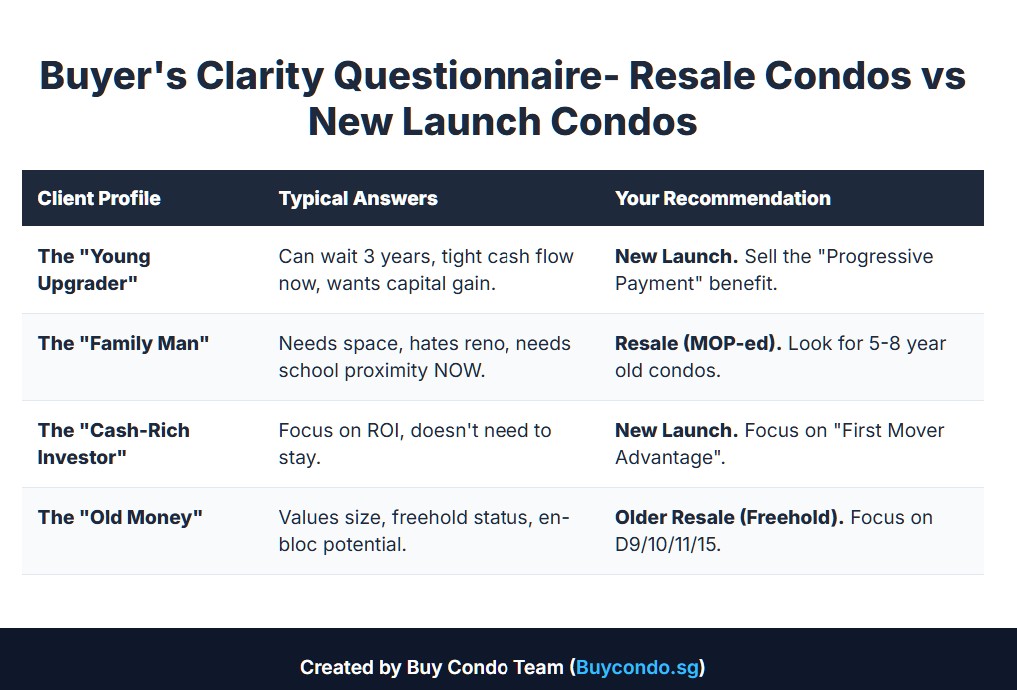

TDSR vs MSR

When buying property in Singapore, homebuyers encounter two important financial ratios that banks use to determine loan eligibility. These government measures help ensure borrowers can manage their debt responsibly while protecting the housing market from excessive lending.

Understanding the key differences between TDSR and MSR is essential for anyone planning to secure a home loan, as both ratios directly impact how much money banks will approve for property purchases. The ratios work differently in terms of what debts they consider and which property types they apply to, making it crucial for potential homebuyers to know how each one affects their borrowing capacity.

1) Definition of TDSR and MSR

TDSR stands for Total Debt Servicing Ratio. TDSR takes into account ALL loan repayments, including outstanding loans when calculating borrowing limits.

MSR means Mortgage Servicing Ratio. MSR limits the amount of money borrowers can borrow based on income, without considering other loans they might have.

Both ratios are government initiatives to promote responsible borrowing in Singapore’s property market.

TDSR applies to all property loans. Banks use this ratio to assess how much total debt a borrower can handle.

MSR is specific to HDB flats and Executive Condominiums bought directly from developers. The current MSR limit is capped at 30% of gross income.

These ratios help banks determine loan eligibility and borrowing capacity for property purchases.

2) TDSR considers all debt obligations : TDSR vs MSR

The Total Debt Servicing Ratio accounts for all monthly debt obligations when banks assess loan applications. This includes housing loans, car loans, personal loans, and credit card payments.

Banks evaluate a borrower’s complete financial picture through TDSR calculations. The framework looks at every outstanding debt payment the applicant must make each month.

TDSR encompasses housing-related debts plus other financial commitments like car loans and credit card repayments. Education loans and renovation loans also count toward the total debt calculation.

This comprehensive approach helps banks understand true financial capacity. A borrower might handle mortgage payments alone but struggle with multiple debt obligations combined.

The TDSR framework considers property loans, car loans, renovation loans, and credit card repayments when assessing new home loan applications. Banks use this information to determine maximum loan amounts.

TDSR provides lenders with a comprehensive view of borrower financial health by considering all debt types. This broader assessment protects both borrowers and banks from overextension.

3) MSR applies only to property loans for HDB and EC

The Mortgage Servicing Ratio (MSR) applies only to loans for HDB flats and Executive Condominiums. This limitation makes MSR more targeted than other loan assessment tools.

Banks must check MSR when buyers apply for loans on these specific property types. The rule does not apply to private condominiums or landed properties.

For Executive Condominiums, MSR applies during the initial years before the Minimum Occupation Period (MOP) completion. After the MOP ends, the EC becomes fully privatized.

HDB flat buyers face MSR requirements regardless of whether they buy new or resale units. This includes Build-To-Order flats, Sale of Balance Flats, and all resale transactions.

The MSR focuses solely on housing loans for these two property categories. It does not consider other debts like car loans or credit card payments.

Private property buyers do not encounter MSR limits. They only need to meet TDSR requirements when applying for housing loans.

This targeted approach helps the government control affordability for public housing while allowing more flexibility for private property purchases.

4) TDSR limits total monthly debt repayments to 60% of gross monthly income

The Total Debt Servicing Ratio caps monthly debt payments at 55% of gross income. This limit was reduced from the previous 60% threshold in December 2021.

TDSR covers all monthly debt obligations including home loans, car loans, personal loans, and credit card payments. Banks calculate this ratio by dividing total monthly debt payments by gross monthly income.

Consider a borrower earning $8,000 monthly. Under current rules, their total debt payments cannot exceed $4,400 per month. This includes their mortgage, car loan, and credit card minimum payments combined.

The ratio encourages responsible borrowing practices and helps prevent over-leveraging. Financial institutions must verify this calculation before approving any new loans.

Borrowers with existing debts face reduced borrowing capacity for new loans. The amount available for housing loans decreases when other debt obligations exist.

This comprehensive approach differs from MSR, which only considers property-related payments. TDSR provides a complete picture of financial commitments.

5) MSR limits housing loan repayments to 30% of gross monthly income

The Mortgage Servicing Ratio caps mortgage repayments at 30% of gross monthly income. This limit applies specifically to HDB flats and executive condominiums purchased from developers.

The 30% MSR limit restricts total monthly property loan payments. If a borrower earns $5,000 monthly, their maximum housing loan payment cannot exceed $1,500.

Consider a buyer earning $8,000 per month. Their MSR calculation allows maximum monthly repayments of $2,400 for property loans. This includes principal, interest, and other loan servicing costs.

The MSR focuses solely on property loan repayments, unlike TDSR which considers all debts. Banks use this ratio to determine loan eligibility for HDB and EC purchases.

A couple with combined income of $10,000 can allocate up to $3,000 monthly for housing loan payments under MSR guidelines. This calculation helps prevent over-borrowing and maintains financial stability.

The 30% limit protects borrowers from over-leveraging while ensuring they can meet other living expenses comfortably.

6) TDSR promotes responsible borrowing by assessing overall financial health

TDSR serves as a financial safeguard that prevents borrowers from taking on more debt than they can handle. The framework examines a person’s complete debt picture rather than just one loan.

Banks must review all existing debts when calculating TDSR. This includes credit cards, personal loans, car loans, and existing mortgages. The comprehensive approach gives lenders a clear view of financial capacity.

The Monetary Authority of Singapore introduced TDSR in 2013 to protect borrowers from over-borrowing. Even people with high incomes can face financial strain if they take on too much debt.

TDSR ensures borrowers do not overextend themselves financially. This protects both individual borrowers and Singapore’s broader economy from excessive debt risks.

Financial institutions must verify that total monthly debt payments stay below 55% of gross income. This limit forces careful consideration of new borrowing decisions.

The framework holds banks accountable for responsible lending practices. Lenders cannot approve loans that push borrowers beyond safe debt levels, creating a protective barrier for consumers.

Best Property Agent in Singapore – a Myth?

Buying a 99 year Landed Property

HDB vs Private Condominium: Which is More Significant? | HDB vs Condo

7) MSR is a government measure specific to public housing loans

The Mortgage Servicing Ratio (MSR) is a targeted government policy that applies only to specific types of public housing. MSR applies only to loans for buying an HDB flat or an Executive Condominium (EC) that has not completed its Minimum Occupation Period.

This policy restricts borrowers to using only 30% of their gross monthly income to repay mortgages for HDB properties or ECs. The government designed this measure to ensure affordable housing remains accessible to citizens.

Banks must assess MSR when borrowers apply for HDB flat or Executive Condominium loans. This requirement does not apply to private property purchases like condominiums or landed homes.

The 30% cap helps prevent buyers from overextending financially on public housing. It ensures monthly mortgage payments stay manageable within household budgets.

MSR focuses specifically on housing debt rather than total debt obligations. This narrow scope reflects the government’s priority to maintain public housing affordability for Singaporean families.

The policy supports the broader public housing framework by preventing excessive borrowing on subsidized properties.

8) TDSR affects eligibility for all types of loans including personal and car loans

TDSR applies to most secured and unsecured loans, not just home mortgages. This includes personal loans, car loans, and credit facilities.

When someone applies for a personal loan, lenders consider TDSR when reviewing applications. The same 55% limit restricts how much they can borrow based on existing debt obligations.

Car loan applications face identical TDSR requirements. Monthly car payments must fit within the borrower’s remaining debt capacity after accounting for all other loans.

Credit card facilities also count toward TDSR calculations. Banks evaluate existing credit commitments before approving new cards or increasing credit limits.

The framework covers investment financing and other credit products too. Financial institutions cannot approve loans that push borrowers above the 55% threshold.

Some exceptions exist for borrowers with substantial financial assets. However, most applicants must stay within standard TDSR limits regardless of loan type.

This comprehensive approach helps prevent over-borrowing across all credit products. Borrowers cannot simply switch to different loan types to bypass debt servicing restrictions.

9) MSR does not consider other outstanding loans

MSR limits borrowing based only on income without looking at other existing debts. This creates a key difference from TDSR calculations.

A buyer might have credit card payments, car loans, or personal loans. MSR ignores these completely when determining loan eligibility.

Consider John who earns $5,000 monthly and wants an HDB flat. Under MSR rules, his maximum monthly mortgage payment is $1,500 (30% of income). This calculation stays the same whether he has $500 in car payments or zero other debts.

Sarah faces a similar situation. She earns $8,000 monthly with $2,000 in existing loan payments. MSR still allows her $2,400 monthly for housing loans regardless of her other commitments.

This approach means MSR focuses purely on housing affordability relative to income. Banks cannot reduce the mortgage amount based on other financial obligations during MSR assessment.

However, buyers still need to pass TDSR requirements afterward. TDSR considers all debt payments including the proposed mortgage.

10) TDSR is mandatory for bank assessments on property loans

Banks must assess all borrowers using TDSR when they apply for property loans. This requirement applies to every loan application without exception.

The Monetary Authority of Singapore introduced this framework in 2013. Banks cannot skip TDSR assessments for any property loan they approve.

TDSR applies to all property types including HDB flats, executive condominiums, and private properties. Banks use the same assessment rules for each type.

Financial institutions must also apply TDSR to loan refinancing applications. Both new loans and refinancing require TDSR checks before approval.

Banks calculate TDSR using specific interest rate floors during assessments. They use 3.5% for residential properties and 4.5% for commercial properties, even when market rates are lower.

The framework ensures banks factor in all outstanding debts when evaluating loan applications. This prevents borrowers from taking on excessive debt they cannot handle.

Key Differences Between TDSR and MSR

TDSR and MSR serve different regulatory purposes and use distinct calculation methods. MSR applies only to HDB flats and Executive Condominiums, while TDSR covers all property types and includes comprehensive debt assessment.

Regulatory Context

TDSR applies to all types of housing loans, including private properties, HDB flats, and Executive Condominiums. This framework was introduced to promote responsible borrowing across Singapore’s entire property market.

MSR has a more limited scope. It applies only to loans for buying an HDB flat or an Executive Condominium that still hasn’t completed its MOP.

The regulatory distinction reflects different risk profiles. HDB flats are subsidized public housing with price controls. Private properties face market forces without government intervention.

Banks must apply both frameworks when they overlap. A borrower purchasing an HDB flat faces both MSR and TDSR assessments simultaneously.

Calculation Methods

MSR limits the amount of money you can borrow based on your income, without considering other loans you might have. The calculation focuses solely on housing-related debt payments.

MSR Formula:

- Monthly housing loan payments ÷ Gross monthly income

- Currently capped at 30% of the borrower’s gross monthly income

TDSR takes into account ALL your loan repayments, including outstanding loans. This includes car loans, personal loans, and credit card minimum payments.

TDSR Formula:

- All monthly debt payments ÷ Gross monthly income

- Capped at 55% of gross monthly income

Implications for Borrowers

Borrowers with minimal existing debt find MSR more restrictive than TDSR. The 30% housing loan limit can reduce borrowing capacity even when total debt remains manageable.

Those with significant non-housing debt face tighter TDSR constraints. Credit card debt, car loans, and personal loans directly reduce available borrowing capacity under TDSR assessment.

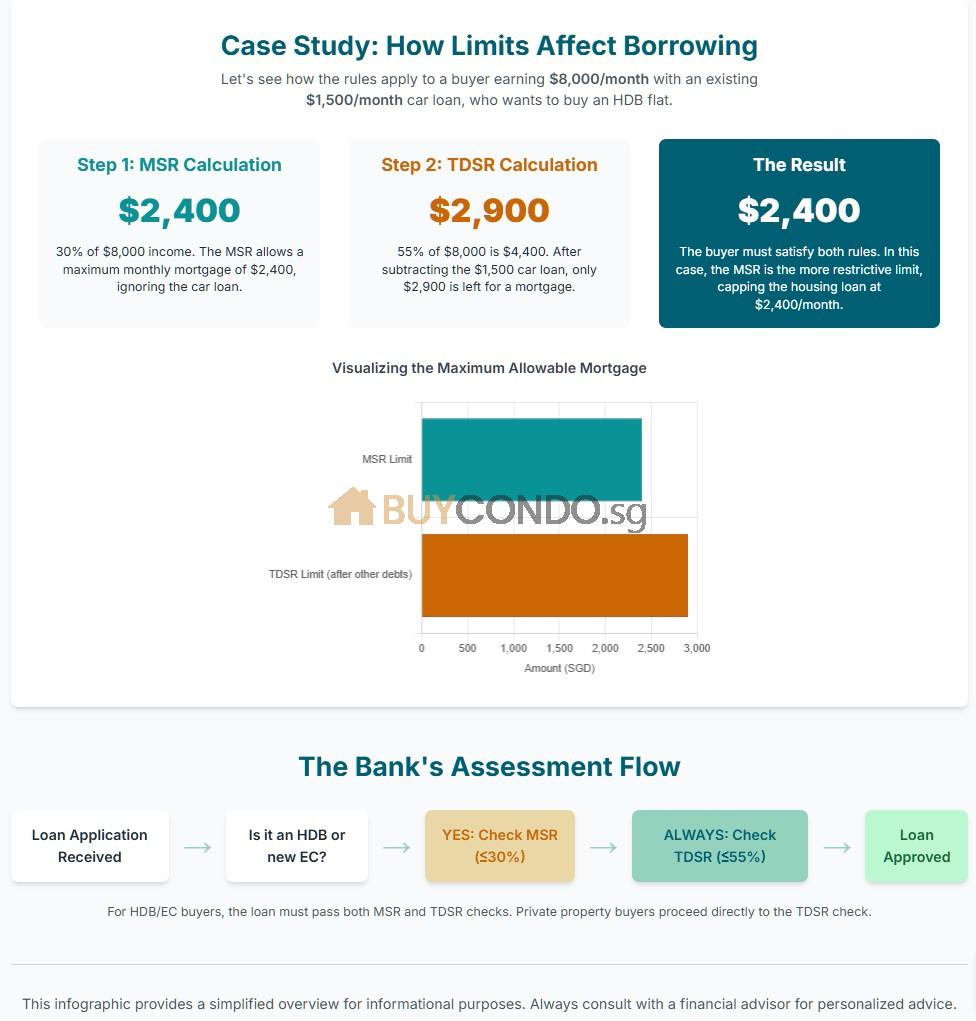

Case Study Example: A borrower earning $8,000 monthly with $1,500 in car loan payments faces different limits:

- MSR allows up to $2,400 for housing loans (30% of $8,000)

- TDSR allows only $2,900 total debt payments, leaving $1,400 for housing after existing obligations

MSR focuses on property loans, while TDSR offers a comprehensive view of an individual’s financial health by considering all debt obligations. This creates different approval scenarios depending on the borrower’s complete financial profile.

Impact of TDSR and MSR on Property Financing

TDSR and MSR regulations directly control how much borrowers can access for property purchases and which property types require specific assessments. The TDSR caps total monthly debt payments at 60% of gross income, while MSR applies exclusively to HDB flats and certain Executive Condominiums.

Borrowing Capacity

The TDSR framework limits borrowers to using no more than 60% of their gross monthly income for all debt obligations. This includes credit card payments, car loans, study loans, and mortgage payments.

For example, a borrower earning $8,000 monthly can allocate a maximum of $4,800 toward total debt servicing. If they already have $1,200 in existing debt payments, only $3,600 remains available for mortgage payments.

Banks conduct mandatory TDSR assessments for all property loan applications. This ensures borrowers maintain financial stability and avoid overextending themselves.

The MSR provides an additional constraint for specific property types. It prevents borrowers from dedicating excessive income solely to mortgage payments, even when their total debt levels appear manageable.

Types of Properties Affected

MSR applies only to HDB flats and Executive Condominiums that have not completed their Minimum Occupation Period. Private condominiums and landed properties are exempt from MSR requirements.

HDB Properties:

- Built-to-Order flats

- Resale flats

- Design, Build and Sell Scheme units

Executive Condominiums:

- Only those within the 5-year MOP period

- EC units after MOP completion follow private property rules

When purchasing HDB properties or qualifying ECs, banks evaluate both ratios simultaneously. Borrowers must satisfy both requirements to secure financing approval.

Private property buyers face only TDSR constraints. This provides greater flexibility in debt management and borrowing capacity calculations.

Frequently Asked Questions

Property buyers and homeowners often have specific questions about how TDSR and MSR calculations work in practice. These ratios directly impact loan approval decisions and borrowing limits for different property types.

What is the difference between Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR)?

TDSR considers all monthly debt obligations when calculating a borrower’s financial capacity. This includes housing loans, car loans, personal loans, and credit card payments.

MSR focuses specifically on property loan payments. MSR applies only to loans for buying an HDB flat or Executive Condominium that has not completed its Minimum Occupation Period.

TDSR applies to all types of housing loans, including private properties, condominiums, and landed homes. Banks use TDSR as the primary assessment tool for most property purchases.

The key distinction lies in scope. MSR focuses on property loans while TDSR offers a comprehensive view of an individual’s financial health by considering all debt commitments.

How is the TDSR calculated when applying for a property loan?

Banks calculate TDSR by dividing total monthly debt obligations by gross monthly income. The result must not exceed 60% for loan approval.

Total monthly debt includes the proposed housing loan payment, existing loan repayments, and minimum credit card payments. Gross monthly income covers salary, bonuses, rental income, and other regular earnings.

For example, if a borrower earns $8,000 monthly and has total debt payments of $4,500, their TDSR would be 56.25%. This falls within the acceptable 60% limit.

Banks conduct mandatory TDSR assessments for all property loan applications. The calculation determines the maximum loan amount a borrower can qualify for.

What is the maximum MSR limit currently allowed for home loans in Singapore?

The MSR limit stands at 30% of gross monthly income for HDB flat and Executive Condominium purchases. This restriction applies specifically to these property types.

Borrowers cannot exceed this 30% threshold when applying for housing loans for HDB properties. The limit ensures buyers maintain adequate income for other living expenses.

For a household earning $6,000 monthly, the maximum allowable housing loan payment would be $1,800. This calculation helps prevent over-borrowing on HDB purchases.

MSR specifically assesses the affordability of purchasing an HDB flat, while private property purchases rely solely on TDSR calculations.

How does MSR apply to HDB flat purchases?

MSR applies to all HDB flat purchases and Executive Condominiums that have not completed their Minimum Occupation Period. The 30% limit restricts monthly housing loan payments relative to gross income.

HDB flat buyers must satisfy both MSR and TDSR requirements simultaneously. The MSR ensures housing costs remain affordable, while TDSR considers total debt obligations.

First-time HDB buyers often find MSR more restrictive than TDSR. The 30% housing loan limit can reduce borrowing capacity compared to the 60% total debt limit.

Banks look at MSR when the property purchased is a HDB flat or Executive Condominium. Private condominium and landed property purchases only require TDSR compliance.

Can you describe the impact of TDSR on property refinancing?

TDSR requirements apply to refinancing applications just as they do for new property purchases. Homeowners must demonstrate that total debt payments remain within 60% of gross income.

Property owners seeking to refinance may face challenges if their income has decreased or other debts have increased since their original loan approval. The 60% limit could restrict refinancing options.

Rising interest rates can push existing borrowers above the TDSR threshold when refinancing. This situation may require debt reduction or income increases to qualify for new loan terms.

Banks evaluate current financial circumstances during refinancing applications. Previous loan approval does not guarantee refinancing approval if TDSR requirements are no longer met.

What are the latest regulatory changes affecting TDSR and MSR calculations?

The current TDSR limit of 60% and MSR limit of 30% have remained stable in recent regulatory updates. These thresholds continue to serve as primary lending guidelines for financial institutions.

Banks must stress-test borrowers at interest rates 3 percentage points above the actual loan rate. This requirement ensures borrowers can handle potential rate increases during the loan tenure.

Regulatory authorities periodically review these ratios based on economic conditions and property market trends. However, no significant changes to the percentage limits have been implemented recently.

Financial institutions continue to apply these ratios consistently across all property loan applications. The stability of these limits provides predictability for both lenders and borrowers in loan planning.