Things You Must Know before buying a home in Singapore

Singapore has become one of the world’s most popular real estate investment destinations. Not only is it one of the safest countries in the world, but it also has one of the lowest personal income tax rates in the developed world and a high quality of life, making it one of the best places to buy a home and raise children.

However, what issues must be addressed before buying a property in Singapore?

Let Garry Lim, an experienced local real estate agent, answer your questions today!

Preliminary Questions

What is the current state of the housing market in Singapore?

Singapore’s private residential prices will rise at a slower pace of 6.7% in 2023, compared to 8.6% in 2022, and 8.6% in 2021.

8.6% in 2022 and 10.6% in 2021. The slowdown is mainly due to a series of government measures to cool the hot market.

Will houses in Singapore appreciate in value?

To judge the future housing prices or real estate market trends of a country, we need to look at three points:

- Finance, policy, and currency in the short-term

- Land supply in the medium-term

- Population growth in the long term

• Short-term – financial, policy, and monetary stability

Singapore is a well-known economic powerhouse with a solid and stable economic foundation. Singapore is the world’s most competitive economy, ranks first in terms of political and national stability, and fourth in total foreign investment inflows.

In addition to its solid economic foundation, Singapore has healthy economic growth. In just five decades, Singapore has developed into one of the most advanced economies in the world, with its gross domestic product (GDP) still ranking first in the region, higher than major Asia-Pacific economies such as Australia, Hong Kong, and New Zealand.

Singapore’s employment rate has always been high thanks to its flexible, adaptable, and highly motivated workforce. The Singapore government also has a solid commitment to talent development: in addition to its first-class education system, Singapore’s nationwide skills development program ensures that its people keep up with changes in the global economy.

Singapore has received more foreign direct investment than most developed economies in the world, and more than 10% of the total foreign direct investment in Asia has flowed to Singapore. Thanks to the favor of global capital and the advantages of low-risk investment, companies are confident in Singapore’s investment potential.

Singapore currency is issued by the Monetary Authority of Singapore (MAS), which is both the central bank and the overall financial regulator for Singapore. The currency—estimated to be just over S$30 billion—is fully backed by gold, silver, or other assets held by the MAS.

As of 2020, the Monetary Authority of Singapore has over US$270 billion in assets. The Singapore dollar is widely regarded as one of the world’s most robust and stable currencies.

• Medium term – land supply

Singapore has limited land resources and covers an area of 710 square kilometers. The government also controls the land supply to avoid oversupply and prevent house prices from falling.

The Singapore Government has been closely monitoring land supply and developments in the country’s property market to ensure that supply and demand are balanced, which will help promote a stable and sustainable market.

• Long-term – employment rate, population growth

Singapore has long been attracting the favor of top global companies and a large amount of investment. Its economy is in good condition and has maintained a high employment rate.

According to the latest 2022 statistics from the Singapore Statistics Department (SingStat), Singapore’s unemployment rate is only 2.1%, the lowest among developed countries worldwide.

Singapore is a multicultural immigrant country. To maintain a sustainable population and its future development, the Singapore government aims to attract global elites and introduce foreign talents.

Singapore has a low birth rate, and the citizen population will age rapidly if new immigrants are not introduced. Therefore, the Singapore government released a population white paper in 2013 that outlined Singapore’s population policy. The Singapore government plans to increase Singapore’s total population from the current 5.45 million to between 6.5 million and 6.9 million by 2030.

To sum up, whether a country’s housing prices will rise in the long run depends on its employment rate and population growth.

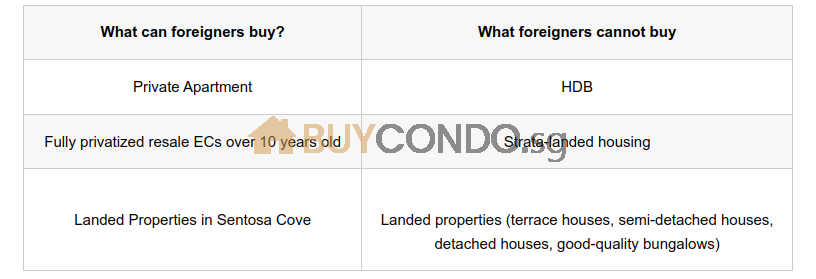

Can foreigners buy property in Singapore? Are there any restrictions?

The most direct answer is Yes.

Singapore is a very inclusive immigrant country, with 74.3% of the population being Chinese, and almost 3 out of 4 Singaporeans are Chinese. It is the only country outside mainland China where the Chinese population is the majority. The Singapore government encourages people from all over the world to come here to work, study, and settle down, so it also allows foreigners to purchase properties in Singapore. However, compared to Singapore citizens and permanent residents (PR), there are some restrictions on foreigners buying properties in Singapore. There are only two types of properties that foreigners can choose to buy in Singapore:

- Private Apartment

- Landed properties in Sentosa Cove

Singapore has a large population and limited land. To stabilize housing prices and allow local residents to buy houses, get married, and settle down at reasonable prices, the government provides extensive policy support to Singaporean citizens, such as building cheap public housing for them and restricting the types of properties that foreigners can purchase in Singapore. Besides the landed houses in Sentosa Cove, foreigners can only buy private apartments.

Can I migrate if I buy a property in Singapore?

Buying a house in Singapore is not the same as immigrating because the purchase of a house is usually from a developer or private seller. Permanent residency belongs to the Singapore government, so buying a house is not a one-step immigrant solution.

Therefore, buying a house is not a one-step solution to immigration. However, buying a home in Singapore does help add points to the Permanent Resident (PR) application and can be a springboard for immigration to Singapore.

Do I have to come to Singapore to buy a property in Singapore?

No, it is not necessary. Overseas buyers can sign the documents at a local Notary Public or Singapore Embassy. Overseas buyers can also sign the Power of Attorney (POWA) through their lawyers.

Overseas buyers can apply for a Power of Attorney (POA) through their lawyer to authorize a relative or friend in Singapore to execute the purchase.

⚠Warm Tip: It is essential to go through an experienced and professional real estate agent for this transaction, as it will save you much hassle!

If you have questions you would like to ask, please contact real estate agent Gary Lim.

Click here for related content: Singapore Stamp Duty – Property Buying Guide

What kind of properties can a Singapore Permanent Resident (PR) buy?

There are two types of properties that Singapore permanent residents can choose to buy:

- Resale HDB Flats (with restrictions)

- Private Apartment

First of all, Singapore permanent residents cannot buy new BTO flats; only resale flats are allowed. Permanent residents who want to buy resale flats must meet these conditions: Both spouses must be permanent residents, and both must have been permanent residents for more than three years before they can buy resale flats.

Single permanent residents are not allowed to purchase second-hand HDB flats.

Singapore permanent residents can purchase condominiums with no requirements or restrictions.

Approximately how much will it cost to buy a flat in Singapore?

If you plan to buy a private apartment in Singapore, how much money do you need?

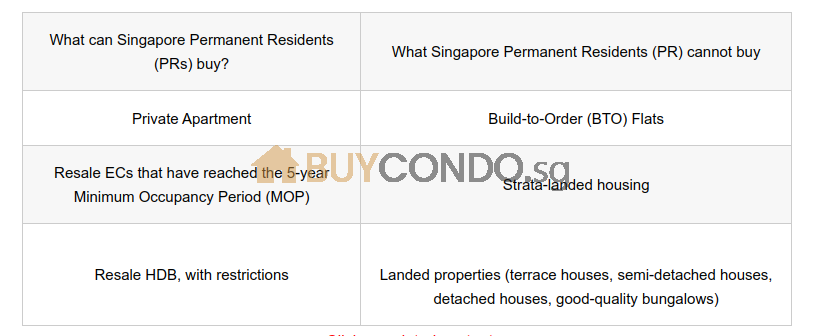

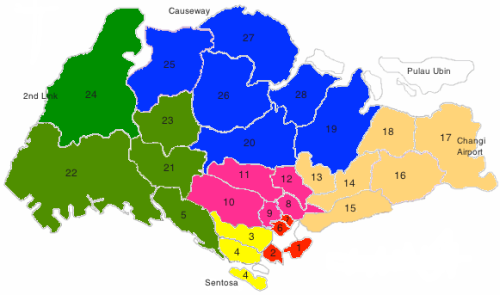

Although Singapore is small in size, it is divided into 28 districts. The property prices in different districts can vary greatly. When choosing a property, you can choose apartments in various price ranges according to your budget.

Generally speaking, apartments in Districts 1-7, 9, 10, 11, and 15 are more expensive because most multinational companies, universities, and traditionally wealthy areas are concentrated there. The following table shows the average price of apartments in these areas:

You can check the apartment prices near your workplace if you work in Singapore. If the average cost is beyond your budget, you can also choose a nearby or distant community with convenient transportation. If you are studying in Singapore or sending your children to study here, selecting an apartment near an international school is most convenient.

Of course, the above are just average prices. Prices will vary in different locations, configurations, and developers. You can choose a trustworthy local real estate agent to provide more detailed information about the area and property.

Geography study of Singapore?

Singapore properties are categorized into 28 postal districts and 3 major zones based on geographical location.

How much is the down payment for buying a flat in Singapore?

Generally, the down payment for a home in Singapore is 25% ~ 40%. Many factors affect the down payment for a home, including Buyer’s Stamp Duty (BSD), Additional Buyer’s Stamp Duty (ABSD), Loan-to-Valuation Ratio (LTV), and whether you are purchasing a pre-financing or an existing home. As long as it is a first home, the down payment should not exceed 25% of the total house price.

If you are purchasing a project home, in addition to the LTV ratio, you must also consider the project’s progress. If the loan is 75%, the down payment would be 25%. If you don’t want to apply for a loan, you don’t need to make a lump sum payment at the time of purchase, but you can pay according to the project’s progress. For example, if you are buying a project where the foundation and concrete structure have already been built, the down payment would be 40%.

If you buy an existing home, the down payment will be the total amount minus the loan amount. For example, if the loan is 75%, the down payment will be 25%, and if the loan is 60%, the down payment will be 40%.

Apart from the down payment, there is also the stamp duty, which can only be paid in cash and not through a loan.

What are the most popular residential areas in Singapore?

– Marina Bay.

The centerpiece of Singapore’s urban transformation project, Marina Bay has evolved into a leading financial hub, a civic space, and a community playground for all.

Marina Bay is located in the central region of Singapore, surrounded by the periphery of four other planning districts: Downtown Core, Marina East, Marina South, and Straits View.

(Marina East, Marina South, and Straits View.

The area surrounding the bay, also known as Marina Bay, is a 360-hectare extension of the adjacent Central Business District.

Extension of the neighboring Central Business District. It is also Singapore’s new city center, built on reclaimed land.

– Sentosa Island (SENTOSA ISLAND)

0.25 miles off the southern coast of the main island of Singapore lies Sentosa, a 5 square kilometer island.

Much of the island is covered by secondary rainforest and is home to many native plants and animals. Sentosa also has

3.2 kilometers of sandy beaches spanning Siloso, Palawan, and Tanjong.

(Tanjong.)

Sentosa is a major destination in Singapore, and it has many attractions and activities that cater to different groups.

The island is known as a cultural heritage center, a natural park, and a recreational paradise for tourists and Singaporeans. Being a major tourist destination in Singapore, Sentosa Island Resort offers a variety of attractions, museums, and other facilities that give the entire collection a breathtaking experience.

– ORCHARD ROAD

The beginnings of Orchard Road can be traced back to the early 1830s when it was an unnamed road home to orchards, nutmeg plantations, and pepper farms.

1958 local businessman CK Tang established Orchard Road’s first department store, TANG Tang.

–In 1958, local businessman CK Tang established Orchard Road’s first department store, TANGS.

This department store, then known as the House of Tangs, marked the first step towards making Orchard Road district one of Singapore’s favorite shopping areas.

The bustling boulevard of Orchard Road is now a retail and dining paradise, with thousands of establishments offering the ultimate lifestyle experience to tourists and locals alike.

Commerce is vital to Orchard Road, as the neighborhood is known for its busy shopping centers.

– BUKIT TIMAH

Bukit Timah, which means “tin hill” in Malay, is the highest natural point in Singapore and the

Singapore’s longest road, measuring 25 kilometers from north to south.

This is the place to be if you want an alternative to restaurant dining and shopping in the city. With a long list of popular brunch spots and trendy cafes, this district is full of independent concepts, small artisanal businesses, and many unique features.

Aside from the necessities of modern life, Bukit Timah is also home to a concentration of Singapore’s native tropical greenery and rainforests- a definite bonus for nature lovers. Bukit Timah has a nature reserve, tree-top walkways, and other unique ecological spots. With the great outdoors on your doorstep, Bukit Timah offers plenty of options for outdoor activities to keep you on the road and in the fresh air.

There are several schools in the area (including a fair number of international schools), so you’ll find a high concentration of families and expats here.

– holland village

Established in the early 20th century by Singapore’s Dutch community, Holland Village was the former home of British military personnel and their families.

Plantations, colonial estates, and nurseries once dotted the neighborhood, and its European-influenced heritage can still be seen in its quaint stores and low-rise buildings.

Over the years, Holland Village has earned a reputation as a creative commune and incubator for local artists, musicians, and entrepreneurs.

Exuding a subtle European charm along the main stretch of Lorong Mambong, Holland Village is a treasure trove of alfresco cafes, restaurants, and popular lifestyle stores.

– NOVENA

Novena is a prime area with a wide range of amenities located in the central region of Singapore. A stone’s throw away from Orchard Road and the Central Business District, Novena offers a comprehensive living, working, and entertainment environment. Consisting mainly of private residences, residents of Novena enjoy easy access to public transportation and a wide range of amenities and services.

The masterplan for Health City Novena, Singapore’s most significant single medical complex, is underway.

Masterplanning is underway. Tan Tock Seng Hospital, Singapore’s third largest hospital, will be expanded with more health and medical care facilities to meet the growing needs of residents. The area is surrounded by a vibrant commercial center dominated by established shopping malls and offices.

Due to its central location, Novena is convenient for professionals working in the city center. With several beanbag classes and primary and secondary schools (including an international school), Novena is also an attractive neighborhood for families.

– EAST COAST

Singapore’s East Coast is a primarily residential area offering green-landed residential villas and high-rise family apartments. The East Coast lifestyle is quite different from the rest of the country, where things are calmer and slower.

Away from the hustle and bustle of the city center, this popular area offers a choice of luxury condominiums with great ocean views and a variety of activities and dining options, making it the perfect residential area for families.

Along East Coast Park’s coastline are 20 kilometers of white sandy beaches, where residents can often be found sunbathing, cycling, canoeing, and windsurfing. There is no shortage of interesting things to do here.

The East Coast is home to Singapore’s Malay and Eurasian communities, and traces of both cultures still exist in Tanjong Katong, so the culinary options are endless.

Some of the most popular international schools are located around the area. As a result, this green area is also popular with expatriate families who want a quieter living experience with plenty of open space to enjoy.

If you have questions you would like to ask, please contact real estate agent Gary Lim.

“Click here for related content: Things You Must Know Before Buying a Home in Singapore

Click here for related content: Singapore Stamp Duty – Property Buying Guide

How is the area calculated for buying a house in Singapore?

Houses in Singapore are calculated on the basis of usable area, and prices are sold on the basis of square footage. If you buy a house that is 100 square meters, it will be 100 square meters when it is delivered.

The size of a house in Singapore is generally measured in square feet, where one square meter is equal to 10.764 square feet (1m² = 10.764 sq. ft.).

(1 m² = 10.764 ft²).

Why are new homes in Singapore better?

What are the benefits of new housing in Singapore:

– New Buildings and Amenities: New development projects will have modern amenities, sustainable features, and smart home systems.

– Pricing of New Homes: It is not uncommon for developers to offer special discounts to gain sales momentum when the project opens. Generally, developers may change their pricing strategy at different stages of a project’s launch, and you may see the price of an earlier purchase gradually increase as more units are sold.

– New 99-year title: Assuming the property is not a freehold or 999-year title, the new home will have a new 99-year title, making the shortening of the remaining lease less of a concern (at least for the next 20 years). This is also important if you want to pass the property on to your children.

– More unit choices: In newer developments, you can choose from a broader range of units. However, in the resale market, the choice of units available depends on what the owner has listed for sale.

– Payment Procedure for Phase 1 Flats: The payment procedure for Phase 1 flats in Singapore is based on the project’s progress. This will ease your financial burden as payments are made in installments after the completion of each phase of construction. This may be 5%to10%of the purchase price as the project is built.

Some developers may offer a Deferred Payment Scheme (DPS) for new, existing homes with a Certificate of Statutory Completion (CSC). This Scheme allows buyers to make a down payment of up to 20% and pay the balance two to three years later.

Defects Liability Period (DLP): When buying a new home in Singapore, developers offer a one-year warranty period. The developer is liable for any defects in the unit, housing project, and community utilities. During this period, the developer must repair the defects at its own cost.

– Lower property costs: The cost of maintaining the building and facilities of a new home will be much lower than that of an older condominium.

Lower Property Costs

– Save on renovation: New condos in Singapore are fully furnished, including basic painting, flooring, air-conditioning, appliances such as refrigerators and washing machines, and the kitchen and toilets will be fully furnished. All you need to do is buy light bulbs, curtains, and furniture, and you are ready to move in.

– Room to add value: According to a study by Settlement Lions, most new homes tend to perform better than second-hand homes over the same period.

Do bad deals happen when I buy a new property in Singapore?

In Singapore, the government has very strict control over developers, who must obtain a Building Plan Permit and a Real Estate Developer’s Sales License before a residential project can commence sales.

The Building Plan Permit is approved by the Building Control Commissioner, and the Real Estate Developer’s Sales Permit is issued by the Government Property Auditor. This ensures that the buyer is buying a property developed by a developer approved by the government to obtain a building permit.

The government’s website provides information on all real estate transactions in Singapore, including transaction prices, making the transaction process highly transparent.

Under the Singapore Housing Developers (Control and Licensing) Act, payments made by the buyer will be placed in a designated account with a bank or financial institution before the completion of the project, and the payment process will follow the progress of the project until the Temporary Occupation Permit (TOP) is obtained. (TOP) is obtained for the project.

(Partial withdrawals are only permitted for particular reasons (e.g., to cover the costs of construction, marketing, and advertising), and the sale and purchase agreement must be in a standardized form.

These rules protect buyers from purchasing properties still in the construction stage, eliminating the possibility of a wrong building.

Can I buy a property in my child’s name in Singapore?

Buying a property in Singapore in the name of a child through a trust is possible.

It is important to note that the parents must pay the total purchase price in cash, and the bank will not provide a loan to the parents for the purchase of the trust property.

Banks will not provide loans to parents who purchase properties under trust.

If you have questions you would like to ask, please contact real estate agent Gary Lim.

Click here for related content: Singapore Stamp Duty – Property Buying Guide

What are the differences between Singapore property and China property?

Ownership

In China, the property rights of a house are usually around 70years, while in Singapore, there are three types: 99

year,999year and freehold.

House Size

In China, there is an amortized area, which is usually 20%- 30% of the total area of the property. So, a 130sq ft house will only have 90 ft of usable area in the end.

In Singapore, however, the size of the house you see is often the usable area, and the price of the house is sold according to the size of the unit.

Therefore, if you buy a house of the same size, the actual usable area in Singapore may be larger than that in China. In addition, the location of a home in China is calculated in square meters, whereas a home in Singapore will be measured in square feet, where 1 square meter is equal to 10 square feet.

feet, where 1square meter is equal to 10.764square feet (1 m² = 10.764 ft²).

Decoration

Currently, there are a number of furnished properties available in China, but most of the properties are still rough at the time of handover, and the homeowners have to design and furnish the property themselves.

New condominiums in Singapore are fully furnished, including basic painting, flooring, and appliances such as air-conditioners, refrigerators, washing machines, and kitchens and toilets will be fully equipped.

You need only buy light bulbs, curtains, and furniture, and you are ready to move in.

Loan Rates

If you are looking for a loan to buy a property in Singapore, the maximum allowable loan rate for your first home is

75%.

Singapore’s current loan interest rates are meager, ranging from 2% to 3% per annum, which is a far cry from the 5% to 6% interest rates in other countries.

This is a far cry from other countries’ 5% ~ 6% interest rates.

Home Buying Policies

Property purchases in Singapore must be made through a lawyer and supervised by a third-party bank account. Compared to China, there are more double guarantees.

Of course, you must pay a lawyer’s fee (usually around S$2,500 ~ S$3,000).

Parking Space When buying a property in China, you often need to pay extra for a parking space. However, in Singapore, buyers do not need to purchase a parking space, as developers usually provide a parking space for each new unit.

In Singapore, however, buyers do not need to purchase a separate parking space. Property Related Taxes In China, apart from stamp duty, a value-added tax (VAT) must be paid when selling a property. In Singapore, there is no capital gains tax on the sale of property. Payment Process for Phase 1 Properties In China, you need to pay the total amount for the Phase 1 project and then wait a few years for the property to be delivered. In Singapore, the payment process for a phased home is based on the project’s progress.

Even if you do not intend to apply for a loan, you do not need to pay the total amount at the time of purchase but can pay according to the project’s progress.

Ownership Issues

How many years is the ownership of a house in Singapore?

Singapore has three main types of property rights: 99-year leasehold, 999-year leasehold, and freehold.

The 999-year leasehold is almost equivalent to a perpetual lease due to its long term.

The 999-year leasehold and the freehold are remnants of the British colonial era and Singapore’s early days as a nation. Due to Singapore’s minimal land resources, the Singapore Government no longer releases freehold land for sale.

The freehold and 999-year leasehold new developments currently available in the Singapore property market are redeveloped by real estate developers through collective purchases from private owners.

When does the ownership of a house in Singapore start?

The title of a house in Singapore starts from the date the developer purchases the land, not from the date of purchase or the date of handover.

Which is better, freehold or 99 years?

The first thing we need to consider when buying a home is the purpose of the purchase. What is the purpose of buying a property in Singapore? Is it for investment or your children’s schooling? Is it for settling down in Singapore or simply to diversify your assets and

Or are you simply looking to diversify your assets and reduce risk?

The factors that must be considered vary to buy a property. Here is a comparative analysis of properties with different leases, starting from the purpose of purchase:

Short-term investment Purpose: I have free money in hand, see the real estate opportunities in Singapore, and want to make a short-term property investment in Singapore.

Short-term Investment Purpose: Those who have free money and see real estate opportunities in Singapore want to make a short-term property investment in Singapore.

You can wait for the property to appreciate in value and then sell it after 5 to 10 years.

Analysis: If you are looking for a short-term investment in Singapore, a property that is easily accessible, has a low total price, and requires a low down payment will be a good choice.

If you are looking to buy a property in Singapore for short-term investment, a 99-year condominium with convenient transportation, a low total price, a low down payment, and low mortgage stress is more suitable than a freehold condominium.

In terms of rent, 99-year leasehold condominiums are not less expensive than freehold condominiums, as tenants do not care about the length of the lease. If you choose a 99-year lease apartment by the subway, next to a school, or in a popular new neighborhood, you may be able to afford a 99-year lease.

If you choose a 99-year lease apartment by the subway, next to a school, or in a popular new neighborhood, the rent can be even higher than a freehold apartment in an average location with little traffic.

Even higher than a permanent leasehold apartment in an average location with limited transportation.

Regarding property appreciation, if you plan to sell your property in 5-10 years, the price of a 99-year-old condo will increase almost as much as a freehold property. Considering that the cost of a 99-year leasehold property is 15% – 20% lower than the price of a freehold property, it is clear that the return on investment for a 99-year leasehold property over ten years will be

Considering that 99-year-old properties are 15% – 20% less expensive than freehold properties over a ten-year period, it is clear that a 99-year-old property will provide a better return on investment.

For children’s schooling Purpose: To facilitate children’s schooling in Singapore, to study in Overseas Chinese High Schools or universities, and for the children to graduate.

Analysis: Singapore’s education level is world-renowned. Therefore, many parents send their children to Singapore specifically to receive education and buy property.

Therefore, many parents send their children to Singapore for education and buy condominiums to live in while studying. When your child graduates, you can sell it, which is convenient for your child’s education and has investment value, killing two birds with one stone.

If you are buying a property in Singapore for your child’s education, a 99-year condominium around a school is the most suitable option. You need to be able to meet your child’s daily needs, preferably next to a school, in a well-developed neighborhood, and with easy access to transportation.

An apartment with a 99-year lease will meet these needs, and a wide range of options are available, whereas a freehold property is less suitable.

Family Housing (Family Migration) Purpose: For children to receive a better education, better development of their careers, and better care for the elderly, there are now more and more places for them to live.

More and more families are choosing to migrate to Singapore as a family to provide better education for their children, better career development for themselves, and better care for the elderly.

The purpose: To provide better education for their children, better career development for themselves, and better care for the elderly; more and more families are choosing to migrate to Singapore with their entire families.

Analysis: If you are looking for a family home, both 99-year-old properties and freehold properties are available.

If you are looking for a family home, depending on your budget, 99-year-old properties and freehold properties are available.

If you have already immigrated to Singapore or are planning to immigrate your entire family to Singapore and have a reasonable budget, you can consider buying a freehold property.

If your budget is more limited and you are looking for a short-term investment, then a 99-year leasehold condominium close to MRT and schools is a good choice.

If you have a limited budget and are looking for a short-term investment, a 99-year leasehold condominium close to MRT and schools is a good option.

Work Residency Purpose: To be based in Singapore for work reasons.

Analysis: As one of the most internationalized countries in the world, 38% of Singapore’s residents are Permanent Residents (PRs) and hold work permits.

Analysis: As one of the most cosmopolitan countries in the world, 38% of Singapore’s residents are permanent residents (PRs), International Migrant Workers (IMWs) on work visas, and students on student visas. Many people stay in Singapore temporarily for a few years for work and may leave Singapore and return to their home countries when their work is finished.

Therefore, many people working in Singapore choose to buy properties for their convenience and as an investment.

For this group, a 99-year leasehold condominium is the most suitable, as is a short-term investment for the same reasons.

Family Inheritance Purpose:

- Inherit the family’s wealth.

- Reduce the risk of investment.

- Preserve the property’s value.

Analysis: Singapore has attracted many wealthy immigrants because there is no inheritance tax. Widely known

Zhang Yong, the chairman of Haidilao, emigrated to Singapore quickly after the company’s listing.

In addition to the lack of inheritance tax, Singapore’s freehold properties also attract tycoons worldwide. After all, in this turbulent modern world, we all value the preservation and security of our assets. For this segment of the population, Singapore freehold properties are, of course, the best assets to preserve their value.

If you have questions you would like to ask, please contact real estate agent Gary Lim.

Click here for related content: Singapore Stamp Duty – Property Buying Guide

Process Issues

What is the process of buying a property in Singapore?

- On the day of booking: 5% of the purchase price (as a deposit)

- Within 1 – 2 weeks: Developer sends the sale and purchase agreement to the solicitor’s firm

- 3 Within one week of receiving the purchase agreement, Loan application, and signing at the solicitor’s office

- Within two weeks of signing the sale and purchase agreement, the buyer pays stamp duty on the purchase.

- 8 Within two weeks: Purchaser pays stamp duty of 15%

- Payment according to the progress of construction

If you are buying a second home in Singapore, you need to take the following steps:

- Pick a property you are happy with (through a real estate agent or online);

- Liaise with the seller to negotiate the price and determine a mutually acceptable price;

- Going to the bank for a loan;

- Signing the purchase contract;

- Paying the remaining purchase price minus the amount of the home loan on the closing date;

- Closing of the house.

What are the payment options for buying a house in Singapore?

The usual payment methods for purchasing a property in Singapore are cheques, cashier’s orders, and bank transfers. Carrying cash or using credit cards is not acceptable.

What is the process of handing over a property in Singapore?

After the Temporary Occupation Permit (TOP) has been issued for the house:

– The developer will communicate the Notice of Vacant Possession (NVP) to the buyer through the solicitor.

(NVP) to the buyer through their solicitor;

– The purchaser will make payment to his solicitor within 14 days of receiving the Notice of Vacant Possession;

– Once payment has been made, the purchaser’s solicitor will receive a Notice of Handover of Keys (critical slip);

– Once the notice has been received, the purchaser can arrange an appointment to collect the keys to the house.

On the appointment day, the homeowner must bring the original Keyslip and his/her identity card (NRIC, Singapore Citizen or Permanent Resident) /passport (Foreigner) for verification. Suppose the owner appoints another person to collect the keys on his/her behalf. In that case, the appointee will be required to provide a power of attorney and proof of identity in the form specified by the developer.

“Click here for related content: Things You Must Know Before Buying a Home in Singapore

Loan Issues

How much can I borrow to buy a flat in Singapore? What is the loan tenure?

Singapore Citizens and Permanent Residents (PR) can borrow up to 75% of the property price. Expatriates with a Singapore Work Pass can also borrow up to 75% of the house price.

The maximum loan amount for foreigners is usually 60%—70%, depending on the financial institution’s loan appraisal.

Loan Tenure

The maximum term of a mortgage loan for purchasing a home in Singapore is 35 years, or the mortgagor’s age plus the loan’s term up to 75 years.

However, if the loan tenure is more than 30 years or the age of the mortgagor plus the loan tenure is more than 65 years, then the maximum amount of the home loan can be

However, if the loan period exceeds 30 years or the borrower’s age plus the loan term exceeds 65 years, then the maximum amount of the home loan will be reduced to 55%.

What is the cash amount to be paid for a home loan in Singapore?

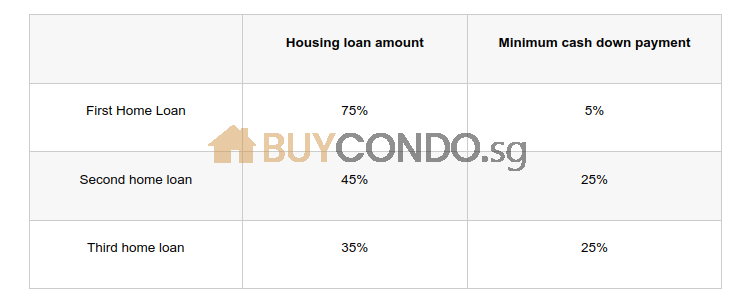

If the loan term does not exceed 30 years, or the applicant is not older than 65 years old when the loan ends, the specific minimum cash down payment can be found in the following table:

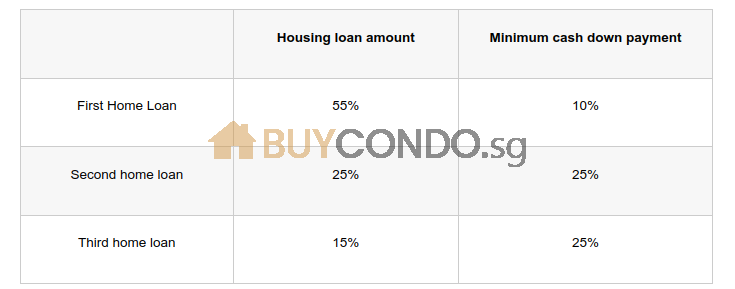

If the loan term is longer than 30 years, or the applicant will be over 65 years old at the time the loan is closed, the minimum cash down payment will be as follows:

Is there an income limit for a home loan in Singapore?

The Monetary Authority of Singapore (MAS) has set a Total Debt Servicing Ratio (TDSR) ceiling of 55%, meaning the monthly loan payment cannot exceed 55%of your income.

What is the monthly mortgage payment for buying a home in Singapore?

The monthly mortgage payment depends on your loan amount, tenure, and package. You can consult a professional real estate agent who calculates it according to your circumstances.

What are the home loan interest rates in Singapore?

As of March 2022, the average fixed interest rate for home loans in Singapore ranges from 0.80%to2.50%.

With most banks offering mortgage rates below 2%。

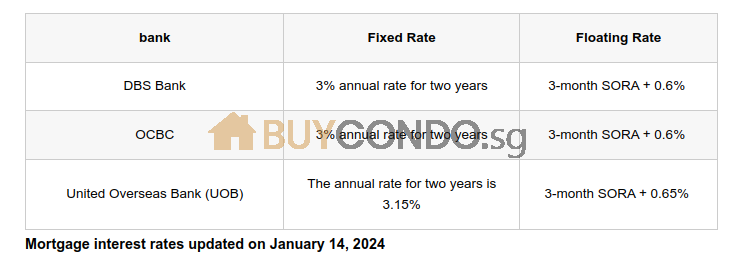

At the beginning of the year, the central banks in Singapore raised their fixed interest rates for home loans. Among them, the United Overseas Bank

(UOB) raised the annualized interest rate (APR) on its three-year fixed-rate packages to 3.85 percent from 2.8 percent and 3.08 percent previously, compared to the previous high of 2.88 percent for fixed rates in mid-2019. The fixed-rate data for other banks can be found in the table below:

What are the types of home loans in Singapore?

Before taking out a home loan, you also need to know about the two types of home loan services in Singapore: Fixed Rate and Floating Rate.

As the name suggests, a fixed interest rate means that the interest rate will remain the same during the repayment period of your home loan so that you can avoid any future losses due to an increase in interest rates. However, if the interest rate decreases during the repayment period, you will still have to pay interest to the bank at the original rate.

A variable interest rate is also easy to understand, as it varies according to the market rate.

The best way to decide which type of mortgage to take out is to consider your needs and consult a real estate professional before making a decision.

What documents do I need to submit to apply for a home loan in Singapore?

You will need to prepare the documents to apply for a home loan;

– Option letter or sale and purchase agreement for the house

– Home loan application form (completed and signed)

– My ID card and photocopy or passport and photocopy

– Proof of income (last 3months pay stubs and bank statement to prove that salary is deposited into your bank account) or bank statement

– Recent income tax assessment

– Other required documents

What is the procedure for applying for a bank loan?

– Selection of the lending bank

– Client submits application and relevant documents

– The bank carries out a valuation of the house

– The bank approves the application.

– The bank informs the lawyer to prepare the contract.

– Client signs the loan agreement

– Lawyer registers the loan agreement

– Client pays outstanding balance to developer

– Bank disburses the loan

– Client makes monthly payments based on the disbursed loan amount and the agreed interest rate

What are the local and foreign banks in Singapore that can provide loans?

The following are banks and financial institutions in Singapore where you can apply for a loan:

– OCBC Bank OCBC

– DBS Bank DBS

– United Overseas Bank UOB

– Standard Chartered Bank Standard Chartered

– Standard Chartered Citibank

– HSBC

– Malayan Banking Berhad Maybank

– CIMB

– Société Générale RHB

– Hong Leong Finance

“Click here for related content: Things You Must Know Before Buying a Home in Singapore

If you have questions you would like to ask, please contact real estate agent Gary Lim.

Click here for related content: Singapore Stamp Duty – Property Buying Guide

Can I get a discount for paying full price for a property in Singapore?

Developers charge the final sale price regardless of whether the buyer pays the full price or takes out a bank loan. Therefore, there is no such thing as a discount on full payment for developers.

Lawyer Issues

Do I need to hire a lawyer to buy a property in Singapore?

No. The property purchase in Singapore must be made through a lawyer, and the lawyer you appoint will handle all the purchase documents on your behalf.

Of course, you will need to pay a lawyer’s fee.

How much does a lawyer cost?

Solicitor’s fees for purchasing a property in Singapore vary according to the form and price of the property, whether it is a pre-purchase or an existing property. Generally speaking, lawyers’ fees range from $2,500 to $3,000.

Taxation Issues

What are the taxes for Singapore citizens buying a property?

f the purchase price of your home is less than S$1 million, the tax payable will be

3%*(3%Buyer’s Stamp Duty).

If your purchase price is between S$1,000,000 and S$1,500,000, the tax payable is 4 of the property price*(4 %Buyer’s Stamp Duty).

If your purchase price is between S$1.5 million and S$3 million, the tax payable is 5% of the property price*(5% buyer’s Stamp Duty).

If your purchase price is S$3 million or more, you must pay 6%* (6% Buyer’s Stamp Duty) of the property price.

6%*(6%Buyer’s Stamp Duty).

*⚠Note: Only applicable to the purchase of a first home.

How much tax do Permanent Residents (PR) have to pay when buying a home in Singapore?

If the purchase price of your home is less than S$1 million, the tax payable is 8%*(3% buyer’s premium) of the property price.

8%*(3%Buyer’s Stamp Duty (BSD) + 5% Additional Buyer’s Stamp Duty (ABSD)) of the property price.

If your purchase price is between S$1,000,000 and S$1,500,000, the tax payable is 9%of the property price *(4%Buyer’s Stamp Duty (BSD) + 5% Additional Buyer’s Stamp Duty (ABSD)).

If your purchase price is between S$1.5 million and S$3 million, the tax payable is 10% of the property price *(5% Buyer’s Stamp Duty (BSD) + 5% Additional Buyer’s Stamp Duty (ABSD)).

If your purchase price is S$3 million and above, the tax payable is 11% of the property price * (6% buyer’s stamp duty + 5% additional buyer’s stamp duty).

11%*(6%Buyer’s Stamp Duty (BSD) + 5% Additional Buyer’s Stamp Duty (ABSD)).

*⚠Note: Only applicable to the purchase of a first home.

What are the taxes and fees for foreigners buying a home in Singapore?

If the purchase price of your home is less than S$1 million, the tax payable is 63% (3% buyer’s stamp duty) of the cost of the house.

63%(3%Buyer’s Stamp Duty (BSD) + 60% Additional Buyer’s Stamp Duty (ABSD)).

If your purchase price is between S$1 million and S$1.5million, the tax payable is 64%of the property price (4%Buyer’s Stamp Duty (BSD) + 60% Additional Buyer’s Stamp Duty (ABSD)).

If your purchase price is between S$1.5million and S$3million, the tax payable is 65%of the property price (5%Buyer’s Stamp Duty (BSD) + 60% Additional Buyer’s Stamp Duty (ABSD)).

If your purchase price is S$3 million or more, you must pay 66% (6% buyer’s stamp duty + 60% additional buyer’s stamp duty) of the property price.

66%(6%Buyer’s Stamp Duty (BSD) + 60% Additional Buyer’s Stamp Duty (ABSD)).

“Click here for related content: Buycondo.sg“

If you have questions you would like to ask, please contact real estate agent Gary Lim.

Click here for related content: Singapore Stamp Duty – Property Buying Guide

Transaction Issues

Is there any regulatory body for property transactions in Singapore?

The Singapore government established the Council for Estate Agencies (CEA) in 2010. It is a statutory body under the Ministry of National Development (MND) and is mainly responsible for regulating the real estate agency industry to develop it into a professional field that the people trust.

The primary responsibilities of the Real Estate Agents Council include

- issuing licenses to real estate agencies and registering real estate agents,

- helping to promote the integrity and ability of real estate agencies and real estate agents, and

- Providing consumers with the necessary knowledge to ensure that they can make informed choices when entrusting agents to handle real estate transactions.

Before you hire a real estate agent to handle your property transaction, you can check the public register on the Real Estate Agents Council website to confirm that your agent is licensed. You can find information about licensed real estate agents on the public register.

Revenue Issues

What is the return on investment for buying a property in Singapore?

The purpose of investment is house price appreciation and rental income.

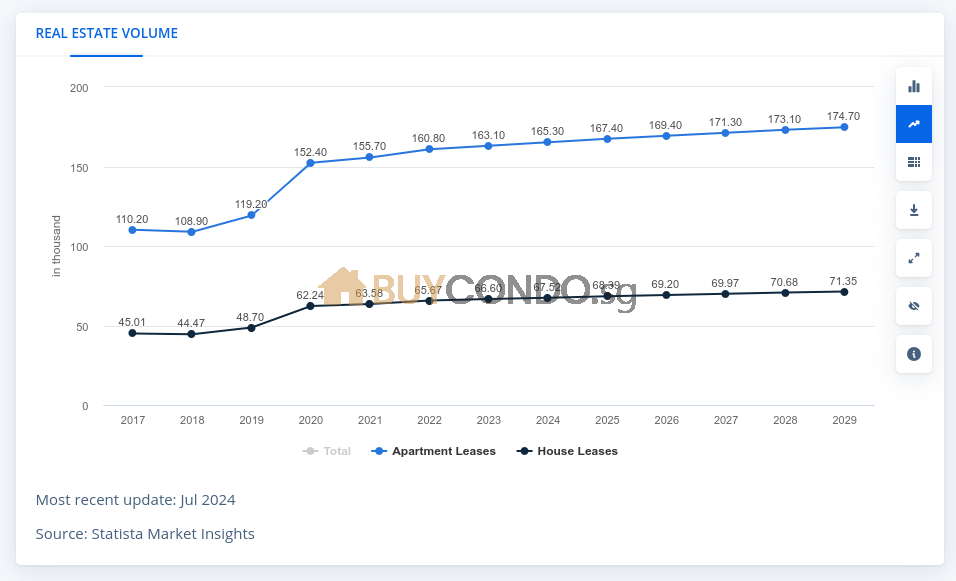

Singapore house prices rose 10.6% for the whole of 2021. Private home prices rose 8.2% in the first three quarters of 2022 and are expected to increase by about 10% by the end of the year.

The demand for rental housing in Singapore exceeds the supply, and the rent of private homes in Singapore rose by 11.4% in 2021. In the first three quarters of 2022, the rent increased by 20.8%.

The rental yield for private apartments in Singapore is around 3% – 5%.

Is it easy to rent out a property in Singapore after buying?

More than 37,000 international companies, including 7,000 multinationals, are headquartered in Singapore. According to Bloomberg, 1.2 million expatriates from all over the world live and work in Singapore.

In addition, more than 60 international schools in Singapore offer American, British, and International Baccalaureate (IB) programs.

Singapore’s education system is known for its quality, which is why students in the region strongly demand to study there. The US Bureau of International Trade estimates that there are about 50,000 foreign students in Singapore (mainly from Malaysia, Indonesia, Thailand, Vietnam, China, India, and South Korea), ranging in age from 13 to 23.

There is a strong demand for rental properties in Singapore, so as long as you buy a house in the right location, with convenient transportation and amenities, you don’t have to worry about finding a tenant.

If you have questions you would like to ask, please contact real estate agent Gary Lim.

Click here for related content: Singapore Stamp Duty – Property Buying Guide

Buying a Home in Singapore?