The million-dollar question people are asking these days” Is it a Good time to Buy Condo in Singapore now? “Political stability and harmony make Singapore’s real estate a dependable place to invest in. Coupled with the strength of the Singapore dollar, which makes property investment rock solid.

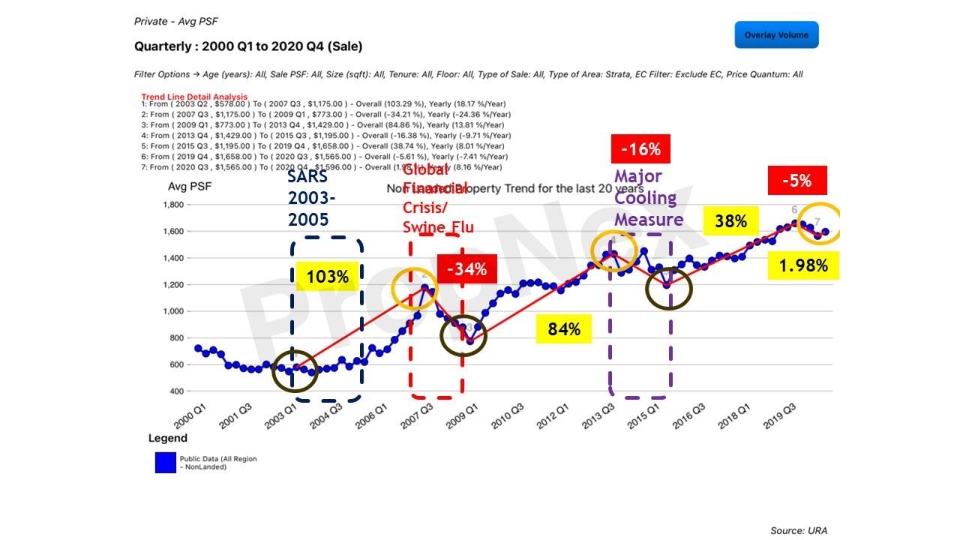

On top of that, the government has also shown that when it comes to property, it is proactive in implementing measures that keep the market stable and prevent a dangerous bubble from forming. This sort of control and emphasis on stability is rare in other markets and keeps property from swinging.

Furthermore, the government also imposes measures that regulate the quality of housing, such as the latest URA guidelines on maximum unit sizes. This commitment to keeping Singapore housing and neighbourhoods liveable is reassuring to investors over the long-term as it reduces uncertainties such as finding out that a once-quiet neighbourhood has been transformed into a traffic nightmare ten years later.

On a more fundamental level, simple facts such as land scarcity along with a need to grow the population and the national GDP support a consistent demand for Singapore real estate.

With a pandemic causing financial markets to tank and lots more uncertainties still on the horizon, investors have been flocking to keep their cash in Singapore, with bank deposits in foreign currencies reaching an all-time high.

Long-standing political crisis around the world, trade war between major counties and uncertainties over the Covid-19 pandemic have led investors to direct their funds here. The Singapore banks are the only banks in the Asia-Pacific region rated as a stand-alone in the double ‘AA’ range and therefore more likely to attract funds in times of stress. This “AA” rating means that the financial institution has a very low risk of defaulting.

As a result, Singapore has recently become home to a list of global technology giants that have been setting up regional hubs with plans to invest billions of dollars and hire thousands in Singapore.

Of which are Zoom Video Communications, with plans on doubling its data centre capacity by opening a research and development centre.

Twitter is setting up its first Asia-Pacific engineering centre in Singapore, covering software and data engineering and data science.

ByteDance, owner of TikTok platform plans to invest billions of dollars in Singapore after opting to base its regional headquarters here and many more with plans to expand and strengthen their presence in ASEAN region.

In the current climates, where interest rates are lower, owning property has become accessible and more attractive as it is an investment that can provide ongoing income through rent payments and capital growth as housing prices rise.