TDSR Calculator

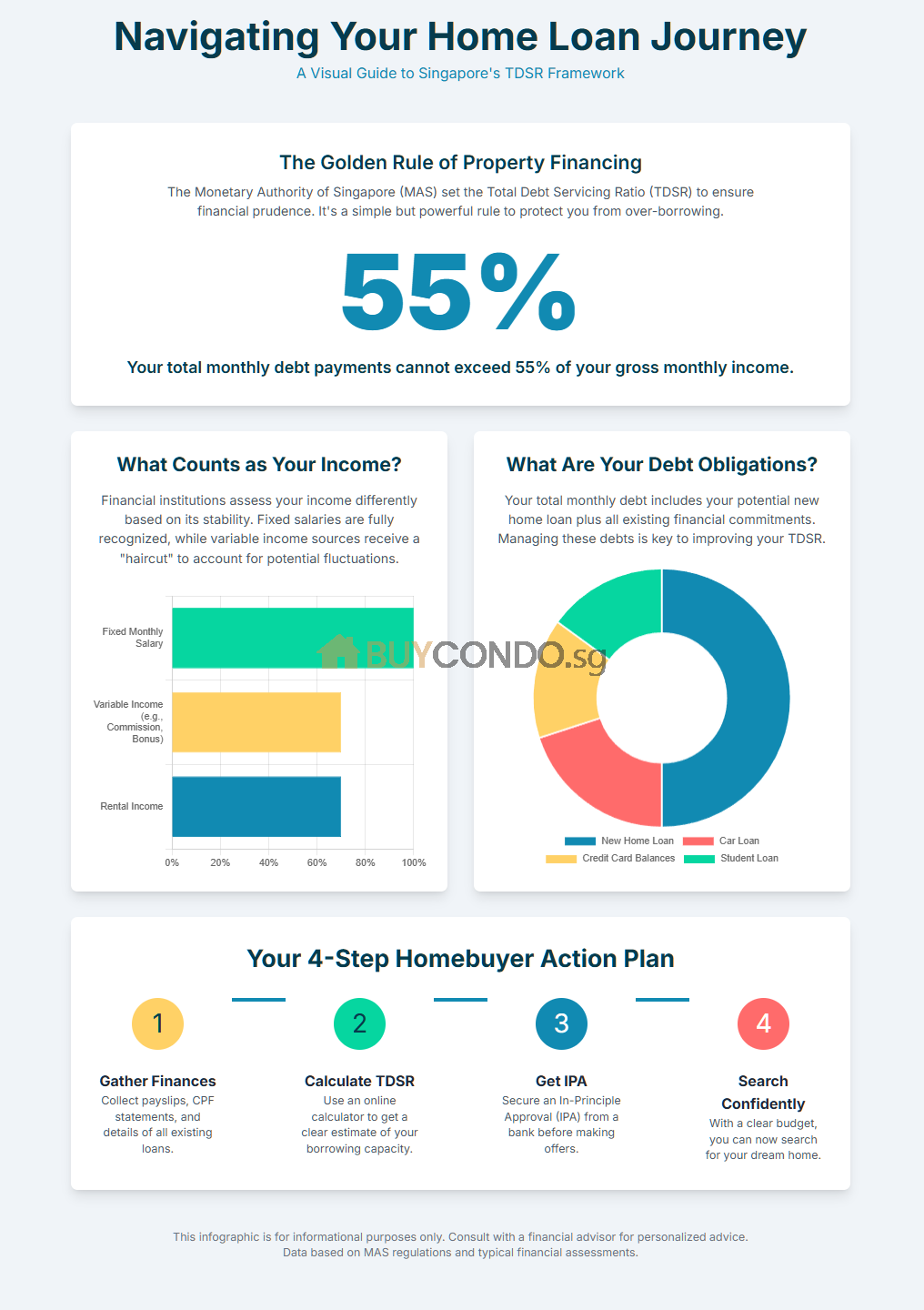

The Total Debt Servicing Ratio (TDSR) is a regulatory framework introduced by MAS in 2013 to foster financial prudence among borrowers and to maintain a stable and sustainable property market.

In simple terms, it sets a limit on the amount of your gross monthly income that can go towards servicing your total monthly debt obligations. This includes your new home loan and all other existing debts.

The current TDSR threshold is 55%.

This means that the total sum of your monthly loan repayments cannot exceed 55% of your gross monthly income. By enforcing this, MAS helps ensure that individuals have enough remaining income to cover daily living expenses, save for the future, and weather unforeseen financial challenges like a job loss or medical emergency.

The TDSR Formula

Understanding how your TDSR is calculated is the first step towards mastering your property financing. The formula itself is straightforward:

Let’s break down the two key components:

1. Total Monthly Debt Obligations (The Numerator): This is the sum of all your monthly debt repayments. It includes:

- The monthly instalment of the new property loan you are applying for.

- Existing housing loans (if any).

- Car loans.

- Student loans.

- Personal loans and credit lines.

- Credit card balances (financial institutions typically take a percentage of the outstanding balance as the monthly repayment).

2. Gross Monthly Income (The Denominator): This is your total income before any deductions like CPF contributions. The way your income is assessed can vary:

- Fixed Salary: For salaried employees, 100% of your fixed monthly pay is recognised.

- Variable Income: For income that is not fixed, such as commissions, bonuses, or freelance work, financial institutions will apply a “haircut.” Typically, only 70% of this variable income is considered for the TDSR calculation to account for its fluctuating nature.

- Rental Income: Similar to variable income, a 30% haircut is applied, meaning 70% of your rental income is recognised.

- Eligible Financial Assets: Certain stocks, bonds, or cash deposits can be pledged to a financial institution to be recognised as income over a 48-month period, potentially increasing your borrowing capacity.

A Step-by-Step Guide for the Aspiring Condo Owner : TDSR Calculator

Feeling ready to see where you stand? Follow these practical steps on your home-buying journey.

Step 1: Gather Your Financial Information Before using the calculator, collect all relevant documents. This includes your recent payslips, CPF contribution history, Notice of Assessment (NOA) from IRAS, and statements for any existing loans (car, personal, credit cards). Having accurate figures is key to getting a realistic estimate.

Step 2: Use Our TDSR Calculator Input your income and debt figures into the calculator on this page. This powerful tool will instantly compute your TDSR percentage. It will give you a clear, preliminary understanding of your maximum affordable loan amount and purchase price. Play with the numbers to see how reducing other debts could increase your housing budget.

Step 3: Secure an In-Principle Approval (IPA) Once our calculator gives you a good estimate, the next official step is to approach a bank for an In-Principle Approval (IPA) or Approval-in-Principle (AIP). An IPA is a formal commitment from a bank stating how much they are willing to lend you. It is typically valid for 30 days and is essential before you pay an option fee for a property.

Step 4: Factor in All Costs Remember, the TDSR only governs your loan amount. Your total cash outlay will also include the downpayment, Buyer’s Stamp Duty (BSD), Additional Buyer’s Stamp Duty (ABSD) if applicable, legal fees, and renovation costs. Plan for these expenses meticulously. Click here to see if what payments when buying a condo can be paid by CPF.

Step 5: Begin Your Search with Confidence With your financial standing clarified and an IPA in hand, you can now search for your dream condo with a confident and realistic budget.

The TDSR framework is your financial safeguard. By understanding it and using tools like our calculator, you transform a complex regulation into a clear roadmap for your property purchase. Start your journey today by getting your personalised TDSR estimate below.