Singapore Real Estate Market Outlook 2024

Prices of newly-launched developments

Prices in newly launched residential developments in the second half of 2023 (based on Savills´ Q3 and Q4 2023 report):

In Core Central Region (CCR):

- In Orchard Sophia, located at Sophia Road, prices of residential units ranged from SG$2,758 (US$2,039) to SG$2,895 (US$2,141) per sq. ft. Of the 78 units offered, 28 units are already sold.

In the Rest of the Central Region (RCR):

- In Watten House, situated at Shelford Road, residential units are offered for a price range from SG$3,077 (US$2,275) to SG$3,545 (US$2,621) per sq. ft. About 63.4% of the total 180 units available are already sold.

- In Grand Dunman, at Dunman Road, a total of 1,008 residential units are offered at a price range of SG$2,108 (US$1,559) to SG$2,805 (US$2,074) per sq. ft. About 57.3% were already sold.

- In Pinetree Hill, at Pine Grove, residential units are priced from SG$2,215 (US$1,638) to SG$2,705 (US$2,000) per sq. ft. Of the 520 units offered in the market, 143 units were already sold.

- At the TMW Maxwell, located on Maxwell Road, prices of residential units range from SG$3,143 (US$2,324) to SG$3,739 (US$2,765) per sq. ft. A total of 324 units are available.

In the Outside Central Region (OCR):

- In Hillock Green, located in Lentor Central, prices of residential units ranged from SG$1,882 (US$1,392) to SG$2,423 (US$1,792) per sq. ft. More than one-fourth of the 474 units offered were already sold.

- In J´den, located at the Jurong East Central 1, residential units are priced from SG$2,109 (US$1,560) to SG$2,824 (US$2,088) per sq. ft. About 89% of the 368 units available were already sold.

- In Lentor Hills Residences, located at Lentor Hills Road, prices of residential units ranged from SG$1,834 (US$1,356) to SG$2,451 (US$1,812) per sq. ft. Two-thirds of the 598 units offered are already sold.

- In The Myst, situated at the Upper Bukit Timah Road, residential units are priced from SG$1,897 (US$1,403) to SG$2,323 (US$1,718) per sq. ft. Of the 408 units available, 153 units are sold.

- In the Lakegarden Residences, at Yuan Ching Road, prices of residential units ranged from SG$1,880 (US$1,390) to SG$2,362 (US$1,747) per sq. ft. Of the 306 units available, 71 units were sold.

- In The Arden, situated on Phoenix Road, 105 residential units are offered for a price range between SG$1,565 (US$1,157) and SG$1,861 (US$1,376) per sq. ft. About 30% were already sold.

- In The Shorefront, at Jalan Loyang Besar, 23 residential units are offered in the market for a price range of SG$1,897 (US$1,403) to SG$1,919 (US$1,419) per sq. ft.

New rounds of property curbs

In February 2023, the government increased the buyer´s stamp duty rates for higher-value properties. More specifically, the portion of a property´s value in excess of SG$1.5 million (US$1.11 million) and up to SG$3 million (US$2.22 million) are taxed at 5%, while those in excess of SG$3 million are taxed at 6%.

Then in an expected move to restrain speculative buying and restrain house price increases, the government introduced another round of measures in April 2023, raising the additional buyer´s stamp duty (ABSD) rates further to “promote a sustainable property market and prioritize housing for owner-occupation,” said the Monetary Authority of Singapore (MAS), Ministry of Finance (MOF), and Ministry of National Development (MND) in a joint statement.

“Demand from locals purchasing homes for owner-occupation has been especially strong, and there has also been renewed interest from local and foreign investors in our residential property market,” said the authorities. “If left unchecked, prices could run ahead of economic fundamentals, with the risk of a sustained increase in prices relative to incomes.”

For Singaporean citizens, in April 2023 the ABSD rate was raised from 17% to 20% for those buying their second residential property, and from 25% to 30% for those buying their third and subsequent properties.

For permanent residents (PRs), the ABSD rate for second residential property purchases will rise from 25% to 30% and from 30% to 35% for third and subsequent property purchases.

Foreigners buying any residential property will now pay an ABSD flat rate of 60%, double the prior rate of 30%. For entities buying any residential property, the ABSD rate was also raised from 35% to 65%.

ADDITIONAL BUYER´S STAMP DUTY RATES Changes Compare from 2018 to April 2023

| ADDITIONAL BUYER´S STAMP DUTY RATES Changes Compare from 2018 to April 2023 | ||||

| Rates from Jul 6, 2018, to Dec 15, 2021 | Rates from Dec 16, 2021, to Apr 26, 2023 | New rates from Apr 27, 2023 | ||

| Singaporeans | Buying 1st residential property | 0% | 0% | 0% |

| Buying 2nd residential property | 12% | 17% | 20% | |

| Buying 3rd and subsequent residential property | 15% | 25% | 30% | |

| Permanent Residents | Buying 1st residential property | 5% | 5% | 5% |

| Buying 2nd residential property | 15% | 25% | 30% | |

| Buying 3rd and subsequent residential property | 15% | 30% | 35% | |

| Foreigners | Buying any residential property | 20% | 30% | 60% |

| Entities | Buying any residential property | 25% | 35% | 65% |

| Housing Developers | Buying any residential property | 25% + non-remittable 5% | 35% + non-remittable 5% | 35% + non-remittable 5% |

| Sources: Dentons Rodyk & Davidson LLP, MOF, MND, MAS, Global Property Guide | ||||

Months earlier, in September 2022, the Singaporean government introduced several market curbs to restrain property demand and encourage prudent borrowing. These include the following:

- The medium-term interest rate floor used to compute the total debt servicing ratio (TDSR) and mortgage servicing ratio (MSR) was raised by 0.5 percentage points for property loans granted by private financial institutions;

- An interest rate floor of 3% for Housing and Development Board (HDB) loan eligibility letter applications from September 30, 2022, was introduced; and,

- The loan-to-value (LTV) limit for HDB housing loans was lowered further from 85% to 80% of the flat value (after it was lowered from 90% to 85% in December 2021), effectively lowering the amount that home buyers can borrow;

- A 15-month wait period for current and former owners of private residential property to purchase a non-subsidized HDB resale flat was imposed from September 30, 2022, onwards.

These measures came after previous curbs in December 2021 raised the ABSD rates for nearly all types of buyers.

Singapore government firmly restrains property prices

The moderation of house prices over the past years is the result of deliberate government policy.

Before and after the global economic crisis, Singapore´s property market surged. The residential property price index rose 38.2% during the space of only one year to Q2 2010 (34% inflation-adjusted).

The Singapore government sensibly took steps, and when these turned out to be not enough, took further measures.

In October 2012 it limited the mortgage term to 35 years and lowered loan-to-value (LTV) ratios to 60% for loans longer than 30 years (or loans stretching beyond age 65).

This was only the first of 10 rounds of property-market cooling measures.

Seller´s stamp duty (SSD) was then introduced on owner-occupied housing sold within a year of purchase. A little later, the stamp duty was revised upwards, with sales of owner-occupied houses sold within a year of acquisition taxed at 16% of the sale price. Then the holding period was increased from one year to four years. In subsequent rounds, LTV ratios were lowered and the minimum cash down payment increased.

Despite these measures, property prices kept surging. In the sixth round, new residential loans were capped at 35 years, with existing loans over 35 years facing tighter LTV ratios. In the seventh round, the government revised the additional buyer´s stamp duty (ABSD), increasing rates from 5% to 7% for Permanent Residents (PRs) first residential property purchase, and Singaporeans´ second residential purchase.

This resulted in a 23.5% decline in sales transactions within a year, but prices continued to surge till the end of 2013.

Eighth, ninth, and tenth rounds of market-cooling measures followed.

These market-cooling measures have been effective, as evidenced by the 10% decline in property prices from 2014 to 2017.

After partially relaxing its market-cooling measures in March 2017, the Singaporean government reversed gear after 2017 sales reached 25,010 units, up 52.7% y-o-y – the biggest increase since 2009, according to URA.

From July 6, 2018, the ABSD rates were raised by 5% for all homebuyers and by 10% for entities, except for Singaporean citizens (SCs) and permanent residents (PRs) purchasing their first residential property. An additional ABSD of 5% was also introduced for developers buying residential properties for housing development.

The government also tightened loan-to-value (LTV) limits on residential property loans from 80% to 75%.

Also, the government raised the stamp duty on home purchases with a value exceeding SG$ 1 million (US$ 739,590) from 3% to 4% in February 2018.

These property curbs have successfully restrained the market in recent years.

Residential property sales still weak

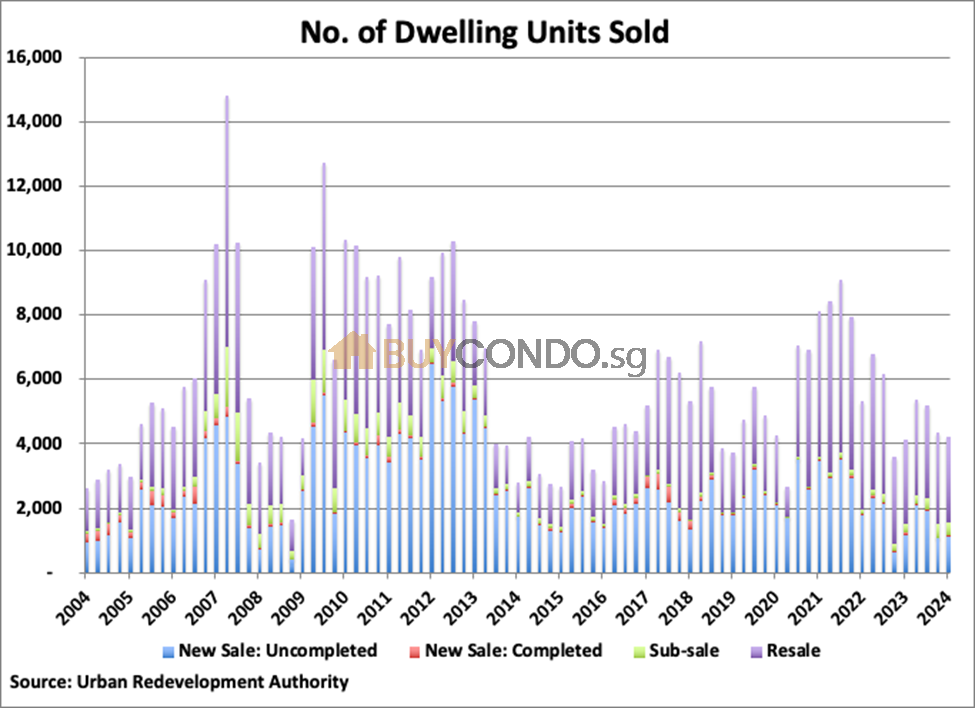

Demand remains fragile, amidst the introduction of new rounds of market-cooling measures. During 2023, total home sales, which include new sales, sub-sales and resales, plunged 13% year-on-year to 19,044 units, following a huge decline of 34.8% in 2022, according to URA figures. In fact, it was the lowest level recorded since 2016.

“Over the past year, potential homebuyers have become increasingly cautious, prompted by successive rounds of market cooling measures, economic challenges, and elevated financing costs. With a greater array of choices and rising prices, homebuyers are now more discerning and price-sensitive, resulting in slower sales as they deliberate longer before committing to a purchase,” said JLL.

Then in the first quarter of 2024, there were a total of 4,230 home sales recorded, up by a modest 2.6% from a year earlier but down by 2.4% from the previous quarter.

In Q1 2024:

- Uncompleted private residential property sales fell by 3.4% y-o-y to 1,124 units, following a 9% decline in the whole year of 2023.

- Completed private residential property sales plunged by 57% y-o-y to 40 units, after falling by 24.2% in 2023.

- Sub-sales skyrocketed by 55.1% y-o-y to 377 units in Q1 2024, after increasing strongly by 69.2% in 2023.

- Re-sales rose modestly by 2.6% y-o-y to 2,689 units, following an annual decline of 19.2% in 2023.

By region:

- In Core Central Region, property sales plummeted by 44.5% y-o-y to 605 units in Q1 2024 from a year earlier, following a decline of 17.8% in the full year of 2023. On a quarterly basis, sales were down by 18.7% in Q1 2024.

- In the Rest of the Central Region, sales were up by 5.1% y-o-y to 1,148 units in Q1 2024, an improvement from a 2.2% fall in 2023. Though quarter-on-quarter, sales were still down by 5% during the latest quarter.

- In Outside Central Region, sales increased strongly by 27.8% y-o-y to 2,477 units in Q1 2024, a sharp turnaround from a decline of 18.2% in 2023. On a quarterly basis, sales were up by a modest 4% in Q1 2024.

Foreign demand is falling

Nearly 39% (about 2.3 million) of Singapore´s population are foreigners, the sixth-highest percentage of foreigners in the world. Of these, more than 9% (o.54 million) are permanent residents, and the remaining 28% (1.8 million) are expats, based on figures from the Department of Statistics Singapore.

Tighter immigration rules are being imposed by the government, due to strong popular disquiet. Beginning 1 September 2015 work pass holders need to meet a minimum fixed monthly salary of SG$5,000 (US$ 3,706) to sponsor the stay of their spouse/children here (on Dependant´s Pass) and a minimum fixed monthly salary of SG$10,000 (US$7,411) to sponsor the stay of their parents here (on Long Term Visit Pass).

Aside from the tighter immigration rules and the imposition of market-cooling measures, the COVID-19 pandemic has adversely impacted demand from foreign homebuyers in the past years.

In the past four years from 2020 to 2023, the total number of private houses purchased by foreigners in Singapore dropped to their lowest levels in the past two decades. According to real estate consultancy firms ERA Realty Network and Orange Tee & Tie, the share of foreign homebuyers to total sales in the country fell to 4.1% in 2020, 4.5% in 2021, and 3.5% in 2022, as compared to about 7% to 8% share a decade ago. During 2023, the foreigners´ share in total house purchases was estimated at about 3%.

In fact, in Q4 2023, foreigners accounted for just 1.5% of the total number of private homebuyers in Singapore.

Purchases made by foreigners plunged to just 62 in Q4 2023, sharply down from 271 in Q1 2023 and the lowest level since the government first introduced ABSD in December 2011, said Lee Sze Teck of Huttons.

Mainland Chinese buyers typically account for the largest group of non-Singaporean homebuyers in the country, followed by Americans, Malaysians, Qataris, Indonesians, and Indians. In 2022, they purchased 241 non-landed private homes in Singapore, which constituted 26.5% of transactions by foreign buyers. However, it was the lowest since 2010 and represented only about 1.3% of total condo sales, said PropNex CEO Ismail Gafoor. Then in the second half of 2023, the number of homes purchased by Chinese buyers plunged to just 11, down from 177 in H1, according to Huttons.

As such, American buyers overtook the Chinese to become the biggest group of foreign homebuyers in Singapore in H2 2023. US citizens are treated the same as Singapore citizens under the US-Singapore Free Trade Agreement, that is, no additional buyer´s stamp duty is payable on the first Singapore residential property purchase.

Foreign demand is expected to remain subdued in the medium term, amidst the imposition of another round of market-cooling measures in April 2023, raising the ABSD rates further for nearly all types of buyers, including foreign homebuyers.

For foreigners, the ABSD doubled from the previous flat rate of 30% to 60%.

After the move, the proportion of foreign homebuyers in the CCR fell to 5.3% in Q3 2023, lower than the 10% in Q2 2023 and 15% in Q1 2023.

Foreign demand continues to fall this year. In Q1 2024, purchases by non-PR foreign buyers in Singapore accounted for just 1% of the total private transactions, down from a 6.4% share in Q1 2023, according to JLL.

“While total private residential transactions slowed 2.4% q-o-q in 1Q24, the latest available data on the URA Real Estate Information System (REALIS) showed that transactions involving non-permanent residents (non-PR) foreign buyers, fell more significantly, by 34.8% q-o-q, to only 43 units in 1Q24,” said JLL.

Foreigners have been able to buy any apartment without prior government approval since the Residential Property Act of July 19, 2005. However, foreigners still cannot purchase vacant land and landed properties without permission from the Singapore Land Authority. Non-residential property is not subject to these ownership restrictions.

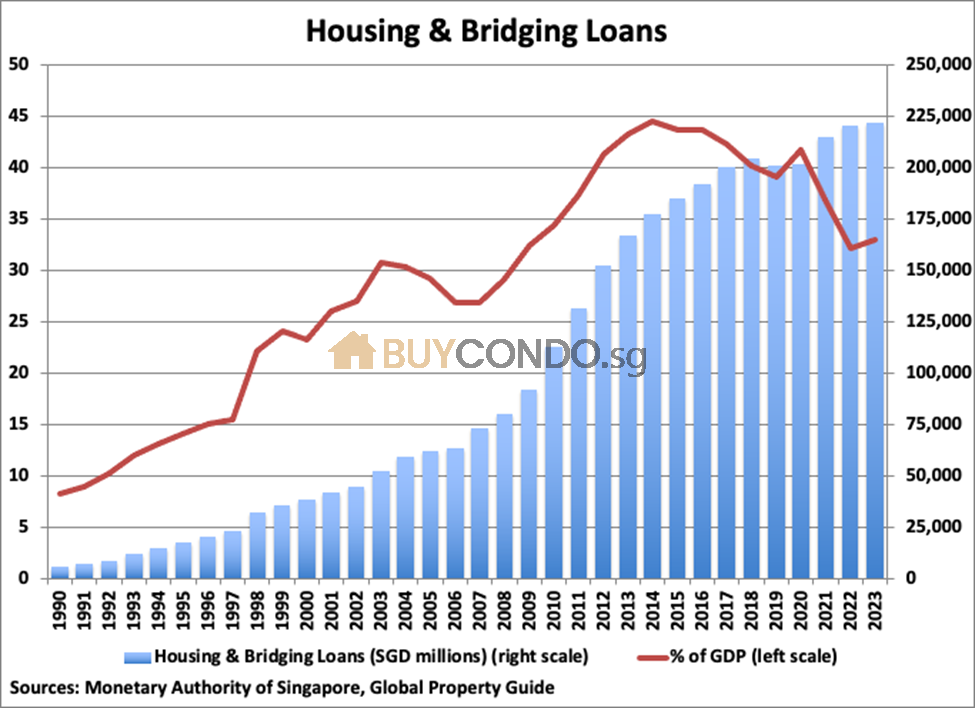

Mortgage loan growth decelerating fast

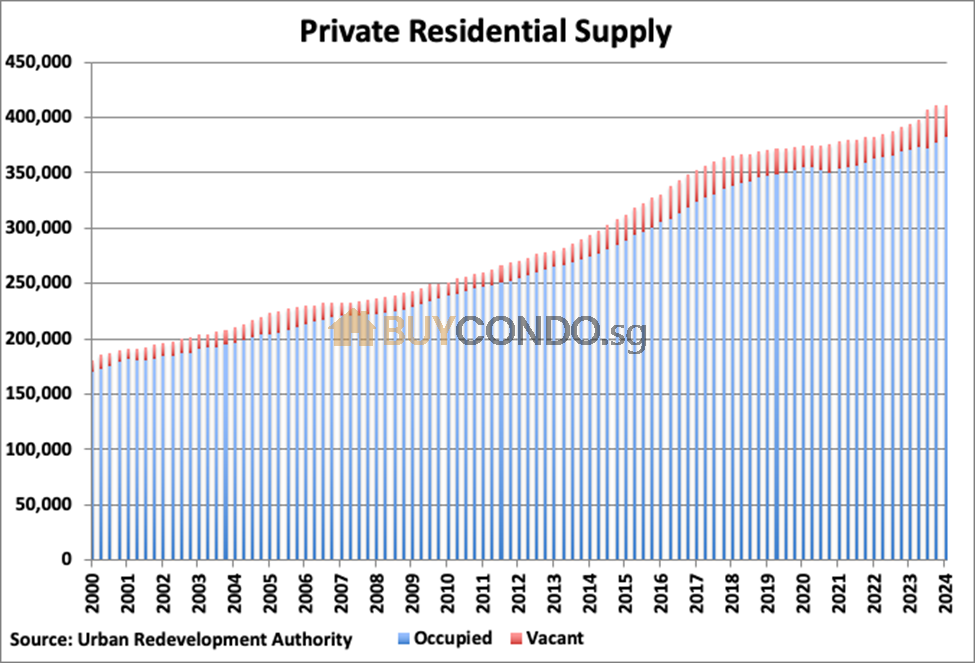

During 2023, outstanding housing loans rose by a minuscule 0.7% from the prior year to SG$222.02 billion (US$164.75 billion), following annual growth of 3.6% in 2022 and 6.7% in 2021, based on figures from the MAS.

About three-fourths of the outstanding housing loans are for owner-occupied properties while the remaining are for investment properties.

As a percent of GDP, the size of the mortgage market contracted to an equivalent of 33% in 2023, down from 36.8% in 2021, 39% in 2019, 42.3% in 2017, and 43.6% in 2015, based on estimates by the Global Property Guide.

Variable interest rate mortgages dominate Singapore´s housing market. Tweaking the rate on mortgages, plus government restrictions on land use and ownership, has helped pre-empt a housing boom despite sharply lower interest rates over the past decade.

Conclusion:

| MAJOR UPCOMING LAUNCHES, Q1 2024 | ||||

| Project | Location | Developer | Locality | No. of Units |

| Amber Sea | Amber Gardens | Urban Park Pte Ltd | RCR | 132 |

| Residential apartments | Enggor Street | New Vision Holding Pte Ltd | CCR | 114 |

| Kassia | Flora Drive | Tripartite Developers Pte Ltd | OCR | 280 |

| The Hill @ One-North | Slim Barracks Rise | Kingsford Real Estate Development Pte Ltd | RCR | 142 |

| Residential apartments | Cairnhill Rise | Ju-I Properties Pte Ltd | CCR | 75 |

| Newport Residences | Anson Road | Hong Leong Properties Pte Ltd | CCR | 443 |

| Skywaters Residences | Shenton Way | Perennial Shenton Property Pte Ltd | CCR | 201 |

| Marina View Residences | Marina View | Boulevard Development Pte Ltd/ Boulevard Midtown Pte Ltd | CCR | 683 |

| Sora | Yuan Ching Road | Lakeside Residential Pte Ltd | OCR | 440 |

| The Collective At One Sophia | Sophia Road | Sophia Residential Pte Ltd/ Sophia Commercial Pte Ltd | CCR | 367 |

| Hillhaven | Hillview Rise | East Residences Pte Ltd | OCR | 341 |

| Lentoria | Lentor Hills Road | Lentor View Pte Ltd | OCR | 267 |

| The Arcady At Boon Keng | Serangoon Road | KSH Ultra Unity Pte Ltd | RCR | 172 |

| Condominium development | Jalan Tembusu | Sim Lian JV (Katong) Pte Ltd | RCR | 847 |

| Lentor Mansion | Lentor Gardens | Lentor Mansion Pte Ltd | OCR | 533 |

| Landed housing development | Luxus Hill Heights/ Seletar Green Walk | Singapore United Estates Pte Ltd | OCR | 156 |

| Residential apartments | Tanjong Rhu Road | ZACD LV Development Pte Ltd | RCR | 107 |

| Source: Savills Residential Sales Briefing, Q4 2023 | ||||

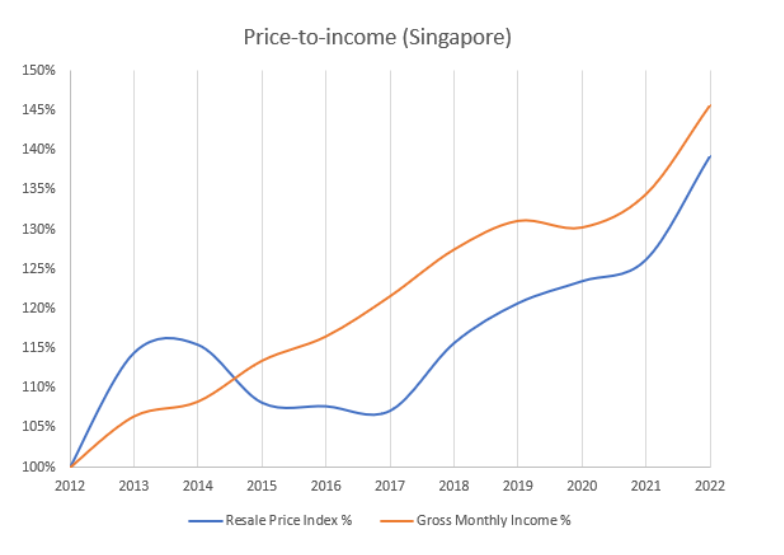

In the period from 2022 to 2023, rental prices have been vigorously pursuing resale prices, narrowing the gap between them.

This indicates that the surge in property prices is well-supported by a corresponding increase in rental prices.

However, it is crucial to acknowledge that current rental prices are exorbitant and not sustainable in the long run unless there is a matching growth in income.

If rental prices stabilize and grow at a relatively similar pace to income, it will ensure that future property price hikes remain sustainable from a rental standpoint.

Price-to-rent and price-to-income ratios remain favourable, indicating a healthy property market.

These two metrics hold immense significance as they provide insights into the sustainability of buyers’ mortgages.

Considered as “bubble” indicators for the residential property market, they play a crucial role.

Mortgage payments rely on rental income and personal earnings.

Therefore, if property prices rise significantly faster than rent and income, it becomes evident that buyers are driven by the fear of missing out (FOMO).

Unfortunately, such behavior leads to financially unsound purchases and excessive reliance on rental income and personal earnings.

In their pursuit of catching the hype train, individuals disregard their own financial stability.

Private Residential Market

Will Property Prices Drop in 2024 Singapore

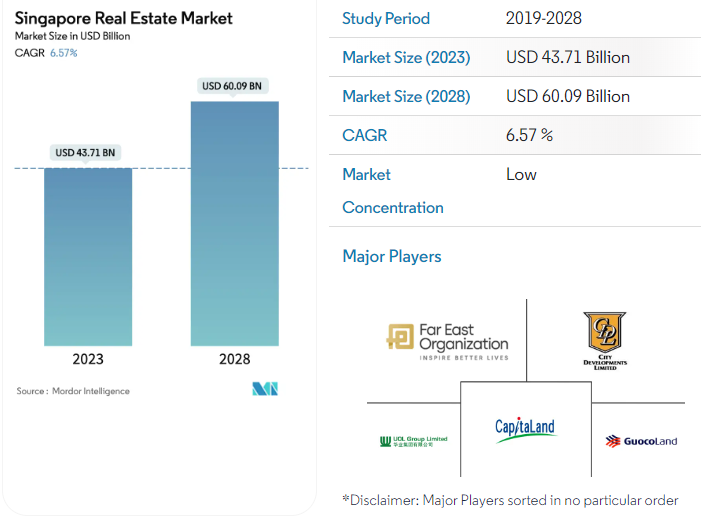

Singapore Real Estate Market Analysis for 2023-2028

The Singapore Real Estate Market size is estimated at USD 43.71 billion in 2023, and is expected to reach USD 60.09 billion by 2028, growing at a CAGR of 6.57% during the forecast period (2023-2028).

Affordable housing projects in the country drive the market. Furthermore, the market is driven by the demand for logistics and industrial real estate.

- Singapore’s real estate market is a haven for foreign investors, and property value is growing steadily. Amidst COVID-19, the Singapore real estate market recorded growth in 2021. According to sources, there were 28,734 non-landed residential transactions in 2021, registering sales of USD 2 billion. This was a 57% increase from 2020 when the total transaction volume reached 18,295. Of the transactions, 12,574 were new launch properties, while 15,677 were resale properties.

- Affordable projects dominated the market in Q3 2021, with 9 out of 10 best-selling projects in the Outside Central Region (OCR). This was mainly due to the excellent performance from launches in the past two years and the preference for larger homes due to enduring work-from-home arrangements. The sustained growth over the past one and a half years of the private property market in Singapore is a strong signal of property sellers’ unwavering confidence in the market. The property price growth is likely to continue, but it shows signs of slowing down alongside decreasing transaction volumes.

- In the office sector, more occupiers have been eyeing locations farther away from the city centre to woo talent. In contrast, others rejig their real estate footprint to enable employees to work in less-dense spaces. Large technology firms in Singapore are further set to drive office demand and co-working space shortly as Singapore is emerging as a technology hub. In the hospitality industry, the Singapore Tourism Board (STB) launched BOOST (Building On Opportunities to Strengthen Tourism), i.e., a USD 90 million initiative to increase the tourist influx within Singapore. Business Travel, Meetings, Incentive Travel, Conventions, and Exhibitions (BTMCE) are some of the significant sources of revenue for the country’s hotel real estate industry.

- The extended low-interest-rate environment will increase the attractiveness of commercial real estate in Singapore, especially those that can provide stable returns. The outlook of an improving property market in Singapore, affordable loans, and relatively more inexpensive small apartments have attracted many investors to real estate. As for industrial real estate, the robust growth momentum has persisted. New warehouse supply is slated to come online, with notable projects in Singapore’s western region, including Logos EHub, which accommodates a broad spectrum of e-commerce uses.

Singapore Real Estate Market 2022-2023

The real estate market refers to selling real estate services by entities (organizations, sole traders, and partnerships) that rent, lease, and allow the use of buildings and land. A complete background analysis of the Singapore Real Estate Marke, including the assessment of the economy and contribution of sectors in the economy, market overview, market size estimation for key segments, and emerging trends in the market segments, market dynamics, and geographical trends, and COVID-19 impact is included in the report.

The Singapore Real Estate Market is segmented By Property type (Residential, Retail, Logistics/Industrial, Hospitality, and Office) and Value (Premium, Luxury, and Affordable). The report offers the market size and forecast values (USD billion) for all the above segments.

By Property Type

Retail

Logistics/Industrial

Hospitality

Office

By Value

Premium

Luxury

Affordable

Singapore Real Estate Market Trends

This section covers the major market trends shaping the Singapore Real Estate Market according to our research experts:

Rise in the Residential Segment of the Singapore Real Estate Market

Despite a struggling economy caused by the COVID-19 pandemic, Singapore’s housing market remains healthy. According to the Urban Redevelopment Authority (URA), prices of private residential properties increased by 5.0% in Q4 2021, compared with a 1.1% increase in Q3 2021. For the whole of 2021, prices of private residential properties increased by 10.6%, compared with the 2.2% increase in 2020. Prime properties at preferred locations are still expected to be the hotspot locations with the high asking prices. The rise of the middle class creates a desperate need for urban real estate, including residential housing.

Growth in the Retail Sector in Singapore

Store expansions and openings are expected to advance as retailers adapt to the new retail environment post-COVID-19. Retail market recovery is expected to be long-drawn, given the risks and uncertainties still lingering. However, it will be mitigated by the moderate level of upcoming supply.

The number of retail properties listed for mortgagee sale jumped by 62% in 2021 to 84 from 52 in 2020. There were also 101 owner-sale listings of strata retail units in 2021, soaring from just 17 in 2020.

The widening of the two-tier market is anticipated to continue the hold, although rental corrections and vacancies for the secondary locations and floors in prime locations could present opportunities. Retail logistics has remained a resilient asset class amid the pandemic, with stable rental growth expected in line with the gradual recovery of Singapore’s economy. The subdued supply pipeline will continue to lend support to occupancy.

Singapore Real Estate Market Overview

Singapore’s real estate market is moderately competitive, with prominent domestic players having a presence in this sector and a sizeable number of foreign investors. Some major players are UOL Group Limited, CapitaLand, City Developments Limited, GuocoLand Limited, Far East Organization, and many more. The housing market has an overall positive sentiment, and investors are eyeing prime locations in the country. Moreover, post-pandemic, the government expects more upcoming projects offering real estate companies lucrative opportunities for investment and construction. With the increasing property prices, Singapore’s real estate market provides a competitive market to developers, buyers, and investors alike.