Lease decay Condos Is it Still Worth to buy?

Lease decay doesn’t always equate to a depreciation in prices or capital value.

While it’s commonly believed that the value of a property correlates directly with its remaining lease tenure, the scenario isn’t always straightforward.

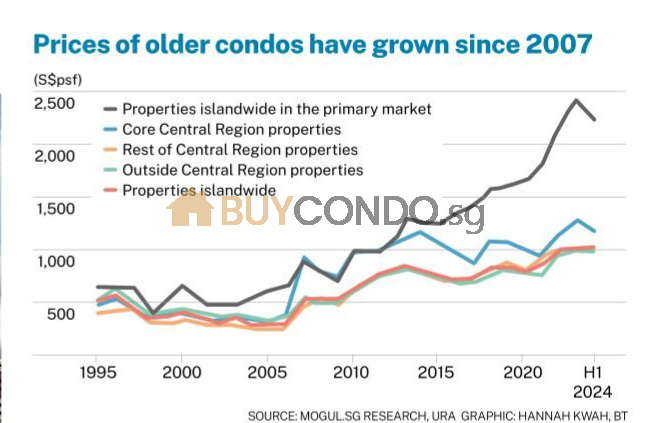

For instance, the prices of older 99-year leasehold condominiums have been on the rise since 2007.

Experts emphasize that market conditions and location attributes play significant roles in determining property value, which means the depreciation effects of a declining lease can sometimes be overlooked, especially in a strong market, according to Wong Xian Yang from Cushman & Wakefield.

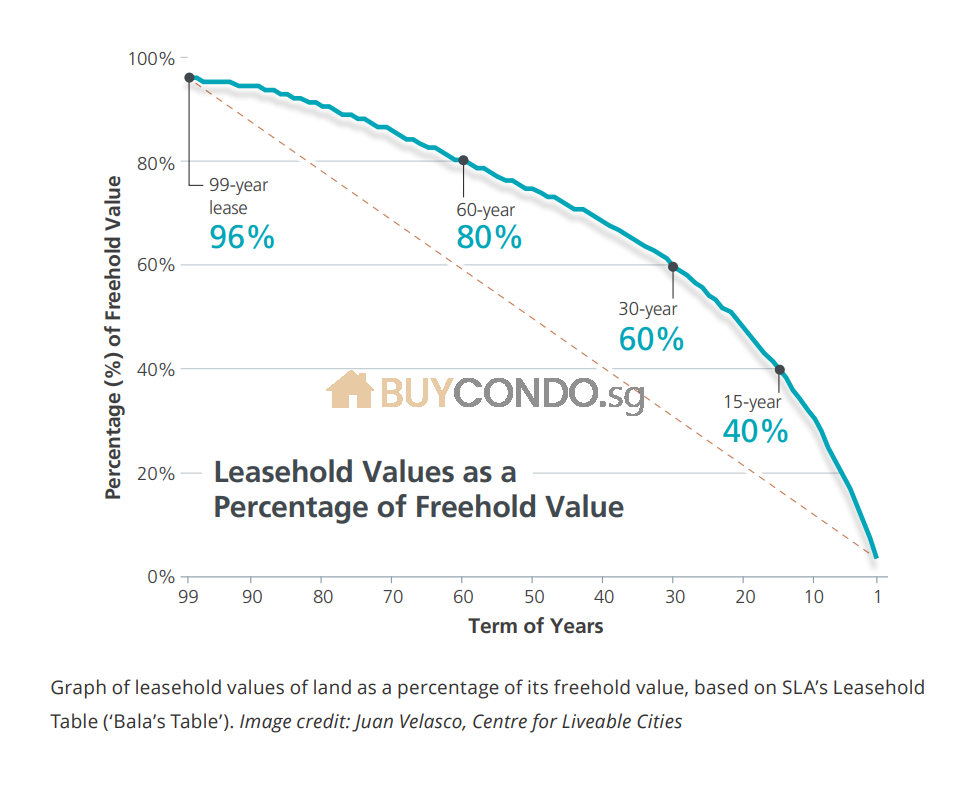

Alan Cheong from Savills Singapore explains that lease decay is not linear but follows a curved trajectory, often referred to informally as Bala’s Curve in real estate circles.

This curve suggests that the acceleration of lease decay becomes notable only after 70 years. The implication is that the optimal time for a collective sale is often before reaching this point. Historically, between 1995 and 2006, median prices of older non-landed private homes in Singapore aligned with this trend, as per Nicholas Mak from Mogul.sg.

However, since 2007, the median prices of these older homes have started to climb due to external factors like economic growth, population increase, and inflation rather than lease decline.

So is an aging 99-year leasehold property a “good deal”?

It depends, Industry experts said Some individuals acquire older condominiums for expansive living spaces, which are often scarce in today’s market and can be pricey if the buyer purchases a new property of a similar size,’ said OrangeTee’s Sun.

Many properties experienced double-digit percentage rises, particularly in certain regions. For example, Neptune Court in Bedok saw its median price surge by nearly 50 percent by 2024.

Similarly, People’s Park Complex, with just 43 years left on its lease, experienced significant price growth. Factors such as potential en bloc sales also influence these trends. Although financing restrictions exist for properties with shorter leases, some older leasehold properties continue to appreciate due to their strategic locations and development potential.

Christine Sun from OrangeTee Group highlights that an analysis of 15 aging 99-year leasehold condominiums showed price increases despite their advancing age.

Chuan Park in Lorong Chuan is one example, having sold for $890 million despite commencing its 99-year lease in 1980. These scenarios suggest that while newer properties can see rapid value appreciation, there remains an opportunity for significant capital appreciation in older leaseholds under the right conditions.

Conclusion : Lease decay Condos Is it Still Worth to buy?

Lee Sze Teck, Huttons Asia, for “evolving socioeconomic that it shows that aging leasehold. “We cannot conclusively say properties do not hold up well that the effects of lease decay are renewals are sometimes granted on the overall market’s performance,” more pronounced for 99-year case-by-case basis. Leasehold properties older than 45. Approvals will be weighed.

He said this is because of the price growth against long-term planning intent. For one, the agency said that URA’s index is influenced by new launches, which tend to trigger stations for these properties.

Since 2008, SLA has been granted renewals to just 28 residential developments, topping the leases up to 99 years. This was done to “facilitate the redevelopment of the land parcels”,

For investors, Cheong of Savills pointed out that as capital values decline over time, the yield should increase to compensate for the potential loss of all capital once the property’s lease expires. “For a property with many years of lease life remaining, the return of capital is masked by the noise in the imperfect transaction market,” he said. But as we get closer to the end of lease life, It starts to make its presence felt.

WIth Reference: Business Times Aug 09,2024

What to know what Condos is Biggest in Singapore?

Next upcoming inputs for Golden Mile Tower Back on the Market at $556m.

New launch Condo Launching:

Ex Golden Mile Complex Now Know as Aurea Condo.