As I reflect on my journey through the dynamic Singapore property market, I can’t help but marvel at how the delicate dance of timing, market trends, and strategic decisions weave together the tapestry of property appreciation in Singapore. The story behind each condominium resale value is unique—a fusion of historical moments, long-term visions, and the pulse of a vibrant city’s economy. I have seen the practical magic of turning investments into significant gains, and now, I share these learnings with you. Let’s navigate the ever-evolving Singapore property market trends together, as I unravel the secrets behind maximizing the ROI on condo sales in the bustling city-state of Singapore.

Key Takeaways

- Understanding market dynamics is key for maximizing ROI on condo sale in Singapore.

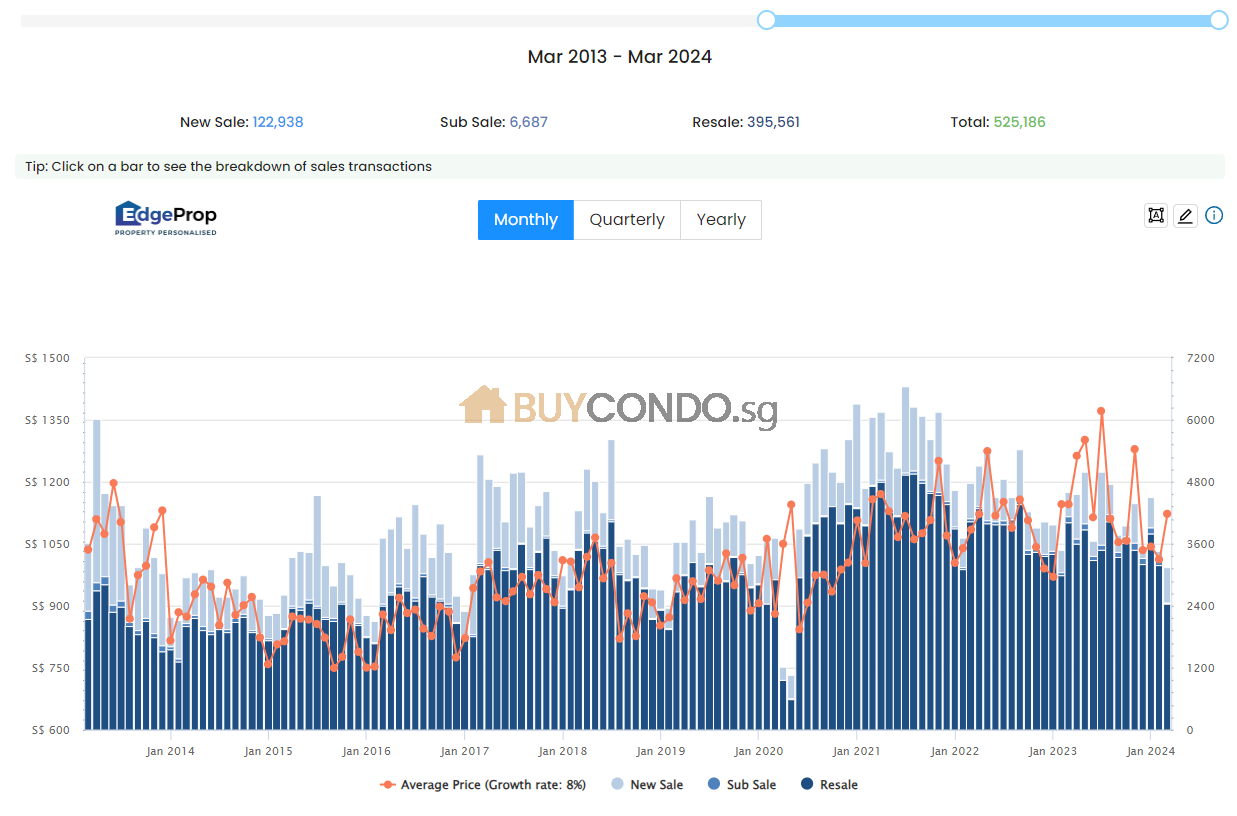

- Historical data showcases the importance of buying during cooler market periods and selling during peaks for appreciable gains.

- New launches in Singapore can present early bird discounts adding to the attractiveness of condominium resale value.

- Realizing the potential for property appreciation in Singapore requires a keen sense of market timing and trends.

- Comprehensive knowledge of Singapore property market trends can lead to savvy investment decisions.

- Rental income potential plays a crucial role in the overall profitability and should be factored into ROI calculations.

Understanding ROI in the Singapore Condo Market

As an investor, understanding the nuances of the condominium resale value in the vibrant Singapore market is pivotal. Delving into the residential property ROI calculation can provide insights that secure maximized profitability when selling your asset. I’ve learned that analyzing contributing factors to ROI is as critical as the visible profits of a sale. Let’s explore the various elements that influence your return on investment in this competitive landscape.

Evaluating Profit vs. Investment Cost

To begin with, a comprehensive real estate market analysis is necessary to evaluate the potential gains against the sum of investment costs. This analysis often reveals that profits are impacted by both the sale price and the varied expenses incurred from acquisition to the point of sale. Reflecting on my own experiences, it seems evident that understanding this balance can differentiate between a merely satisfactory deal and a lucrative sale.

The Impact of Market Conditions and Trends on ROI

Market conditions undeniably shape the condominium resale value, heavily impacting overall ROI. My observations reaffirm that external factors, such as regulatory cooling measures or market trends, must be considered in forecasting the investment’s yield. For savvy investors who keep abreast of these conditions, the ability to maneuver for maximizing condo sale profits becomes inherently sharpened.

Components of ROI Calculation for Condo Sales

Precise residential property ROI calculation involves more than just subtracting the original purchase price from the sale price. Additional expenses, often overlooked, play a significant role in determining the accurate ROI. These include renovation costs, maintenance fees, and even potential rental incomes lost during periods when new developments are not yet habitable. Clear-cut understanding of these components is vital for investors aiming to make informed decisions.

| Investment Aspect | Details | Impact on ROI |

|---|---|---|

| Purchase Price | Initial Cost of Condo | Baseline for Profit Calculation |

| Renovation and Maintenance | Improvement Costs Incurred | Can Enhance or Reduce Profit Margins |

| Market Timing | Period of Acquisition and Sale | Capitalizes on Market Highs and Lows |

| Regulatory Changes | Cooling Measures and Stamp Duties | Influences Buy/Sell Price Point |

| Rental Income | Potential Earnings from Tenants | Additional Revenue Stream Prior to Sale |

By weaving together these insights, investors in Singapore’s real estate domain can facilitate strategies that not only boost condominium resale value but also ensure maximization of returns in every deal they embark upon. My journey has taught me the importance of a meticulous approach to ROI calculations— it has been the cornerstone of my successful property investments thus far.

Analysis of Property Appreciation in Singapore

As I delve into the Singapore property market, a consistent trend emerges, underscoring the significance of strategic investments to benefit from property appreciation in Singapore. The condominium market particularly showcases an intricate pattern where smaller units and leasehold terms often command higher percentage returns. This observation aligns seamlessly with the broader Singapore property market trends, which suggest that entry costs and demand play a pivotal role in investment profitability.

Potential investors must consider these factors when selecting properties for investment. The competitive advantage of newer leasehold developments has not only been a temporary phenomenon but a solid trend over an extended period. This insight is the product of analyzing data spanning from 2013 to 2023, a period that encapsulates a full cycle of market highs and lows.

In the Singapore real estate market, a clear distinction has been made between leasehold and freehold property appreciation, with the former showing more aggressive growth over time. This reinforces the sentiment that in the fast-moving realm of real estate, long-term ownership benefits need to be weighed against the potential for significant appreciation in a shorter time frame.

| Property Type | Average Percentage Return (2013-2023) | Notable Trend |

|---|---|---|

| Leasehold Units | Higher Returns | Favored in New Launches |

| Freehold Units | Stable Returns | Premium Long-Term Investment |

| Smaller Units | Lower Returns | Lower Entry Costs and Lesser Demand |

The implications of these findings are straightforward for my investment strategy. By targeting smaller, leasehold condos, especially those introduced to the market via new launches, I am positioning myself to take full advantage of the cyclical nature of property appreciation in Singapore. This effective tactic has been honed and validated through meticulous observation of Singapore property market trends, and it aligns with my commitment to make informed, data-driven decisions in the property investment landscape.

Maximizing Condo Sale Profits

When I decide to put my condo on the market, my overarching aim is to maximize profits and ensure my investment yields the highest return possible. The key is to tap into strategic condo selling strategies and have a firm grasp on real estate market analysis to determine when and how to list my property. In Singapore, where property appreciation can significantly affect outcomes, each decision must be data-driven and well-timed.

Optimal Timing for Listing Your Condo

From my observation, timing plays a critical role. Listing my condo during a market high, after significant property appreciation in Singapore, naturally positions me for better returns. By analyzing market trends and economic indicators, I can more effectively predict those peak periods that are likely to attract serious buyers willing to pay a premium for properties like mine.

Effective Pricing Strategies in the Current Market

Setting an effective price is a balancing act. The figure should be competitive enough to draw attention in the bustling Singapore real estate scene while ensuring that my financial goals are met. This requires a keen understanding of the current market, including how similar units in my area are priced and how they’re moving in terms of sales. I leverage this information to craft a pricing strategy that aligns with maximizing condo sale profits.

Enhancements and Renovations to Increase Resale Value

To further sway the odds in my favor, I consider investing in enhancements and renovations that can significantly boost my condo’s appeal. Targeted upgrades, such as modern finishes or smart home features, can be the deciding factor for potential buyers evaluating my property against others. Naturally, these improvements must be cost-effective to maintain a healthy profit margin upon selling my condo.

In conclusion, each step in the process of selling a condo in Singapore—from timing the market to setting the right price and making strategic enhancements—is integral in turning a substantial profit. Through careful planning and execution of these condo selling strategies, my efforts culminate in successful sales that reflect both the current trends and the lasting value of Singaporean real estate.

ROI on Condo Sale in Singapore: Case Studies and Data Insights

When I examine the ROI on condo sales in Singapore, I consider various case studies that shed light on the intricate nature of condo investment returns. One such case study involving The Stirling showcases the significant property appreciation in Singapore’s Potong Pasir area. Here’s how it played out:

“I analyzed The Stirling Residences’ transaction history and found that units sold within five years from their launch appreciated with a growth rate of 28% based on the average price, indicating a robust ROI.”

Similarly, another development that provides critical data insights is Artra, located in Redhill. This development’s strategic location and modern amenities exemplify the factors contributing to positive condo investment returns in the respective market.

I analyzed Artra transaction history and found that units bought during 2017 untill today 2024 from their launch appreciated with a growth rate of 45% based on the average price, indicating a robust ROI.

With such insights:

Data suggests that timely investments in these types of properties can lead to substantial property appreciation in Singapore.

Much of this success hinges on multiple variables such as:

- Development scale

- Tenure

- Location

- Market conditions at the time of purchase and sale

This comprehensive approach to analyzing ROI on condo sale in Singapore through real-life examples confirms the vital role of personalized investment strategies to achieve desirable returns. The specific case studies of The Poiz Residences and Queens Peak allow me to understand how choices made at the time of purchase—and the external factors prevalent during the sale—directly impact the investment’s profitability.

Taking it a step further, I juxtaposed the ROI from condo sales against rental yields. This holistic approach reveals not just the potential for capital gains, but also the sizable returns that can be obtained from rental income, thus enhancing the overall profitability of condo investments in Singapore.

In conclusion, these individual case studies and data insights are indispensable when projecting the ROI on condo sale in Singapore, showcasing the undeniable influence of well-informed investment strategies on maximizing condo investment returns.

Real Estate Market Analysis for Informed Selling Decisions

When venturing into the sale of a condominium, the keystones of success lie in a solid understanding of the real estate market analysis, carefully aligning with Singapore property market trends. To leverage condo selling strategies effectively, one must engage in meticulous evaluation of the past and present data, alongside judicious forecasts.

Tracking Market Performance and Predicting Future Trends

Ensuring a competitive edge in my condominium resale value starts with my ability to track the market’s performance adeptly. As an investor, I scrutinize not just my property’s past performance but also predict the directions in which the market is headed. This rigorous approach to identifying patterns allows for strategic decision-making, vital in timing the market to my advantage.

Condo Resale Value: Benchmarks and Comparatives

An integral part of my real estate market analysis revolves around setting benchmarks. By comparing the resale values within Singapore’s districts, I robustly position my condo in the marketplace. By doing so, I can proficiently gauge where my property stands amongst comparatives and how I can potentially adjust my selling strategies to maximize returns.

Role of Cooling Measures in ROI

The Singaporean government’s cooling measures, like the ABSD, influence investor behavior and impinge upon my potential ROI. Understanding and adapting to these regulatory frameworks translates into a proactive rather than a reactive stance in real estate transactions. It necessitates a thoughtful response to such interventions, ensuring that my condo selling strategies remain both compliant and profitable.

The Role of Rental Income in Residential Property ROI Calculation

As an investor in the Singapore property market, I’ve learned that rental income is not just a secondary income stream but a core component of residential property ROI calculation. It goes beyond capital appreciation, impacting the overall profitability of my investments. When I calculate the ROI for rental properties, it requires a careful assessment where annual rental income is weighed against operating expenses. This figure is then compared to the mortgage payments or the sum of the initial investment. It’s a meticulous process that can significantly affect the accuracy of my investment evaluation.

In my experience, properties that boast higher rental yields—like those in prime locations where demand outpaces supply—serve as a catalyst in maximizing condo sale profits. It’s not just about selling at the right time or at the right price; it’s also about how much revenue an asset can generate while it’s in my portfolio. These rental yields become especially meaningful when I pair them with the capital gains obtained at the time of resale. It essentially represents a dual revenue model, optimizing my condo investment returns and driving up the total ROI.

Singapore’s real estate market is attractive for its potential rental income, and for good reason. High-demand areas command substantial yields, making them key targets for boosting my ROI on condo sale in Singapore. In fact, prioritizing rental income has become an integral strategy in my investment decisions, underpinning the push for higher profitability. This approach underscores the importance of rental income in the complex tapestry of residential property ROI calculation, proving it to be an indispensable tool in the arsenal of any seasoned real estate investor here in Singapore.

Best Property Agent in Singapore – a Myth?

How To Find A Good Property Agent In Singapore?

FAQ

What drives the ROI on condo sales in Singapore?

The ROI on condo sales is influenced by a combination of factors such as the initial purchase price, sale price, market trends, timing of the sale, property cycle stages, and additional costs incurred like renovations and stamp duties.

How do I evaluate the profit versus the investment cost for my Singapore condo?

To evaluate the profit versus the investment cost, subtract the initial purchase expenses, upkeep costs, and any renovation expenses from the final sale price of the condominium. Consider rental income if the property was leased out during your period of ownership.

How do market conditions and trends affect my condo’s ROI?

Market conditions such as supply and demand, economic factors, and government policies like cooling measures can impact condominium resale values. Trends in the property market can also affect the ROI, influencing when and for how much a property can be sold.

What components should I include in my ROI calculation for condo sales?

When calculating ROI for a condo sale, include the sale price, purchase cost, costs of financing (if any), legal fees, taxes, maintenance costs, renovation expenses, and any rental income earned during the period of ownership.

When is the optimal time to list my condo for sale in Singapore for the best profit?

The best time to list your condo for sale is typically during a seller’s market when demand is high and inventory is low, or when the market is on an upward trend. It’s important to closely monitor market trends and property cycles for optimal timing.

How should I price my condo in the current market to maximize profits?

To effectively price your condo, research recent sales of similar properties, consider the current demand and supply, and take into account unique attributes of your property. It’s also beneficial to consult a real estate professional for an accurate valuation.

Which enhancements and renovations can increase my condo’s resale value?

Strategic enhancements that improve the aesthetic appeal, functionality, and overall condition of the property—such as updating the kitchen, bathroom renovations, and fresh paint—can significantly increase the resale value of your condo.

Can you provide case studies or data insights on the ROI of condo sales in Singapore?

Yes, analyzing case studies like sales data from specific condominiums gives us insights into rental yields and capital gains, providing real-world examples of how market factors and property specifics can influence ROI.

How can real estate market analysis inform my condo selling decisions?

Real estate market analysis can provide information on historical and current market conditions, future trend predictions, and benchmarking against similar properties, all of which assist in making informed selling decisions.

How do I track my condo’s resale value and compare it to the market?

Tracking resale value can be achieved by following market reports, understanding district-specific trends, and analyzing comparative sales. This helps to benchmark your property against others in the market.

What role do cooling measures play in the ROI of my condo sale?

Cooling measures, such as the ABSD, can suppress demand and influence pricing power, potentially affecting the ROI negatively if applied near the time of purchase or sale. However, if these measures are lifted or relaxed, they can have a positive impact on ROI.

How does rental income contribute to residential property ROI calculation?

Rental income contributes to ROI by providing a steady stream of cash flow during the period of ownership, which, when combined with capital appreciation upon sale, can significantly enhance the overall return on the investment.