For many HDB upgraders, purchasing a new launch condo before selling their HDB appears to be the perfect plan.

This not only simplifies the timeline but also reduces concerns about potential homelessness during the transition.

In the best case, rental income from the flat can help the mortgage process for the condo. However, for some people, affordability remains a big question.

Therefore, this blog provides simple steps to help you check your current situation and prepare well to assure seamless moving from an HDB flat to a new launch condo.

Step 1: Make sure you reached the MOP (Minimum Occupation Period)

The Minimum Occupation Period (MOP) for an HDB flat in Singapore is the minimum duration that homeowners must live in their flat before they are allowed to sell it in the open market or buy private property.

Most HDB flats have a standard MOP of five years from the date of key collection.

During this period, residents need to physically occupy the flat.

Exceptions may apply in certain schemes or situations, such as the Prime Location Public Housing (PLH) scheme, the Selective En bloc Redevelopment Scheme (SERS), or when buying resale flats without CPF Housing Grants.

You can check your remaining MOP by visiting HDB resale portal and registering Intent to Sell.

| HDB flat type | Minimum Occupation Period (MOP) |

| New HDB flats (including BTO, EC & DBSS) | 5 years |

| New flats under the HDB Prime Location Housing (PLH) Model | 10 years* |

| Resale HDB flats* (2-room or larger, applied on or after 30 Aug 2010) | 5 years |

| Flats purchased under the Fresh Start Housing Scheme | 20 years |

| SERS flats | 5 years from the effective date of the replacement flat, or 7 years from the date of selection of the replacement flat |

You can find the full list of HDB MOPs in the Housing & Development Board, Eligibility webpage.

Step 2: Begin financial planning for home loans and CPF

You’ll likely need a loan in case you don’t have enough ability to afford a new condo.

The maximum loan you can get depends on your Total Debt Servicing Ratio (TDSR) and Loan-to-Value (LTV) ratio:

- TDSR is the percentage of your income used to pay debts, capped at 55%.

- LTV determines the maximum bank loan and minimum downpayment, based on your age, loan tenure, and outstanding housing loans.

Understanding these ratios helps you figure out if the new home fits your budget.

| Outstanding housing loans | LTV limit | Minimum cash downpayment |

| None | 75% or 55% |

|

| 1 | 45% or 25% | 25% |

| 2 or more | 35% or 15% | 25% |

Step 3: Make a list of new launch condos and visit them

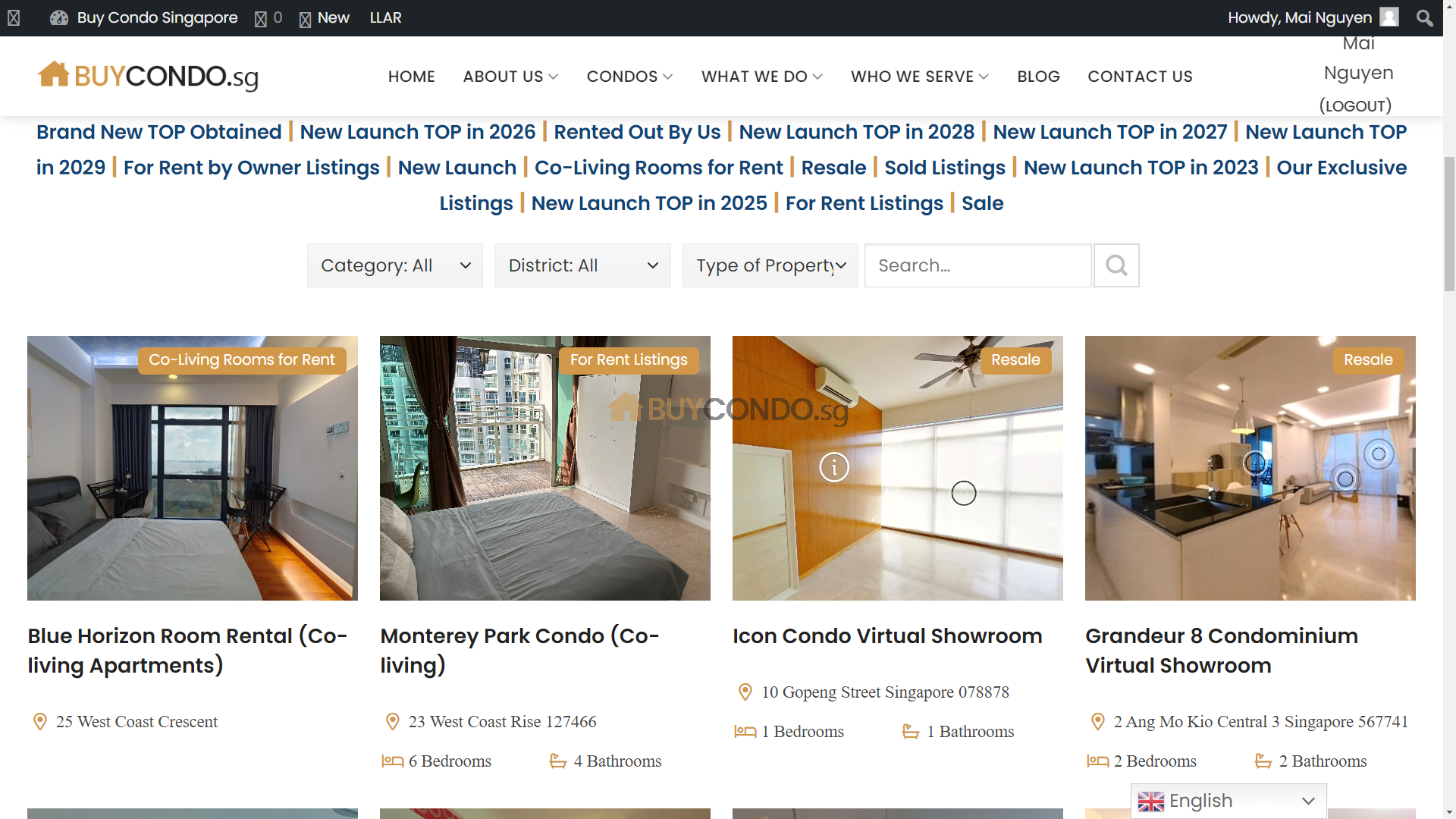

After knowing the amount of loan you can receive, you should now visit potential new homes to help envision the space and plan any renovations. Note that some interior decorations and furniture may not be included. Besides, having an unbiased property agent during viewings will help you compare options objectively. Guided tours, professional advice and information about the latest condos are always updated on our website buycondo.sg.

Step 4: Pay a 5% deposit for your chosen new launch condo

Once you’ve chosen your desired home, you must secure it by paying a 5% booking fee in cash. This triggers the issuance of the Option to Purchase (OTP) by the developer.OTP is a written agreement, signifying your commitment to purchasing the property. Ensure you’re entirely certain at this stage, as backing out after receiving the OTP may lead to forfeiting up to 25% of the initial booking fee.

Step 5: Sign the Sale and Purchase Agreement (S&P) and activate the Option to Purchase (OTP)

After you receive the Option to Purchase (OTP), your property developer will issue the Sales & Purchase Agreement (S&P) within two weeks.

Once you receive both documents, you will need to sign them and make relevant payments within a stipulated period of time to make sure the property transaction will be convenient.

The following table breaks down the payment timeline during this period.

| Timeline | Your tasks |

| 2 weeks after receiving OTP | Receive S&P |

| 3 weeks after receiving S&P | Sign S&P and enable OTP before three-week period lapses |

| 2 weeks after signing S&P | Pay the Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) before two-week period lapses |

| 8 weeks after buyer signs OTP | Buyer to foot the 15% downpayment (exercise fee) in cash or CPF before eight week period lapses |

BSD is calculated according to the following formula:

- 1% for the first $180,000

- 2% for the next $180,000

- 3% for the next $640,000

- 4% for the remaining amount

For example, a condo costing $1,700,000 will charge a BSD of about $52,600.

Also, starting from May 9, 2022, new laws regarding residential properties transferred into a living trust have been implemented:

- An Additional Buyer’s Stamp Duty (ABSD) of 35% will now be applied to any transfer of residential property into a living trust.

- ABSD will be payable even if there is no identifiable beneficial owner at the time the residential property is transferred into a trust.

Step 6: Promote marketing activities for the HDB flat

To market your flat, we can help you effortlessly do so by making a post on buycondo.sg website and virtual showroom.

During 10 years in the market, we have sold 138 properties, promising to bring you the most pleasant experience.

Step 7: Pass the HDB flat keys to the new occupants

Once you sell your flat successfully, moving out and handing over the keys by the HDB completion appointment date is compulsory.

If your new condo is not ready, applying for a Temporary Extension of Stay for up to three months can be considered, subject to new HDB flat owner’s approval.

Another option is temporary accommodation with friends or relatives to avoid legal issues and additional charges.

Step 8: Receive the keys to your dream condo

The day you receive the keys to your new property is mentioned on the Temporary Occupation Permit (TOP), an official document indicating government approval for residence.

This marks the completion of purchasing your new condo after selling your HDB.

The TOP, provided by the developer, specifies the key collection date, concluding the process of acquiring your new condo before selling your HDB flat. Congratulations!