Even as interest rates rise, loan servicing may become more manageable over time.

Consequently, buying a property with higher interest rate may be better than renting, in a long run, from expert perspectives.

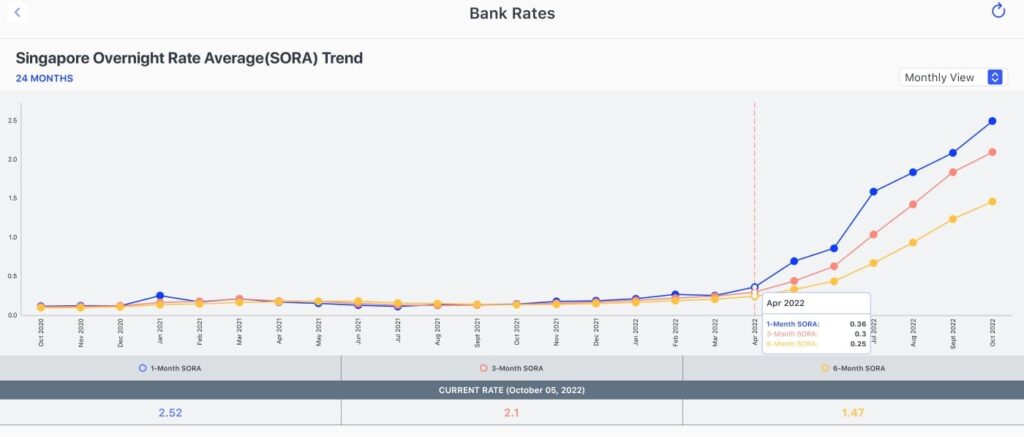

The three-month compounded Singapore Overnight Rate Average (Sora) has soared from under 0.2 per cent per annum at the start of the year to nearly 2.2 per cent as of the value date Oct 7, 2022.

You can read more detail information about this considerable change in this blog.

A floating rate home loan pegged at 1 per cent plus three-month Sora will now cost around 3.2 per cent per annum.

Thus far, Housing Development Board (HDB) resale and private home prices in Singapore have been resilient. Based on flash estimates by the Board and the Urban

Redevelopment Authority, HDB resale and private home prices in the third quarter of 2022 are up 11.4 per cent and 13.2 per cent, respectively, from a year ago.

Rising home loan rates may not deter cash-rich buyers, saving for when there is an opportunity cost when deploying funds to buy homes.

Still, many homebuyers borrow. Perhaps, the interest rate hikes to date are manageable. But, the US Federal Reserve, which has been actively raising interest rates, is signalling further rate hikes.

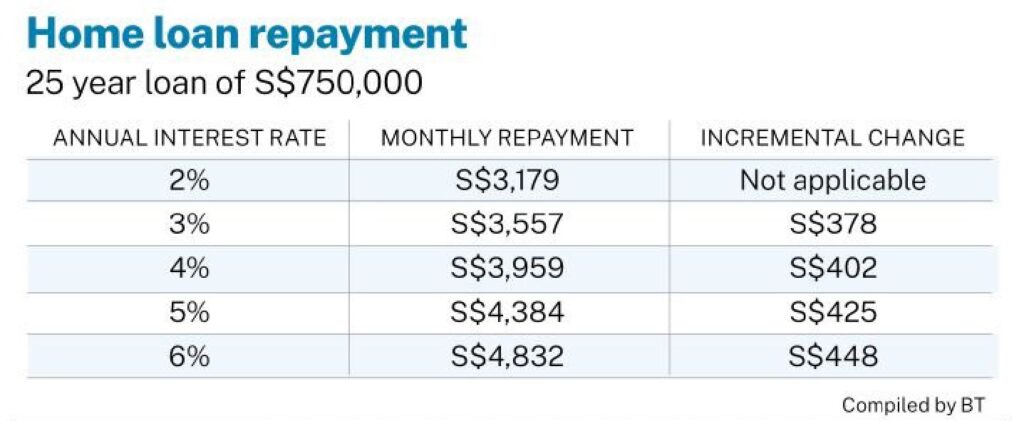

Homebuyers may feel the pain should interest rates rise to 4 per cent or more per annum? For a 25- year loan of S$750,000, the monthly repayment is S$3,365, assuming an annual interest rate of 2.5 per cent and S$3,959 or 18 per cent more, at a 4 per cent interest rate.

Currently, DBS offers fixed-rate home loan packages where borrowers can lock in an interest rate of the gross monthly income that goes towards repaying monthly debt obligations, including the loan being applied for, which is 55 per cent.

The MSR cap of 30 per cent on the gross monthly income that goes towards repaying all property loans, including the loan being applied for, applies to buyers of HOB flats and executive condominium (EC) units where the EC’s minimum occupancy period has not expired. An interest rate floor of 4 per cent per annum is used to compute TDSR and MSR for home loans.

Historically, homebuyers have paid over 4 per cent per annum in home loan rates, such as in the late 1990s.

Borrowing at a 4 per cent interest rate: Is buying a property worth it?

It can make sense to take a multi-year loan to buy a home, even if home loan rates reach 4 per cent per annum.

Firstly, assuming a home generates an annual total return of over 4 per cent, funding its purchase by borrowing at 4 per cent per annum can make sense. If a house generates a net yield of 2 per cent and a capital gain of over 2 per cent per annum, the annual total return will top 4 per cent.

Secondly, a non-homeowner may incur home rental costs. One may spend close to the monthly repayment amount of a home loan on paying rent instead. When one buys a home, one owns an asset,

which can appreciate over time. Also, one can use CPF funds to service a home loan, not rental payments.

Thirdly, even if home loan rates here hit 4 per cent per annum or more, rates may not stay at such levels over a prolonged period. Central banks could lower interest rates should economies hit hard landings. With ageing populations in many places, higher savings rates could help rein in the level of interest rates over the longer term. Moreover, servicing a loan can become easier if a borrower’s economic circumstances improve. However, one needs to invest in a profitable business or assets that may offer higher returns versus homeownership.

Still, some people may spend more on consuming goods and services that provide no investment return if not tied to servicing a home loan. Homeowners also use the mortgage loan part of their savings plans.

Tighter borrowing limits: Challenge when buying a property nowadays

In this year’s National Day Rally speech, Prime Minister Lee Hsien Loong highlighted how an estimated 150,000 new homes can be built in the future town of Paya Lebar after the Paya Lehar Air Base relocates in the 2030s. Lee assured that Singapore would not run out of space in the future, and that housing would be available and affordable.

Building new homes to meet demand takes time. Recently, the government acted to promote sustainable conditions in the property market by ensuring prudent borrowing and moderating demand.

Measures affecting borrowing that kicked in on Sep 30, 2022, include higher interest rate floors to compute TDSR and MSR, as well as the eligible loan amount for hous•

ing loans granted by HOB. The LTV for HOB housing loans was lowered to 80 per cent from 85 per cent previously.

As home loans get costlier and economic conditions turn nastier, new homebuyers must be extra prudent when signing multi-year home loans. Still, the ability to gear up helps young adults to realise their homeownership aspirations.

Lending by private financial institutions to homebuyers is subject to loan-to-value (LlV) limits, as well as caps on the total debt servicing ratio (TDSR) and mortgage servicing ratio (MSR).

Even if home loan rates here hit 4% per annum or more, rates may not stay at such levels over a prolonged period. Central banks could lower interest rates should economies hit hard landings.

A young adult with no parental help may need to secure a big home loan to bring forward his purchase of a home to build memories. Hopefully, first-time homebuyers will not see more curtailing their ability to borrow.

We hope this article has helped you learn what to take note of when planning your office relocation.

Looking for an affordable property? Tell us what you need and we’ll help you locate the right one for you! Visit our website for more tips if you find this article helpful!