Rental Market in Singapore 2024

Tanglin/Holland/Bukit Timah: Average Yield – 3.85%

Hougang/Punggol/Sengkang: Average Yield – 5.03%

Alexandra/Commonwealth: Average Yield – 4.85%

Orchard/River Valley: Average Yield – 3.98%

East Coast/Marine Parade: Average Yield – 4.12%

Newton/Novena: Average Yield – 4.25%

In 2023, The Rental are seeing softening by seeing the available units turnover has slown down by quite abit. There are more units there is available immediate vs to two years back the supply is based on a back locks. Units are putting in the market three to five months ahead of the lease expiry.

For Landlords whom the leases is ending. You may want to review your pricing strategy.

Luxury Property Rental units. The Price will be expected to be stable as the high property tax and income taxes have largely raised the cost of renting; these are deterring the foreign landlords to rent cheaper to subsidize the tenants.

Let me add my own insights just for reference given that we have been listing properties and see response and communications with the landlords and tenants.

$18,000 per month above Category. Rent Price will remain Strong.

$10,000 -$17,999 per month above Category. Rent Demand slightly lesser. Tenants now have more choices.

https://buycondo.sg/property/the-teneriffe-cluster-landed/

$8,000 – $9,999 Rent Price will remain Strong. Due the Expats relocating with the families these price range is expected and within their price when they move their entire family over.

$6,000 -$7,999 In this price range, The demand will be good if the size of the apartment is minimum 1,000sqft above. Below 1000sqft the rental price may drop to lower tier nearer to $5,000.

$4,000 – $5,999 In this price range, Depends on the location and the Size.

$4000 and below. In this category, 1 bedroom rents would be weak, apparently a 1 bedroom in Geylang or Joo Chiat can ask for $3,300 and a similar rent or slight higher can get you brand new Condo Near Town. ( This Category landlords should review the price accordingly and not the held the price for too long. Renting out the property with less vacancy is the key)

One way to lease out the property faster and with a stable and tenancy landlord can also consider co-living. We have a panel of operators that worked closely with us as part of our property management services. We screen and shortlist the co-living companies that can provide sustainable, prompt payments and with maximise rental efficiently. Contact us and we can advise you accordingly.

Real Estate Market Outlook for Final Quarter 2023 and 1st Quarter 2024 Not optimistic.

📉 The market is experiencing a meltdown, and the ripple effects may surface after another six months later, perhaps.

The Asking Price and Number of units available do not match the actual demand. There will be more empty units given that more condos have also obtained TOP. Normanton Park, Avenue South Avenue, Sky Everton, Dairy Farm Residences and many more.

Tell Tale Signs.

🏠 Landlords not having enough viewing request after listing the property two months before lease expiry.

🏠 Sellers may experience a lot of viewing but still cannot sell due to low supply in the market.

💣 The lowest transaction volume in the last 50-60 months is a warning sign for the Singapore property market.

🤔 The property market is in a confusing and contradictory period, causing prices to be balanced, corrected, and stabilized.

🤔 Interest rates dropping may not be enough to counter the negative impact of external factors on the property market.

Closer Working Relationship with Your Appointed Salesperson

🏠 A property’s marketing strategy and pricing can determine whether it is seen as a serious sale or just an over-priced “show unit”, impacting buyer interest and decisions.

🏠 Agents to add value by being a consultant and advisory role to proactively prepare customers and update the market.

🏠 Understanding how to strategize and plan in a down market is crucial for survival in the real estate industry.

Private residential rents fall 2.2% in May: Savills

Despite the month-on-month decline, the average median rent for a three-bedroom home has still risen 17.8% year on year

The average median rent for private non-landed homes in Singapore declined 2.2 per cent in May

2023, in contrast to the 2.4 per cent increase in the previous month, the Savills May 2023 Rental Guide indicated.Savills said the softening of rentals for this one-to-four bedroom category was due to an increase in new housing supply in 2023, as more projects are near completion and construction delay issues have

been resolved. It also noted that the challenging macroeconomic situation has compelled companies to tighten their budgets for staff. Cost-cutting has

extended to measures such as a smaller budget for expatriates’ rental use as well as staff layoffs.Savills’ executive director of research and consultancy, Alan Cheong, commented that the weakening rental is a relief for people seeking to find accommodation, as rental rates “in more districts start to soften”.

In Cheong’s view, the impact to landlords is marginal as their overall yields remain healthy. Despite weakening in rents, healthy overall yields allow landlords to “effectively counterbalance higher interest costs”. For investors, Cheong added that their financial positions are still well protected as the rental decine remains moderate. By unit type, the average median rent for a three-bedroom home decreased 3.2 per cent month on month. Year on year, the average

median rent increased by 17.8 per cent. In terms of the sub-market with the highest median monthly rents, Savills noted that District 4 was

ranked the highest at SS9,300 per month. This includes areas such as Sentosa, Mount Faber, Keppel andTelok Blangah.

This was followed by District 1 (Chinatown, Boat Quay, Havelock Road, Marina Square, Raffles Place, Suntec City) at S$8,500 and District 9 at S$7,500 (Cairnhill, Killiney. Leonie Hill, Orchard, Oxley). Marcus Loo, chief executive officer of Savills Singapore, said he believes the period of rising private home rents is over as more homes come onto the market with the passing of the pandemic. He added that as economic headwinds strain tenants’ budgets, the rental correction would “allow the

market to reset to a more sustainable foundation for the longer-term good of the economy”. Analysts say that rentals have softened on the increase in new

housing supply, as more projects are near completion and construction delay issues have

been resolved.

THE BUSINESS TIMES

Wednesday Jul 12,2023

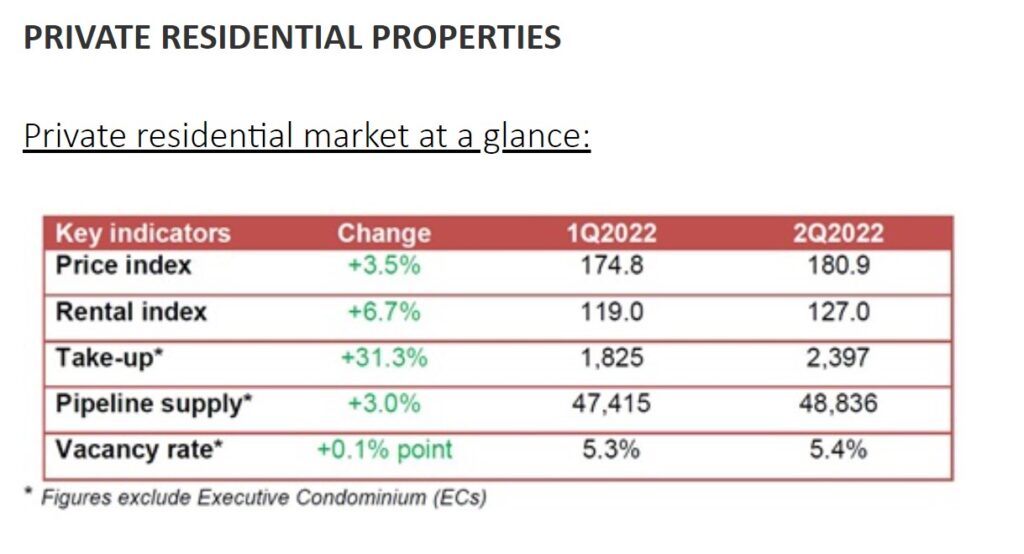

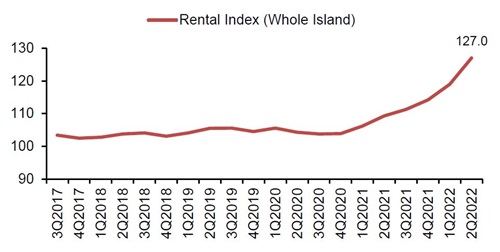

Rental Market in Singapore FOR 2022-2023 has been on the rise, especially from the beginning of 2022, and this trend is expected to continue in the short term.

Inflation is hitting Singapore’s housing market hard, and the next step of the property journey will be much more expensive.

Now for the rental housing market in Singapore, the recent hike in rental rates is no secret, largely due to the Construction delays of the new HDB flats and residential development.

The rental market in Singapore is heating up, with prices rising 8.5% in the first half of 2022.

Price hikes are increased Rental demand due to the pandemic and delays in the supply of new housing developments.

Change of Lifestyle leads more tenants working from home to look for bigger spaces.

Foreigners are looking to bring their families to Singapore (Such as Hongkong/China).

More Locals want to rent after selling their properties.

Home Owners that sold their homes but are still trying to prepare a new place in time.

Now either the renovation needs more time to be completed, or they can’t find a suitable new property at a reasonable price.

While high rental prices might be unsustainable in the long run, they are there to support rising home prices.

In case of the market turns, it might need more willing renters due to shrinking demand from prospective tenants.

Before 2020, the rental market was on the decline, and in 2017 prices started to stabilize from 2018 onwards.

Once all the residential under-construction developments are obtained TOP, that will help to fulfil the demand of the renters.

Although we are seeing the volume of transactions (Depend Sectors) has been shrinking the rental prices have made a parabolic move upward.

The renter market is booming, including HDB and Private Residential Properties.

Landlords are not inclined to lower prices due to the vast number of enquiries flowing in at this stage. Especially with the Rising Interest Rates.

Private Properties vs HDB Rental Market in Singapore 2023-2024

The condominium and apartments are the largest rental market in Singapore by volume.

In the event of a price decline, it will be private properties followed by HDB rental prices.

Alternatives to Renters (HDB Flats)

Renters might go to find more affordable renter options in the HDB rental market, pushing the prices there higher instead.

Rents are increasing at an alarming rate, if you’re still looking, do act on it.

So why are rental prices rising, and will they continue to rise? Numbers don’t lie.

Rental prices have risen, possibly due to a search in demand from people who want their place.

Get predictions for the rental market

Condo rents are the ones to watch to see if a bubble is forming in the rental market.

Unlike HDB, landed rentals still have the potential to keep rising in the short run.

The rental market is constantly evolving

– Get ahead of the competition.

– Stay informed about market changes.

– Feel proud of yourself for outsmarting the system.

– Secure a place for your family in this ever-growing city.

– Feel like you’re on top of the world as you watch your investment grow.

– Will Your Rental Income Continue to Increase for Landlords?

Conclusion

Global citizens might choose to live in a haven like Singapore, so the demand for rental properties will continue to rise.

The rental market for condominiums and apartments will continue to heat up, which is undoubtedly good news for Landlords who own investment property

If you’re a real estate investor in Singapore, it’s crucial to stay up-to-date on the latest market trends.

Being a Property Agent in Singapore 2023