Home Owners and Buyers What to Take Note for Singapore Budget 2024

Key insights

- 🏠 The budget 2024 introduces changes to the properties in Singapore, mainly focusing on the impact of the recent budget on property prices.

- 🏠 This policy is helping to withstand a potential wave of buyers going into the hdb market.

- 💰 The new changes in tax rates will result in a 44 to 54% increase in property tax for private property owners who are investors, impacting their investment property negatively.

- 🚫 It is essential to be careful not to penalize the landlord when considering property tax changes.

- 🏠 Treating property as a business may no longer be profitable due to increased property tax, potentially detering some landlords from continuing renting out to collect rental.

- 💰 The landlord and tenant ecosystem needs to be looked at holistically, with neither party being the villain or bearing all the responsibility and downside.

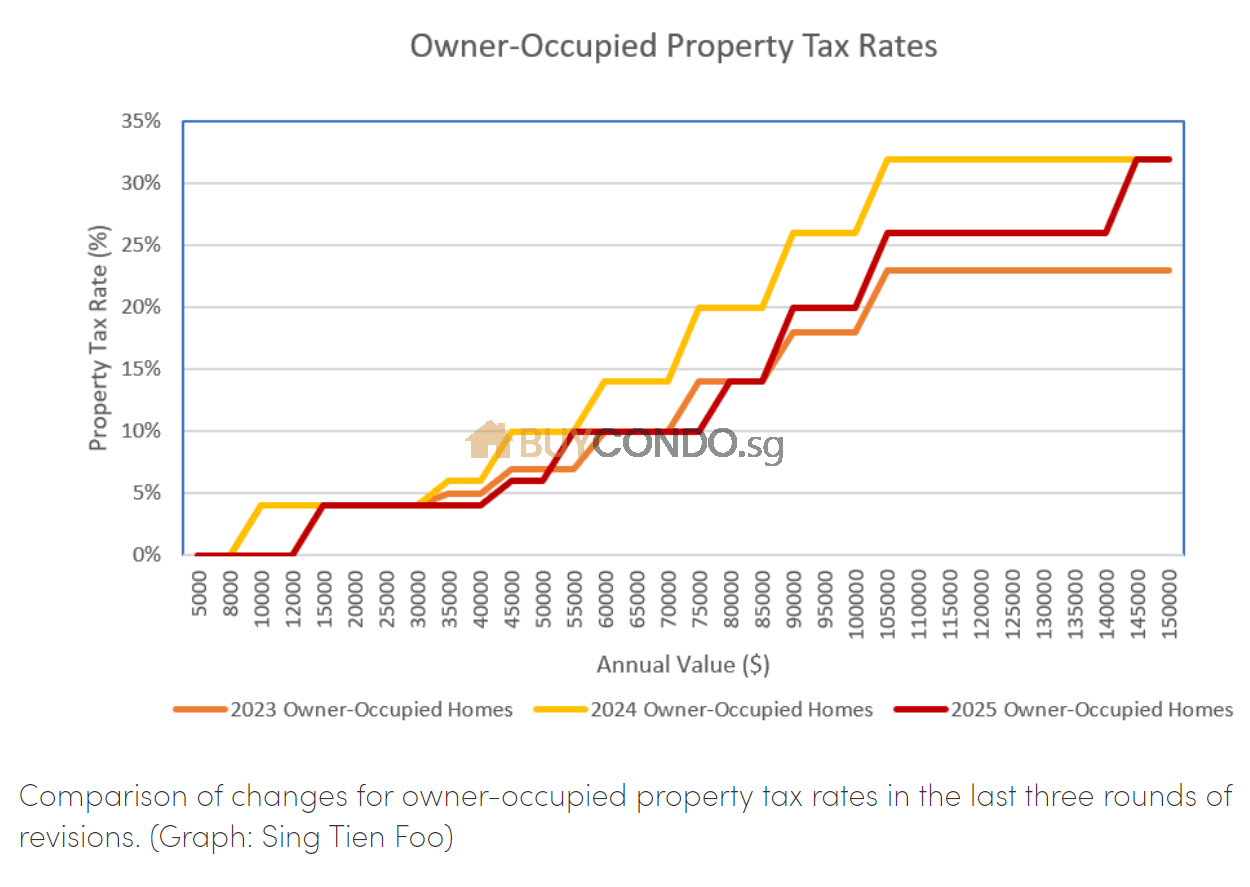

Changes to Annual Value for Owner-Occupied Properties

| Property tax rate | Current AV band | Revised AV band from 1 Jan 2025 |

| 0% | First $8,000 | First $12,000 |

| 4% | >$8,000 to $30,000 | >$12,000 to $40,000 |

| 6% | >$30,000 to $40,000 | >$40,000 to $50,000 |

| 10% | >$40,000 to $55,000 | >$50,000 to $75,000 |

| 14% | >$55,000 to $70,000 | >$75,000 to $85,000 |

| 20% | >$70,000 to $85,000 | >$85,000 to $100,000 |

| 26% | >$85,000 to $100,000 | >$100,000 to $140,000 |

| 32% | >$100,000 | >$140,000 |

| Annual Value ($) | Property Tax Payable Effective 1 Jan 2024 | Property Tax Payable Effective 1 Jan 2025 | Difference in Amount | % Difference |

| 12,000 | 160 | 0 | -160 | -100% |

| 15,000 | 280 | 120 | -160 | -57% |

| 20,000 | 480 | 320 | -160 | -33% |

| 25,000 | 680 | 520 | -160 | -24% |

| 30,000 | 880 | 720 | -160 | -18% |

| 40,000 | 1,480 | 1,120 | -360 | -24% |

| 50,000 | 2,480 | 1,720 | -760 | -31% |

| 75,000 | 6,080 | 4,220 | -1,860 | -31% |

| 100,000 | 11,980 | 8,620 | -3,360 | -28% |

| 125,000 | 19,980 | 15,120 | -4,860 | -24% |

| 150,000 | 27,980 | 22,220 | -5,760 | -21% |

| 700,000 | 203,980 | 198,220 | -5,760 | -3% |

(Source from CBRE)

• For residential properties with AV of $12,001-$30,000, property tax payable from 1 Jan 2025 will decrease by $160, which will be a reduction of 18-99.9% from 2024’s tax levels.

• For residential properties with AV of $50,000, property tax payable from 1 Jan 2025 will decrease by 31%, compared to current property tax payable.

• For residential properties with AV of $100,000, property tax payable from 1 Jan 2025 will decrease by 28%, compared to current property tax payable.

• For residential properties with AV of $150,000, property tax payable from 1 Jan 2025 will decrease by 21%, compared to current property tax payable.

In general, public housing have lower AVs of below $20,000 and thus will see the largest savings. However, bearing in mind there was a one-off property tax rebate of up to 100% by property types for all owner-occupied residential properties in 2024, the actual savings will differ. For some cases, the property tax bill may even increase in 2025, assuming AVs are unchanged.

For private homes, the revision of the AV bands is expected to benefit owner-occupiers of mid-tier properties with AVs of $50,000 – $100,000 the most, with a reduction of $760-$3,360 or savings of 28-31% of their 2024 tax bill. For properties with AVs of $140,000 and above, the difference in tax payable remains at $5,760, which will be increasingly insignificant for higher AVs, which underscores the spirit of this “wealth tax”.

Previously, those living in higher value properties who have no or lower income may have considered downgrading. With the revised AV bands, coupled with the 24-month interest-free installment plan for retirees, owners may be able to pay the property taxes and hold firm to their current properties.

Case Study on Singles Above 55 Looking to downsize

If you’re buying a second property, you will have to pay a 20% ABSD if you are a Singapore citizen, so the change here is that they wanted to better support singles. The existing policy for ABSD refunds already exists, but it only applies to couples (buying a matrimonial home with joint names).

Singapore citizen seniors who wish to right-size their residential property in short. They want to help people who will sell at a higher price. Higher value private property into a lower value or smaller place.

For example, if a couple owns a $2 million condo and would like to downsize into a, let’s say, 1.5 million condos. They can purchase. The 1.5 million condos first pays up the ABSD of 20%, then, later on, gets the ABSD remission. Once they have sold their current home, which is worth $2 million, this new rule will extend to singles as well. Singles who are above 55 will be able to claim this, here are the requirements.

Conditions:

1) This is just for Singapore citizens who are single, and you need to be 55 and above.

2) The property must be either solely owned by the single person or right by the single person and another family member who also needs to be a single (Both must be 55 or above).

3) The Replacement Property you plan to buy has to be a lower value than your existing one. For example, if you are selling your place at $2 million, okay, you will only be eligible for this ABSD remission if the next property that you’re buying to replace is less than $2 million when you purchase it.

4) the application for a refund of ABSD is made within six months after the date of purchase of the first replacement property.

To Take Note:

They divorced and are co-owning the current property with their children, who are less than 55 years old, so they will not be eligible for this.

You still have to pay the ABSD upfront before you can apply for a refund if you are eligible.This means you need to prepare 20% More Funds upon the purchase price, excluding the buyer stamp duties of around 4%.

As an estimate, ABSD refunds can take place around 5-6 weeks on average. ( This is based on the feedback from our clients)

You should also be aware that you should keep the ownership right in the subsequent replacement property and not sell the property by adding another person into the ownership.

This will benefit Who?

1) Eliglible buyers who are 55, wanting to get a Bigger HDB flat (5rm or bigger). Cash Rich (Can be Private Properties Owners cashing out) that can pay the ABSD first and apply refund.

ABSD Remission Clawback for Housing Developers

Table 1: Revised ABSD remission clawback for residential projects

| Proportion of Units Sold (%) | Projects with residential land acquired between Jul 6, 2018 and Dec 15, 2021, subject to 30% ABSD with upfront 25% remission | Projects with residential land acquired on or after Dec 16, 2021, subject to 40% ABSD with upfront 35% remission | ||

| (Rounded down to nearest whole %) | ABSD Remission Clawback Applicable before Feb 16, 2024 (%) | ABSD Remission Clawback Applicable on or after Feb 16, 2024 (%) | ABSD Remission Clawback Applicable before Feb 16, 2024 (%) | ABSD Remission Clawback Applicable on or after Feb 16, 2024 (%) |

| 100 | 0 | 0 | 0 | 0 |

| 99 | 25 | 15 | 35 | 25 |

| 98 | 25 | 16 | 35 | 26 |

| 97 | 25 | 17 | 35 | 27 |

| 96 | 25 | 18 | 35 | 28 |

| 95 | 25 | 19 | 35 | 29 |

| 94 | 25 | 20 | 35 | 30 |

| 93 | 25 | 21 | 35 | 31 |

| 92 | 25 | 22 | 35 | 32 |

| 91 | 25 | 23 | 35 | 33 |

| 90 | 25 | 24 | 35 | 34 |

| <90 | 25 | 25 | 35 | 35 |

Source: MND

Conclusion : Home Owners and Buyers What to Take Note for Singapore Budget 2024

The recent budget in Singapore introduces changes to property taxes, potentially impacting property prices and the landlord-tenant ecosystem.

- 🏠 Singapore Budget 2024 will affect property prices with new absd remission rule for second properties and property tax exemptions for singles aged 55 and above.

- Budget 2024 in Singapore will impact property prices with two main changes, including a new ABSD remission rule for second properties to support Singapore citizen seniors looking to downsize.

- Singles aged 55 and above in Singapore can claim property tax exemptions. Still, there are strict conditions, including the property being solely owned by a single person or co-owned with another single family member aged 55 and above.

- 🏢 The Singapore Budget 2024 will impose conditions on property ownership, potentially impacting property prices by requiring the purchase price of a replacement property to be lower than the selling price of the original property.

- The Singapore Budget 2024 will impose conditions on property ownership, including not changing ownership when selling and purchasing a replacement property of lower value.

- The Singapore Budget 2024 may impact property prices by potentially requiring the purchase price of a replacement property to be lower than the selling price of the original property to be eligible for remission.

- 🏢 The Singapore Budget 2024 will shake up property prices by increasing supply and implementing a 15-month waiting period for private property owners to buy resale HDB flats while incentivizing elderly sellers to downgrade to smaller condos.

- The new policy aims to increase supply in the market and prevent a potential wave of buyers entering the HDB market by implementing a 15-month waiting period for private property owners before they can buy a resale HDB flat.

- Elderly private sellers above 55 are incentivized to downgrade to smaller condos instead of five-room HDB flats, but the upfront costs may still be a barrier for many.

- 🏢 The Singapore Budget 2024 will not impact private property prices but will result in significant savings for owner-occupied properties, providing more vital holding power for private property owners.

- The new policy will have minimal impact on private property prices, but lower property tax for owner-occupied properties will result in significant savings, especially for mid-tier properties.

- The Singapore Budget 2024 will positively impact property trends, providing more vital holding power for private property owners but no benefit for investment property.

- 🏠 Property owners in Singapore may face unequal tax treatment based on occupancy, potentially leading to double taxation, with concerns about fairness and the impact on landlords.

- Property owners in Singapore may be subject to different tax rates based on whether their property is owner-occupied or non-owner-occupied. This leads to potential double taxation and unequal treatment as a landlord and questioning the system’s fairness.

- Property tax may not drop in line with rent drops, as policy changes in Singapore do not occur in cycles, and it is essential not to over-penalize landlords.

- 🏢 Landlords may see lower rental supply and increased rent due to higher property taxes, potentially pushing some out, similar to the UK’s experience.

- Landlords may see lower supply in the rental market and increased rent due to higher property taxes, potentially pushing out some landlords.

- Landlords in the UK faced a decrease in rental supply and increased rental prices, while Singapore experienced a minor increase in rent prices.

- 🏢 Landlords and tenants must share the responsibility and downside of property costs, as potential changes in Singapore’s budget may lead to rent increases.

- 🏡 Reach out to BUYCONDO Team for more information.

Hdb and Condo is now allowed to rent up to 8 person unrelated (Updated for 2024)