Singapore Stamp Duty – Property Buying Guide: Buying real estate, as a reliable way to preserve and increase the value of assets, has become one of the must-have investment projects for high-net-worth individuals. However, the governments of many countries have regulated the real estate market. Policy restrictions have made it impossible for many people to invest even if they want to, so they have turned their attention to overseas real estate markets. In addition to Europe, the United States and Japan, Singapore is also a popular destination for overseas real estate investment.

Singapore is known as the “Garden City” and is also popular among middle-class parents as a “baby-raising paradise”. Its high-quality education system has also attracted a large number of international students. In addition, its geographical location is also very attractive to Chinese people. Therefore, many Chinese people will give priority to Singapore when considering investing in overseas real estate.

Singapore allows foreigners to purchase real estate in the country, but in addition to the house price, an additional stamp duty will be charged. So what taxes do foreigners need to pay when purchasing real estate in Singapore, and how to calculate these taxes? Today, as a senior local real estate agent in Singapore, I will explain it to you in detail.

Property Buying Guide || Singapore Stamp Duty

When purchasing a property in Singapore, as a buyer, there are two types of stamp duties involved: Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD).

What is Stamp Duty?

Stamp duty is a real estate-related tax. Regardless of residency or nationality, buyers are required to pay stamp duty to the Inland Revenue Authority of Singapore (IRAS) when buying a property in Singapore.

Stamp duty on house purchases: The higher the house price, the higher the tax

Whether you are a Singapore citizen or a foreigner, you will need to pay Buyer’s Stamp Duty (BSD) when buying a property in Singapore.

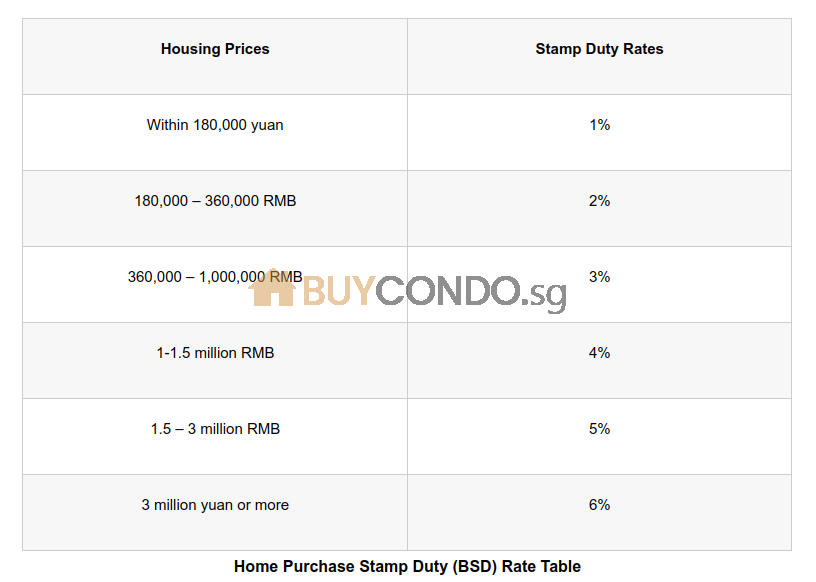

The stamp duty rate for buying a house varies in a step-by-step manner according to the total price of the property. The following table shows the stamp duty rate for buying a house in Singapore (the house price is based on the higher of the actual purchase price and the market price):

How to calculate it specifically? For example:

- If the total price of the property you purchase is S$900,000 (more than S$360,000 but less than S$1,000,000), then the stamp duty you need to pay = $900,000 * 3% – $5,400 = $21,600 ;

- If the total price of the property you purchase is S$1.4 million (more than S$1 million but not more than S$1.5 million), then the stamp duty you need to pay = $1,400,000 * 4% – $15,400 = $40,600 ;

- If the total price of the property you purchase is S$2 million (more than S$1.5 million but less than S$3 million), the stamp duty you need to pay = $2,000,000 * 5% – $30,400 = $69,600 ;

- If the total price of the property you purchased is S$3.1 million (more than S$3 million), the stamp duty you need to pay = $3,100,000 * 6% – $60,400 = $125,600

Click here for related content: Singapore Stamp Duty – Property Buying Guide

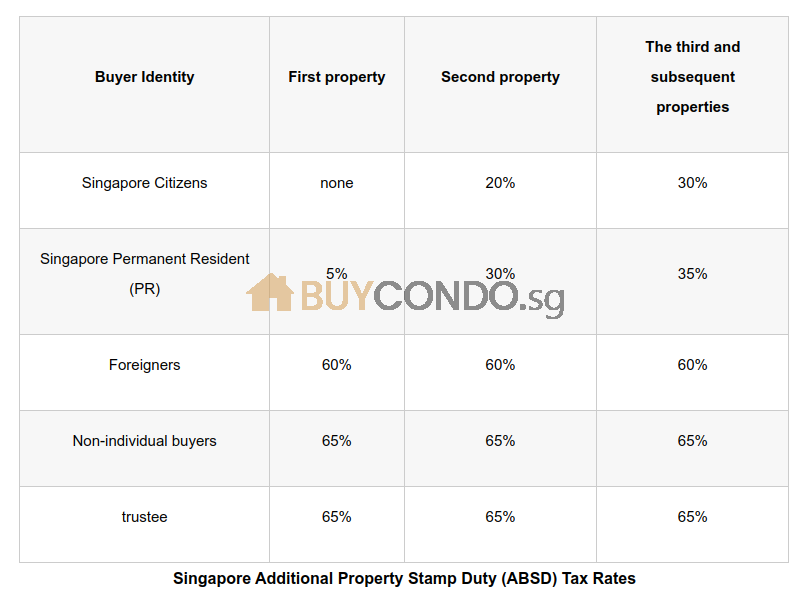

Additional stamp duty for buying a house: different tax rates for different identities

Regardless of their status, buyers need to pay the corresponding stamp duty for property purchases. However, buyers with certain identities are also required to pay the corresponding additional stamp duty for property purchases (ABSD). The following is the tax rate table for additional stamp duty for property purchases in Singapore:

As shown in the table above, people of different identities need to pay different additional stamp duties when purchasing real estate:

-

Singapore Citizens

If you are a Singapore citizen, you do not need to pay any additional stamp duty on your first property purchased in Singapore. If it is your second property, you will need to pay 20% of the property price as additional stamp duty. For the third and subsequent properties, you will need to pay 30% of the property price as additional stamp duty.

-

Singapore Permanent Resident (PR)

If you hold Singapore Permanent Resident (PR) status, you only need to pay an additional stamp duty of 5% of the property price when purchasing your first property in Singapore. If it is your second property, you will need to pay an additional stamp duty of 30% of the property price.

-

Foreigners (overseas buyers)

Singapore allows foreigners to buy property in the country. If you have not immigrated to Singapore, you will need to pay an additional stamp duty of 60% of the house price for any property you purchase.

In addition, since Singapore has signed a free trade agreement (FTA), if you are a citizen or permanent resident of Iceland, Norway, Switzerland or Liechtenstein, or a US citizen, when purchasing a property in Singapore in your personal name, you can enjoy the same treatment as Singaporean citizens and only need to pay stamp duty when buying a house.

-

Non-personal users

If you purchase a property in Singapore in the name of a company or other non-individual name, you will need to pay an additional stamp duty of 65% of the house price.

-

trustee

From 9 May 2022, all transactions transferring residential real estate to a living trust will be subject to an additional buyer’s stamp duty of 65%.

Additional Buyer’s Stamp Duty (ABSD) is payable on the transfer of residential property into a living trust, but eligible trustees may apply for a refund from the Inland Revenue Authority of Singapore (IRAS).

There are three conditions for applying for a tax refund:

1) All beneficial owners are identifiable individuals;

2) When the residential property is transferred to the living trust, the actual beneficiary holds the ownership of the residence;

3) Beneficial ownership cannot be further divided or restored, or subsequent conditions must be fulfilled.

When do I pay stamp duty on a property?

There are two main payment periods for stamp duty on property purchases:

- If you sign a sales contract or subscription agreement in Singapore, you must complete the payment within 14 days from the date of signing the contract;

- If you sign a sales contract or subscription contract overseas, you need to complete the payment within 30 days from the date of signing the contract.

Click here for related content: Singapore Stamp Duty – Property Buying Guide

Click here for related content: Things You Must Know Before Buying a Home in Singapore

How to pay stamp duty for buying a house? Can I use CPF?

-

- If you are an overseas buyer, you need to pay the stamp duty in full and cannot apply for a loan. Of course, in terms of payment methods, the stamp duty supports a variety of online payments.

- If you are a Singapore citizen or permanent resident, you can use your CPF account to pay stamp duty for buying a property. Of course, there are certain rules to follow. For example:

- You can only use the amount in your CPF Ordinary Account to pay stamp duty for buying a house;

- If it is the second property, and the provident fund was used to purchase the first property, then the sum of the provident fund special account and ordinary account must exceed the current basic deposit amount before the remaining amount in the ordinary account can be used to pay the stamp duty for the purchase of the property;

- If you are purchasing an existing property, the buyer needs to pay the stamp duty on the purchase of the property first, and then apply for provident fund compensation; if you are purchasing a pre-sale property, you can directly use the provident fund to pay the stamp duty on the purchase of the property.

If a couple buys a house jointly, can they be exempted from the additional stamp duty on the purchase of the house?

The situation of a couple buying a house jointly is more complicated, and first of all, it depends on the identities of the couple.

If one of the spouses is a Singapore citizen and this is their first home purchase, it will be treated as a Singapore citizen’s first home purchase and they will be exempt from paying additional stamp duty.

If both spouses are Singapore permanent residents (PR) and are purchasing their first home, they will need to pay an additional 5% stamp duty on the purchase of the home.

If only one spouse is a Singapore permanent resident and the other is a foreigner, and they are purchasing their first home, they will have to pay an additional 30% stamp duty on the purchase of the home.

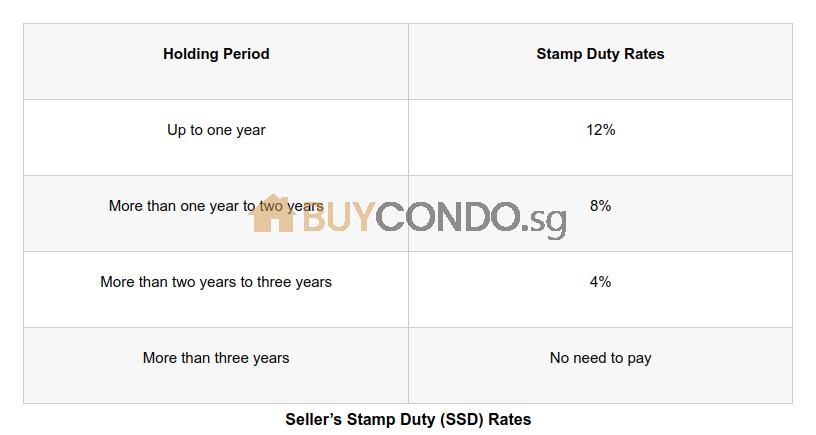

Do I have to pay tax when selling a property in Singapore?

Sellers of private homes sold within three years are required to pay Seller’s Stamp Duty (SSD). The stamp duty rate for these three years ranges from 4% to 12%.

The three-year holding period is calculated from the date you acquire the property. Below is the Seller’s Stamp Duty rate table in Singapore:

If the property is rented out, who should pay the stamp duty?

Stamp duty in Singapore is not only required when buying a house, but also when renting out a house. However, homeowners do not need to worry, because the Singapore government clearly stipulates that the stamp duty for renting a house is paid by the tenant.

Summarize

The stamp duty rate for home purchases in Singapore is basically determined according to the buyer’s identity and the value of the house. The more expensive the property, the higher the tax will naturally be, while also protecting the country’s residents.

However, as one of the few developed countries that allows foreigners to purchase real estate in the country, Singapore’s real estate market is still very attractive to high-net-worth individuals considering purchasing overseas real estate.

If you decide to purchase a property in Singapore, please contact us! Our professional real estate experts will provide you with fair and tailor-made solutions!

Click here for related content: Things You Must Know Before Buying a Home in Singapore

For more details, please contact: Gary Lim