Understanding the CPF SA Closing: What It Means For Your Savings at 55

Just In Case We are Not a aware..

CPF Special Account (SA) for those aged 55 and above, effective early 2025. It’s crucial to understand how this impacts your retirement savings, especially if you’re nearing or past this age.

Let’s break down the key changes and what they mean for your money.

The Current CPF Landscape (Pre-2025 for over 55s)

Currently, your CPF accounts earn different interest rates:

- Ordinary Account (OA): Earns 2.5% per annum (with an additional 1% on the first $20,000).

- Special Account (SA): Earns 4% per annum.

- Retirement Account (RA): Also earns 4% per annum.

The question often arises: if both SA and RA earn 4%, what’s the difference if money goes into RA? The key lies in liquidity and how the funds are used post-55.

What Happens at 55? The Creation of Your Retirement Account (RA)

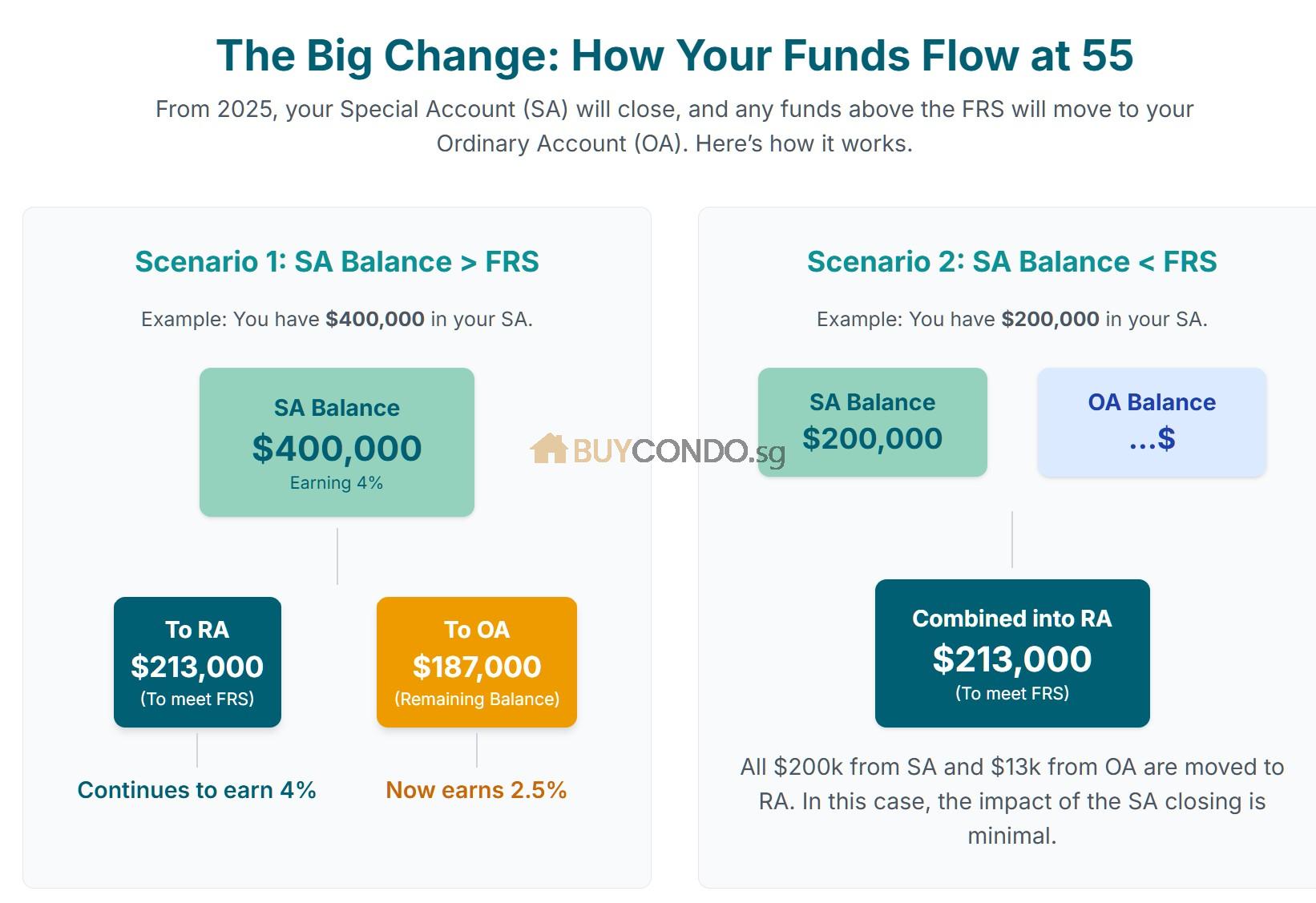

When you turn 55, a Retirement Account (RA) is created for you. Funds from your SA and, if needed, your OA, are transferred to your RA, up to the Full Retirement Sum (FRS). For 2025, the FRS is projected to be $213,000.

Scenario 1: You have more than the FRS in your SA Let’s say you have $400,000 in your SA.

- $213,000 (the FRS) will be transferred from your SA into your RA.

- Your remaining SA balance will be $187,000 ($400,000 – $213,000).

Before the SA closing, this remaining $187,000 in your SA would continue to earn the higher 4% interest.

The Big Change: SA Closing at 55

With the SA closing for those aged 55 and above (effective early 2025):

The remaining balance in your SA (above the FRS) will no longer earn 4% interest. Instead, this money will be transferred into your Ordinary Account (OA), where it will then earn the OA’s prevailing interest rate of 2.5% per annum.

This means that for any amount in your SA exceeding the FRS, you’ll be earning 1.5% less interest than before (4% vs 2.5%). This primarily affects individuals whose SA balance exceeds their FRS.

Scenario 2: You have less than the FRS in your SA If you have, for instance, $200,000 in your SA (which is less than the FRS of $213,000 for 2025):

- All $200,000 from your SA will be transferred into your RA.

- You will be short of $13,000 for your FRS.

- To fulfill the FRS, $13,000 will be transferred from your OA into your RA.

- In this case, the SA closing doesn’t significantly change your interest earnings, as the entire SA balance would have moved to RA anyway.

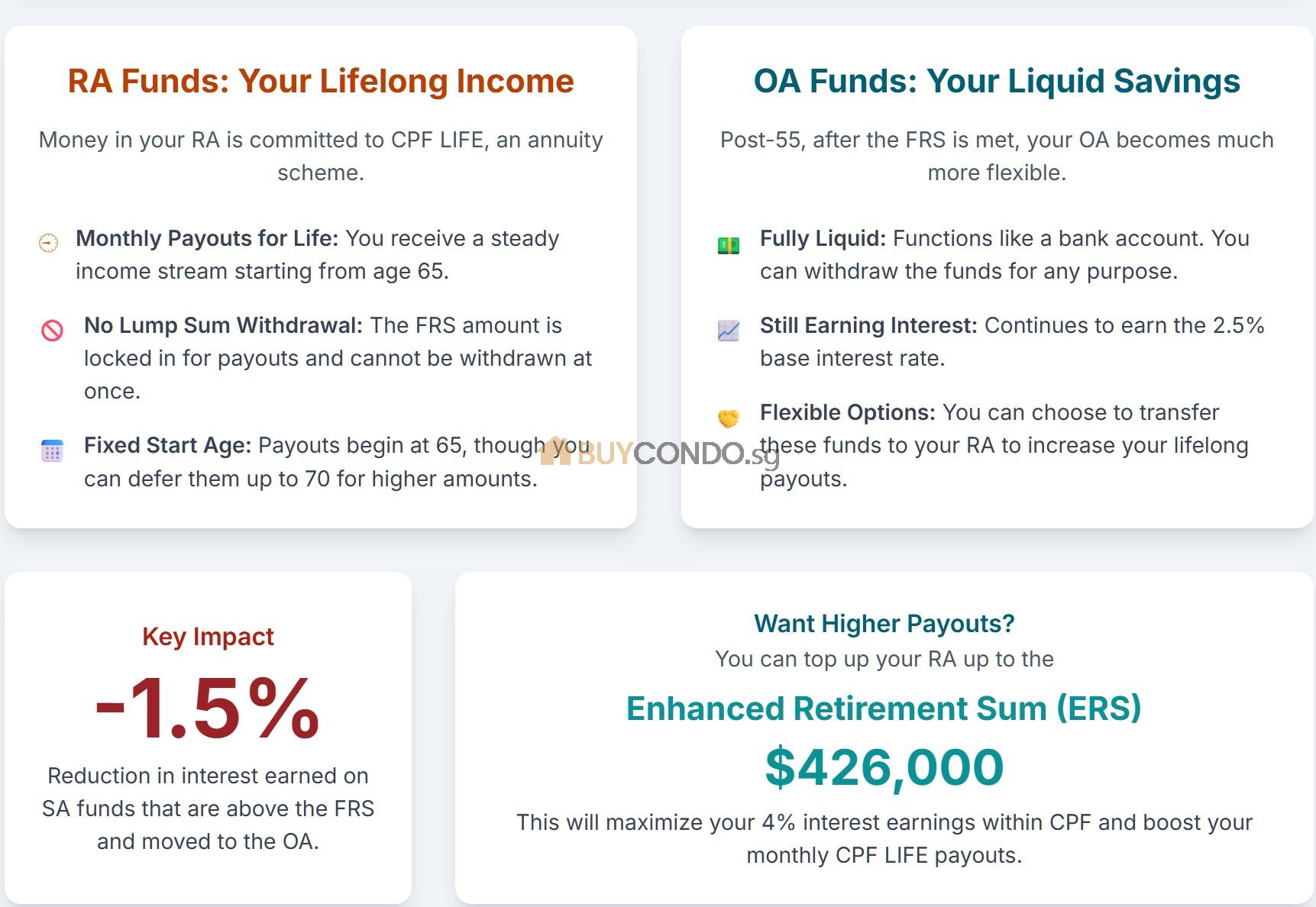

What Happens to Money in Your RA (and Why it’s Different from OA)

When money is in your RA, particularly the FRS amount, it’s used to subscribe to CPF LIFE.

- CPF LIFE: This is an annuity scheme that provides you with monthly payouts for life starting from age 65 (or later, up to 70).

- No Lump Sum Withdrawal (FRS): The FRS amount in your RA is not accessible as a lump sum at 65. You only receive monthly income.

- Start Age: Even if you retire earlier (e.g., 40 or 50), the payouts from CPF LIFE only begin at age 65. You can defer it up to age 70 for higher monthly payouts, but you cannot start it earlier.

The Liquidity of Your OA Post-55

The good news is that your Ordinary Account (OA) offers more liquidity after age 55.

- Before 55: Your OA funds are generally restricted to specific uses like housing (mortgage), education loans (for approved tertiary education), Dependent’s Protection Scheme (DPS), Home Protection Scheme (HPS), and investments.

- After 55: Once your FRS has been set aside in your RA, any remaining funds in your OA are fully liquid. It functions much like a bank account, still earning 2.5% interest, but you can withdraw it for whatever you need.

Optimizing Your Retirement Funds: Topping Up RA or Not?

You have the option to voluntarily transfer more money from your OA into your RA. The maximum amount you can put into your RA to earn 4% interest is up to the Enhanced Retirement Sum (ERS). For 2025, the ERS is $426,000 (which is two times the FRS).

- Putting funds up to the ERS in your RA will earn 4% interest and result in higher monthly payouts from CPF LIFE starting at age 65.

- However, remember that these funds become part of CPF LIFE, meaning they are not withdrawable as a lump sum and only provide monthly income from age 65 onwards.

The Gist of the SA Closing

The primary impact of the SA closing is that any funds in your SA that exceed your Full Retirement Sum at age 55 will be transferred to your OA. This means that money will now earn 2.5% interest instead of 4%, effectively a 1.5% reduction in interest earned on that portion of your savings.

This change mainly affects individuals who have more than their FRS in their SA. If your SA balance is exactly or less than your FRS, then most or all of it would have been transferred to your RA anyway, so the direct impact of the SA closure on your interest earnings might be minimal.

For those with significant excess in their SA, this might prompt a re-evaluation of their financial planning and investment strategies to optimize returns on their retirement savings.

If you have questions about how these changes specifically when some cases home owners would like to cash our their sales proceeds before transferring to the RA at age 55.

Contact us at 94507545.

My CPF Ordinary Account (OA) Savings Can I use to Pay for Property?

Can I use my CPF to pay for the Stamp duties and ABSD