GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market

This is still not including the Income Tax payable for the Rental income (Highest tier of 24% for Ultra High Income earners)

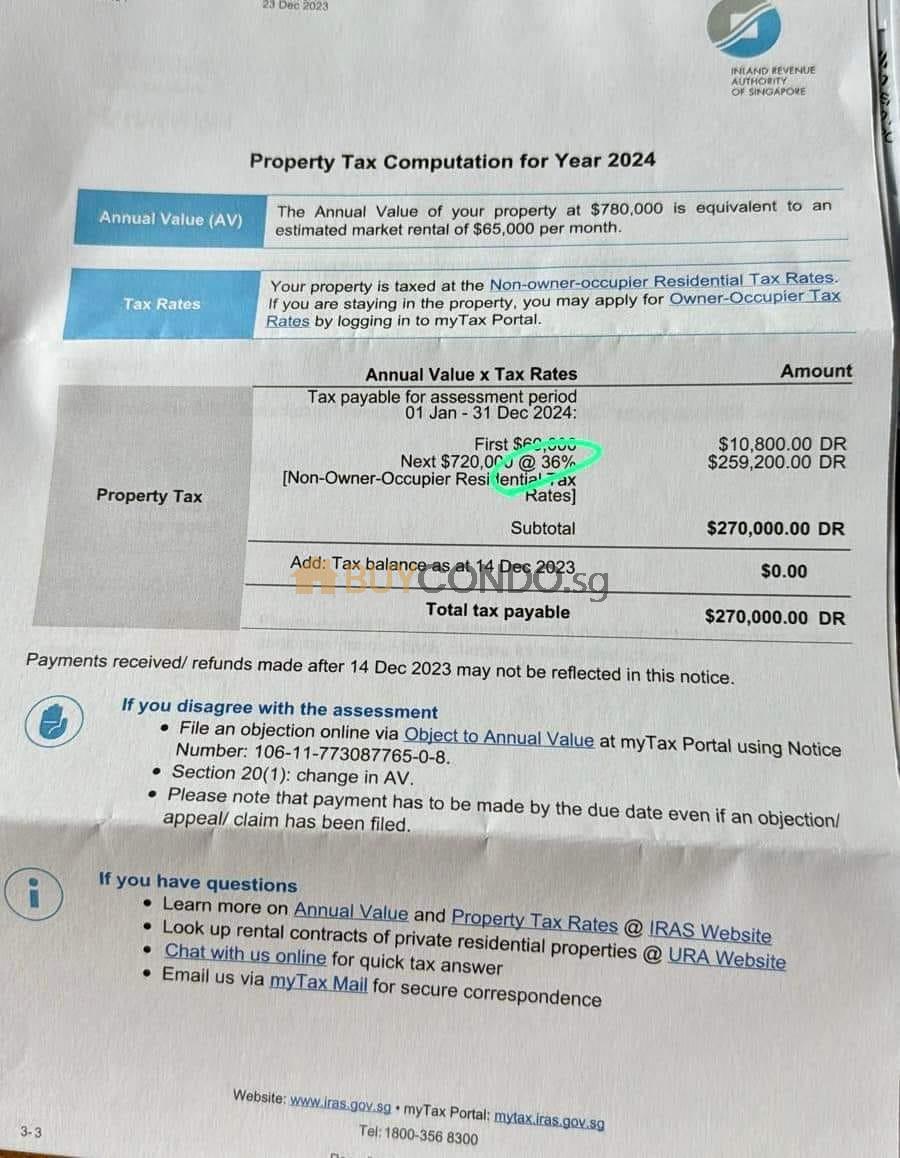

Lets dive into the Case Study.

(Non-Owner Occupier Tax. First $60,000 is 18%; in excess of the $60,000, the next $720,000 is taxable at the rate of 36%)

Assume the GCB is renting out at $65,000 per month.

Annually the Rental Income shall be $780,000 per annum.

( Net Income before property maintenance and bank loan with interest if any)

$780,000(Annual Rent) – $270,000 (Property Tax) – $187,200 ( Income Tax) = Net Rental Income $322,800.

( Holding Cost of such Ultra Luxury Landed Property)

$270,000 + $187,200 = Holding Cost $457,200.

Some Points Gathered:

Holding Cost for a rented out property is higher than the total rental income.

What are this kind of Properties that falls into this Bracket?

Good Class Bungalows(GCB) with an average of 15,000sqft land with the built up 8,000 ~ 12,000sqft

Such GCB can be in the market valued around $30,000,000 to $60,000,000.

Ultra Luxury Apartments in CCR.

Le Nouvel Ardmore ~ $80,000 per month, 4 bedroom 4058sqft.

Four Seasons Park Penthouse $78,000 per month, 9 Bedroom 6150sft.

Nassim Park Residences Penthouse $65,000 per month, 4 Bedroom 6800sft.

If you have a Desire to Own Such Property Would You Buy a GCB or Ultra High Luxury Apartment? Lets Compare

Annualized Capital Appreciation for Ultra High Luxury Apartments

Le Nouvel Ardmore ~ Rental $80,000 per month, 4 bedroom 4058sqft.

(Owner Bought $18,500,000 ($4559psf/4058sqft) in 2021, Based on the latest Transaction of $5,800psf today’s Market Value is worth $23,536,400.

$23,536,400 – $18,500,000 = Approx $5,000,000 in 3 Years.

Annualized Capital Appreciation for Le Nouvel Ardmore: Approx $1,600,000, 8.6% per annum.

If we factor in the holding cost of say estimate of $600,000. There is still a net $1m per year before mortgage interest.

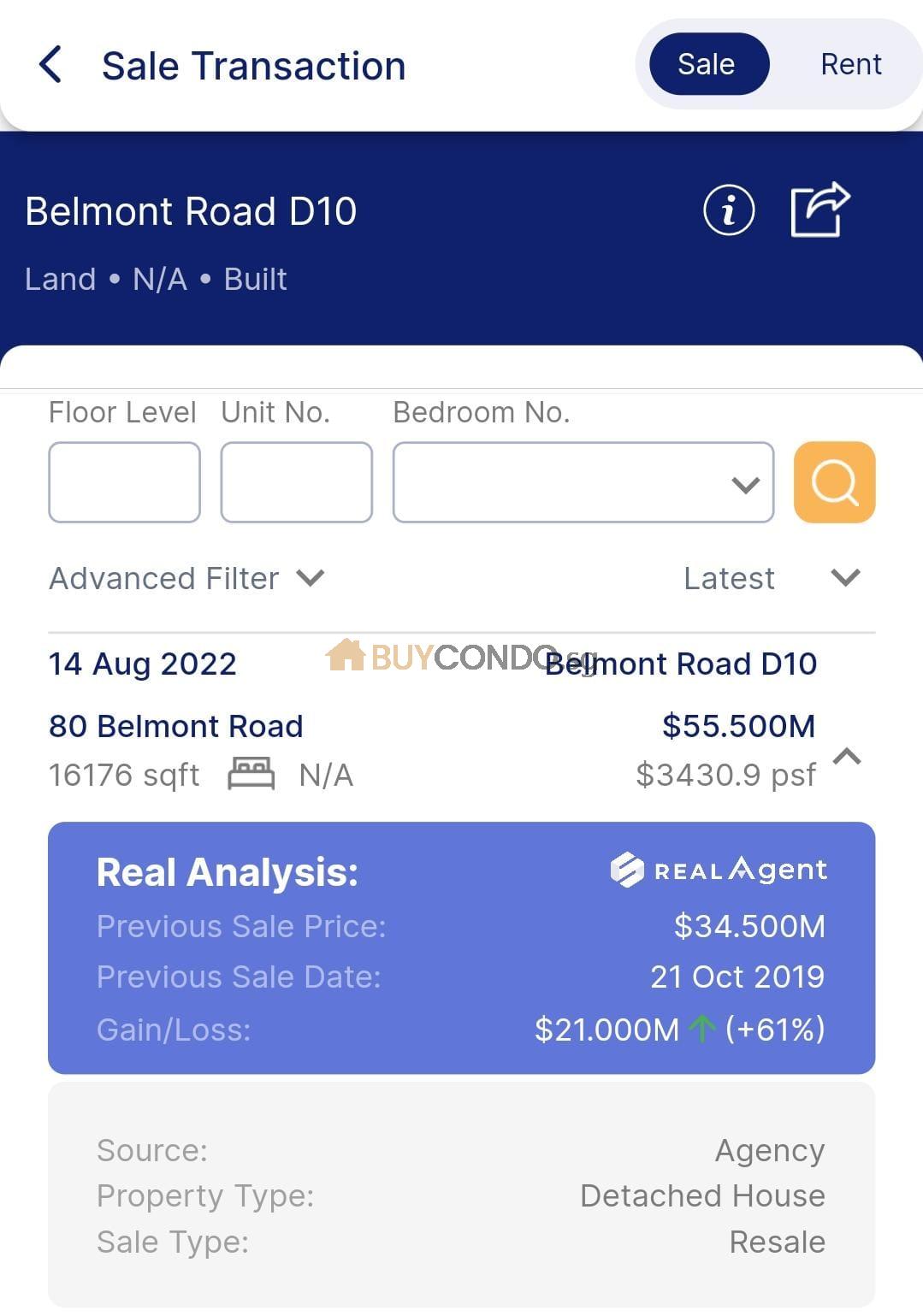

Annualized Capital Appreciation for Good Class Bungalow

80 Belmont Road. $55.5m – $34.5m = $21m Gains in 3 years.

Annualized Capital Appreciation for Le Nouvel Ardmore: Approx $7,000,000, 20% per annum.

From these comparison of Facts it will be quite clear where is better to place your money.

https://buycondo.sg/property-management-services/

Non-owner-occupier residential tax rates (residential properties) in 2024

Non-owner occupied residential properties are condominiums, HDB flats or other residential properties that the owner does not live in (“occupy”). Hence, owner-occupier tax rates do not apply.

The following tax rates apply to non-owner occupied properties except for those in the exclusion list.

Excluded properties

- Accommodation facilities within any sports and recreational club

- Chalet

- Child care centre, student care centre, or kindergarten

- Welfare home

- Hospital, hospice, or place for rehabilitation, convalescence, nursing care or similar purposes

- Hotel, backpackers’ hostel, boarding house or guest house

- Serviced apartment

- Staff quarters that are part of any property exempted from tax under S6(6) of the Property Tax Act

- Student’s boarding house or hostel

- Workers’ dormitory

The property must have received planning approval for the above use. No application to IRAS is required.

Non-owner-occupier residential tax rates

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

|---|---|---|

| First 30,000 Next $15,000 |

12% 20% |

$3,600 $3,000 |

| First $45,000 Next $15,000 |

– 28% |

$6,600 $4,200 |

| First $60,000 Above $60,000 |

– 36% |

$10,800 |

| Annual Value ($) | Tax rate effective from 1 Jan 2023 to 31 Dec 2023 | Property tax payable |

|---|---|---|

| First $30,000

Next $15,000 |

11%

16% |

$3,300

$2,400 |

| First $45,000

Next $15,000 |

–

21% |

$5,700

$3,150 |

| First $60,000

Above $60,000 |

–

27% |

$8,850

|

Owner-occupier tax rates (residential properties) in 2024

Owner-occupied residential properties are condominiums, HDB flats or other residential properties where the owner lives in (“occupies”) the property. Owner-occupied residential properties enjoy owner-occupier tax rates.

Owner-occupier tax rates

| Annual Value ($) | Effective 1 Jan 2024 | Property Tax Payable |

|---|---|---|

| First $8,000 Next $22,000 |

0% 4% |

$0 $880 |

| First $30,000 Next $10,000 |

– 6% |

$880 $600 |

| First $40,000 Next $15,000 |

– 10% |

$1,480 $1,500 |

| First $55,000 Next $15,000 |

– 14% |

$2,980 $2,100 |

| First $70,000 Next $15,000 |

– 20% |

$5,080 $3,000 |

| First $85,000 Next $15,000 |

– 26% |

$8,080 $3,900 |

| First $100,000 Above $100,000 |

– 32% |

$11,980

|

| Annual Value ($) | Tax rate effective from 1 Jan 2023 to 31 Dec 2023 | Property tax payable |

|---|---|---|

| First $8,000

Next $22,000 |

0%

4% |

$0

$880 |

| First $30,000

Next $10,000 |

–

5% |

$880

$500 |

| First $40,000

Next $15,000 |

–

7% |

$1,380

$1,050 |

| First $55,000

Next $15,000 |

–

10% |

$2,430

$1,500 |

| First $70,000

Next $15,000 |

–

14% |

$3,930

$2,100 |

| First $85,000

Next $15,000 |

–

18% |

$6,030

$2,700 |

| First $100,000

Above $100,000 |

–

23% |

$8,730

|

IRAS Income Tax rates (residential properties) in 2024

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 Next $180,000 |

– 22 |

44,550 39,600 |

| First $500,000 Next $500,000 |

– 23 |

84,150 115,000 |

| First $1,000,000 In excess of $1,000,000 |

– 24 |

199,150 |

From YA 2017 to YA 2023

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 |

0 2 |

0 200 |

| First $30,000 Next $10,000 |

– 3.50 |

200 350 |

| First $40,000 Next $40,000 |

– 7 |

550 2,800 |

| First $80,000 Next $40,000 |

– 11.5 |

3,350 4,600 |

| First $120,000 Next $40,000 |

– 15 |

7,950 6,000 |

| First $160,000 Next $40,000 |

– 18 |

13,950 7,200 |

| First $200,000 Next $40,000 |

– 19 |

21,150 7,600 |

| First $240,000 Next $40,000 |

– 19.5 |

28,750 7,800 |

| First $280,000 Next $40,000 |

– 20 |

36,550 8,000 |

| First $320,000 In excess of $320,000 |

– 22 |

44,550 |

The Property Value Paradox: Rising Tax Versus Housing Market Gains

The increase in property tax raises the question of the property value paradox. While homeowners may experience higher tax obligations, they may also witness gains in the housing market. Understanding the relationship between rising property taxes and housing market gains is essential to evaluate the overall impact on homeowners’ finances.

As property taxes rise, homeowners might worry about the financial burden it presents. However, it’s important to consider the potential gains in the housing market. The property tax paradox emerges when higher taxes coincide with a robust housing market. While the tax burden increases, homeowners still benefit from appreciation in property value, creating a delicate balance.

Property values are influenced by various factors, including location, demand, and market trends. While property taxes are based on property values, the housing market can drive significant gains in property value over time. This creates a paradoxical situation where higher taxes are accompanied by increasing property values, raising questions about the overall financial impact on homeowners.

When property values increase, homeowners may consider the potential gains in equity and future resale value. These gains can offset the higher tax obligations, providing a positive aspect to the property value paradox. However, it’s crucial to assess the specific circumstances of each homeowner and evaluate the net impact of rising taxes and housing market gains.

The interplay between property taxes and market value highlights the complexity of homeowners’ financial considerations. While higher taxes can place a burden on homeowners, they should also consider the potential gains in property value, leading to increased wealth and financial stability.

Understanding the property value paradox and its implications is crucial for homeowners navigating the current landscape. By analyzing market trends, consulting with real estate professionals, and staying informed about property tax regulations, homeowners can make informed decisions about their investments and financial future.

| Housing Market Gains | Property Tax Paradox |

|---|---|

| Positive | Increase in tax obligations |

| Potential for equity gains | Potential for increased property value |

| Future resale value | Complex financial considerations |

Predicting Rental Income Tax Implications for Landlords

As a result of the property tax increase, landlords may encounter potential implications on their rental income taxes. It is crucial for landlords to navigate these changes and implement strategies to maintain profitability despite the increased tax burden.

Maintaining Profitability with Increased Property Taxes

With the rise in property taxes, landlords need to evaluate their financial position and explore ways to sustain profitability. This requires careful budgeting and analysis of rental income and expenses. Landlords should consider the impact of the increased property taxes on their rental yield and assess the feasibility of adjusting rental pricing to offset the higher tax obligations.

Cost-Passing Strategies: Rental Pricing Adjustments

One possible approach to manage the increased property taxes is to make rental pricing adjustments. Landlords may need to pass on a portion of the tax burden to tenants through reasonable rental price increases. However, it is essential to strike a balance between maintaining profitability and tenant affordability. Landlords should carefully analyze the rental market, competition, and demand before implementing any pricing adjustments.

Projected Effects on Rental Yield and Market Competition

The property tax increase can impact the rental yield, which measures the return on investment for landlords. Higher taxes may lower the overall rental yield, making it challenging for landlords to maintain expected returns. Additionally, market competition could intensify as landlords make pricing adjustments to address the increased tax burden. Consequently, landlords must monitor market dynamics closely and adapt to changing trends to remain competitive.

In summary, predicting the rental income tax implications for landlords in light of the property tax increase is crucial for their financial planning and decision-making. By maintaining profitability, implementing cost-passing strategies, and assessing the effects on rental yield and market competition, landlords can navigate these tax changes effectively and make informed choices for their rental properties. Let your Property Manager Handle for your properties today.

Is It Still Profitable to Rent Out or Sell in 2024?

With the significant increase in property taxes, homeowners must assess whether renting out or selling their property remains a profitable venture. The higher tax obligations may impact the potential returns for landlords, leading to a reconsideration of renting out properties. Similarly, homeowners may question whether selling their property is a more financially viable option in light of the property tax implications.

Profitability Comparison: Renting Out vs. Selling

In order to determine whether it is still profitable to rent out or sell in 2024, homeowners need to evaluate the financial implications of both options. Here is a breakdown of the key factors to consider:

| Renting Out | Selling | |

|---|---|---|

| Potential Rental Income | Homeowners can generate a steady stream of income through rental payments from tenants. | Selling the property can result in a lump sum cash infusion. |

| Property Tax Obligations | Rental income is subject to property tax, and the recent tax increase may impact profitability. | Selling the property may trigger capital gains tax, which needs to be factored into the financial calculations. |

| Maintenance and Upkeep | Landlords are responsible for ongoing maintenance and repairs, which can impact overall profitability. | Selling the property relieves homeowners of the financial and time commitments associated with maintenance. |

| Market conditions | The rental market conditions, demand, and competition can influence the rental income potential. | The current state of the housing market may impact the selling price and time it takes to sell the property. |

“The decision to rent out or sell a property requires a careful analysis of the financial implications and market dynamics. Homeowners should weigh the potential rental income against property tax obligations, maintenance costs, and market conditions in order to make an informed decision that aligns with their financial goals.”

By considering these factors, homeowners can assess whether renting out or selling their property is the most profitable choice in the current landscape of increased property taxes. It is advisable to consult with financial advisors or real estate professionals to fully understand the implications and make a well-informed decision.

Conclusion ; GCB vs Ultra High Luxury Apartment : Property Tax hiked will it affect the luxury market

In the wake of the significant increase in property tax for 2024, homeowners in Singapore are facing a challenging financial burden. The implications of this tax hike extend far beyond what was initially anticipated. It is imperative for homeowners to fully grasp the impact on their finances and explore potential strategies to manage the increased tax burden.

To navigate these changes effectively, homeowners must stay well-informed about payment deadlines and take advantage of advancements in digital tax billing. Embracing electronic property tax bills and utilizing the new interactive bill system can streamline the payment process and enhance convenience.

Furthermore, homeowners should consider the available government assistance options, such as the one-time rebate for owner-occupied properties. Assessing eligibility criteria for tax rebates will help homeowners determine if they are qualified for this crucial financial support.

In conclusion, the property tax increase for 2024 presents a significant challenge for homeowners, affecting their overall financial well-being. By understanding the implications, exploring strategies for managing the increased tax burden, and considering government assistance options, homeowners can navigate these changes with greater confidence. Staying abreast of payment deadlines, embracing digital tax billing advancements, and remaining proactive in tackling the property tax landscape are key to minimizing the burden of the tax hike and securing a stable financial future.

FAQ

What is the impact of the dramatic increase in property tax on homeowners?

The dramatic increase in property tax for 2024 has significant implications for homeowners in Singapore. It raises concerns about the affordability of homeownership and increases the financial burden on homeowners.

How can homeowners understand the new property tax rates for 2024?

Homeowners can understand the new property tax rates by reviewing the latest assessments and tax bills provided by the government. It is essential to stay informed about any changes in the tax rates.

How does the tax hike affect owner-occupied residences?

The tax hike specifically affects owner-occupied residences, leading to increased financial burdens for homeowners. They will have to bear the brunt of the higher tax obligations.

How can homeowners compare their tax obligations between 2023 and 2024?

Homeowners can compare their tax obligations between 2023 and 2024 by reviewing their previous tax bills and assessments. They can analyze the differences in the tax rates, assessments, and overall tax burden.

Are landlords likely to raise rental prices due to the property tax increase?

Due to the property tax increase, landlords may face pressure to raise rental prices. They may need to pass on the increased costs to tenants, which could impact the rental market and affordability for tenants.

How can homeowners calculate their home’s annual value (AV)?

Homeowners can calculate their home’s annual value by considering the estimated market rentals of similar properties in the rental market. This calculation is crucial for determining their property tax obligations.

What role do rental market trends play in annual value (AV) determination?

Rental market trends play a significant role in annual value (AV) determination. The estimated market rentals of similar properties impact the calculation of a home’s AV, which directly affects the property tax bill.

Will the annual value (AV) vary for different property types?

Yes, the annual value (AV) may vary for different property types. Different property types have unique features and attributes that can impact their estimated market rentals and, subsequently, the AV and property tax bill.

What is the relationship between rising property taxes and housing market gains?

While rising property taxes may increase the tax burden on homeowners, they may also witness gains in the housing market. It is essential to understand this relationship to evaluate the overall impact on homeowners’ finances.

How can landlords maintain profitability with increased property taxes?

Landlords can maintain profitability with increased property taxes by implementing cost-passing strategies, such as rental pricing adjustments. These adjustments help offset the higher tax burden and ensure profitability for landlords.

What are the potential effects on rental yield and market competition due to the property tax hike?

The property tax hike may have potential effects on rental yield and market competition. Landlords may need to adjust rental prices, which can impact rental yield, and increased costs may influence market competition.

Should homeowners reconsider renting out or selling their property in light of the property tax implications?

With the significant increase in property taxes, homeowners must assess whether renting out or selling their property remains a profitable venture. The higher tax obligations may impact potential returns for landlords, leading to a reconsideration of renting out properties.

What government assistance is available to alleviate the financial burden on homeowners?

The government provides property tax rebates as a form of assistance to alleviate the financial burden on homeowners. A one-time rebate is available for owner-occupied properties, and homeowners can apply for this rebate to reduce their tax obligations.

How can homeowners understand if they qualify for property tax rebates?

Homeowners can assess their eligibility for property tax rebates by reviewing the criteria set by the government. They need to determine if their property qualifies as an owner-occupied property and if they meet the income and ownership requirements.

What are the payment deadlines and processes for property tax in 2024?

Homeowners need to be aware of the payment deadlines and processes for property tax in 2024. It is essential to know when the tax payment is due and to familiarize themselves with the various payment options available.

What advancements in digital tax billing and payments can benefit homeowners?

Homeowners can benefit from advancements in digital tax billing and payments. They can adopt electronic property tax bills and utilize the new interactive bill system, which streamlines the process for homeowners. It is also important to stay informed about any enhancements in property tax digital services for added convenience.