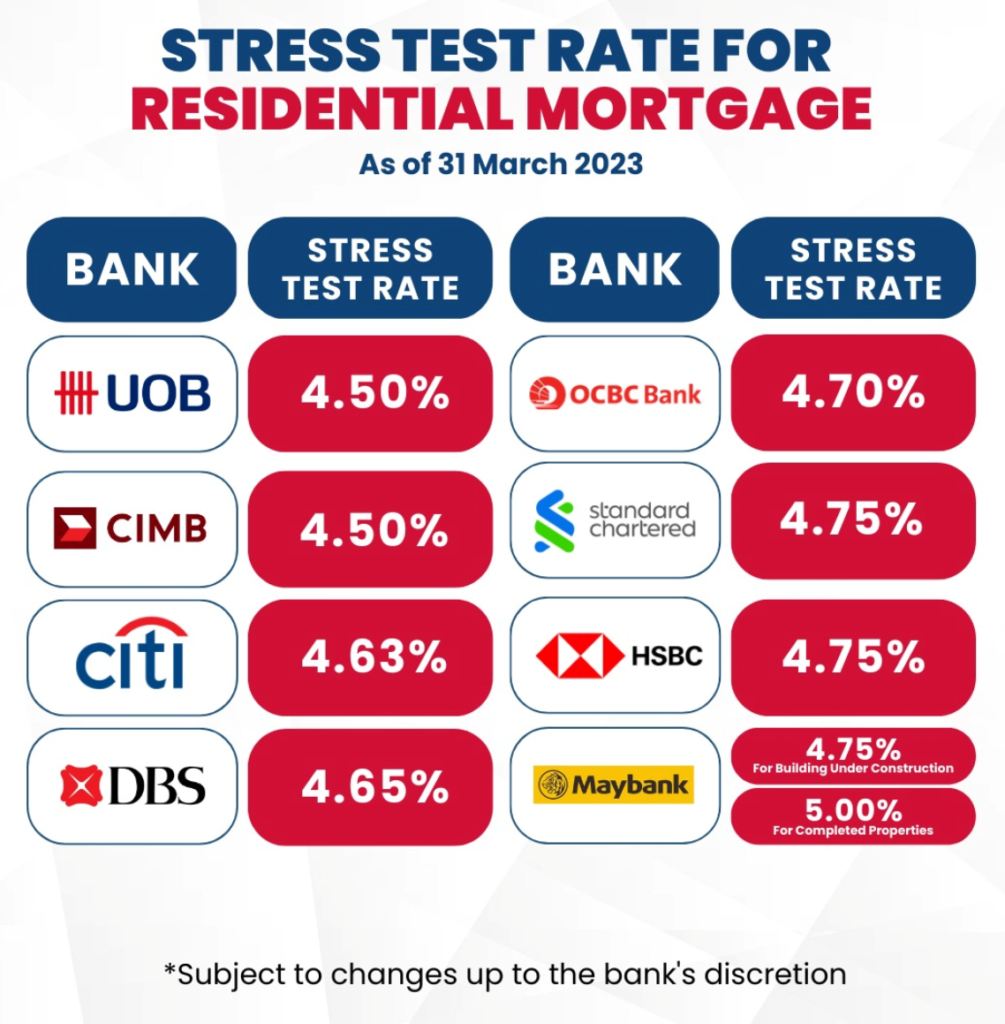

TSDR Stress Test Table

Since 30th September 2022, the TSDR Stress Test guided by MAS is at 4% interest For Residential. And for Non-Residential is at 5% interest.

As of 31st March 2023, at BUYCONDO team we help our clients find the right property and recommend a bank loan to support their purchase. The table is good for knowing which banks are taking what percentage as the Stress Test for the loan.

For example for a property purchase on 1st October 2022,

Based on $10k income, 55% MSR You can get up to $5,500 Max Monthly Mortgage ( this includes the secured/non-secured loans) based on a stress test interest simulating at 4%,75% LTV, 30 Year Tenure, you can Loan Up to $1,152,037, Max Purchase Price $1,536,049.

For example for property purchase on 1st April 2023,

Based on $10k income, 55% MSR You can get up to $5,500 Max Monthly Mortgage ( this includes the secured/non-secured loans) based on a stress test interest simulating at revised minimum of 4.5%,75% LTV, 30 Year Tenure, you can Loan Up to $1,085,486, Max Purchase Price $1,447,315.

4% -> 4.5%, All this equals, you can only borrow $66,551 lesser in the loan. The Purchase price on the affordability will be $88,734 lesser than the previously supported Sale Price unless is topped up by cash for the difference.

Old TDSR simulated interest Max Purchase Price $1,536,049.

New TDSR simulated interest Max Purchase Price $1,447,315.

The Main effect which means:

The buyer who is keen in getting a Residential Condo can only get a condo of a purchase price of approx $100k lower than before.

The ripple effect of the Increase of the TDSR Simulated interest :

- Forking out more cash on top of the 25% Downpayment, excluding of the stamp duties/ABSD payable.

- Getting a Smaller size property.

- Getting a lower priced property and the cons of it being located further away from MRT. Older Condos.

New Bank TDSR Stress Test Table Updated March 2023