Calculate Condo Investment Profitability in Singapore

For many Singaporeans, purchasing a condominium is not just about finding a home; it’s one of the most significant investment decisions they’ll ever make. But how do you move beyond glossy brochures and slick sales pitches to determine if a property is a truly profitable investment?

This guide will walk you through the essential steps to calculate the investment value and profitability of a residential property. Understanding these fundamentals will empower you to make smarter, more informed decisions in your condo-buying journey.

Understanding Investment Value

First, it’s crucial to distinguish between

Market Value and Investment Value. Market value is the price a property will likely fetch on the open market. Investment value, however, is unique to you, the investor. It considers your financial situation, investment goals, risk appetite, and potential cash flow from the property.

Factors that influence investment value include:

- Financing capabilities and tax rates

- Subjective needs and investment strategies

- Micro-factors like the unit’s facing, floor level, layout, and in-project facilities

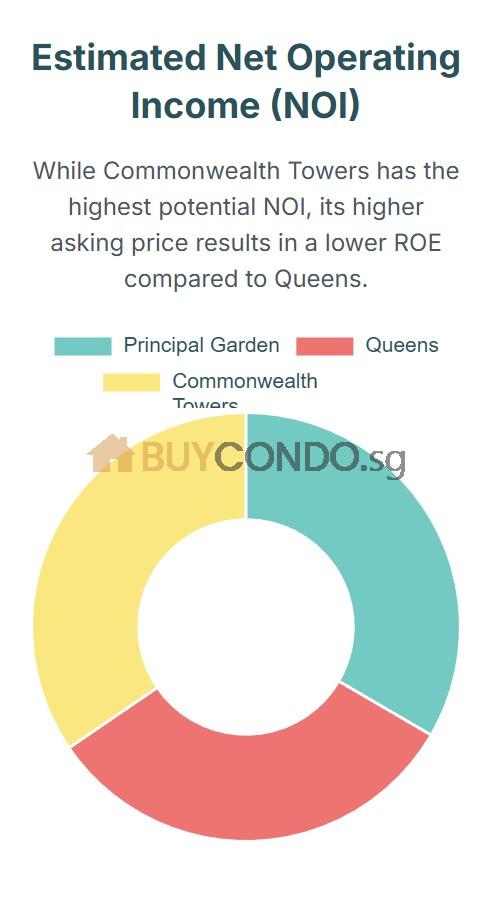

The Core of Profitability: Net Operating Income (NOI)

To assess a condo’s profitability, you need to calculate its Net Operating Income (NOI). This is the annual income generated by the property after all operating expenses are paid.

Here’s a simplified breakdown:

- Gross Scheduled Income: This is the total potential annual rent. You can estimate this using recent rental data for similar units, which is available on the URA website.

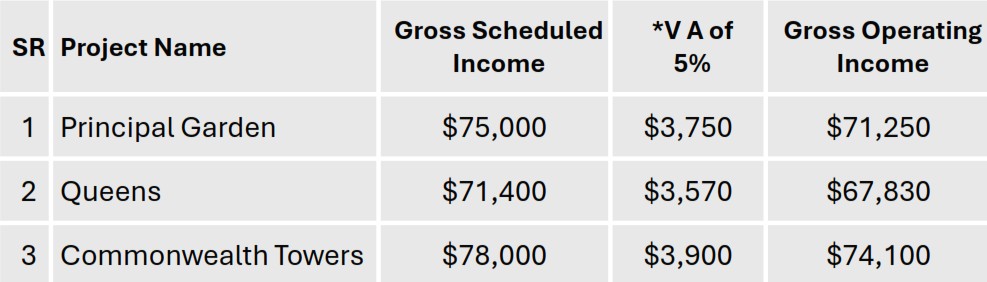

- Gross Operating Income (or Effective Gross Income): This is the income you actually collect. To get this, subtract a vacancy allowance (typically 3-5% of the gross scheduled income) from the Gross Scheduled Income to account for periods the unit might be empty.

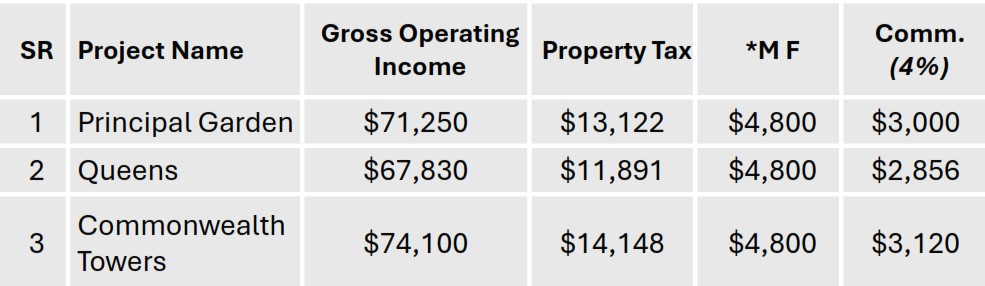

- Standard Operating Expenses (SOE): These are the necessary costs to keep the rental income flowing. They include property taxes, maintenance fees, insurance, and agency commissions. Note that mortgage repayments and capital improvements are not considered part of SOE.

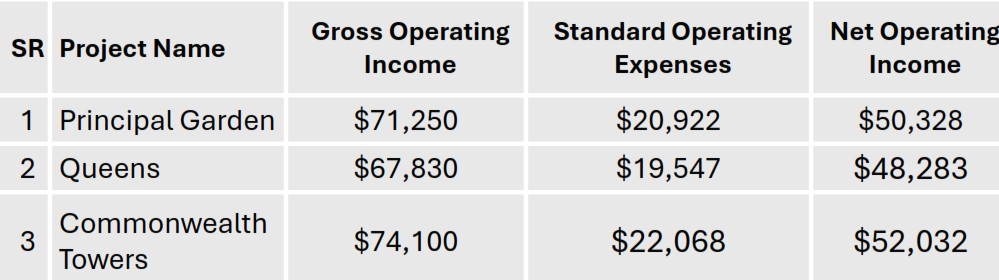

- Net Operating Income (NOI): Subtract the total Standard Operating Expenses from the Gross Operating Income. This figure represents the cash in your pocket before accounting for loan payments.

Measuring Your Return: The Power of Return on Equity (ROE)

Once you have the NOI, you can calculate the Return on Equity (ROE), a powerful metric that measures the return on your actual cash investment.

The course highlights two primary methods for this calculation:

- Method 1: First-Year Return (NOI / Initial Cash Investment)This simple formula is great for getting a quick snapshot of your potential return in the first year. It’s similar to calculating the Net Yield.

- Method 2: Future Return (Cash Flow / (Resale Value – Mortgage Balance))This method projects your return over a longer period (e.g., 5-10 years), factoring in mortgage payments and potential appreciation. It uses Cash Flow (NOI minus mortgage repayment) instead of just NOI.

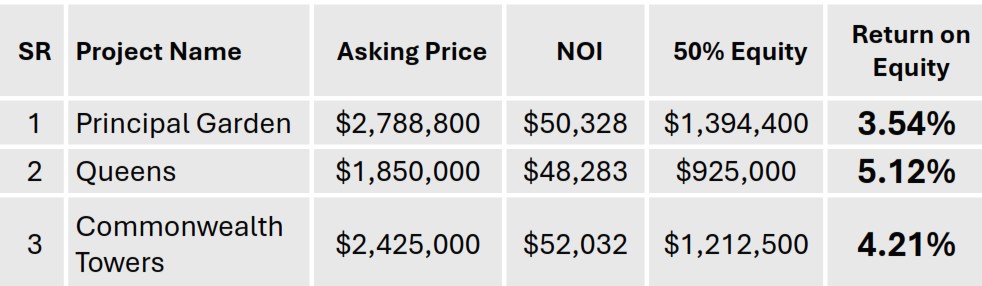

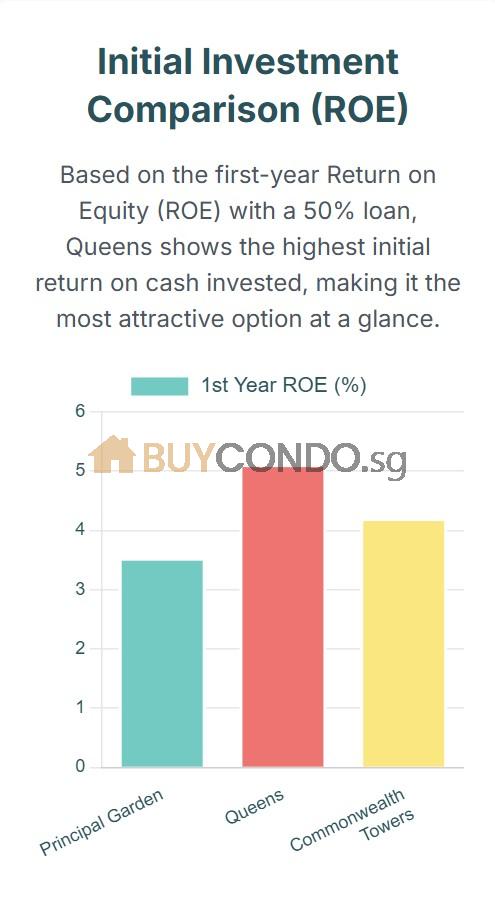

Case Study: A Look at Three District 3 Condos

Let’s apply these concepts to a real-world scenario where “Mr. and Mrs. Heng” are considering three different 3-bedroom condos for investment. (Raw data from URA website)

- Principal Garden, 1195sqft, $2.788M

- Queens, 1184sqft, $1.85M

- Commonwealth Towers, 1055sqft, $2.425M

Six Steps On Method 1: First-Year Return (NOI / Initial Cash Investment)

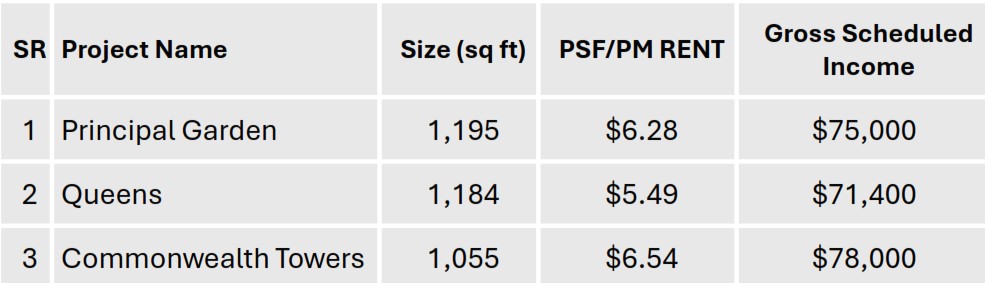

Step 1 – Ascertain Gross Scheduled Income

Step 2 – Ascertain Gross Operating Income (by deducting vacancy allowance at 3-5%)

Step 3 – Ascertain Standard Operating Expenses (SOE) (Property costs e.g., Insurance, repairs, utilities, management fees, Property tax, Agency comm)

Step 4 – Ascertain Net Operating Income (NOI)

Step 5 – Work out Initial Cash Investment

Step 6 – Work out Return On Equity

- Using Income to ascertain ROE (own capital)

- Rule Of Thumb measurement – easy to use but not accurate

- Give a rough estimate of “Which is a better investment?”

- Limitation: Does not consider financial leverage which may increase effectiveness (using less of one’s equity to achieve an enhanced return)

- Therefore, the need for Method 2 to ascertain ROE

- Financial Leverage reduces investors’ own capital -making them financially (more) effective

- No longer uses Income but Cash Flow – Net Operating Income less Mortgage repayment and other costs of property ownership

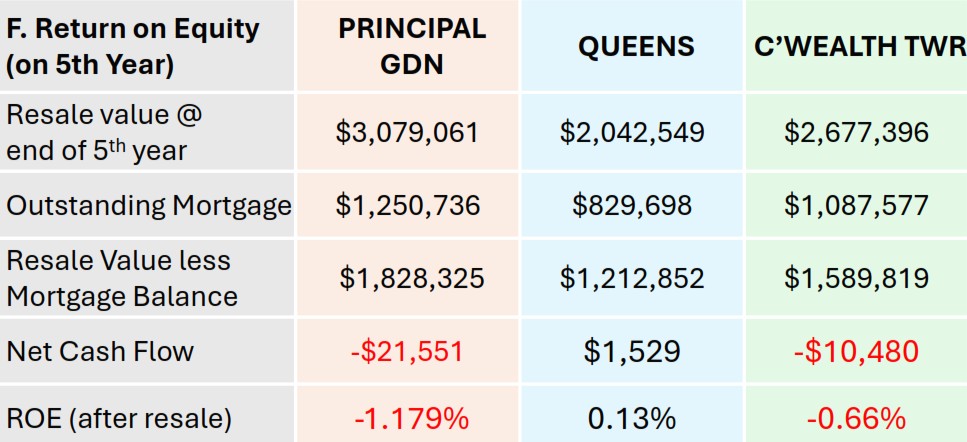

Method 2: Cash Flow / Resale Value – Mortgage Balance

This method projects the investment’s performance over a five-year holding period, incorporating the real-world impact of mortgage payments on cash flow. A conservative 50% gearing (50% loan-to-value), we assume a 30-year loan tenure, a 3.5% interest rate, and a modest 2% annual appreciation in property value.

Step 1 – Ascertain Resale Value (at the end of 5th Year) / Capital Appreciation (assuming at 2% annually)

Step 2 – Ascertain Mortgage Balance (assuming 1. 50% gearing, 2. 30 years tenure, & 3. 3.5% interest)

Step 3 – Ascertain Cash Flow (NOI less Mortgage repayment)

Working out ROE

Does Higher Borrowing Mean Higher Returns?

A common assumption is that taking a larger loan (higher leverage) will always lead to a higher ROE. Tests this by comparing a 50% loan-to-value (LTV) scenario against a 75% LTV scenario.

The analysis reveals that a higher 75% gearing results in a negative ROE for all three properties after five years. This is because the significantly higher mortgage repayments erode the cash flow, turning it negative.

Interestingly, when analyzing the potential Capital Gain after 5 years, the 50% gearing scenario results in a positive gain for all three properties, whereas the 75% gearing leads to a net loss for Principal Garden and Commonwealth Towers.

This demonstrates a critical lesson: the highest leverage is not always the best strategy. A balanced approach is essential.

Ready to find your next profitable condo investment? The experts at buycondo.sg are here to help. Contact us today for a personalized analysis and to discover which properties in the current market offer the best potential for growth and return.