement of $35,000 into you CPF Ordinary Account (OA) at key collection – Another $15,000 will be disbursed into your CPF OA in equal tranches over five years after key collection

|

|

Ownership/interest in property |

You must not own other properties overseas or locally, and have not disposed of any within the last 30 months |

|

Other notes |

– Your family must have been occupying a public rental flat for at least a year and have good payment history (no arrears in the past year) – Your family must qualify for HDB’s Letter of Social Assessment (LSA) and apply for a flat within the 1-year validity of the SLA – You must renew the LSA annually and have a valid LSA at the key collection. Failure to renew will result in cancellation and a 5% penalty – After the key collection, you must continue renewing the LSA annually for 5 years to keep the grant disbursement – You can take up an HDB concessionary housing loan of up to 80% of the flat price – At least 10% of the flat price must be paid using CPF OA or cash – The Fresh Start Housing Scheme will be your second and final HDB flat purchase |

Staggered Downpayment Scheme

This scheme lets you pay your down payment in two parts, upon signing the Agreement for Lease and at key collection. The payment can be made with cash, CPR Ordinary Account and CPF housing grant if eligible.

Eligibility conditions for first-timer couples:

– At least one applicant is a first-timer applicant

– You obtained a valid HFE letter on or before the younger applicant turns 30

– You booked an HDB uncompleted 5-room or smaller flat

Eligibility for flat owners right-sizing to a 3-room or smaller flat in non-mature estates:

– You have not completed the sale of your existing flat at the time of HFE application

– You booked an HDB 3-room or smaller flat in a non-mature estate

Deferred Downpayment Scheme (DDS)

DDS helps senior flat owners manage their finances by deferring down payments while they transition to a new flat. To qualify, buyers must be at least 55 years old, haven’t sold their existing flat and have booked an uncompleted 3-room or smaller flat.

With DDS, eligible buyers only pay stamp duty and legal fees when signing the Agreement for Lease, then pay the flat’s purchase price upon key collection. If the new flat application is cancelled, the usual 5% forfeiture applies. Eligibility for down payment deferral is confirmed during the flat booking appointment.

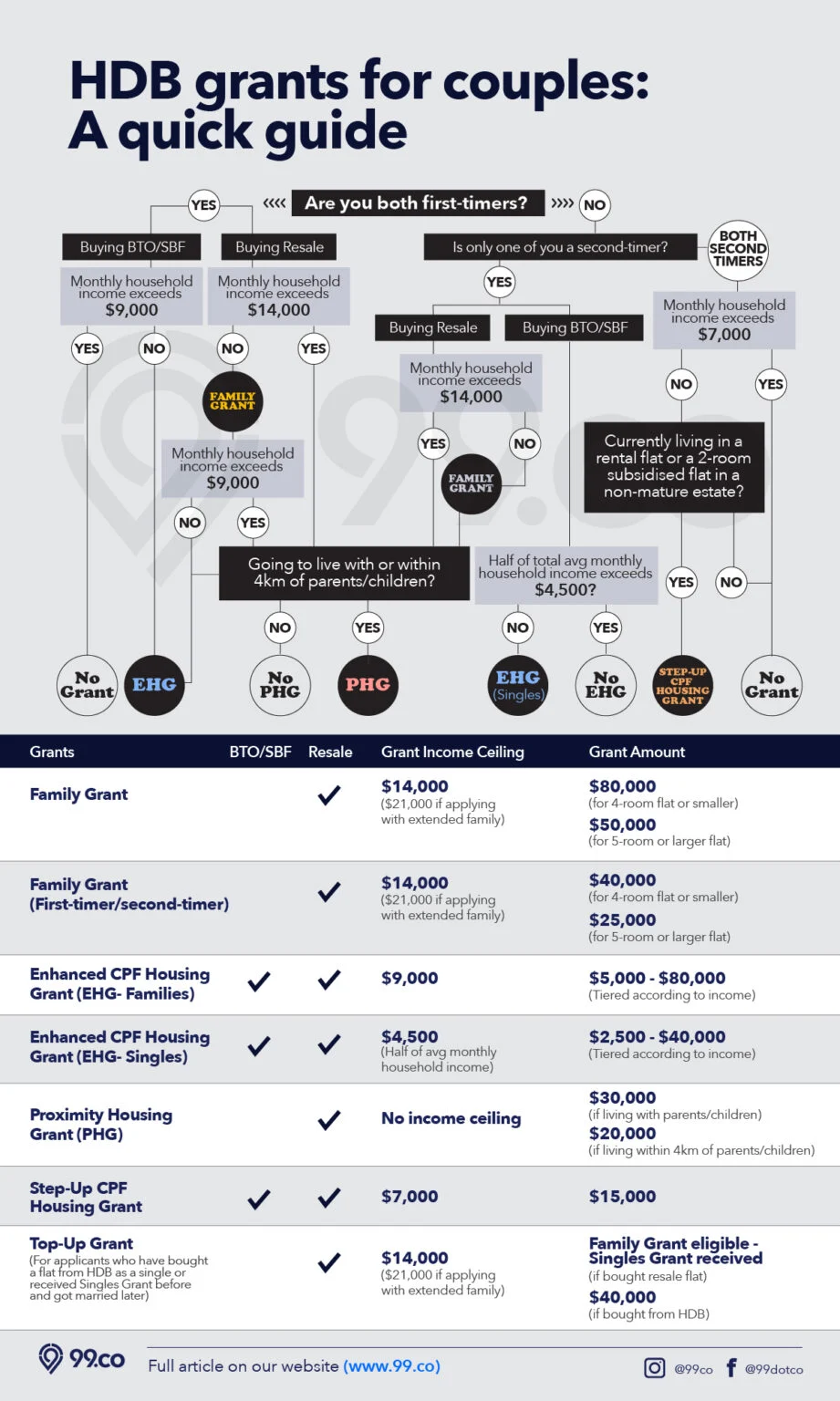

There are different grants available depending on your profile and the type of flat you want to buy. Grants can also be combined so make sure to apply to as many as you can to maximise your financial benefit.To make this process easier for you, we will explore these grant options based on the buyer’s profile.

Singles

1. CPF Housing Grant for Resale Flats (Singles), also referred to as Singles Grant

As the name suggests, this grant provides financial help to first-timer single Singaporeans to purchase a resale flat. Below are the details.

|

Criteria |

Details |

|

Age |

– Min. 35 years old for first-timer applicants buying an HDB flat on their own or with other first-timer single citizens – Min. 35 years old for first-timer applicants buying a resale flat on their own, with other first-timer single citizens or with their parents – Min. 21 years old for a first-timer applicant buying a resale flat with a non-resident spouse |

|

Citizenship |

You must be a Singapore Citizen (SC) |

|

Monthly household income ceiling |

The average gross monthly household income must not exceed: – $7,000 if purchasing a flat on your own – $14,000 if purchasing a flat with your family or other singles |

|

Previous housing subsidies |

Only first-time core applicants are eligible for this grant. If the core applicant has previously received a housing subsidy, then they are considered a second-timer and will not qualify. |

|

Flat type |

– 2 to 5-room (excluding resale PLH and 3Gen flats) for singles buying alone – 2-room or bigger (excluding resale PLH and 3Gen flats) for singles buying with family or other singles – 2-room or bigger (excluding 3Gen flats) for singles buying with parents |

|

Remaining lease of flat |

More than 20 years |

|

Grant amount |

– $40,000 for a first-timer SC buying a 2 to 4-room resale flat alone – $25,000 for a first-timer SC buying a 5-room resale flat alone – $40,000 for a first-timer SC buying a 2 to 4-room resale flat with parents, non-resident spouse or other first-timer singles (total of $80,000 for two singles) – $25,000 for a first-timer SC buying a 5-room resale flat with parents, non-resident spouse or other first-timer singles (total of $50,000 for two singles) |

|

Usage and distribution |

The Singles Grant can be used to offset the price of the flat or reduce the housing loan to purchase the flat. If your household qualifies for the EHG, all the eligible SC and SPR applicant(s) and occupier(s) will receive equal shares of the grant, which will be credited to their CPF account(s). It will not be paid in cash. |

|

Ownership/ interest in property in Singapore or overseas other than HDB flat |

All persons listed in the HDB Flat Eligibility (HFE) letter application can, as a household, own up to 1 non-residential property at the time of application and up to 30 months before the application. However, all applicants and occupiers must not: – own or have an interest in any local or overseas private residential property – have disposed of any private residential property in the last 30 months before the HFE letter application – Be buying an HDB flat that has been announced for the Selective En bloc Redevelopment Scheme (SERS)

Note: Interest or ownership in a property means you have acquired a property through purchase, gift or inheritance. It also includes when the property is owned, acquired or disposed of through nominees. |

2. Enhanced CPF Housing Grant (EHG) (Singles)

The EHG aids those looking to buy an HDB flat, new or resale. Below are the details.

|

Criteria |

Details |

|

Age |

– Min. 35 years old for first-timer applicants buying an HDB flat on their own or with other first-timer single citizens – Min. 35 years old for first-timer applicants buying a resale flat on their own, with other first-timer single citizens or with their parents – Min. 21 years old for a first-timer applicant buying a resale flat with a non-resident spouse |

|

Citizenship |

You must be a Singapore Citizen (SC) |

|

Employment |

You and/or your core co-applicant(s) and/or core occupier(s) must have worked continuously for at least one year, two months before the HFE letter application and be working at the time to the HFE letter application |

|

Monthly household income ceiling |

The average gross monthly household income must not exceed: – $4,500 if you are buying a flat on your own – $9,000 if you are buying a flat with other single(s) or a resale flat with your parents – $9,000 (half of the gross household income must not exceed $4,500) if you are buying a flat with a non-resident spouse |

|

Remaining lease of flat |

– More than 20 years – Flat must have sufficient lease to cover the youngest core applicant and core occupier to the age of 95 to qualify for the full EHG amount. Otherwise, it will be prorated |

|

Grant amount |

The amount you can receive is based on the average gross monthly income assessed over the 12 months worked prior to the flat application. Households with lower incomes will receive a bigger grant amount.

Click here to see the detailed breakdown. |

|

Usage and distribution |

EHG can be used to offset the price of the flat or reduce the housing loan to purchase the flat. If your household qualifies for the EHG, all the eligible SC and SPR applicant(s) and occupier(s) will receive equal shares of the grant, which will be credited to their CPF account(s). It will not be paid in cash. |

|

Ownership/ interest in property in Singapore or overseas other than HDB flat |

All persons listed in the HDB Flat Eligibility (HFE) letter application can, as a household, own up to 1 non-residential property at the time of application and up to 30 months before the application. However, all applicants and occupiers must not: – own or have an interest in any local or overseas private residential property – have disposed of any private residential property in the last 30 months before the HFE letter application – Be buying an HDB flat that has been announced for the Selective En bloc Redevelopment Scheme (SERS)

Note: Interest or ownership in a property means you have acquired a property through purchase, gift or inheritance. It also includes when the property is owned, acquired or disposed of through nominees. |

|

Other notes |

If you are buying a resale flat, you must first qualify for the CPF Housing Grant for Resale Flats (Singles) before applying for the EHG |

3. Proximity Housing Grant (PHG) (Singles)

Moving closer to family? Apply for a PHG if you plan on buying a resale flat to live with or near your parents/child.

|

Criteria |

Details |

|

Age |

– Min. 35 years old for applicants buying a resale flat on their own, with family or with other singles – Min. 21 years old for applicants buying a resale flat with a non-resident spouse |

|

Citizenship |

You must be a Singapore Citizen (SC) |

|

Previous housing subsidies |

PHG is only applicable for those who have not taken the PHG previously |

|

Flat type |

– Any flat type for singles living with parents/child – Any flat type for applicants buying with their non-resident spouse – 2 to 5-room flat for singles living near parents/child (within 4 km) |

|

Remaining lease of flat |

More than 20 years |

|

Grant amount |

– $15,000 to live with your parents/child – $10,000 to live near your parents/child (within 4 km) |

|

Other notes |

Parents buying over their child’s flat will not be eligible for the PHG |

Conditions for parents/child helping applicants to qualify for PHG

|

Criteria |

Parents or Married Child |

Single Child |

|

Age |

Not applicable |

Min. 35 years old |

|

Citizenship |

SC or SPR |

|

|

Proximity condition |

– Your parents/child will beliving with you in the resale flat you intend to buy and they must be included as co-applicants or essential occupiers – Your parents/child are living within 4 km of the resale flat you intend to buy. If they live in a private residential property that they do not own, the property must also be occupied by the owner(s) who is also an immediate family member(s) |

|

Couples and Families

1. CPF Housing Grants for Resale Flats (Families), also referred to as Family Grant

The Family Grant helps first-timer families purchase resale flats. Additionally, if you have previously taken the CPF Housing Grant for Resale Flats as a single, and are now married, you can apply for the Top-Up Grant.

|

Criteria |

Family Grant |

Top-up Grant |

|

Age |

Min. 21 years old |

|

|

Citizenship |

You must be an SC and include at least one other SC or SPR |

You must be an SC and include your spouse or child who is an SC or SPR |

|

Household |

– Couples, families or orphaned siblings who are first-timer applicants buying an HDB resale flat – First-timer Singapore Citizen (SC) and Singapore Permanent Resident (SPR) applicants or occupiers whose fiancee , fiance, spouse or sibling has previously taken any housing subsidy |

Recipients of the CPF Housing Grant for Resale Flats (Singles) or those who bought a 2-room or 2-room Flexi flat from HDB on their own, with other first-timer singles, parents or a non-resident spouse.

Conditions: – You married an SC or SPR after the flat purchase, or – Your spouse/child has obtained SC or SPR status |

|

Monthly household income ceiling |

– $14,000 – $21,000 if purchasing with an extended or multi-generation family. Click here for more details. |

|

|

Previous housing subsidies |

At least one core applicant or core occupier is a first-timer to receive the housing grant. |

You were a recipient of the CPF Housing Grant for Resale Flats (Singles) or you bought a 2-room or 2-room Flexi flat from HDB on your own, with other first-timer singles, parents or a non-resident spouse. You have not taken any other housing subsidy. |

|

Flat type |

2-room or bigger |

|

|

Remaining lease of flat |

More than 20 years |

|

|

Grant amount |

First-timer households buying a 2 to 4-room resale flat: – SC & SC: $80,000 – SC & SPR: $70,000

First-timer household buying a 5-room or bigger resale flat: – SC & SC: $50,000 – SC & SPR: $40,000

First-timer and second-timer couples buying a 2 to 4-room resale flat: $40,000

First-timer and second-timer couples buying a 5-room or bigger resale flat: $25,000 |

The Top-Up Grant amount is up to: – The difference between the prevailing Family Grant and the Singles grant you previously received, or – $40,000 if you bought a 2-room or 2-room Flexi flat from HDB |

|

Usage and distribution of housing grant |

The Family Grant or Top-Up Grant can be used to offset the price of the flat or reduce the housing loan to purchase the flat. If your household qualifies for the Family Grant or Top-Up Grant, all the eligible SC and SPR applicant(s) and occupier(s) will receive equal shares of the grant, which will be credited to their CPF account(s). It will not be paid in cash. |

|

|

Other notes |

None |

You must submit your application for Top-Up Grant within 6 months of: – your marriage registration, or – your spouse/child becoming an SC/SPR |

2. Enhanced CPF Housing Grant (EHG) (Families)

The EHG aids those looking to buy an HDB flat, new or resale.

|

Criteria |

Details |

|

Employment |

You and/or your core co-applicant(s) and/or core occupier(s) must have worked continuously for at least one year, two months before the HFE letter application and be working at the time to the HFE letter application |

|

Monthly household income ceiling |

– For first-timer household, the average gross monthly household income must not exceed $9,000 – For first-timer and second-timer applicants, half of the average monthly household income must not exceed $4,500 |

|

Remaining lease of flat |

– More than 20 years – Flat must have sufficient lease to cover the youngest core applicant and core occupier to the age of 95 to qualify for the full EHG amount. Otherwise, it will be prorated |

|

Grant amount |

The amount you can receive is based on the average gross monthly income assessed over the 12 months worked prior to the flat application. Households with lower incomes will receive a bigger grant amount.

Click here to see the detailed breakdown. |

|

Usage and distribution |

EHG can be used to offset the price of the flat or reduce the housing loan to purchase the flat. If your household qualifies for the EHG, all the eligible SC and SPR applicant(s) and occupier(s) will receive equal shares of the grant, which will be credited to their CPF account(s). It will not be paid in cash. |

|

Ownership/ interest in property in Singapore or overseas other than HDB flat |

All persons listed in the HDB Flat Eligibility (HFE) letter application can, as a household, own up to 1 non-residential property at the time of application and up to 30 months before the application. However, all applicants and occupiers must not: – own or have an interest in any local or overseas private residential property – have disposed of any private residential property in the last 30 months before the HFE letter application – Be buying an HDB flat that has been announced for the Selective En bloc Redevelopment Scheme (SERS)

Note: Interest or ownership in a property means you have acquired a property through purchase, gift or inheritance. It also includes when the property is owned, acquired or disposed of through nominees. |

|

Other notes |

If you are buying a resale flat, you must first qualify for the CPF Housing Grant for Resale Flats (Families or Singles) before applying for the EHG |

3. Step-Up CPF Housing Grant (Families)

Couples and families who have previously received subsidised housing and are looking to upgrade may qualify for this grant.

|

Criteria |

Details |

|

Employment |

You and/or your core co-applicant(s) and/or core occupier(s) must have worked continuously for at least one year, two months before the HFE letter application and be working at the time to the HFE letter application |

|

Monthly household income ceiling |

$7,000 |

|

Flat type |

– 3-room flat (HDB or resale) for those currently living in a 2-room flat in a non-mature estate that is bought from HDB after October 1995 or bought on the open market with a CPF housing grant – 2-room resale flat, 2-room Flexi flat and 3-room flat for those currently living in a public rental flat |

|

Previous housing subsidies |

You and your family are second-timer applicants |

|

Remaining lease of flat |

– More than 20 years – Flat must have sufficient lease to cover the youngest core applicant and core occupier to the age of 95 |

|

Grant amount |

$15,000 |

|

Usage and distribution |

The Step-Up CPF Housing grant can be used to offset the price of the flat or reduce the housing loan to purchase the flat. If your household qualifies for the Step-Up CPF Housing grant, all the eligible SC and SPR applicant(s) and occupier(s) will receive equal shares of the grant, which will be credited to their CPF account(s). It will not be paid in cash. |

|

Ownership/ interest in property in Singapore or overseas other than HDB flat |

All persons listed in the HDB Flat Eligibility (HFE) letter application can, as a household, own up to 1 non-residential property at the time of application and up to 30 months before the application. However, all applicants and occupiers must not: – own or have an interest in any local or overseas private residential property – have disposed of any private residential property in the last 30 months before the HFE letter application – Be buying an HDB flat that has been announced for the Selective En bloc Redevelopment Scheme (SERS)

Note: Interest or ownership in a property means you have acquired a property through purchase, gift or inheritance. It also includes when the property is owned, acquired or disposed of through nominees. |

4. Proximity Housing Grant (PHG) (Families)

Seniors

Even though there’s only one grant available to seniors specifically, which is the Silver Housing Bonus, don’t forget that you can still grab other applicable grants (singles or families). Plus, you can enjoy a unique perk, which is the ability to buy a short-lease 2-room Flexi Flat or Community Care Apartment, a privilege that isn’t available to other groups.

Silver Housing Bonus (SHB)

Overall, these diverse housing schemes and grants can offer guidance in your journey to home ownership. Having a priority balloting system, flexible payment options and financial relief can ease the burden of acquiring a home.

Despite that, potential homeowners might be discouraged by the extended waiting period that comes with BTO flats, which can delay their ability to sell and upgrade. If you’re seeking a shorter route to homeownership and wealth accumulation, we can help you explore alternative investment strategies.

Source: Propnex