Analysis of the GLS for 2025

GLS 2025 Infographic

Section 1: Executive Summary : Analysis of the GLS for 2025

The Singapore Government Land Sales (GLS) programme for 2025 embodies a strategy of calibrated continuation, sustaining a high level of housing supply to temper price growth while adapting to evolving market dynamics. The government has slated a total of approximately 9,755 private residential units, including Executive Condominiums (ECs), for release under the Confirmed List for the year. This comprises 5,030 units in the first half (H1) and a slightly moderated 4,725 units in the second half (H2).1 This sustained supply pipeline, while representing a marginal decrease from the 2024 peak, underscores a firm commitment to ensuring market stability and meeting the underlying demand for housing. The slight downward adjustment in H2 2025 signals a pragmatic governmental response to prevailing economic headwinds and a more cautious developer sentiment.4

A defining strategic shift in 2025 is the enhanced role and significant expansion of the Reserve List, which now functions as the primary market-responsive buffer. This move effectively transfers the onus of triggering land sales to developers, de-risking the government’s supply pipeline in an environment of heightened developer caution. Another pivotal policy thrust is the unprecedented surge in EC supply. The Confirmed List features five EC sites projected to yield nearly 2,000 units, the highest annual figure since 2014.2 This represents a direct and decisive policy intervention aimed at addressing the affordability gap for HDB upgraders and cooling the increasingly competitive land bidding in this popular housing segment.

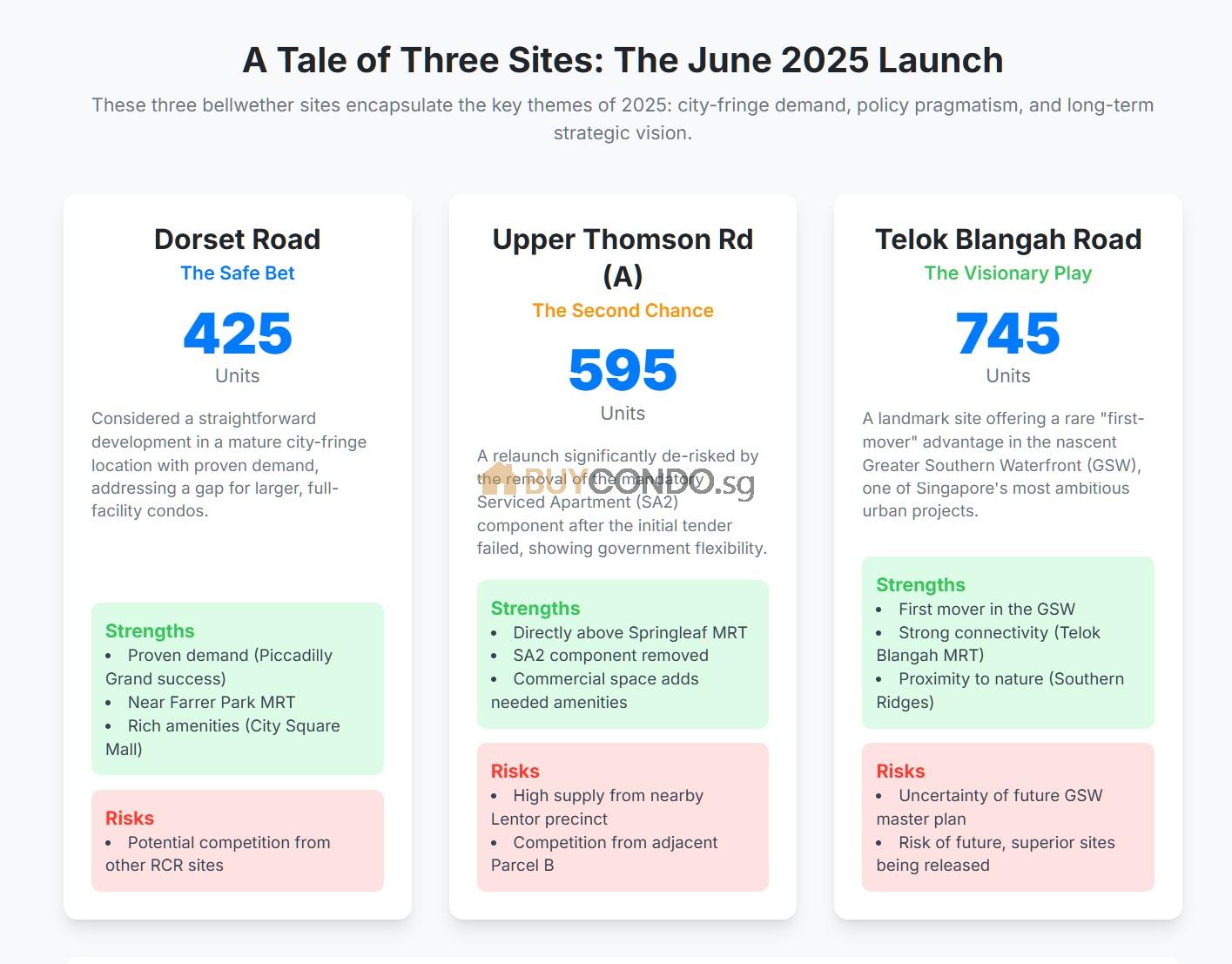

The launch of three residential sites in June 2025—at Telok Blangah Road, Upper Thomson Road (Parcel A), and Dorset Road—encapsulates the key themes of the year. The Telok Blangah site presents a landmark “first-mover” opportunity for developers to establish a presence in the nascent Greater Southern Waterfront (GSW), a multi-decade urban transformation project. This opportunity, however, is tempered by the inherent risk of future, potentially superior, land parcels being released in the same precinct.1 The relaunch of the Upper Thomson Road (Parcel A) site, now stripped of its mandatory Serviced Apartment (SA2) component, highlights the government’s pragmatism and responsiveness to clear market feedback after the initial tender failed to attract any bids.3 Developer sentiment across the board remains highly selective and risk-averse, shaped by a “trilemma” of high construction costs, quantum-sensitive buyers, and the punitive financial pressure of the Additional Buyer’s Stamp Duty (ABSD) deadline. This has cultivated a clear preference for smaller, lower-risk sites situated in locations with proven, pent-up demand.6

The market outlook for 2025 is characterized as a buyer’s market in terms of choice, but not necessarily in terms of price. Persistently high development costs are expected to establish a firm floor under new launch prices. For developers, navigating this landscape successfully will hinge on astute site selection and strategic differentiation. Success will likely favour those who target plots with unique competitive advantages, such as the “last-mover” scarcity value of the Bedok Rise site or the prime centrality and limited competing supply of the Bukit Timah Road plot. The government’s policy of sustained high supply is fundamentally reshaping the market, steering it away from a “fear of missing out” (FOMO)-driven environment towards a more mature ecosystem where product differentiation, quality, and intrinsic value are the paramount drivers of success.

Section 2: The 2025 GLS Programme: A Year of Sustained Supply and Strategic Calibration

The 2025 GLS programme is a critical instrument in the Singapore government’s ongoing efforts to ensure a stable and sustainable private property market. Against a backdrop of global economic uncertainty and shifting local demand dynamics, the programme’s structure for the year reveals a sophisticated strategy that balances the need for a robust supply pipeline with a pragmatic acknowledgement of developer risk appetite. The government continues to leverage land supply as its primary tool for market stabilisation, but with nuanced adjustments that reflect a deep reading of current market conditions.

2.1 Analysis of the 2025 Confirmed List Supply: The Moderation Signal

The total supply of private residential units on the 2025 Confirmed List stands at approximately 9,755 units, a figure that includes ECs.2 This supply is divided between 5,030 units in H1 2025 and 4,725 units in H2 2025.1 This quantum is a continuation of the government’s multi-year initiative to ramp up supply to meet persistent housing demand and moderate the pace of price appreciation.5 The sustained high volume follows significant increases in previous years, with 9,250 units offered in 2023 and a peak of over 11,000 units in 2024.14

While the 2025 figure remains historically high—significantly above the supply levels seen from 2015 to 2023—it also signals a deliberate and measured moderation.4 The 6.1% decrease in unit supply from H1 to H2 2025, and the overall dip from the 1H 2024 peak (which was the highest since the 2H 2013 programme), should not be interpreted as a reversal of policy.4 Rather, it is a strategic

calibration. This adjustment reflects the government’s cognisance of a more challenging macroeconomic environment, signs of developer caution observed in recent land tenders, and the successful cooling of property price growth.4 The consistent supply over the past few years has effectively expanded the inventory of unsold private homes and slowed the rate of price increases from a high of 8.6% in 2022 to a more sustainable forecast of 1% to 4% in 2025.10

2.2 The Role of the Reserve List: A Shift to Market-Driven Supply

A key feature of the 2025 GLS programme is the strategic expansion of the Reserve List, which places a greater emphasis on a market-driven supply mechanism. The number of potential units on the Reserve List was increased significantly, rising from 3,475 units in H1 to 4,475 units in H2.4 This brings the total potential supply for 2025, combining both Confirmed and Reserve Lists, to over 17,705 units—the highest level recorded since 2014.2

The Reserve List for H2 2025 is notably diverse. It comprises six private residential sites (at Holland Plain, Marina Gardens Lane, Media Circle, Media Circle Parcel B, River Valley Green Parcel C, and Cross Street), one commercial site (Punggol Walk), three White sites (Marina Gardens Crescent, Jurong Lake District, Woodlands Avenue 2), and two hotel sites (River Valley Road, Telok Ayer Street).10 This includes new sites specifically designated for long-stay serviced apartments (SA2) in the Central Business District (CBD) at Cross Street and Telok Ayer Street, indicating a continued, albeit more flexible, interest in developing this housing typology.13

This deliberate shift towards a larger Reserve List is a sophisticated policy pivot. The government’s primary objective remains the maintenance of a stable and sufficient supply pipeline to prevent future price shocks.5 However, recent land tender results have clearly indicated a heightened sense of caution among developers. Low bidder participation and even outright failed tenders, such as the initial attempt to sell the Upper Thomson Road (Parcel A) site and the rejection of the sole bid for the Media Circle SA2 site, have sent strong signals to policymakers.9 Forcing an excessive amount of supply onto the market via the Confirmed List under these conditions would risk more failed tenders, which could precipitate a negative sentiment loop.

By bolstering the Reserve List, the government skillfully navigates this challenge. It maintains the potential for a high volume of supply to be injected into the market, thereby anchoring expectations and deterring speculative behaviour. Simultaneously, it transfers the activation risk to developers. A site on the Reserve List will only be triggered for sale if a developer is confident enough in market demand to commit to an acceptable minimum bid. This transforms the supply mechanism from a top-down, government-led “push” to a more organic, market-responsive “pull.” It is a calibrated de-risking strategy that acknowledges the market’s reduced risk appetite while ensuring the long-term supply pipeline remains robust and flexible.

The following table provides a consolidated overview of the entire 2025 GLS programme, serving as a foundational dataset for understanding the quantum, geographical distribution, and timing of the year’s land supply.

Table 1: 2025 GLS Programme at a Glance (Confirmed & Reserve Lists, H1 & H2)

| Programme Half | List Type | Location | Est. Units | Site Area (ha) | Max GFA (sqm) | Commercial GFA (sqm) | Est. Launch / Status |

| :— | :— | :— | :— | :— | :— | :— | :— |

| H1 2025 | Confirmed | Senja Close (EC) | 295 | 1.01 | 30,300 | 0 | Mar 2025 |

| H1 2025 | Confirmed | Woodlands Drive 17 (EC) | 420 | 2.52 | 42,840 | 0 | Apr 2025 |

| H1 2025 | Confirmed | Lakeside Drive | 575 | 1.39 | 50,040 | 1,000 | Apr 2025 |

| H1 2025 | Confirmed | Dunearn Road | 370 | 1.34 | 32,160 | 0 | Apr 2025 |

| H1 2025 | Confirmed | Chuan Grove | 505 | 1.45 | 43,500 | 0 | May 2025 |

| H1 2025 | Confirmed | Sembawang Road (EC) | 265 | 1.90 | 26,600 | 0 | May 2025 |

| H1 2025 | Confirmed | Hougang Central | 835 | 4.68 | 117,000 | 40,000 | May 2025 |

| H1 2025 | Confirmed | Upper Thomson Road (Parcel A) | 595 | 2.44 | 53,729 | 2,000 | Jun 2025 |

| H1 2025 | Confirmed | Dorset Road | 430 | 1.05 | 36,750 | 0 | Jun 2025 |

| H1 2025 | Confirmed | Telok Blangah Road | 740 | 1.36 | 63,920 | 0 | Jun 2025 |

| H1 2025 | Reserve | Marina Gardens Lane (Plot 2) | 390 | 0.60 | 33,600 | 150 | Available |

| H1 2025 | Reserve | Holland Plain | 280 | 1.57 | 28,260 | 0 | Available |

| H1 2025 | Reserve | Media Circle (Plot 2) | 520 | 0.57 | 23,940 | 400 | Available |

| H1 2025 | Reserve | River Valley Green (Parcel C) | 470 | 1.15 | 40,250 | 0 | Available |

| H2 2025 | Confirmed | Bukit Timah Road | 340 | 0.59 | 28,910 | 0 | Aug 2025 |

| H2 2025 | Confirmed | Bedok Rise | 380 | 2.03 | 32,480 | 0 | Sep 2025 |

| H2 2025 | Confirmed | Woodlands Drive 17 (EC) | 560 | 2.70 | 56,700 | 0 | Oct 2025 |

| H2 2025 | Confirmed | Dairy Farm Walk | 500 | 3.06 | 42,840 | 0 | Nov 2025 |

| H2 2025 | Confirmed | Dover Road | 625 | 1.35 | 56,700 | 3,000 | Nov 2025 |

| H2 2025 | Confirmed | Tanjong Rhu Road | 525 | 1.23 | 45,510 | 0 | Nov 2025 |

| H2 2025 | Confirmed | Dunearn Road | 335 | 1.91 | 30,560 | 1,400 | Dec 2025 |

| H2 2025 | Confirmed | Kallang Avenue | 450 | 1.21 | 42,350 | 115 | Dec 2025 |

| H2 2025 | Confirmed | Lentor Central | 580 | 1.65 | 49,500 | 0 | Dec 2025 |

| H2 2025 | Confirmed | Miltonia Close (EC) | 430 | 1.54 | 43,120 | 0 | Dec 2025 |

| H2 2025 | Reserve | Holland Plain | 280 | 1.57 | 28,260 | 0 | Available |

| H2 2025 | Reserve | Marina Gardens Lane | 390 | 0.60 | 33,600 | 150 | Available |

| H2 2025 | Reserve | Media Circle | 520 | 0.57 | 23,940 | 400 | Available |

| H2 2025 | Reserve | Media Circle (Parcel B) | 500 | 1.00 | 43,000 | 400 | Available |

| H2 2025 | Reserve | River Valley Green (Parcel C) | 470 | 1.15 | 40,250 | 0 | Available |

| H2 2025 | Reserve | Cross Street (SA2) | 300 | 0.23 | 14,490 | 750 | Sep 2025 |

Sources: 1

2.3 The Executive Condominium (EC) Market Surge: A Policy-Driven Intervention

One of the most significant policy statements within the 2025 GLS programme is the dramatic increase in the supply of land for ECs. The Confirmed List includes a total of five EC sites, the highest number offered in a single year since 2014, which are collectively expected to yield nearly 2,000 new units.2 The sites are strategically distributed to cater to HDB upgrader demand in various mature and developing estates, with two plots in Woodlands Drive 17, and one each in Miltonia Close, Senja Close, and Sembawang Road.18

This supply surge is a direct response to acute market pressures. Demand for ECs has been exceptionally strong, with recent launches such as Aurelle of Tampines and Novo Place achieving high take-up rates despite rising prices, demonstrating the segment’s deep pool of buyers.32 This robust demand had depleted the available stock of unsold ECs to critically low levels—falling to just 138 units as of January 2025—creating an urgent need for a substantial supply injection to replenish the pipeline.33

The government’s decision to ramp up EC supply serves as a multi-pronged social and market stabiliser. Firstly, it directly addresses the critical issue of housing affordability. As private condominium prices have escalated, the price differential between HDB resale flats and private homes has widened, putting private property ownership out of reach for many. ECs, which are sold at a significant discount to comparable private condos and come with CPF housing grants for eligible buyers, provide an essential and more affordable pathway for the “sandwiched class” of HDB upgraders to transition into private housing.32

Secondly, the move is designed to cool the overheated EC land market. The scarcity of EC sites in previous years had led to increasingly aggressive bidding from developers. Average EC land costs surged by 164% between 2015 and 2024, culminating in a record-breaking bid for a recent EC site in Tampines.33 By substantially increasing the number of available EC sites, the government aims to dilute this fierce competition. This is expected to temper land bid prices, which should, in turn, help moderate the launch prices of future EC projects and keep them within an affordable range for their target demographic.4

Finally, this strategy serves a market segmentation function. By creating a more robust and attractive EC market, the government can effectively channel a significant portion of upgrader demand away from the mass-market private condominium segment, particularly in the Outside Central Region (OCR). This acts as what some analysts term a “resilient buffer” 5, preventing a spillover of demand that could otherwise exert further upward pressure on prices in the broader private property market.

Section 3: Deep Dive Analysis: June 2025 Confirmed List Launch

On June 24, 2025, the Urban Redevelopment Authority (URA) launched tenders for three residential sites from the H1 2025 Confirmed List. These sites—located at Dorset Road, Upper Thomson Road (Parcel A), and Telok Blangah Road—are significant as they serve as bellwethers for developer sentiment and strategic focus for the remainder of the year. Each site presents a distinct value proposition and risk profile, encapsulating the key themes shaping the 2025 property landscape.

3.1 Dorset Road: Capitalising on City-Fringe Demand

The Dorset Road site is a 1.04-hectare plot located in the established city-fringe precinct of District 8 (Kallang/Whampoa). Zoned for residential use, it has a maximum gross floor area (GFA) of 36,397 square metres and is expected to yield approximately 425 units.1 The site’s primary appeal lies in its strong locational attributes; it is within walking distance of Farrer Park MRT station on the North-East Line, providing excellent connectivity to the city centre. It is also surrounded by a wealth of amenities, including City Square Mall, Mustafa Centre, and reputable schools such as Farrer Park Primary School and St Joseph’s Institution Junior.1

From a market perspective, the Dorset Road site addresses a specific gap. The immediate area is predominantly characterized by smaller, boutique residential projects.1 The scale of this site, allowing for a larger, full-facility condominium, is a rarity in the vicinity and is poised to meet pent-up demand for such offerings. This demand was vividly demonstrated by the successful launch of the 407-unit Piccadilly Grand in 2022, a comparable large-scale project in the area which sold a remarkable 77% of its units during its launch weekend, confirming strong buyer appetite for both the location and larger project formats.1

Given these strong fundamentals, the site is anticipated to attract healthy interest from developers and is widely considered a relatively “safe” and straightforward development proposition. Analysts forecast a competitive tender, with participation expected from three to five bidders. Top bid price predictions are robust, with Huttons Asia projecting a range of S1,050 per square foot per plot ratio (psf ppr), while PropNex offers a more bullish forecast of S1,200 psf ppr.1 The tender for this site is scheduled to close on October 9, 2025.1

3.2 Upper Thomson Road (Parcel A): A Second Chance after the SA2 Experiment

The site at Upper Thomson Road (Parcel A) is a substantial 2.44-hectare mixed-use plot situated directly above the Springleaf MRT station on the Thomson-East Coast Line. It is slated to yield approximately 595 private homes along with 2,000 square metres of commercial space on the first storey.1 The history of this site is crucial to its analysis; this is a relaunch. The original tender, launched in late 2023, failed to secure any bids—a rare event in Singapore’s land-scarce market that sent a clear message to policymakers.3

The failure of the first tender was widely attributed to the mandatory requirement for the developer to build 100 long-stay Serviced Apartment (SA2) units. The SA2 concept, which mandates a minimum stay of three months, was a new and untested asset class. Developers perceived it as carrying significant risks, including uncertain rental demand, higher upfront capital investment, and the need for specialized management expertise. These risks were amplified by the site’s suburban location, which lacks a strong, built-in corporate rental catchment area that would typically support such a housing model.9

The government’s response was a pragmatic pivot. The SA2 concept was piloted across three sites: Zion Road (Parcel A), Upper Thomson Road (Parcel A), and Media Circle.22 The market’s reaction was unequivocally negative. The Upper Thomson site received zero bids, the prime Zion Road site attracted only a single bid, and the sole bid for the Media Circle site was ultimately rejected by URA as being “too low”.9 This feedback demonstrated that developers were unwilling to bear the risks of the SA2 model under the proposed terms. Consequently, URA’s decision to remove the mandatory SA2 component for the relaunch of the Upper Thomson site is a crucial, market-friendly adjustment that significantly de-risks the project for potential bidders.3 This demonstrates the flexibility of the GLS system, where the primary goal of ensuring land is sold for housing supply can take precedence over a policy experiment that proves unworkable in the current market.

Despite this de-risking, challenges persist. The site faces considerable competition from the large volume of housing supply in the nearby Lentor precinct, where around 100 units from past launches remain unsold and more projects are in the pipeline.1 It will also compete directly with the adjacent 940-unit Upper Thomson Road (Parcel B) site, which was awarded earlier.1 Furthermore, the Springleaf area itself is still developing and currently lacks a comprehensive range of amenities and schools, although the site’s own commercial component is designed to help address this deficiency.39 Bidding is therefore expected to be conservative. Analysts anticipate between two to five bidders, with top bid forecasts ranging from S

1,050 psf ppr.1 The tender will close on October 23, 2025.1

3.3 Telok Blangah Road: The Vanguard of the Greater Southern Waterfront (GSW)

The Telok Blangah Road site is arguably the most significant of the June 2025 launches due to its strategic importance. This 1.37-hectare plot, set to yield a substantial 745 residential units, is notable for two reasons: it is the first GLS site offered in the Telok Blangah area in 35 years, and more critically, it is the very first residential site to be launched for sale within the transformative Greater Southern Waterfront (GSW) precinct, located on a portion of the former Keppel Golf Course.1

The GSW is a long-term, visionary urban redevelopment project of immense scale. It covers approximately 2,000 hectares of prime southern coastline, stretching from Pasir Panjang to Marina East, and is envisioned to become a new major gateway for Singapore, seamlessly integrating urban living, employment, and recreation.49 This site offers a developer a rare and powerful “first-mover advantage,” providing the opportunity to establish a landmark project, anchor their brand in this iconic district, and set the market benchmark for the new precinct.3 The site’s fundamentals are strong, boasting excellent connectivity with Telok Blangah MRT station on the Circle Line within walking distance, and immediate access to nature via Mount Faber Park and the Southern Ridges trail.8

This unique combination of factors is expected to generate intense interest from developers. Analysts predict a hotly contested tender, with four to six bidders vying for the plot. Top bid forecasts are in a premium range, from S1,350 psf ppr, reflecting the site’s landmark potential.1 The tender for this pivotal site closes on November 4, 2025.1

However, the first-mover advantage is not without its complexities and risks. While being the first project in the GSW offers significant branding and pricing power, it also comes with considerable uncertainty. The vast swathes of surrounding land within the GSW are also zoned for future residential and mixed-use development. As analyst Nicholas Mak has pointed out, it is possible that future land parcels released within the GSW could offer even more superior attributes, such as direct and permanently unblocked sea views or better integration with future commercial and lifestyle hubs that have yet to be built.1 Furthermore, the upcoming 2025 Draft Master Plan, which guides Singapore’s development for the next decade, could introduce changes to plot ratios or zoning in the GSW, potentially enhancing the value of competing future sites and altering the competitive landscape.1

This creates a strategic dilemma for developers. They must decide whether to bid aggressively to capture the undeniable “first-in” premium and shape the narrative of the new precinct, or to bid more conservatively, acknowledging the risk that this site may not ultimately be the most desirable one in the GSW’s long-term phased rollout. The tender for the Telok Blangah Road site is therefore not just a bid for a piece of land; it is a high-stakes strategic gamble on the future trajectory of one of Singapore’s most ambitious urban projects.

Table 2: Comparative Analysis of June 2025 Launch Sites

| Attribute | Dorset Road | Upper Thomson Road (Parcel A) | Telok Blangah Road |

| :— | :— | :— | :— |

| Location | D8 Kallang/Whampoa (City Fringe/RCR) | D26 Springleaf (Suburban/OCR) | D4 Bukit Merah (City Fringe/RCR) |

| Site Area (sqm) | 10,399 | 24,421.9 | 13,688.9 |

| Max GFA (sqm) | 36,397 | 53,729 | 64,338 |

| Est. Unit Yield | ~425 | ~595 (+ 2,000 sqm commercial) | ~745 |

| Analyst Bidder Est. | 3 – 5 Bidders | 2 – 5 Bidders | 4 – 6 Bidders |

| Analyst Top Bid (psf ppr) | S950−S1,200 | S900−S1,050 | S1,200−S1,350 |

| Key Strengths | Proven demand; strong amenities; near MRT; addresses pent-up demand for larger projects in the area. | Direct MRT access; de-risked with SA2 removal; commercial component adds amenities to an underserved area. | First-mover advantage in GSW; landmark potential; strong connectivity; proximity to nature and CBD. |

| Key Weaknesses/Risks | Potential competition from other city-fringe sites. | Supply glut from nearby Lentor; competition from adjacent Parcel B; lack of existing amenities/schools. | Risk of future, superior sites in GSW; uncertainty from future Master Plan changes; high land cost. |

Sources: 1

Section 4: Strategic Review of All 2025 Confirmed List Sites

Beyond the June launches, the 2025 GLS Confirmed Lists feature a diverse portfolio of sites across Singapore’s market segments. A thematic analysis of these sites reveals the government’s multi-faceted approach to urban development, targeting specific demand drivers from prime district scarcity to suburban precinct creation and upgrader aspirations.

4.1 Prime & City-Fringe Opportunities (CCR & RCR): The Hunt for Scarcity and Location Premium

The Confirmed Lists for 2025 include several high-profile sites in the Core Central Region (CCR) and Rest of Central Region (RCR), which are expected to attract keen interest due to their prime locations and, in some cases, a scarcity of new supply.

- Bukit Timah Road: This site, yielding an estimated 340 units, is arguably one of the most attractive plots in the H2 2025 programme. Its location adjacent to the Newton MRT interchange (serving the North-South and Downtown Lines) provides unparalleled connectivity. The site benefits from a significant lack of new private home supply in the immediate vicinity since the launches of Kopar at Newton in 2022 and Pullman Residences Newton in 2019.2 This pent-up demand, combined with its prime CCR address, positions it as a top pick for developers seeking to make a statement in the high-end market.16

- Dunearn Road: This 335-unit mixed-use site holds strategic importance as the second land parcel to be offered in the nascent Bukit Timah Turf City precinct. Developers will be drawn to the opportunity to be an early mover in what will become a major new housing estate over the next two to three decades.2 The site’s appeal is further enhanced by its proximity to the Sixth Avenue MRT station and a host of prestigious schools along the Bukit Timah education belt.4

- Dover Road: A sizeable 625-unit mixed-use site, this plot’s primary value proposition is its proximity to the one-north research and development hub. The area is home to a large and growing workforce of approximately 50,000 professionals, yet suffers from a relative shortage of private housing options.2 The site is well-positioned to capture this strong rental and owner-occupier demand. Its location near one-north MRT station and a cluster of reputable educational institutions, including Fairfield Methodist School, Anglo-Chinese Junior College, and INSEAD, solidifies its attractiveness.4

- Tanjong Rhu Road: This 525-unit site is distinguished by its scarcity value. It is the first GLS plot to be offered in the highly coveted Tanjong Rhu residential enclave in over two decades, since 1997.2 This long absence of new supply is expected to translate into strong pent-up demand from both upgraders and new buyers seeking a prestigious waterfront lifestyle. The site’s appeal is amplified by its proximity to the upcoming Katong Park MRT station on the Thomson-East Coast Line and the ongoing rejuvenation of the wider Kallang area under the Kallang Alive masterplan.4

- Kallang Avenue: This 450-unit mixed-use site marks the first private residential GLS offering near the Kallang MRT station. It is strategically positioned to benefit from the Kallang Alive initiative, which aims to transform the area into a vibrant sports, entertainment, and recreational hub centred around the Singapore Sports Hub.2 Its location by the Kallang River and a short drive from the CBD offers a compelling city-fringe living proposition.

4.2 Suburban Hotspots & Precinct Development (OCR): Testing Market Depth

The OCR sites on the 2025 Confirmed List are concentrated in areas of active placemaking and established housing estates, providing critical tests of market depth and developer confidence in these suburban locations.

- Bedok Rise: This 380-unit site possesses a powerful and unique strategic advantage: it is the last available land parcel with direct, sheltered access to the Tanah Merah MRT station.2 This “last-mover” status provides a significant competitive moat, as the developer can be assured of no future direct competition of this nature. The site is expected to attract strong demand from the large pool of HDB upgraders in the mature and popular Bedok estate, further supported by the upcoming Sceneca Square mall, which will enhance local amenities.16

- Dairy Farm Walk: At 3.06 hectares, this is the largest site by land area in the H2 2025 programme, intended for a 500-unit development. It is the fifth site to be launched in the developing Dairy Farm residential enclave, which is being marketed as a tranquil, nature-centric community adjacent to the Bukit Timah Nature Reserve.2 While the successful launch of The Botany at Dairy Farm demonstrated underlying demand for this lifestyle concept, developers will approach this new site with caution.12 The growing pipeline of supply in the immediate vicinity will be a key consideration, potentially tempering bidding enthusiasm as developers weigh the risk of future competition.16

- Lentor Central: This 580-unit site is the eighth residential plot to be released in the Lentor precinct, a new housing estate being built from the ground up around the Lentor MRT station. The site is well-located, adjacent to the integrated development Lentor Modern, which provides retail and F&B amenities.12 The Lentor development story has been one of successful placemaking, with most of the preceding projects achieving strong sales and establishing the area as a popular choice for buyers.65 However, the sheer volume of supply—with over 3,000 units sold and more to come—means this eighth site will be a critical test of market absorption capacity, buyer fatigue, and price sensitivity.12

The government’s approach of creating new residential enclaves through a concentrated series of GLS releases, as seen in Lentor and Dairy Farm, represents a key urban planning strategy. Lentor exemplifies a more mature “precinct play,” where a high-density, MRT-centric town centre has been successfully established through seven prior land sales.69 The launch of an eighth site here directly tests the limits of this model, with market commentary highlighting concerns about potential oversupply and elevated pricing, even as historical sales have been robust.65 In contrast, Dairy Farm represents a more nascent enclave, promoting a lower-density, nature-adjacent lifestyle.63 The launch of a large 500-unit site tests a different value proposition: can the “nature oasis” theme sustain demand as supply scales up, or will its relative lack of immediate amenities and distance from the MRT become a drag on buyer interest? The tender outcomes for these two sites will provide invaluable market feedback on which placemaking model—high-density transit-oriented versus lower-density nature-oriented—developers and homebuyers currently favour.

4.3 Executive Condominium (EC) Sites: Tapping the Upgrader Market

The 2025 GLS programme places a strong emphasis on the EC market, with five sites on the Confirmed List specifically targeting the housing aspirations of HDB upgraders.

- Woodlands Drive 17 (Two Sites): The programme includes two separate EC plots on Woodlands Drive 17—a 420-unit site from H1 and a larger 560-unit site from H2.26 Both sites are strategically located within walking distance of the Woodlands South MRT station on the Thomson-East Coast Line. This allows them to tap into the substantial pool of potential upgraders from the large, mature Woodlands HDB estate.60 Their long-term appeal is further bolstered by the ongoing transformation of the nearby Woodlands Regional Centre into a major commercial and employment hub.2

- Miltonia Close: This 430-unit EC site is the first to be offered in the Yishun/Miltonia area since 2014, suggesting significant pent-up demand.16 Its unique selling proposition is its attractive location adjacent to the Lower Seletar Reservoir and the Orchid Country Club golf course. This promises future residents permanent, unblocked views of greenery and water—a rare and highly desirable attribute for an EC project.2

- Senja Close & Sembawang Road: These two smaller EC sites, yielding 295 and 265 units respectively, were notably moved from the 2H 2024 Reserve List to the 1H 2025 Confirmed List.18 This administrative re-designation is a clear signal of the government’s confidence in the demand for these locations and its proactive strategy to accelerate the injection of EC supply into the market to meet the needs of eligible buyers.

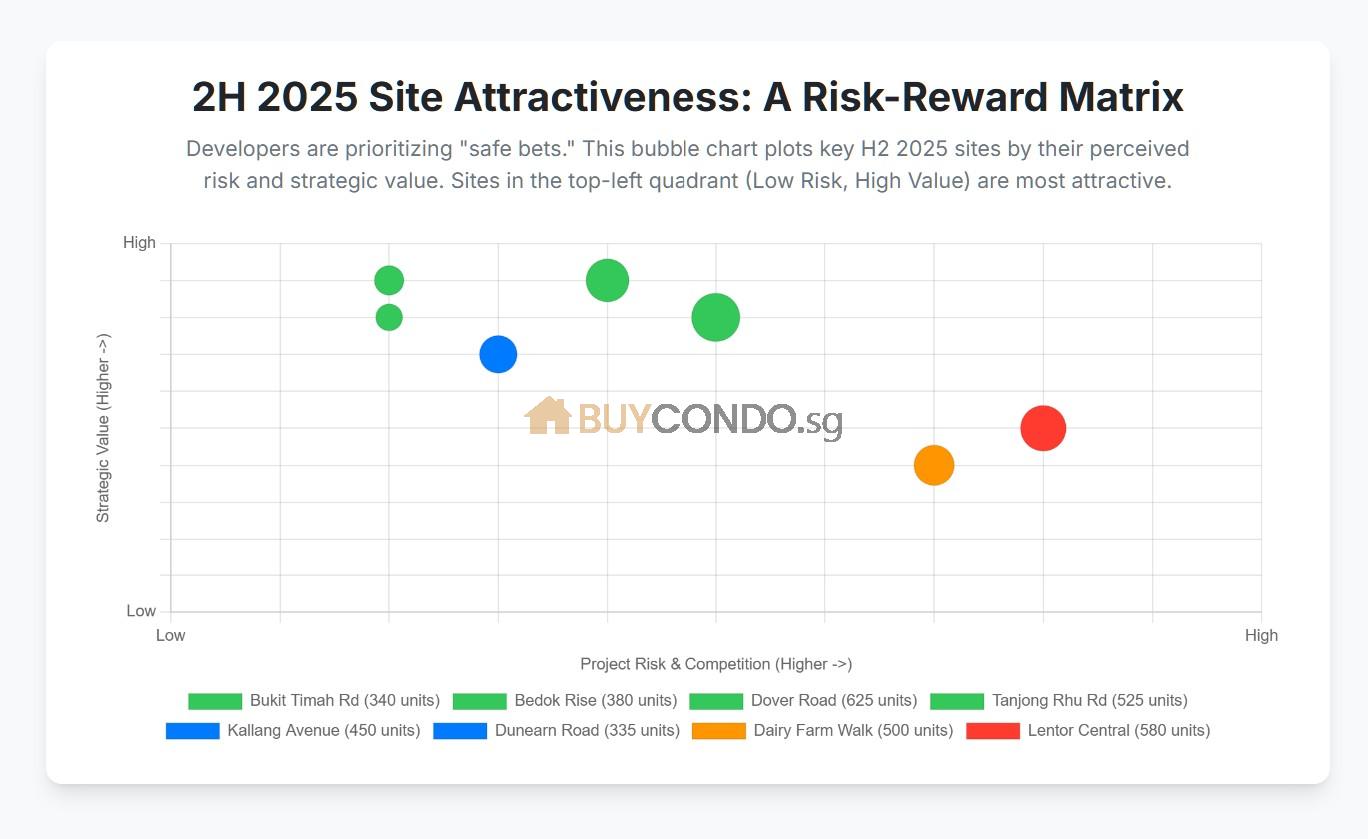

Table 3: Attractiveness Matrix for 2H 2025 Confirmed List Sites

To systematically evaluate the relative potential of the H2 2025 sites, the following matrix assesses each plot against key criteria that influence developer interest and project viability. These criteria—including MRT proximity, local amenity richness, the level of competing supply, project risk (driven by size and capital outlay), and unique strategic value—are consistently cited in market analysis as primary drivers of bidding behaviour.

| Site | Est. Units | Location Type | MRT Proximity | Amenity Richness | Supply Competition | Project Risk (Size/Quantum) | Strategic Value (First/Last Mover) | Overall Attractiveness | |

| Bukit Timah Rd | 340 | CCR | High (Next to Newton) | High | Low | Low | N/A | High | |

| Bedok Rise | 380 | OCR | High (Direct Access) | Medium | Low | Low | High (Last Mover) | High | |

| Dover Road | 625 | RCR | High (Near one-north) | High | Medium | Medium | N/A | High | |

| Tanjong Rhu Rd | 525 | RCR | High (Near Katong Park) | High | Low | Medium | High (First Mover) | High | |

| Woodlands Dr 17 (EC) | 560 | OCR (EC) | High (Near Woodlands Sth) | Medium | Medium | Low | N/A | High | |

| Kallang Avenue | 450 | RCR | Medium (Walk to Kallang) | Medium | Low | Low | High (First Mover) | Medium-High | |

| Dunearn Road | 335 | RCR | Medium (Walk to Sixth Ave) | Medium | High (Future Supply) | Low | High (First Mover) | Medium-High | |

| Miltonia Close (EC) | 430 | OCR (EC) | Low | Low | Low | Low | N/A (Unique Views) | Medium | |

| Dairy Farm Walk | 500 | OCR | Low | Low | High | Medium | N/A | Medium | |

| Lentor Central | 580 | OCR | High (Next to Lentor) | High (Lentor Modern) | High | Medium | N/A | Medium-Low | |

| Sources: 2 |

Section 5: Market Outlook and Developer Sentiment for 2025

The viability and bidding outcomes for the 2025 GLS sites are intrinsically linked to the broader market environment. A confluence of macroeconomic factors, developer risk calculations, and long-term urban planning goals will collectively shape the landscape for land acquisition and property development throughout the year.

5.1 The Macroeconomic Environment: A Mixed Bag of Tailwinds and Headwinds

The economic context for 2025 presents a mix of supportive and challenging conditions for the property market.

A significant tailwind is the moderating interest rate environment. Following a series of rate cuts by the U.S. Federal Reserve in the latter half of 2024, Singapore’s mortgage rates have trended downwards, settling in a more favourable range.11 This directly improves housing affordability for buyers by lowering monthly loan repayments and is expected to be a key factor supporting robust housing demand throughout 2025.11

On the other hand, inflationary pressures present a more complex picture. While headline and core inflation are generally easing, construction costs remain stubbornly high due to persistent labour and material expenses.11 This, combined with land prices that have remained stable under the GLS programme, creates a “sticky-down” effect on the final selling prices of new homes. Developers have limited room to offer significant discounts without compromising their margins, which establishes a firm price floor for new launches.11

Finally, the global economic outlook serves as a potential headwind. Ongoing geopolitical tensions and the risk of escalating trade conflicts are cited by economists as downside risks that could dampen business confidence and foreign investment sentiment, potentially impacting the broader economy and, by extension, the property market.11

5.2 Gauging Developer Risk Appetite: A Flight to Safety

Recent land tender results from 2024 and early 2025 reveal a clear and consistent trend of developer caution and heightened risk aversion. The average number of bidders participating in each GLS tender has fallen significantly from the historical norms of a more bullish market, now averaging just two to three bidders per site.2

This caution has led to a distinct bifurcation in market interest. Sites that are perceived as “safe bets”—those that are well-located, of a manageable size, and possess clear, defensible demand drivers—continue to attract strong competition. Examples include the Lakeside Drive and Bayshore Road sites, which drew six and eight bids, respectively.23 Conversely, sites that are large in quantum, conceptually risky, or located in unproven areas have seen extremely tepid interest or have failed to sell altogether. The lack of bids for the first Upper Thomson Road (SA2) tender and the rejection of the sole bids for the Marina Gardens Crescent and Media Circle sites are stark illustrations of this risk-off sentiment.23

A major factor contributing to this caution is the build-up of unsold inventory in the market. The total number of unsold private residential units has steadily increased from 14,330 in 2021 to over 17,000 by the end of 2023, making developers hesitant to aggressively add to their land banks, especially with large new projects.74

This market behaviour can be understood as the “Developer’s Trilemma,” where developers are caught between three powerful and conflicting pressures. First, they face intense cost pressure from high construction expenses and stable land prices, which establishes a high break-even point for any new project.11 Second, they face demand pressure from buyers who, despite robust underlying demand, have become increasingly price- and quantum-sensitive due to the wide array of choices available from the high volume of recent and upcoming launches.15 Third, and perhaps most critically, they face policy pressure from the government’s ABSD regime. The requirement to sell all units in a project within five years or face a punitive 35% levy on the land price is a significant financial risk. This risk is magnified for larger projects (typically those over 600 units), making developers extremely averse to such plots.6

This trilemma logically forces developers into a “flight to safety.” Their rational response is to focus their capital on smaller, more palatable sites (in the 300-500 unit range) in proven locations where they can be highly confident of selling out well within the five-year ABSD deadline.6 They are willing to pay a premium for this certainty, which explains the selective yet competitive bidding behaviour observed for the most attractive sites on the GLS list.

5.3 The Long-Term Vision: The Impact of Master Plans on Land Value

The GLS programme is not merely a mechanism for managing short-term supply; it is the primary instrument through which the government executes its long-term vision for Singapore’s urban transformation. Many of the sites on the 2025 list are strategically positioned to either kickstart or continue the development of key new precincts that will reshape the city’s landscape over decades.

- Greater Southern Waterfront (GSW): The Telok Blangah Road site is the vanguard of this monumental project. It is the first residential plot to be carved out of the former Keppel Golf Course, an area slated to eventually accommodate 9,000 new homes (6,000 public and 3,000 private).48 This is just the initial phase of a 20- to 30-year transformation of the entire southern coast, a project of national significance.52

- Bukit Timah Turf City: Similarly, the Dunearn Road site is only the second plot to be offered in the new Bukit Timah Turf City housing estate. This former racecourse and lifestyle hub will be comprehensively redeveloped into a new residential town with 15,000 to 20,000 public and private homes over the next two to three decades.26

The sustained high level of supply released through the GLS programme since 2022-2023 is a deliberate, multi-year strategy with cascading, long-term effects on the market.6 The first-order effect has been the successful moderation of property price growth, achieving the government’s immediate stabilisation goal.5 The second-order effect, now clearly visible, is the corresponding increase in unsold housing inventory and the resulting rise in developer caution.74

The third-order, and arguably most profound, long-term impact is a fundamental shift in market psychology. The constant and visible pipeline of new land and housing opportunities across the island effectively diminishes the “fear of missing out” (FOMO) that characterized and fueled previous property market upcycles.76 With a steady stream of options available, buyers can afford to be more discerning and selective. In this new environment, developers can no longer rely on a rapidly rising market tide to lift all boats. They are compelled to compete more intensely on the intrinsic merits of their projects: product quality, design innovation, layout efficiency, and strategic pricing. The sustained high supply from the GLS programme is thus actively engineering a more mature, stable, and fundamentals-driven property market for the long term.

Section 6: Conclusion and Strategic Recommendations

The analysis of the 2025 Government Land Sales programme reveals a property market at a point of equilibrium, meticulously managed by government policy to balance supply, demand, and affordability. This landscape presents distinct challenges and opportunities for developers, investors, and homebuyers, necessitating carefully considered strategies to navigate the year ahead.

6.1 Synthesis of Findings: A Market in Equilibrium

The 2025 GLS programme reflects a market that is being carefully steered towards stability. The government is deploying a high but calibrated supply of land to counteract inflationary pressures on property prices. Simultaneously, it demonstrates responsiveness to developer risk aversion through pragmatic policy pivots, such as the expansion of the Reserve List and the retraction of the mandatory SA2 housing requirement on the Upper Thomson site.

Developer sentiment can be characterized as one of cautious optimism. The prospect of moderating interest rates provides a positive demand-side outlook, but this is heavily constrained by the realities of high construction costs and the unyielding pressure of the five-year ABSD deadline. This has resulted in a highly selective and risk-averse land acquisition strategy, favouring certainty over speculation.

For prospective buyers, 2025 offers a market rich with choices across a wide spectrum of locations, project types, and price points, with an unprecedented number of options in the Executive Condominium segment. However, the high cost base for new developments means that while choice is abundant, significant price reductions are unlikely, keeping affordability as a central and persistent consideration.

6.2 Outlook and Recommendations for Developers

- Prioritise “Good Bets”: In the current risk-off environment, capital should be directed towards sites with clear, defensible competitive advantages. The Bedok Rise site, with its “last-mover” premium as the final plot with direct MRT access, and the Bukit Timah Road site, with its prime CCR location and low competing supply, represent the lowest-risk profiles on the 2025 Confirmed List and are likely to command strong pricing power upon launch.

- Embrace the “Precinct Play” with Caution: For sites that are early entrants into long-term master-planned areas, such as Dunearn Road (Turf City) and Telok Blangah Road (GSW), a successful bid must be predicated on more than just land value. It requires a robust branding and placemaking strategy to justify the first-mover premium and create a destination. The risk of superior competing sites emerging in later phases is significant and must be factored into bidding calculations.

- Right-Size the Risk: The market has shown a clear aversion to large-quantum projects. Developers should avoid sites projected to yield over 600 units unless there is an overwhelming strategic rationale or a substantial discount on the land price. The prevailing market sentiment and the severe financial penalty of the ABSD make such projects disproportionately risky. The sweet spot for development in 2025 lies in small to medium-sized plots that can yield between 300 and 500 units.

- Capitalise on the EC Opportunity: The government’s strategic surge in EC supply presents a major opportunity for developers with expertise in this segment. The five Confirmed List sites tap into a deep and proven well of demand from HDB upgraders. While participation is highly recommended, developers should be aware that the increased supply is also intended to foster more competition, which will likely lead to more competitive bidding and put pressure on profit margins.

6.3 Outlook and Recommendations for Investors & Homebuyers

- For HDB Upgraders: The year 2025 represents a golden window of opportunity for those eligible to purchase an Executive Condominium. The availability of five distinct sites on the Confirmed List offers an unprecedented level of choice in terms of location and project attributes. Given that ECs are priced at a significant discount to private condominiums and that rising land costs are likely to push the prices of future EC launches even higher, eligible buyers should give this segment serious consideration.33

- For Private Homebuyers: The market in 2025 is one that rewards selectivity and careful analysis.

- Best Value Growth Potential: Buyers seeking strong potential for capital appreciation should look towards projects emerging from RCR sites with compelling underlying fundamentals. The Dover Road site, with its direct link to the one-north employment hub, and the Tanjong Rhu Road site, with its scarcity value and precinct rejuvenation story, are prime examples of plots with strong, long-term value drivers.

- Be Selective in High-Supply Areas: In precincts with a high concentration of new launches, such as Lentor, buyers hold the advantage. They are in a strong position to negotiate and should meticulously compare projects based on specific attributes like layout efficiency, unit facing, and facility provisions. Buyers should be wary of overpaying for a generic “Lentor premium” when supply is abundant and choice is plentiful.

- Adopt a Long-Term Vision: For buyers with a long investment horizon (10-20 years), acquiring a unit in one of the inaugural projects in the Greater Southern Waterfront (Telok Blangah) or Bukit Timah Turf City (Dunearn Road) could yield significant long-term capital gains. This is a higher-risk, higher-reward strategy that bets on the successful maturation of these ambitious mega-precincts. It requires patience and a belief in Singapore’s long-term urban development vision.